EG Industries Berhad: Worth for me to invest ?

mwong3

Publish date: Mon, 30 Nov 2015, 06:02 AM

EG Industries Berhad is an investment holding company. The Company operates through its subsidiaries, which include SMT Technologies Sdn. Bhd., which is engaged in the provision of electronic manufacturing services for computer peripherals, telecommunication and consumer electronic/electrical products industries; Mastimber Industries Sdn. Bhd., which is engaged in the manufacture and sale of two layer solid wood parquet flooring; EG Wireless Sdn. Bhd., which is an original equipment manufacturer/original design manufacturer (OEM/ODM) in complete box built products, and SMT Industries Co., Ltd., which is engaged in the provision of electronic manufacturing services (EMS) for computer peripherals, telecommunication and consumer electronic/electrical, and automotive industrial products industries. It has operations in Malaysia, Singapore, Europe, the United States, Korea and Thailand. (Background from klseinvestor)

At a glance EG Industries in FY2015 recorded, record profits at MYR26.35m and EPS at 35.39sen. At current price level 0.825sen, P/E at mere 2.33x, superb earnings. However the reality was around MYR15.5m of the income were derived from realising their investments (quoted shares) which were a non-recurring income. The gain from disposing their investment translate to around 20.50sen per share.

Taking into account only income from operations at around MYR10.86m, the EPS were at 14.89sen while the P/E at 5.5x, extremely undervalued if compared to s90imilar companies. It is likely EG Industries is not attractive due to its thin gross profit margin at less than 6% and Return on sales (ROS) at mere 2%.

On a more positive note its gross profit margin had been steadily improving and it is likely continue in next few financial years. Gross profit margin in 2015 – 5.3%, 2014 – 4.5%, 2013 – 2.9%. Meanwhile its last 2 quarters gross profit margin has been inching up gradually 2015 Q4 – 6.1%, 2015 Q3 – 4.9%.

On its balance sheet, EG is slightly short on its liquidity evident in the following ratios

· Current Ratio = 0.98x (Quick = 0.70x)

· Non Current Asset to Networth = 1.21x

· Fixed asset to Networth = 1.03x

· Debt Ratio = 0.71x

· Interest bearing borrowings = RM205.7m

While EG Industries liquidity is on the tight side, on more optimistic side, its cash amounts to RM47.5m (account for 10.8% of total assets). Recent rights issue completed in Oct 2015 have added another RM57.8m (net fees) and recently approved private placement of 19.2m shares at RM0.80 would add another RM15.36m which would increase its net cash level to RM120.66m. After the rights networth would have added by around MYR60m to its equity at RM133.7m reported in 30th June 2015 result.

NTA after rights issued in Oct 2015 = 98sen (exclude warrant), currently the it is trading at 0.825

To summarize EG Industries financial performance had been mediocre for the last 5 years and unlikely to register material improvement in the remaining 2015 ie. Jun – Dec 2015 (Q1 & Q2 of FY2016). In Q1 2016, (3 Mths ended Sep 2015) EG likely will register at least RM4m to 5m net profit base on its Q3 and Q4 of FY2015 performance and net income would be slightly bump up by RM770K from the land sales which was expected to be completed in July 2015.

ALLURE/ATTRACTION

However despite its mediocre performance, exciting times are ahead of EG Industries and will certainly improve its profitability materially. In mid 2014, EG Industries had embark on restructuring to improve expand its customer network and its products solution. EG Industries aspires to be a one stop solution for EMS and OEM.

To better comprehend the next section here are some chronological event

· On 11th July 2014, Jubilee Industries a subsidiary of WE Holdings Pte Ltd (listed in Singapore Catalist Board) bought 19.5m shares (26% at the point of time) of EG Industries @ RM1.00

· On 18th July 2014, Terence Tea appointed as EG Industries Berhad’s Executive Chairman

· Terence Tea is also WE Holdings’ Executive Chairman and CEO, Jubilee Industries’ CEO and major shareholder of Singyasin Holdings Pte Ltd

· On 2th Feb 2015, Jubilee Industries acquired WE Component from WE Holdings

· On 21st April 2015, EG Industries proposed to buy 95.81% stake in Singyasin Holding for RM10.3m.

· On 15th May 2015, EG Industries bought 10.22% of WE Holdings for SGD2.035m (RM5.550m)

· On 15th June 2015, Jubilee Industries increased its stake in EG Industries to 24.97m shares (estimated 13.002%)

· On 4th November Terence Tea increase its stake in EG Industries to 10m shares (5.254%)

Jubilee Industries are in similar business segment while Singyasin operate in a different segment of the value chain which will complement EG industries business.

The key to EG Industries transformation lies in the appointment of Terence Tea as Executive Chairman. It cannot be a coincident that Terence Tea was appointed as EG Industries Executive Chairman in July 2014, who also is the Executive Chairman and CEO of WE Holdings and CEO of Jubilee Industries. Furthermore as of todate, Terence Tea currently owns 5.254% of EG Industries shares.

M&A with Jubilee Industries will move EG Industries into the direction of one-stop electronics solutions provider for its customers and will achieve a greater cost savings, operational efficiency and more competitive pricing in the market as well as greater bargaining power with suppliers and expanding product portfolio to customers.

EXPECTATION

In Q4 of 2015, EG Industries reported its gross profit margin increased to 6.1% and net profits before tax from EMS segment was at RM11m

EG Industries gross profit margin will continue to improve as the group is focusing in more high end products.

Synergies with Jubilee Industries have yet to be fully unlocked and once unlocked will contribute further to its gross profit margin. More synergies expected after acquisition of Singyasin Holding Pte Ltd.

2 year contracts with Tramigo worth USD50m will likely start to contribute to EG Industries earnings in Q3 2016 onwards (i.e. in Jan 2016 onwards) and each quarter will add USD6.25m @ USD/MYR 4.20 =RM26.25m revenue to its operations.

Tramigo contract will increase EG Industries revenue by

· FY2016 = RM52.5m (Q3 & Q4 2016)

· FY2017 = RM105m (Q1 to Q4 2016)

Sales of 3 parcels of land in Kedah for RM4.5m which will be completed in July 2015 will bump up EG Industries non-recurring income by RM770k in Q1 of 2016.

Recent rights issue and recently approved private placement provides EG industries additional funds for investments/expansions as well as reduction to its interest bearing borrowings which are expected to contribute further to its bottomline.

There was a plan hatched in 2014, to expand SMT activities

Taking into consideration of

1. Q3 and Q4 revenue and gross profit margin

2. Improving gross profit margin due to synergies and moving towards better margin products.

3. Tramigo contract contributing to EG Industries income in Q3 and Q4 of FY2016

The forecasted revenue in FY2016 would be at least in the region of RM700m – RM750m while its profit before tax would be above RM16m to RM20m. For FY2016 EPS should be in the region of 8.3sen – 10.4sen.

The forecasted number does not include the full potential synergies from Jubilee Industries and WE Holdings. If EG Industries can unlock and capitalize on the synergies earlier than expected in FY2016, expect further upside in its revenue and profitability.

EG Industries excitement lies in 2016 and beyond, with flurry of joint venture/M&A activities with Jubilee Industries, WE Holdings and Singyasin Holdings to improve its gross margin and customer network, expectation to unlock the synergies between 4 companies are high. In medium term, EG Industries revenue, gross profit margin and net income are expected to increase accordingly.

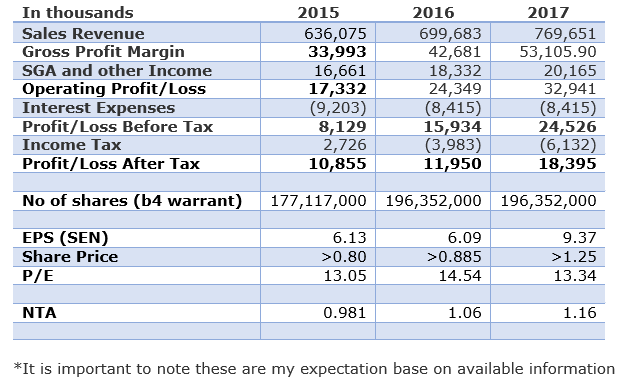

Base on 192million shares and expectation EG Industries increase in revenue and profitability here are the expected price level if the following profitability is achieve.

Expectation

· No new shares issued after private placement of 19.2m shares

· Revenue grow by 10% (included Tramigo 2 yr contract generating RM52.5m and RM105m in FY2016 and FY2017 respectively.

· Gross profit margin grow at 0.8% per annum

· SGA rise in tandem with sales revenue

· Interest bearing borrowings reduced by RM17m from RM205m reported in FY2015 averaging 5% per annum

*Note below 2015 excluded the non-recurring gain of RM15.5m from sales of quoted share and using the enlarged issued shares for comparison.

Happy investing and I would like to take oppotunity to said thank you to my partner(KH WONG) who spend valueble time to do research and share with us,

DISCLAIMER:

Stock analysis and comments presented on klseelwavetrading.blogspot.com are solely for education purpose only. They do not represent the opinions of klseelwavetrading.blogspot.com on whether to buy, sell or hold shares of a particular stock.

Investors should be cautious about any and all stock recommendations and should consider the source of any advice on stock selection. Various factors, including personal or corporate ownership, may influence or factor into an expert's stock analysis or opinion.

All investors are advised to conduct their own independent research into individual stocks before making a purchase decision. In addition, investors are advised that past stock performance is no guarantee of future price appreciation.

More articles on KLSE Technical Analysis

Created by mwong3 | Nov 21, 2020

Created by mwong3 | Nov 18, 2020

Created by mwong3 | Nov 18, 2020

Discussions

Best example you can used is for MBSB during dec 2014. Because of deferred tax, the company earned 14.56sen uringdec 2014. Subsequently, the company earning dropping as the deferred taxation eat back the earning of MBSB

2015-11-30 08:42

when commenting on PE and EPS.....please check your figures for rights issues ( Oct2015 after the YE)

I am not saying cannot buy.

But this is a very common amateur problem.

2015-12-22 13:21

Nice to meet all of u.

I would like some clarifications. The author estimated that for FY 2016 the estimated EPS will be 8.3 - 10.4 sen. But according to the 1st quarter 2016 financial result, the EPS alrdy has reached 6.56 sen. So is the EPS estimation for FY 2016 too conservative??

And another point i want to highlight, the number of shares for 2015 shown on the table above is 177,117,000 shares. But according to the annual report 2015, the total number of shares is 77,117,000. Is this a mistake?? Even reduction of par value of share from RM 1 to RM0.50 , should not have affected the number of shares.

if the number of shares is wrongly quoted, it will affect a large part of the financial estimation including the EPS and NTA per share. Can the author kindly clarify on this ? Thank you very much. Awaiting reply soon :)

2015-12-26 12:35

pingdan

The revenue dropped from more than 200k to ess than 200k for this quarter. Any reason for the dropping of revenue?

Plus, last quarter eps 8.79 most of the part consists of deferred tax. I believe the deferred tax is from purchase of new machine, For your info, usually the company will have deferred taxation income when they purchase new machine because in tax persception, capital allowance claim faster than the depreciation. Hence this deferred tax advantage will slowly eat the earning of EG Industries for coming next few quarter.

Unless the company's revenue come back to 200k, or else it is not a good investment.

High debt and no dividend paid is also one of the concern on me on this share.

Im maybe wrong. If im wrong please give me contructiv feedback. Thx

2015-11-30 08:37