Great stocks = Less risk = Less return

Ricky Yeo

Publish date: Mon, 23 Jan 2017, 11:07 PM

-

High P/E

-

It has been priced in

-

Low return

-

Boring

Most investors tend to shy away from high P/E stocks (P/E 15 and above) because they are not considered ‘cheap’ and put more focus on so-called ‘undervalued gem’, or stocks that trade below PE 10 as these stocks are considered to have higher upside potential if the business continues to perform well while PE expands, say from PE 7 to 10.

It has been priced in

When measured against popular multiples like Price-to-Earnings ratio, Price-to-Book ratio etc great stocks generally sell at a much higher multiples compare to their gem peer. As the reasoning goes, their quality has been priced into the share price. So they’re unlikely to provide a satisfactory return for the investor.

Low return

Because of the inherent quality of these stocks, they are considered low risk and safe. Investors equate low-risk investment with low future return such as fixed deposit. Thus they are unlikely candidates to offer a high return.

Boring

Most investors don’t want to hold great stocks because they are simply unexciting.

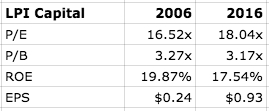

To see how well these reasons hold up, let’s take a look at an example — LPI Capital. LPI Capital is a general insurance company and below is some of their key figures for 2006 and 2016.

LPI is a classic stock that fits the bill of great quality, selling at high P/E and one that’s extraordinarily boring. LPI looks richly valued today as they were 10 years ago, and not what many investors would be willing to own it back then or now. So how did the return looks like over the past 10 years?

I’m not sure if 10 years compound annual return of 21% is considered ‘satisfactory’ for a common investor, but it is pretty amazing to me (Turning $1 into $6.73). This return easily beats 99% of the stocks out there.

This could be a hindsight bias by singling out a stock that ‘worked’ while ignoring others that have suffered a different fate. Let us consider an alternative future. Suppose LPI Capital today trade at PE 10 instead of 18. A simple EPS calculation would still show you that the 10 years CAGR is around 15% after suffering such a horrendous PE contraction.

The 2nd myth that we can debunk is that even if all the information have been factored into the share price, it does not mean superior return cannot be achieved. The long-run compounding rate of a business is a reliable estimate on how much an investor can earn over the long term. LPI Capital’s 10-year CAGR return has been tracking closely to its 15–20% ROE band, plus and minus the entry price of the investor, which matters less and less as the holding time lengthens. Buy price still matters a lot if you have a short investment horizon but the weight gradually shifts from buy price to time on hand the longer you expand your investment horizon. But of course, if you can own a great stock at a cheap price, why not. The key here is investors tend to underprice the long term compounding power of a great stock.

Valuation multiples i.e P/E, EV/EBIT are all shorthands and many times they do not tell the true story of a business. The key here is not about ignoring them, but knowing their limitations. So does every other valuation methods such as DCF. Just as there are many undervalued stocks that never turns, there are also those few great stocks that do not regress back to the average for a long long time. Once you found it, all you need is a lot of patience and let it does its job. And it is much easier to differentiate a great business from poor ones compares to telling whether a stock is under or overvalued.

Write to me at ricky.yeo@musingzebra.com

If you find this helpful please share it and subscribe to our listhttp://eepurl.com/b93qbH

More articles on Intelligent Investing

Discussions

Finding great business with great future and sound management, invest with strategy and let it does its job, your money will grow over time.

As usual, good sharing & writing from Ricky. Keep it up!

---------------------------------------------------

Once you found it, all you need is a lot of patience and let it does its job. And it is much easier to differentiate a great business from poor ones compares to telling whether a stock is under or overvalued.

2017-01-23 23:34

Paying a low Price-P for a currently visibly attractive Earnings is better or ...a higher Price for a low Earnings which requires deeper than surface analysis on the hidden future Earnings growth potential?

actually the question is meaningless....as its all about how sure you are on the future Earnings and paying the price according to your intelligence (confidence) level.

So then...lets not talk about P/E....just talk about how to predict Earnings growth.

2017-01-23 23:45

True true, what you say is true. It's OK to buy great business even if it's trading at a high PE. For me, I see that as higher risk because I have to assume that the company can continue to grow at the past growth rate. But if I buy a company with low PE, I only need to assume it can sustain its current result. Since I can't see the future, the former does carry higher risks than the latter, in my opinion.

2017-01-24 00:09

I would say, find a style that suits you. It is more like a decision of- "you want to prove yourself right Or you want to make money".

2017-01-24 09:35

Right, this will be one of the techniques & of course making $$$ is absolutely the best evidence of proving oneself right... right kah?

2017-01-24 14:43

"Over the long term, it's hard for a stock to earn a much better return than the business which underlies it earns. If the business earns 6% on capital over 40 years and you hold it for that 40 years, you're not going to make much different than a 6% return – even if you originally buy it at a huge discount. Conversely, if a business earns 18% on capital over 20 or 30 years, even if you pay an expensive looking price, you'll end up with a fine result."

From Charlie Munger

2017-07-12 01:02

Flintstones

Boring

2017-01-23 23:19