A STOCK TRADING AT 68% DISCOUNT TO ITS NTA, WITH PROMISING FUTURE !!!

Investhor

Publish date: Sat, 20 Mar 2021, 01:05 PM

Hi to all fellow investors and traders !

Today I would like to share my thoughts the following counter:

JERASIA CAPITAL BERHAD or JERASIA (Code 8931, MAIN Market, Consumer Products & Services)

Some basic info on this company:

i. Number of shares float : 82.05 million

ii. Market Cap : RM 27.49 million

iii. Last closing price : 33.5 cents

iv. Website : http://corporate.jerasia.com.my/about.php

JERASIA - A STOCK TRADING AT 68% DISCOUNT TO ITS NTA, WITH PROMISING FUTURE !!!

1. Positive Growth Outlook in Apparel Sector As Economy Recovers & Consumer Buying Power Improves

JERASIA is a company involved in manufacturing and retail of apparels.

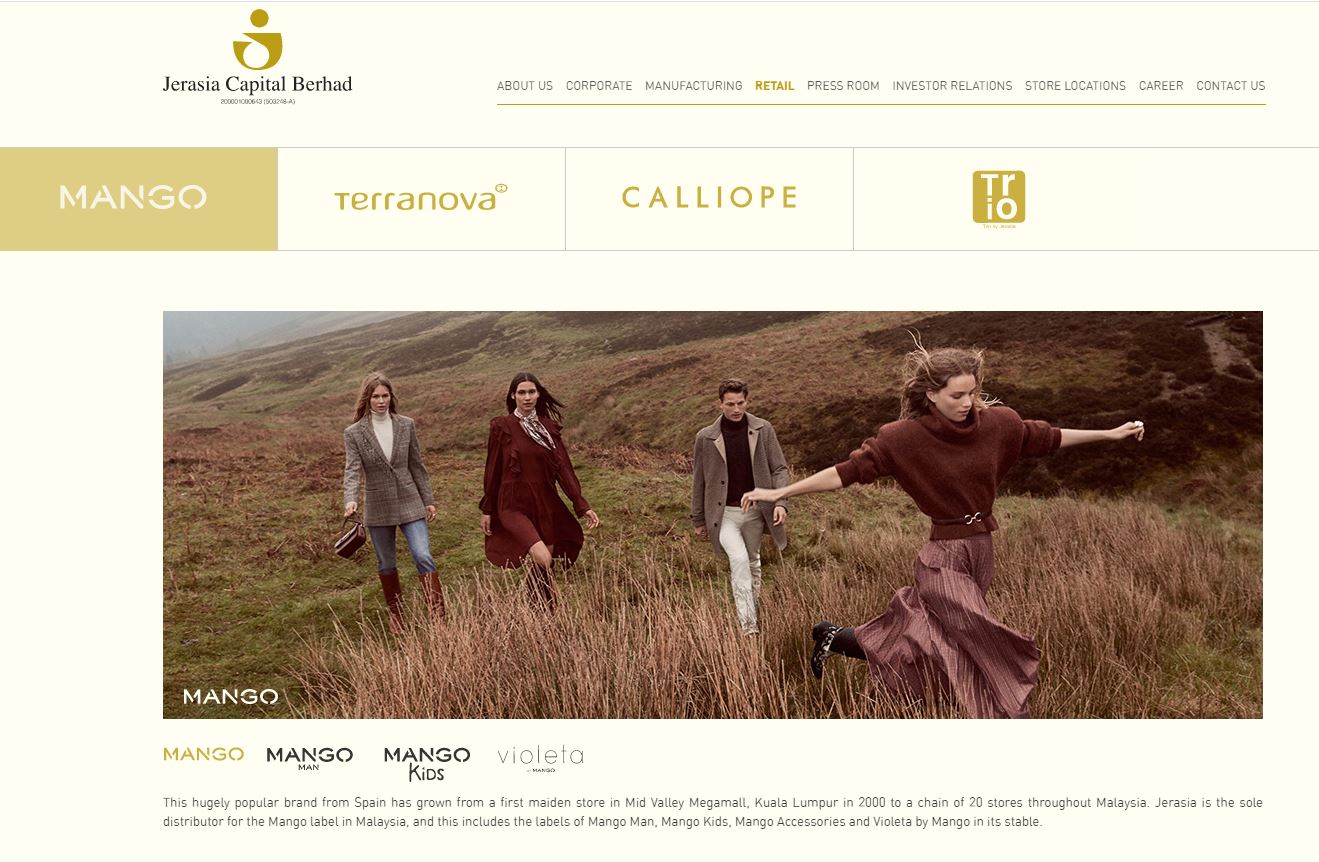

Few brands under them include MANGO, TERRANOVA, CALLIOPE and TRIO (refer screenshot below from website).

Therefore, as COVID19 cases decrease and the economy recovers, consumer buying power will improve greatly. Thus, apparel sector will be one of the main beneficiary of this economic recovery.

2. Small Float Shares - Only 82 Mil Shares Total

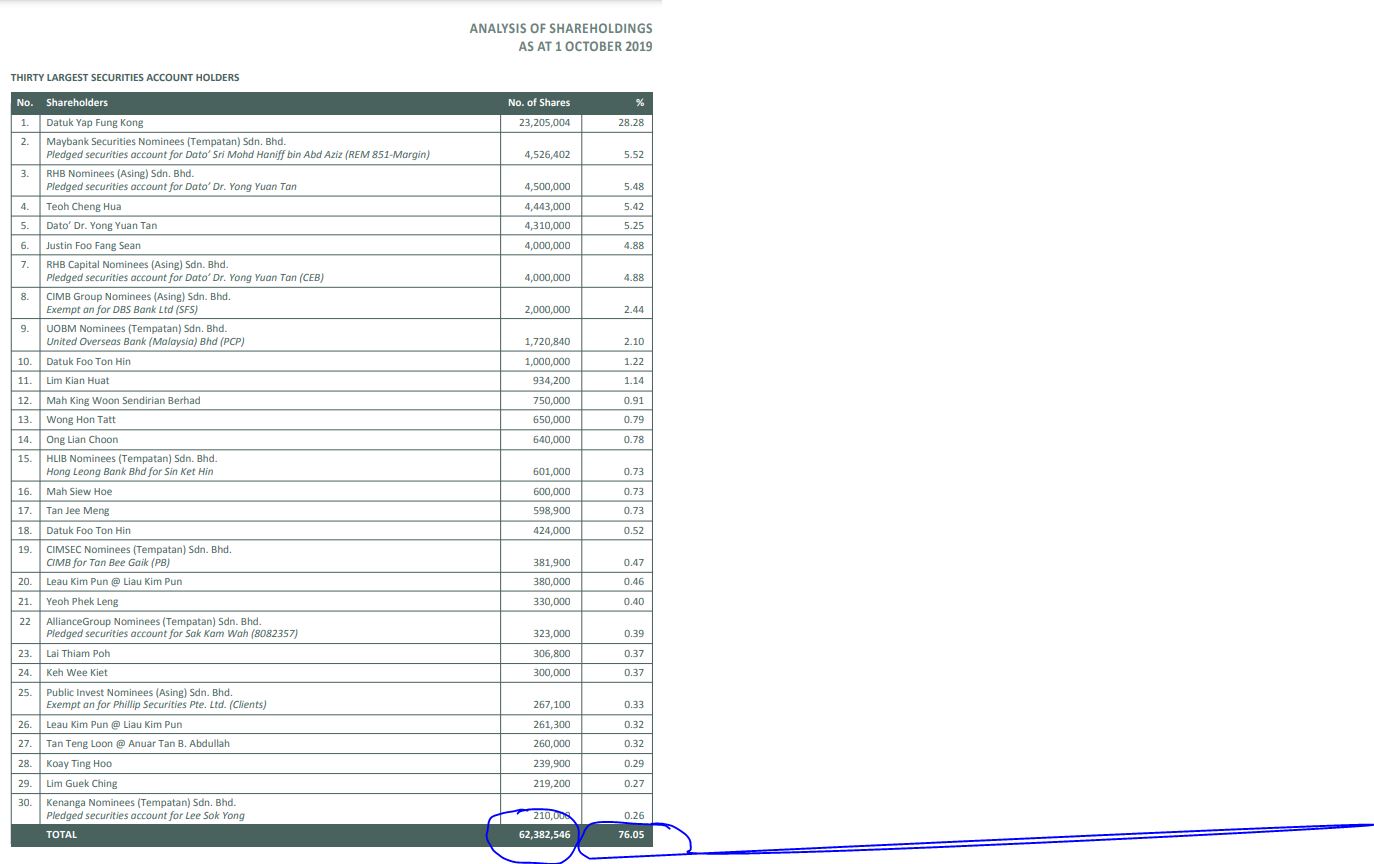

Refer screenshot taken from latest Annual Report available. From a total float of 82 mil, the top 30 shareholders are holding 62.3 mil or 76% of the total float.

This means that about only 19.7 mil shares or 24% are floating in the market if we consider the top 30 shareholders as long term investors.

Therefore, less resistance will mean a smooth movement towards uptrend.

3. Trading At 68% Discount to Its NTA of RM 1.04

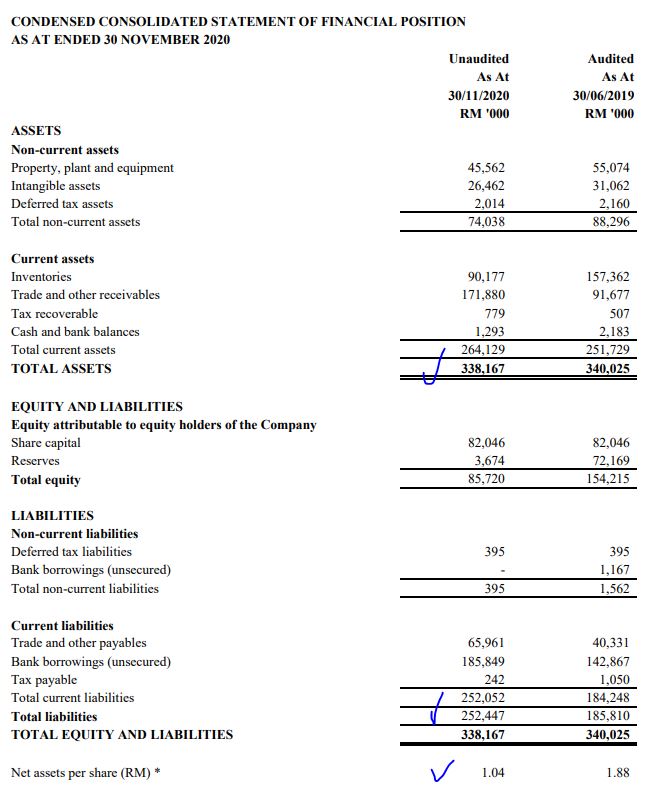

Refer screenshot taken from latest QR. As we can note the following:

i. Total Assets amouting to RM 338.1 mil

ii. Total Liabilities amounting to RM 252.4 mil

iii. Net Asset exceeds Net Liabilities by RM 85.7 mil

iv. Total NTA stood at RM 1.04. With the latest closing price of 33.5c this means that the price is trading at 68% discount to its NTA

3. Technical Analysis - MACD Crossed Upwards - Pending a Breakout above 37c For Long Term Uptrend

Let's take a look at the daily chart of JERASIA :

A few observations:

i. From Circle 1 & 2, we can see that just last year in August 2020, the stock was trading at 92c peak price on the back of ultra high volume

ii. Refer Circle 3 & 4, we note that the price had again experienced a strong uptrend to around 70c but failed to break its downtrend channel, therefore resuming its downtrend

iii. Refer Circle 5 & 6, the price had again rallied to test and break its downtrend resistance at 50c, but failed again and continued downtrend

iv. Refer Circle 7, 8 and 9, recently we see that the MACD has crossed upwards, indicating a bullish trend. The volumes are picking up, as the price moves to test its downtrend resistance at around 37c area. Should a breakout happen at this level, the next resistance seen is at 50c then 70c

CONCLUSION

Based on my opinion, JERASIA should be given attention in coming weeks, based on below:

i. Economic recovery will improve consumer buying power, therefore benefiting apparel sector

Thanks for reading and see you in the next post.

THE ABOVE IS NOT A BUY OR SELL CALL AND IS ONLY A PERSONAL OPINION ARTICLE AS A SHARING TO BSKL COMMUNITY MEMBERS.

Yours Truly,

INVESTHOR

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Investhor's Mighty Hammer of Wisdom

Created by Investhor | Sep 27, 2021

Created by Investhor | Aug 14, 2021

Created by Investhor | Aug 07, 2021

Created by Investhor | Aug 22, 2020

Discussions

this is definitely NOT value investing ya.

In value investing you have to look at its EPS. Study the cash flow. Loss making companies will not qualify for value investing label. They should become turnaround companies first.

If continue promoting loss making companies, then it should be called a new casino opened.

2021-03-20 14:51

Malaysia many stock below their real value. Kps, yilai, all also undervalue

2021-03-20 22:53

Be more alert...

Total unsecured loan by RM 184 mil (net debt company)...

Even though all fixed assets combined also unable to cover unsecured loan...

Don't always just looking at NTA...

2021-03-20 23:24

the counter may have high nta but the management is poor in their visionary going forward, it is useless for investors. bjcorp is a good example vincent tan, when he took over the chaimanship, he told his vision is to make the share price to rm 1 level. the shareholders including me clap dieheart. that time the share price was around 35sen level. after three years the share price is around 18-20 sen level.

2021-03-21 00:32

qqq3333

These people , they never learn. They always looking for cheap stuffs. They call themselves value investors. Looking for stuffs other people throw away. U think stock market is pasar malam meh?

2021-03-20 13:45