What is bonus issue? (什么是红股?)

YOLO123

Publish date: Fri, 04 Dec 2020, 01:11 PM

We often see that some companies are proposing bonus issue, but what exactly are those? We will see companies that propose bonus issue often write their announcement like this, “the company is proposing bonus issue that provide 1 share for every 2 shares”. Does that mean we will get one share for free for every two shares we owned? The rest of the article will answer this question.

First, we will need to understand why can a company issue bonus shares? There was a rule before September 2020 stating that the retained earnings of the company must be sufficient, in order to issue bonus shares. For example, a company must have at least the same amount of retained earnings with amount of share capital, to issue a 1:1 bonus share. However, this rule was amended in September and now every company has the right to issue bonus shares without having their retained earnings being higher than their share capital, hence why we are seeing companies proposing 1-for-3 or even 1-for-4 bonus issues recently.

So why some companies would like to propose bonus issue? This is to increase the number of shares and brings down the share price, allowing more investors to buy their shares. Since the share price will be adjusted after bonus issue, their price will be more attractive, hence fellow investors will be able to push up the share price again.

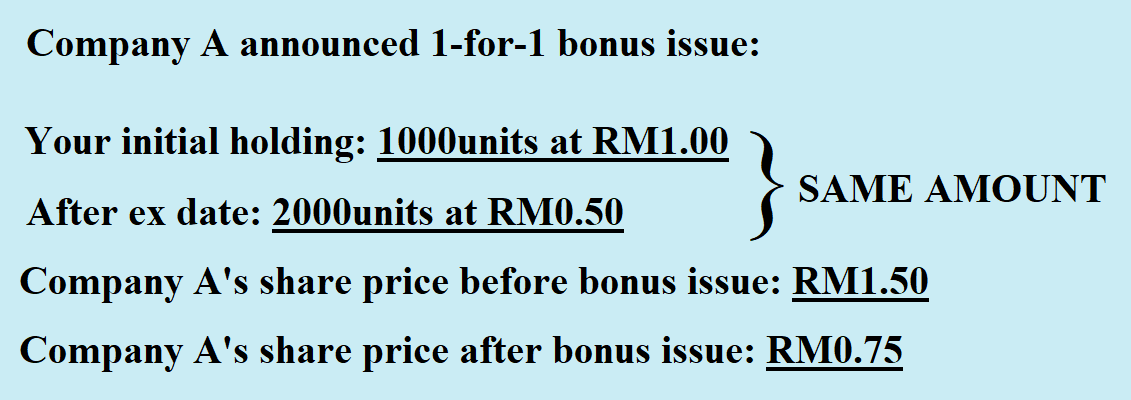

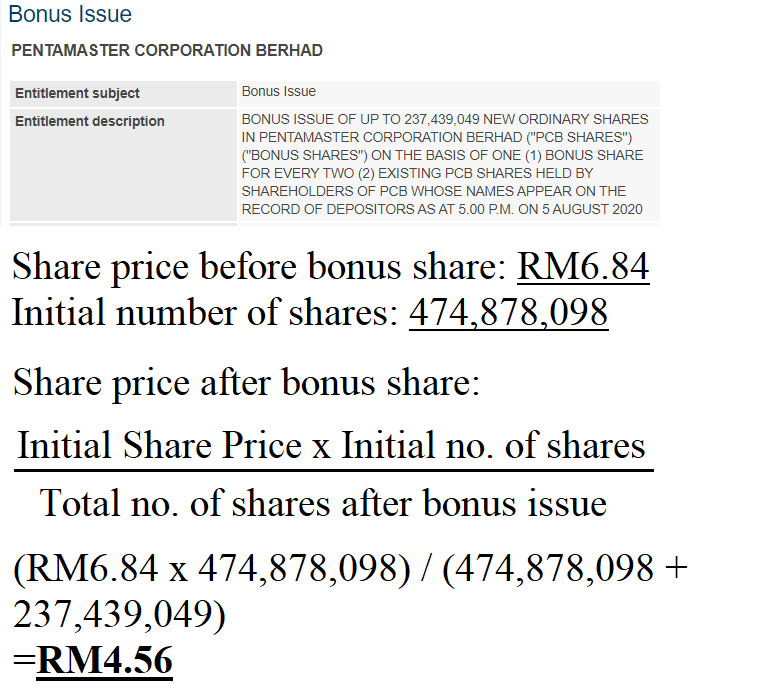

Back to the question, do we really get the shares for free if a company that we are currently holding propose bonus issue? The answer is a no, we will only get extra amount of shares, but the price will also be adjusted. Let say initially you owned 1000 shares of Company A at RM1.00, and the company proposed a 1:1 bonus issue, then your holding after the bonus shares entitlement will change to 2000 shares of RM0.50, where the total amount will remain unchanged. The following diagram will show a clearer illustration of this.

In short, bonus issue does not grant the investors free shares, but is to merely increasing the number of shares and reduce the share price. This is to make sure the company’s share price is more affordable and “seemly” more attractive to fellow investors.

我们时常可以看到有公司宣布红股,可是那是什么呢?这些宣布红股的公司,它们的公告都是这么写的:“本公司将会宣布2给1的红股。”那么这是不是意味着我们会额外获得免费的股呢?这个问题将会在以下的内容中解答。

首先,我们要明白为什么公司可以给红股?在2020年9月前,有一条规矩说到公司在宣布红股之前必须确定公司拥有足够的保留盈余。举例,公司必须要有至少与股本相当的保留盈余才可以宣布1给1的红股。但是,这个条规在9月过后便被取消,所以公司可以在不足够保留盈余的情况下宣布红股,亦因为如此,我们最近时常可以看到有公司宣布1給3甚至1给4的红股。

那为什么公司要给红股呢?这是为了增加公司的股数而且降低公司的股价,来让更多投资者愿意买公司的股份。既然公司的股价下跌了,那么自然而然地就会吸引更多的投资者,并且再把股价推到更高的价位。

回到我们的问题,如果我们在公司给红股之前买入,真的可以因此获得免费的股?答案是否定的,我们只能获得额外的股数,但我们所持有的股,它的股价也会被调整。我们举例现在我们持有者A公司的1000股,并且在它RM1.00时买入。那么当公司给了1给1的红股后,我们所持有的数量便会变成2000股,而价钱也会被调至RM0.50,所以我们持有的总数值是不变的。笔者在接下来的图中会更仔细的解释。

总结,红股并不会让投资者获得免费的股,但只是提高股数并且调整股价而已。这样,公司的股价会让众多投资者更负担得起,并且“看起来”更吸引和便宜。

For more EXCLUSIVE content, visit: https://www.facebook.com/InvestingKnowEverything/

请关注笔者的脸书专页以获得独家资讯。

More articles on Investing: Know Everything

Created by YOLO123 | Feb 02, 2021