A POTENTIAL TAKEOVER TARGET (I WROTE ABOUT DAIBOCI ON 14/8/21 BEFORE TAKEOVER OFFER ON 13/9/21) !!!

Investhor

Publish date: Mon, 27 Sep 2021, 05:36 PM

Hi to all fellow investors and traders !

I wrote about Daboci on 14/8/2021 (link below) and the company was offered a takeover by SCIENTX on 13/9/2021:

https://klse.i3investor.com/blogs/InvesthorsHammer/2021-08-14-story-h1569740417-STOCK_SITTING_IN_A_COVID_PROOF_SECTOR_PAYING_OUT_REGULAR_DIVIDENDS.jsp

Today I would like to share my thoughts the following counter:

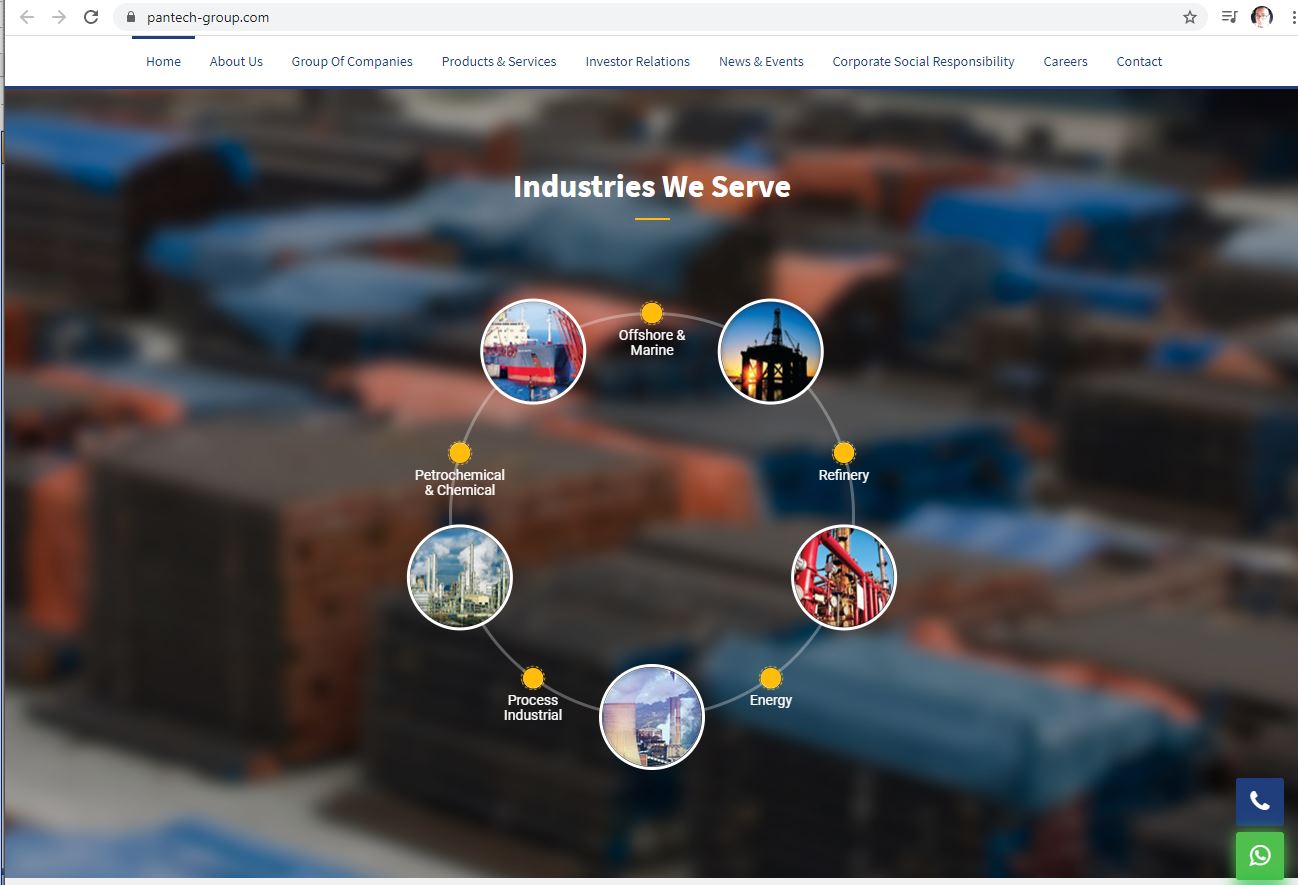

PANTECH GROUP HOLDINGS BHD or PANTECH (Code 5125, MAIN Market, Industrial Products & Services -Metals)

Some basic info on this company:

i. Number of shares float : 780.41 million

ii. Market Cap : RM 398.01 million

iii. Last closing price : 51 cents

iv. Website : https://pantech-group.com/

PANTECH - A POTENTIAL TAKEOVER TARGET (I WROTE ABOUT DAIBOCI ON 14/8/21 BEFORE TAKEOVER OFFER ON 13/9/2021) !!!

1. PANTECH - Mainly Servicing Oil & Gas Sector - Riding the Crude Oil Uptrend - Right Now Only Trading at PE Ratio 6.375 !!!

Pantech is a supplier in the oil & gas industry. As we know, crude oil price is on the rise. As at writing. BRENT OIL is at USD 78.36 and WTI Crude OIl is at USD 75.06.

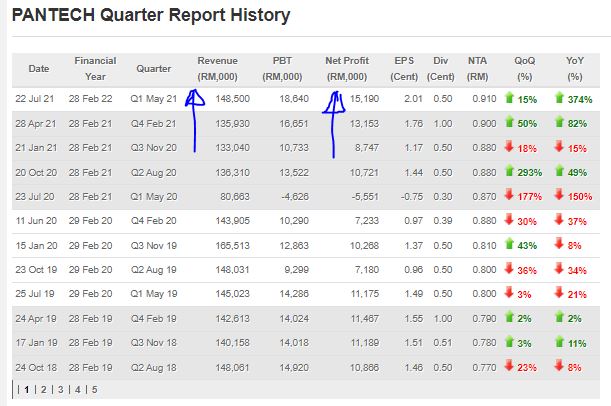

Refer below PANTECH latest QR summary. As we can see, for the past 3 quarters, the Revenue and Net Profit has been improving. As of latest, the Revenue stood at RM 148.5 mil and Net Profit at RM 15.19 mil.

This translates to Earnings Per Share of 2.01c in the recent quarter. If we consider the next 3 quarters earnings similar to this, the full year EPS will stand at 8c per share. This means that the stock is currently trading at a mere PE Ratio of 6.375 its earnings.

Taking a standard PE Ratio of 10-12 times, would see long term fair value of 80-96c for PANTECH (coincidentally this matches with its NTA of 91c).

https://www.malaysiastock.biz/Corporate-Infomation.aspx?securityCode=5125

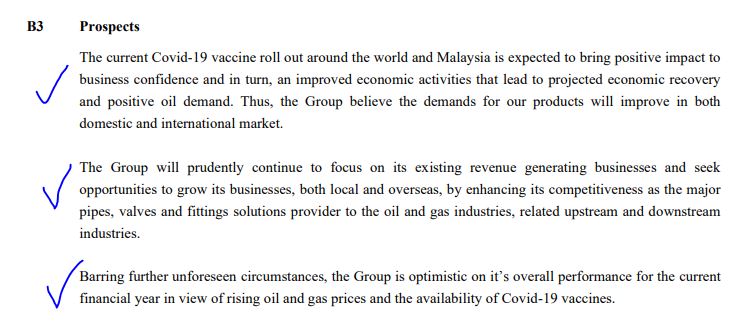

Also, refer below prospects as commented by the Board at the latest QR. It was mentioned that the company is optimistic on its overall performance for this financial year in view of rising oil and gas prices and high vaccination rates.

2. NTA 91c With RM 132.88 Million in The Bank ! Trading at 44% Discount to NTA !!!

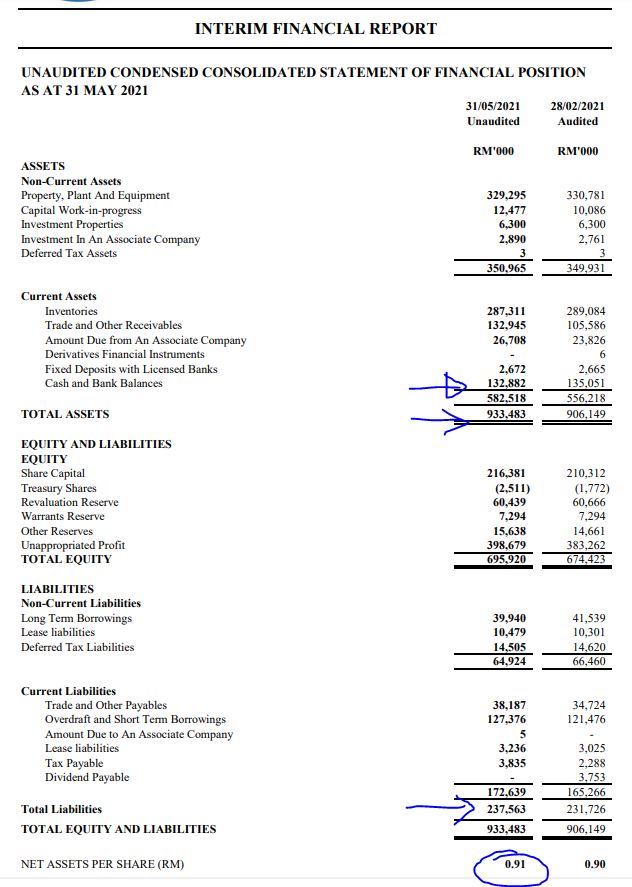

Refer below Assets Vs Liability sheet as of latest QR. A few points to note:

i) Total Assets stood at RM 933.48 mil (91c per share)

ii) Total Cash in the bank stood at RM 132.88 mil (a whopping 17c cash per share !!!)

iii) Total Liabilities stood at RM 237.56 million

iv) Net Assets Over Liabilities of about RM 695.92 (which makes it a Net Asset company)

With the hefty cash pile in hand, PANTECH should be able to finance its operations and expansions for future without needing to borrow from banks or doing a rights issue.

The fact that it is currently trading at 44% discount to its NTA, and assets are overwhelmingly above the liabilties, makes it an attractive magnet for takeovers !!!

3. Technical Analysis - A Reasonable Entry for Long Term Investors, As Price is in Retracement But Strong Holders are Still Holding On for Longer Term Appreciation

Let's take a look at the weekly chart of PANTECH in Homily Software:

A few observations:

i. At the moment, the chart is showing price retracement towards a key support level of 49-50c, which presents a good opportunity for long term investors to enter

ii. Chart shows that more than 80% holders are red chips holders, which means longer term shareholders who are holding on for longer term capital appeciation

iii. Other indicators also show an oversold position, allowing for investors to enter at a bargain

4. PANTECH-WB - A Lower Capital Entry Into PANTECH for Potential Capital Appreciation

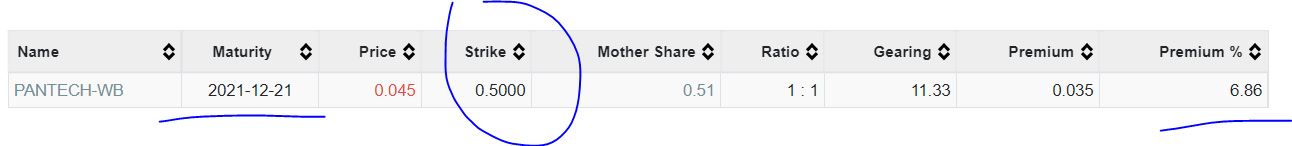

Refer screenshot profile of PANTECH WB taken from KLSE Warrant Screener (http://www.klsescreener.com/v2/screener-warrants):

A few observations:

i. Maturity at 21 December 2021, which means about 3 months till expiry. This allows for reasonable capital appreciation should the mother shares go on a good uptrend within these 3 months

ii. Strike price of 50c implying premium of 6.86%. This premium is considered very reasonable with the amount of time it has left. Should the mother share go up to 60-70c, then the warrant should be theoretically trading at 10-20c prices

CONCLUSION

Based on my opinion, PANTECH should be given attention in coming weeks, based on below:

i. PANTECH trading at low PE Ratio of 6.375, and potential of earnings to expand with rising crude oil prices

Thanks for reading and see you in the next post.

THE ABOVE IS NOT A BUY OR SELL CALL AND IS ONLY A PERSONAL OPINION ARTICLE AS A SHARING TO BSKL COMMUNITY MEMBERS.

Yours Truly,

INVESTHOR

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Investhor's Mighty Hammer of Wisdom

Created by Investhor | Aug 14, 2021

Created by Investhor | Aug 07, 2021

Created by Investhor | Mar 20, 2021

Created by Investhor | Aug 22, 2020

Discussions

D) AND BETWEEN THIS TIME IS COLD COLD WINTER

Bank of America forecast this will be a Very Cold Winter & OIL will Spike Up to USD100 per barrel

See

Sept 13 (Reuters) - Bank of America Global Research said it could bring forward its $100 per barrel oil price target to the next six months from mid-2022 if the winter is colder than usual, potentially driving a surge in demand and widening a supply deficit.

BRENT OIL ALMOST USD80 NOW

WILL TRIGGER BIODIESEL ENGINE

BOOST SOYBEAN & PALM OIL FOR BIODISEL : UP UP & UP

DON'T MISS JTIASA NOW

https://klse.i3investor.com/blogs/www.eaglevisioninvest.com/2021-09-23...

2021-09-28 10:42

Yes buy palmoil stock loh!

Palm oil Sustained good prospect with undervalued share price

Posted by calvintaneng > Sep 28, 2021 10:42 AM | Report Abuse

D) AND BETWEEN THIS TIME IS COLD COLD WINTER

Bank of America forecast this will be a Very Cold Winter & OIL will Spike Up to USD100 per barrel

See

Sept 13 (Reuters) - Bank of America Global Research said it could bring forward its $100 per barrel oil price target to the next six months from mid-2022 if the winter is colder than usual, potentially driving a surge in demand and widening a supply deficit.

BRENT OIL ALMOST USD80 NOW

WILL TRIGGER BIODIESEL ENGINE

BOOST SOYBEAN & PALM OIL FOR BIODISEL : UP UP & UP

DON'T MISS JTIASA NOW

2021-09-28 10:44

I made 18% gain today within one week after buying thanks to this write-up.

2021-10-08 18:00

congrats to all who managed to join the train !!! a whopping gain on both mother shares and warrant on 8th October 2021 !!!

winners will talk, losers will talk..at the end, community will only care about winners

2021-10-10 13:20

warrant whether goes to zero would depends on mother share at expiry date. Exercise price 0.500 Conversion Ratio 1:1. High chances of price going up...not likely zero..

2021-10-12 08:01

Now as you can seen from Bursa's announcement, Chief Executive Director, Executive Director and Chief Financial Officer wanted dealing in listed securities. Lets wait and see Buy or Sell...to give us some hints. But apparently Pantech is beneficial from oil bull run.

2021-10-12 08:11

Legend

PANTECH trading at low PE Ratio of 6.375, and potential of earnings to expand with rising crude oil prices...Trading at 44% Discount to NTA... wow!

2021-09-28 08:25