How Money Blinds Hot-headed Investors (金钱如何蒙蔽了性急的投资者)

YOLO123

Publish date: Wed, 16 Dec 2020, 12:31 PM

Back in August…

The market was so crazy that it hit several days of historical trading volume, and various counters hitting limit ups. During that time, all we can see is the market surging more and more.

During that time, investors were extremely irrational, where any stocks that are related to glove and masks will have their share price shoot up to the sky.

However, because the market was so hot that some people even mistaken some stocks with others.

BORNOIL (7036) = mistaken to be oil company where in reality there are involved in fast foods and franchise.

APEX (5088) = mistaken as AHEALTH when pharmaceutical stock in the rise, while they are actually involved in financial business.

This kind of mistake does not only happen in Malaysia market, and it is definitely not the first time happening. Anything can happen when the investors are being hot-headed.

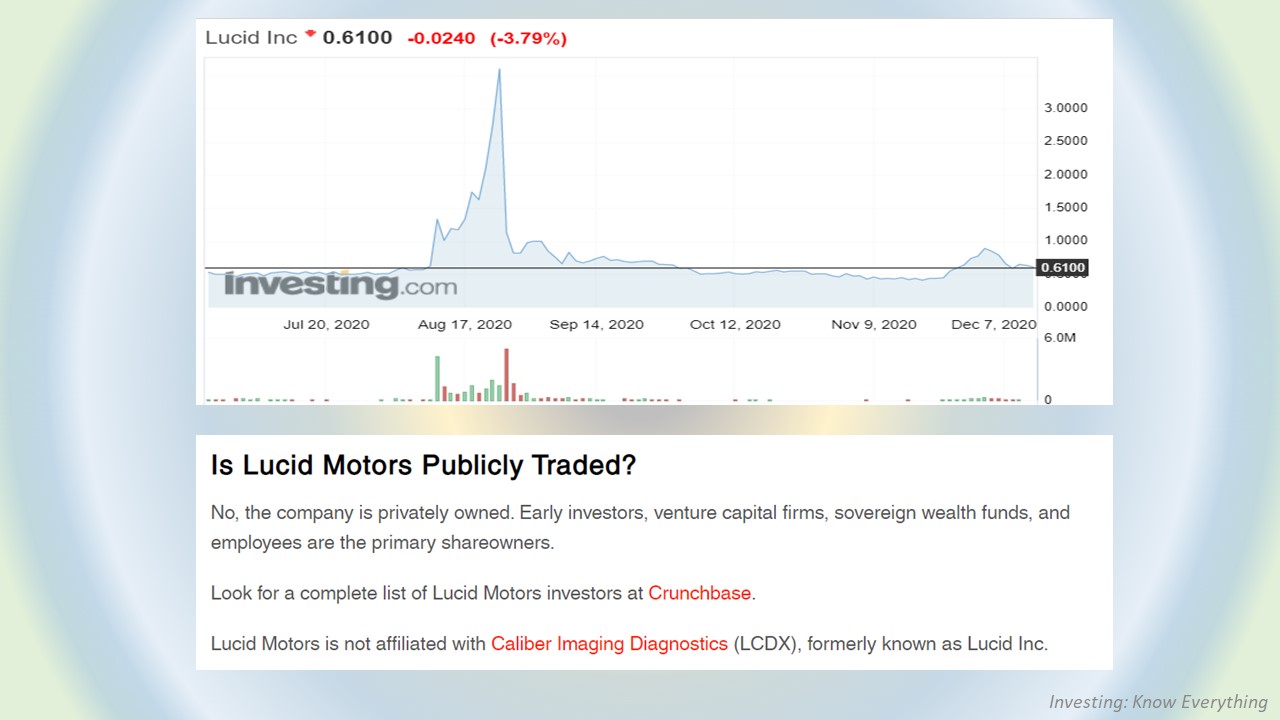

LUCID MOTORS is known for their electrical car. When they announced their operation back in August 2020, LUCID INC surged in share price, where they rose from USD 0.50 up to the highest USD 3.50. Little do they know, LUCID INC is a pharmaceutical company and is different from LUCID MOTORS, who has yet to have their IPO.

Back in the late 1998, TMCO, a building-maintenance company surged three times its previous closing price randomly. Investors later found out that they have mistaken TMCO for TMCS, which was a internet-related company that underwent the first day of trading.

In short, investors shall do their own research before buying into any stocks. Do not buy a stock just for the fact that others are buying too, investors should be intelligent enough to make their own assessment. That way, they will not repeat the previous mistakes made by others.

在8月时…

当时的市场非常的疯狂,连续地突破历史新高的交易量,以及好几家公司一起涨停板。当时看到的就只是会一直上升的市场而已。

当时的投资者是非常不理智的,任何有关于到手套和口罩的公司,他们的股价都会飞上天。

但是,正因为当时的市场如此火热,一些人甚至混淆了一些股。

BORNOIL (7036) = 被当成油气股,而其实他们的业务是关于快餐以及连锁店的。

APEX (5088) = 被当成是做医药的AHEALTH,而其实他们的行业是关于金融的。

这种乌龙并不只是发生在马来西亚市场上,而也并非历史上第一次发生。这就是为什么在投资者心急时,什么都可能发生。

LUCID MOTORS是一家出产电子车的公司。当他们在2020年8月宣布开始生产后,LUCID INC的股价便开始攀升,从0.50美金上升到3.50美金。但是投资者后知后觉的是,LUCID INC是一家医药公司,和还没上市的LUCID MOTORS截然不同。

在1998年尾,TMCO是一家建筑维修的公司,而他们的股价突然暴增了三倍。投资者再过后发觉他们把TMCS错当成TMCO,而TMCS是一家在当时第一天上市的互联网公司。

总结,投资者必须在买入公司时做足所有的研究。不要因为大家都买这家公司而跟风去买,一个足够聪明的投资者能够正确的评估一家公司。这样,我们便能避免重复其他人在以前犯过的错误。

For more EXCLUSIVE content, visit: https://www.facebook.com/InvestingKnowEverything/

请关注笔者的脸书专页以获得独家资讯。

More articles on Investing: Know Everything

Created by YOLO123 | Feb 02, 2021