Risk-to-reward Ratio (风险回报率)

YOLO123

Publish date: Wed, 25 Nov 2020, 12:30 PM

有些投资者在买股时,并没有意识到自己正处于高风险的情况。但是,我们要怎么辨识自己是否处于高风险的情况呢?笔者相信这篇文章可以解决这个问题。

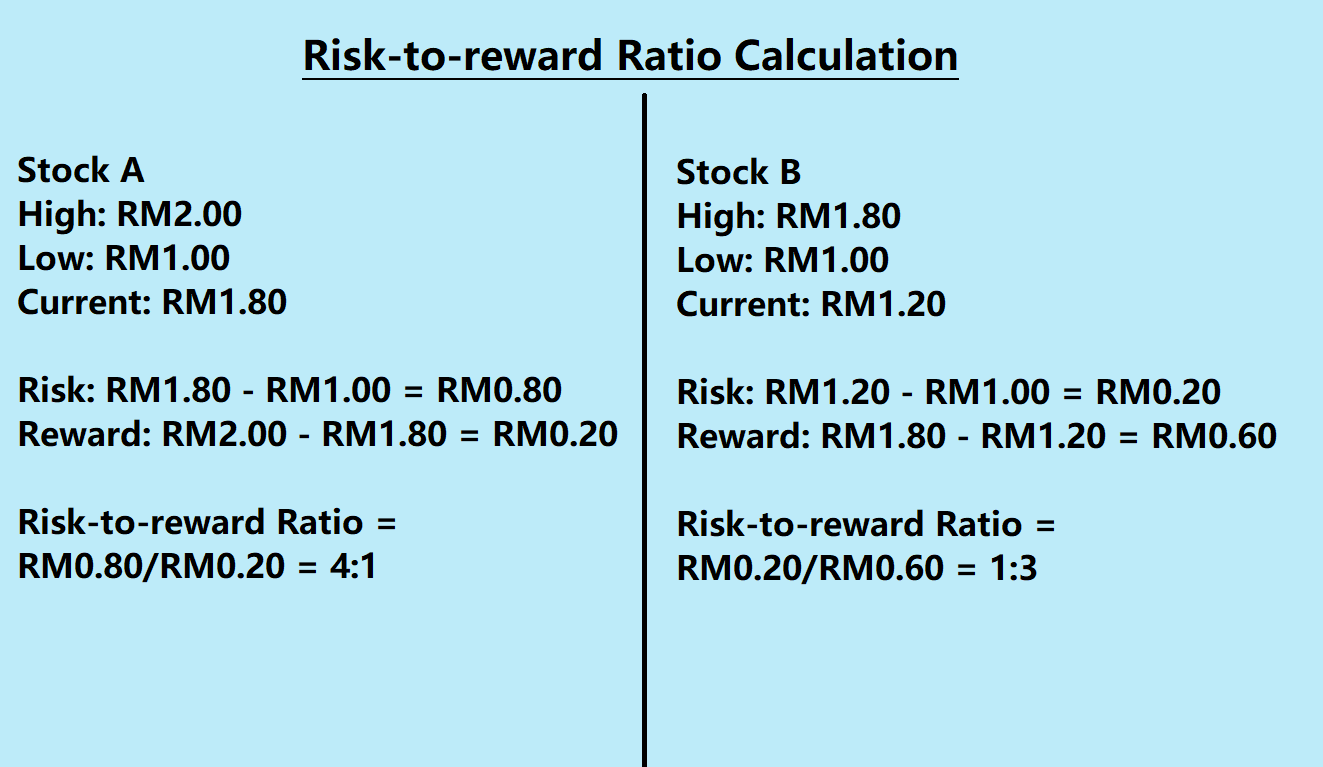

风险回报率是让可能发生的风险以及可能获得的回报来做出比对。举例,股票A的历史高价是在RM2.00,而最近它刚从RM1反弹回来,现在处于RM1.80的价位。我们可以看到如果股价回到历史新高,我们的回报会是RM0.20;但如果市场不好,它也有可能跌回最近的低价,即RM1.00。这代表着它的风险回报率是4:1,也代表着买在RM1.80的风险大大高于回报。

另一方面,如果股票B刚从RM1.00回弹到现在的RM1.20,而历史高价是在RM1.80.这样它的风险回报率就会是1:3,亦代表着投资者会有机会获得比风险更高的回报。这个比率是其中一个让你做风险管理的方法,也避免你在高价时买股,而会等到回调,并且回报比风险大时进场。

总结,风险回报率是一个投资者应该用的机制之一。此外,风险回报率最好至少有1:2,这样回报至少是风险的两倍。投资者也要知道风险越低,回报越高,即赚益更高。

There are some investors do not realize they are exposed to a relatively high risk when they tend to buy a stock. However, how should we know whether we are buying at a higher risk or lower risk? The writer believes this article can somehow solve this problem for you.

Risk-to-reward ratio is a proportion to show is it worth to buy a stock with the possible risk compared to the possible return. For example, Stock A has a historical high price art RM2.00, and has recently just rebounded from RM1.00, and is currently sitting at RM1.80. We can see that the possible return in RM0.20 if it goes back to its previous high, but a possible RM0.80 losses when the market is bad, and it dropped back to its recent low. Having its risk-to-reward ratio that is around 4:1 means that investors are exposing themselves is a rather risky situation when they decided to buy Stock A at RM1.80.

On the other hand, if Stock B has just rebounded from RM1.00, currently sitting at RM1.20, where its historical high is RM1.80. This makes the risk-to-reward ratio to 1:3, that means you have a higher chance to be rewarded and have a lower risk to suffer big losses. This ratio is also one of the method to conduct risk management, where you pass the chance to buy at a higher point, but wait for a slight retracement before buying the stock.

In short, risk-to-reward ratio is a mechanism that shall be used by investors before buying a stock. The best ratio shall be at least 1:2, where reward is still two-time the risk, however do note that the lower the risk, the higher the reward, thus better chance for you to earn more.

For more EXCLUSIVE information, visit: https://www.facebook.com/InvestingKnowEverything/

请关注笔者的脸书专页以获得独家资讯。

More articles on Investing: Know Everything

Created by YOLO123 | Feb 02, 2021