Return on Invested Capital (ROIC) vs Return on Equity (ROE) (投资资金回报率vs权益回报率)

YOLO123

Publish date: Thu, 29 Oct 2020, 10:52 PM

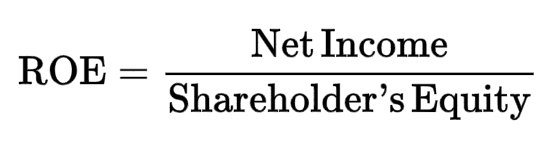

One of the most used fundamental value is to assess a company’s ROE, which shows how much does the company make from the equity that have been invested into the company. However, ROE is lacking some aspects as it only includes equity, where leaving borrowings or debts behind. Do take note that company borrows money to expand their businesses, hence any sort of borrowing shall be considered as their invested capital.

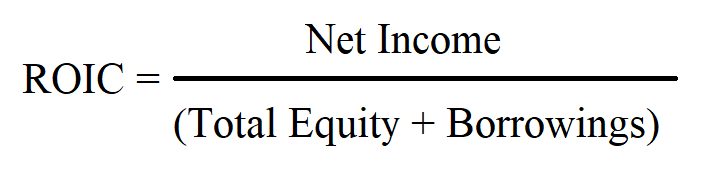

The formula to calculate ROIC is only slightly different with ROE, as it only adds all the borrowing and categorized them as invested capital.

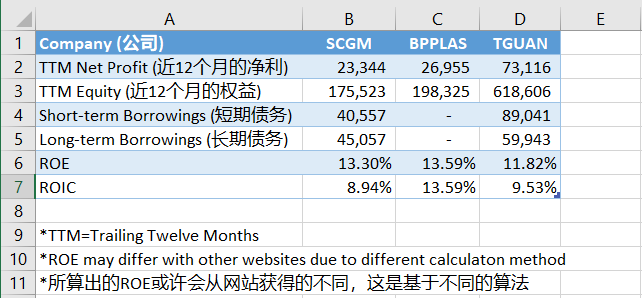

So shall ROIC be prioritized over ROE? Actually, both shall be used to compare companies in the same sector. The example given below is to compare SCGM, BPPLAS, and TGUAN, where all these three companies are all related to plastic packaging. As we can see BPPLAS has the same ROE and ROIC because it has no borrowing, and ROIC for both SCGM and TGUAN has been dragged down due to the higher amount of borrowing.

However, having a lower ROIC does not necessary means that the company is bad, it just acts as the broader perspective to assess a company. ROE only focuses on equity (shareholder), but ROIC focuses on both borrowing and equities (shareholder and bondholder).

In short, BPPLAS with the highest ROE and ROIC shall be the best option out of these three.

权益回报率是投资者在审核公司的基本面时喜欢用的指标之一,而这也会显示公司在这般多的权益面前会把多少转换成利润。但是,投资者忽略了权益回报率只注重在“权益”本身,而投资资金回报率会是一个更好的指标,因为它不止会把权益归纳为投资资金,亦会把借款算入其中。投资者必须明白当一间公司决定去向银行借钱时,它们一定决定了要投入多少资金去扩张它们的生意,因此所有的借款应该要被归纳成为投资资金。

ROIC的算式其实并不会和ROE的算法有很大的不同,它只是纯粹的加上全部的债务,亦把它们全部列为投资资金。

那么ROIC应该要比ROE来得更重要吗?其实不一定,这两个指标都应该拿来比较同板块的公司。笔者拿了三家公司来做比较,名SCGM,BPPLAS,TGUAN,这三家公司都从事与塑料包装。我们可以看到BPPLAS的ROE和ROIC其实是一样的,这是因为它没有任何的债务,而SCGM和TGUAN的ROIC却被拉低,这是因为这两家公司都有一定的债务。

但是,有较低的ROIC并不能代表一家公司的好坏,他只是以一个更广的视野来看整个公司。如之前所说,ROE单纯以股东的角度看公司,但ROIC所涉及到的也包括了债卷持有者所给予的债务。

总结,当我们单纯比较这三家公司,BPPLAS应该会来的比其他两家稍微来得更有优势因为它的ROE和ROIC来得更高。

For more information, visit: https://www.facebook.com/InvestingKnowEverything/

More articles on Investing: Know Everything

Created by YOLO123 | Feb 02, 2021