Pyramid Style Buying (金字塔买入法)

YOLO123

Publish date: Mon, 30 Nov 2020, 12:30 PM

One of the biggest problem for investors is when to buy a stock, will the current entry price be too high or too low? In order to solve this problem, the writer introduces pyramid-style buying, where you buy a stock based on this hierarchy.

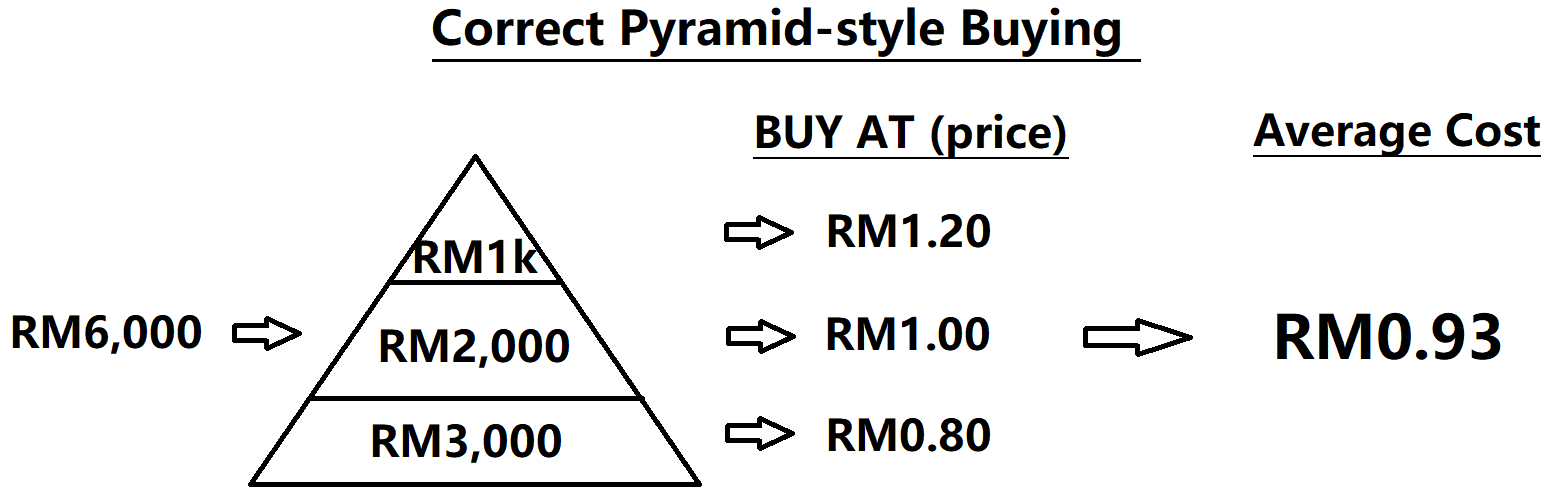

So, how should one operate using this style of buying stocks? Let say Stock A is currently trading at RM1.00, and is a relatively average price to enter. However, you are scared of it dropping lower, and also scared of it going up before you bought the stock. Hence, investors shall try to use this buying style, where you separate your intended buying amount into 3 parts, with the ratio 1:2:3. Let say you have RM6k and since Stock A is trading at an average price, investors can try to put RM2k into it, meaning you put 33% of your intended holding amount into the stock first.

The stock will then have two different routes, where it may go up or down. If it goes down, investors should use another RM3k to average down their cost, summing the total holding to RM5k. On the other hand, if the stock goes up, investors can use RM1k to bring up the quantities, but not too much of the cost.

The reason for the writer to follow this style of buying because investors nowadays tend to go the other way round, where they bought Stock A with RM2k at RM1.00, but add another RM3k when the price goes up. This will lead to a higher average cost, and investors may earn lesser or even suffer losses when the price dropped down. The examples will be shown in the figures below.

In short, pyramid-style buying allows investors to remain their average cost as low as possible, while increasing the holding quantity at the same time. However, doing it the other way round may increase the risk, hence easier to suffer losses.

投资者其中一个最大的烦恼就是买入的时机,以现在的价钱会不会太高或太低?要解决这个问题,笔者向你们介绍金字塔买入法,而投资者可以随着金字塔的阶层买入。

那我们究竟该怎么操作呢?我们举例A股现在是RM1.00,而这个价钱是一个蛮合理的价位。但是,你会担心究竟股价会不会再下滑,亦或者股价会不会在你买入之前就上升了。因此,投资者可以尝试这个买入法,首先将你想要投入的资金,以1:2:3的比率分成三份。假设你想投入六千令吉进A股而现在这个价钱会比较中等的,那么你可以先投入两千令吉,即是你想投入资金的33%。

那么过后股价会有两种走势,上升或下跌。如果下跌,那么投资者可以用分出来后三千令吉来拉底你的平均价,那么你的总投入资金就会来到五千令吉。反之,如果股价上升,我们就用分出来的一千令吉来提高持股数量,但也尽量不将平均价提高很多。

笔者会提议这种买入法主要是因为现在的投资者反而是用着“倒三角金字塔买入法”。那么如果投资者是价钱越高就买得越多的话,平均价也会相对的提高很多。当平均价比较高时,投资者往往会赚得比较少,亦或者比较容易亏损。下面的图表会展示笔者所说的例子。

总结,金字塔买入法可以让投资者买股的平均价尽量调低,亦同时提高持股数量。但是如果投资者反其道而行,反而会给自己提高风险,进而容易面对亏损。

For more EXCLUSIVE content, visit: https://www.facebook.com/InvestingKnowEverything/

请关注笔者的脸书专页以获得独家资讯。

More articles on Investing: Know Everything

Created by YOLO123 | Feb 02, 2021