MORE VEHICLES ON THE ROAD??? GOOD FOR THIS STOCK !!!

Investhor

Publish date: Sat, 09 Oct 2021, 12:37 PM

Hi to all fellow investors and traders !

Today I would like to share my thoughts the following counter:

EVERSAFE RUBBER BHD or ESAFE (Code 0190, ACE Market, Industrial Products & Services -Auto Parts)

Some basic info on this company:

i. Number of shares float : 240.59 million

ii. Market Cap : RM 74.58 million

iii. Last closing price : 31 cents

iv. Website : http://www.eversafe.com.my/

ESAFE - MORE VEHICLES ON THE ROAD ??? GOOD FOR THIS STOCK !!!

1. Uplift of MCO - Causing More Vehicles on The Road !!!

ESAFE core business is development, manufacturing and distribution of tyres retreading materials.

As the Movement Control Order (MCO) is being lifted as more people gets vaccinated, there would be more vehicles on the road. Simply put, demand for tyres will be increasing as the personal, business and leisure activities pickup the pace from here onwards.

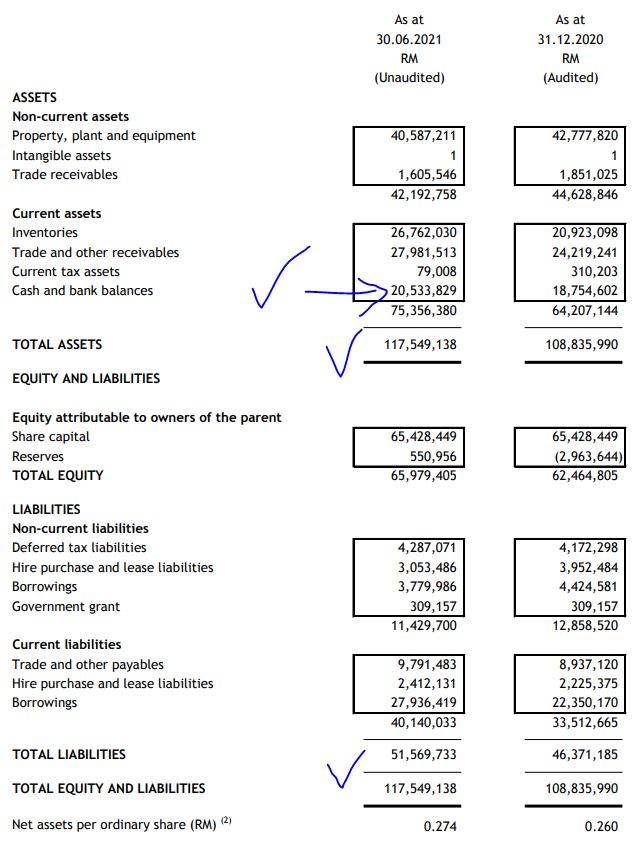

2. Assets Are More Than Liabilities, With Strong Cash Balance For Future Business !!!

Refer below Assets Vs Liability sheet as of latest QR. A few points to note:

i) Total Assets stood at RM 117.5 mil

ii) Total Cash in the bank stood at RM 20.5 mil

iii) Total Liabilities stood at RM 51.5 million

iv) Net Assets Over Liabilities of about RM 66 mil (which makes it a Net Asset company)

With the hefty cash pile in hand, ESAFE should be able to finance its operations and expansions for future without needing to borrow from banks or doing a rights issue.

3. Technical Analysis - Rebound At the EMA200 Support - Resume Uptrend

Let's take a look at the daily chart of ESAFE:

A few observations:

i. The price recently hit the EMA200 support at just below 30c line, but made a rebound towards the upside. This indicates a strong demand by buyers at any price below 30c

ii. Stochastics indicate that the stock is still in oversold position, as the number is still quite low. This represents a good bargain for long term buyers to enter

iii. Possible Resistance 1 at 35c (R1) and Resistance 2 at 41c (R2). Support Zone at price range between 28-30c

CONCLUSION

Based on my opinion, ESAFE should be given attention in coming weeks, based on below:

i. Uplitfment of MCO, causing more vehicles on the road, hence demand for tyres increased

Thanks for reading and see you in the next post.

THE ABOVE IS NOT A BUY OR SELL CALL AND IS ONLY A PERSONAL OPINION ARTICLE AS A SHARING TO BSKL COMMUNITY MEMBERS.

Yours Truly,

INVESTHOR

More articles on Investhor's Mighty Hammer of Wisdom

Created by Investhor | Sep 27, 2021

Created by Investhor | Aug 14, 2021

Created by Investhor | Aug 07, 2021

Created by Investhor | Mar 20, 2021

Created by Investhor | Aug 22, 2020