STOCK SITTING IN A COVID-PROOF SECTOR, PAYING OUT REGULAR DIVIDENDS !!!

Investhor

Publish date: Sat, 14 Aug 2021, 10:57 AM

Hi to all fellow investors and traders !

Today I would like to share my thoughts the following counter:

DAIBOCI BERHAD or DAIBOCI (Code 6125, MAIN Market, Industrial Products & Services - Packaging Materials)

Some basic info on this company:

i. Number of shares float : 327.92 million

ii. Market Cap : RM 724.71 million

iii. Last closing price : RM 2.21 cents

iv. Website : https://daibochi.com/

DAIBOCI - STOCK SITTING IN COVID-PROOF SECTOR, PAYING OUT REGULAR DIVIDENDS !!!

1. Packaging Sector - A Bulletproof Sector Even In Pandemic As They Continue to Supply Packaging for Essential Products (food, personal hygiene, healthcare)

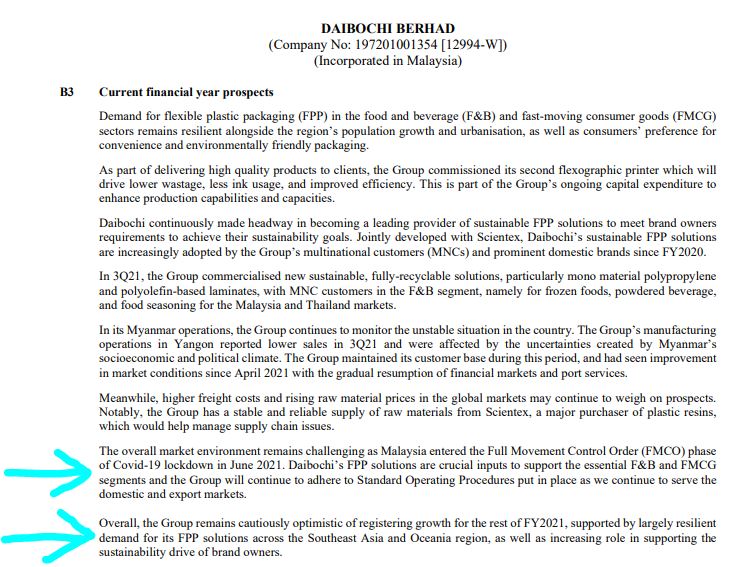

Refer below comments by the Company on Current Financial year prospects.

As mentioned in the title of this article, despite Malaysia imposing MCO during this COVID-19 pandemic, packaging materials remain as an essential component of the basic needs products. DAIBOCI continues to supply its product to local and overseas customers, whilst adhering to the Standard Operating Prodecures (SOP) of the Government.

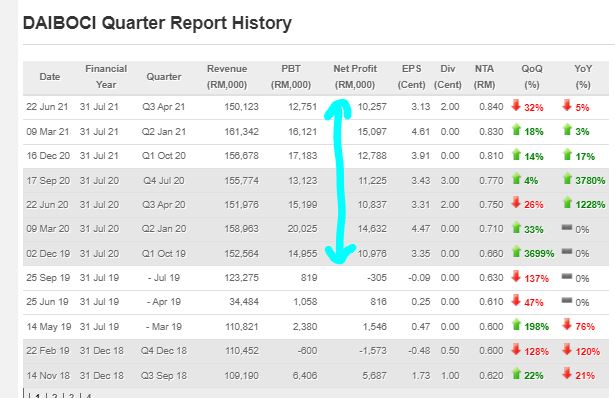

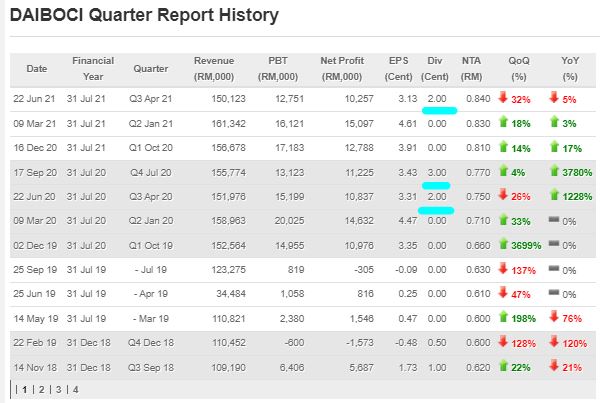

Refer below comments by the Company on Current Financial year prospects Another proof which can be seen on this consistency is earning is from the Quarter Results Summary below.

As we can see, from December 2019 to latest June 2021 quarter results, DAIBOCI has NEVER recorded net profit of less than RM 10 million, eventhough Malaysia has been thru a few lockdowns so far. This proves that packaging is a recession-proof sector that can survive even in the harshest environments.

https://www.malaysiastock.biz/Corporate-Infomation.aspx?securityCode=8125

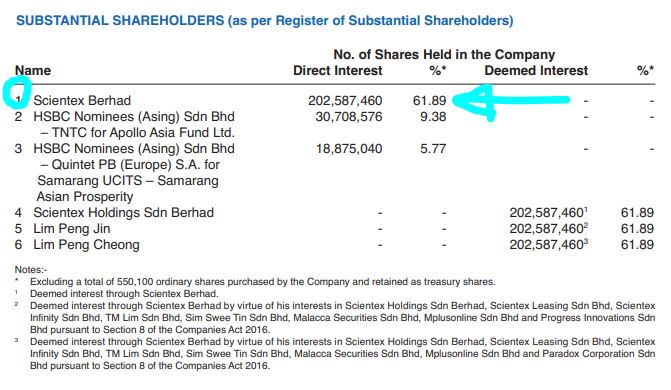

2. SCIENTX as Major Shareholder - SCIENTX share price has maintained, therefore more likely for DAIBOCI to mirror it

Refer below substantial shareholders of DAIBOCI as of latest Annual Report. We see that SCIENTEX BERHAD (BSKL Code 4731, Main Market, Industrial Products & Services - Packaging Materials, Market Cap RM 6.5 billion) is a 61.89% shareholder.

This is interesting as both companies are in the same sector. It would imply that SCIENTX would also be backing up and supporting DAIBOCI with cross-company orders to sustain its earnings as well as SCIENTX has a big stake in DAIBOCI.

Refer below the side by side chart of SCIENTX and DAIBOCI. As you can see, SCIENTX has been maintaining its uptrend pattern this year whilst DAIBOCI has seen some downwards consolidation (though I must say with low volume).

Therefore, with major shareholders not selling, I believe the more likely it is that DAIBOCI shares price will be fading the move downwards and return to normality in due time.

SCIENTX (Feb 2020 - August 2021)

DAIBOCI (Feb 2020 - Aug 2021)

3. Earnings Boosted Since Early 2019, With Regular Dividend Payments Been Made

Refer screenshot taken from latest QR summary. We note the following:

i. 5c Dividend was paid in 2020 despite COVID-19 pandemic causign world economy to falter

ii. So far 2c dividend has been declared in 2021

iii. With full year forecast earnings of 13-14 cents, we anticipate another dividend to be declared in the next quarter

4. Technical Analysis - A Reasonable Entry for Long Term Investors, As Price is Still in Oversold regions and Highest VOP is between RM 2.65 - 2.74 Range

Let's take a look at the daily chart of DAIBOCi:

A few observations:

i. Since hitting the high of RM 2.95 in July 2020, price has been on a downtrend with small volumes exiting

ii. Refer bottom Circle, Stochastics indicate that the price is still in oversold region. This represents a reasonable opportunity for long term investors which are looking to buy and hold for longer term capital appreciation and also solid dividend payments

iii. A Volume on Price analysis shows that majority of volume is between RM 2.65 - 2.74, which is coincidentally the Resistance 2 (R2) in the chart. We see that at prices lower than RM 2.10, the VOP is very low, indicating that not many volumes transacted at low prices

iv. Resistance 1 (R1) is between RM 2.30 - 2.40, and R2 at RM 2.65-2.74, whilst the ultimate Resistance 3 (R3) is at the peak of RM 2.95. These levels are to be monitored for any kinds of technical breakout to indicated a further uptrend.

5. DAIBOCI-WB - A Lower Capital Entry Into DAIBOCI for Potential Capital Appreciation

Refer screenshot profile of DAIBOCI WB taken from KLSE Warrant Screener (http://www.klsescreener.com/v2/screener-warrants):

A few observations:

i. Maturity at 19 June 2022, which means about 10 months till expiry. This allows for reasonable capital appreciation time

ii. Strike price of RM 2.50 implying premium of 19.91%. This premium is considered very reasonable with the amount of time it has left. Should the mother share go up to 2.80-2.90, then the warrant should be theoretically trading at 30-40c prices

Recently, many warrants that is near to expiring had gone up by huge amounts. Therefore, potential for DAIBOCI WB, which is lower premium and longer life, is something to be closely looked at in the near time. In my personal opinion, I would not be surprised to see a limit up in the warrants as the total float is only 27 million overall (which is very much smaller float than most warrants).

CONCLUSION

Based on my opinion, DAIBOCI should be given attention in coming weeks, based on below:

i. Plastic packaging being a recession-proof , Covid-proof sector as it supplies to the basic need market

Thanks for reading and see you in the next post.

THE ABOVE IS NOT A BUY OR SELL CALL AND IS ONLY A PERSONAL OPINION ARTICLE AS A SHARING TO BSKL COMMUNITY MEMBERS.

Yours Truly,

INVESTHOR

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Investhor's Mighty Hammer of Wisdom

Created by Investhor | Sep 27, 2021

Created by Investhor | Aug 07, 2021

Created by Investhor | Mar 20, 2021

Created by Investhor | Aug 22, 2020

HerbertChua

Post removed.Why?

2021-08-16 10:54