A TRULY OVERLOOKED STEEL STOCK !!!!

Investhor

Publish date: Sun, 28 Feb 2021, 11:54 AM

Hi to all fellow investors and traders !

Today I would like to share my thoughts the following counter:

CHUAN HUAT RESOURCES BERHAD or CHUAN (Code 7016, MAIN Market, Industrial Products & Services - Building Materials)

Some basic info on this company:

i. Number of shares float : 168.67 million

ii. Market Cap : RM 75.9 million

iii. Last closing price : 45 cents

iv. Website : http://chuanhuat.com.my/

CHUAN - A TRULY OVERLOOKED STEEL STOCK !!!

1. Superb Improvement in Feb 2021 Quarter Results - Mainly Due to Rise in Steel Price

CHUAN is a company with core business in Steel trading.

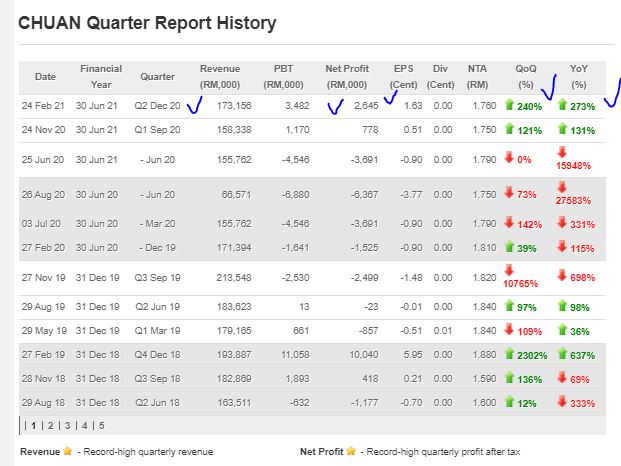

Refer its latest FEB 2021 QR below and the review of performance.

We can see that they had recorded an increase in revenue to RM 173 million, and a net profit of RM 2.6 million which is a 3 year high net profit (EPS of 1.63c).

This represents an increase of 240% QoQ and 273% YoY.

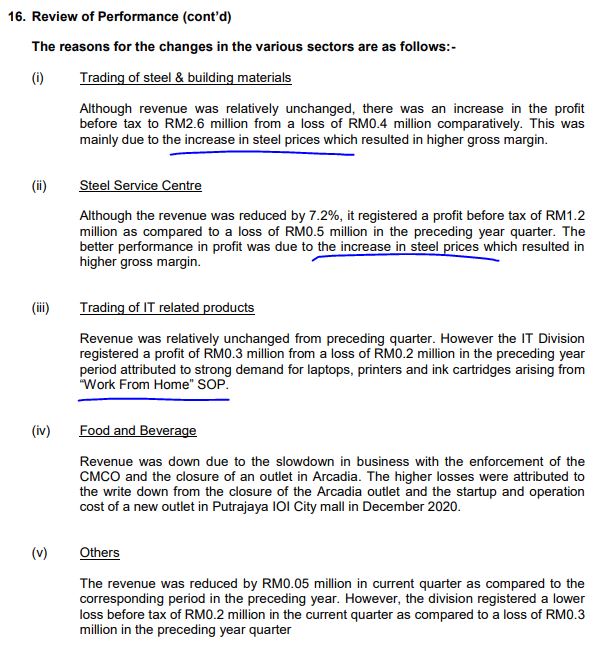

The big improvement in QR was mainly attributed to the rise in steel prices around the world, which has improved margins in all steel trading.

2. Trading at 74% Discount to its NTA of RM 1.76

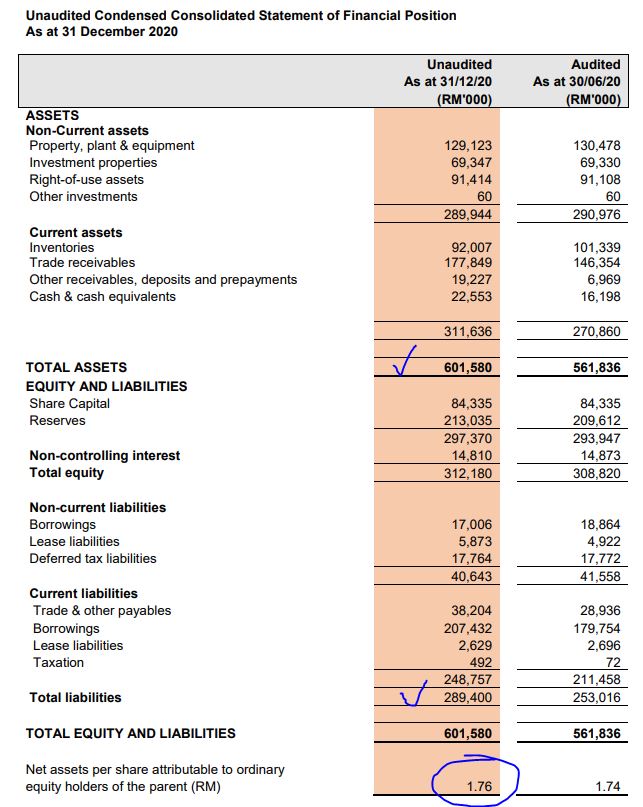

Refer below the latest Asset versus Liability sheet from latest QR FEB 2021. A few points to note :

i. Total Assets stood at RM 601 mil versus Liabilities of RM 289 mil. This makes it a net Asset company with surplus RM 312 mil

ii. Total NTA stood at RM 1.76. With latest closing price of 45c, this means the stock is trading at discount of 74% to its NTA

iii. Cash position also improved to RM 22.5 mil compared to RM 16.2 mil in previous corresponding quarter

3. Technical Analysis - Uptrending in Channel, With Clear Support and Resistance Levels

Let's take a look at the daily chart of CHUAN :

A few observations:

i. We see that the price is on a bullish uptrend, as the price trades above the long term EMA200 and EMA365

ii. Price is trading within the uptrend channel, with the Support (S1) around the 42c area, whilst Resistance around the 51c area

iii. During a down day, it is observed that selling volume is smaller than buying volume. This means that more investors are holding on to the stock for higher prices

CONCLUSION

Based on my opinion, CHUAN should be given attention in coming weeks, based on below:

i. Big improvement in Quarter Results, due to rising steel price

Thanks for reading and see you in the next post.

THE ABOVE IS NOT A BUY OR SELL CALL AND IS ONLY A PERSONAL OPINION ARTICLE AS A SHARING TO BSKL COMMUNITY MEMBERS.

Yours Truly,

INVESTHOR

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Investhor's Mighty Hammer of Wisdom

Created by Investhor | Sep 27, 2021

Created by Investhor | Aug 14, 2021

Created by Investhor | Aug 07, 2021

Created by Investhor | Mar 20, 2021

Created by Investhor | Aug 22, 2020

Discussions

Steel not like glove just a one time increase in prices mainly of increase demand in China, after a while the steel price going to drop a lot after supply more than demand. Not a long time good investment. Look at so many red colour in their QR reports.

2021-02-28 12:45

Aiyo...please lahhh...

Don't mislead market traders lahhh...

Chuan Huat Resources actually is hardware company lahhh...

Of course hardware company also dealing with steel lahhh...

Really so naive & dumb...

2021-02-28 13:16

If you think Chuan Huat is good, better take a second to look to LeonFuat.

LeonFuat is difference from other steel counter, which mainly focus on either manufacturing or trading. LeonFuat is more focus on steel processing, which is higher margin and less competitor, and they have owned one of the highest speed machine in South East Asia.

Steel trading mean you just buy steel from manufacturer, then sell to hardware shop or construction site.

Steel processing mean you customise the steel to any shape or design that your client request. Example, if you client is furniture manufacturer, they will request you to produce a steel handle for their drawer, steel stand for their table...etc.

2021-02-28 13:21

Better look at Dominan 7169

Profit breaking high but share at march level.

Chuan price alr flying high.

2021-02-28 13:50

CHUAN is 100% better than Leon Fuat in term of Higher NTA, Lower No. of Shares , Lower Directors Remunerations, Same Profitability, more stability, less gearing and business economy. Buy Chuan Huat now for a huge discount of 74%. NTA of Chuan is now RM1.76 per share.

2021-03-03 17:18

Chuan Huat business is quite similar with Leon Fuat. In fact, Chuan Huat manufactures Wire Mesh, BRC, Scaffolding steel and other construction tools. Chuan Huat business is even more diversified than Leon Fuat.

2021-03-03 17:38

You guys all critisizing openly who knows maybe quietly also collecting everyday LOL!!

2021-03-20 19:18

probability

prestar eps 8 cents with optimistic prospect also can drop....market dominated by retailers very unpredictable...moody like teenagers

2021-02-28 12:22