MBL - Concealing A Material Transaction and Its CASH (Part 6)

ismailkarin

Publish date: Sun, 23 Jan 2022, 04:28 PM

MBL and its directors may soon be in a hot soup, as details (of some legal suits and enforcement actions) are beginning to surface.

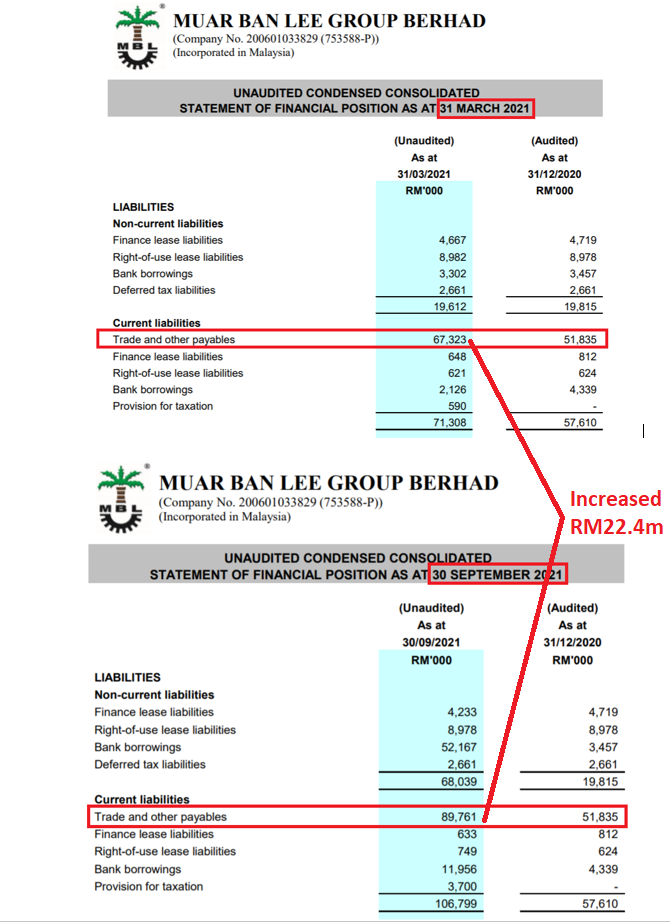

But before we jump to the action, let's look at some peculiar figures in MBL's Q3 Unaudited Consolidated Statement of Financial Position as below :

Based upon the above, one can see that the Trade & Other Payables as at 31 March 2021 is RM67.323m. The Trade & Other Payables of the Current Liabilities jumped to RM89.761m as at 30 September 2021, an increase of RM22.4m or 33.3%.

Trade & Other Payables are defined as "trade payables to creditors/ suppliers, deposit received from third party or customers, accruals, dividend payable....etc". In this instance, accounting principles provide that if a deposit received is in the normal course of business of the company, there will be NO necessity to provide detail of such deposit no matter how big the deposit amount is.

On the contrary, if a deposit received is not in the normal course of business of the company and the amount is more than RM500,000, the company must disclose the nature, the amount and the transaction in full detail.

So why is there a big jump of RM22.4m between end March 2021 and end September 2021?

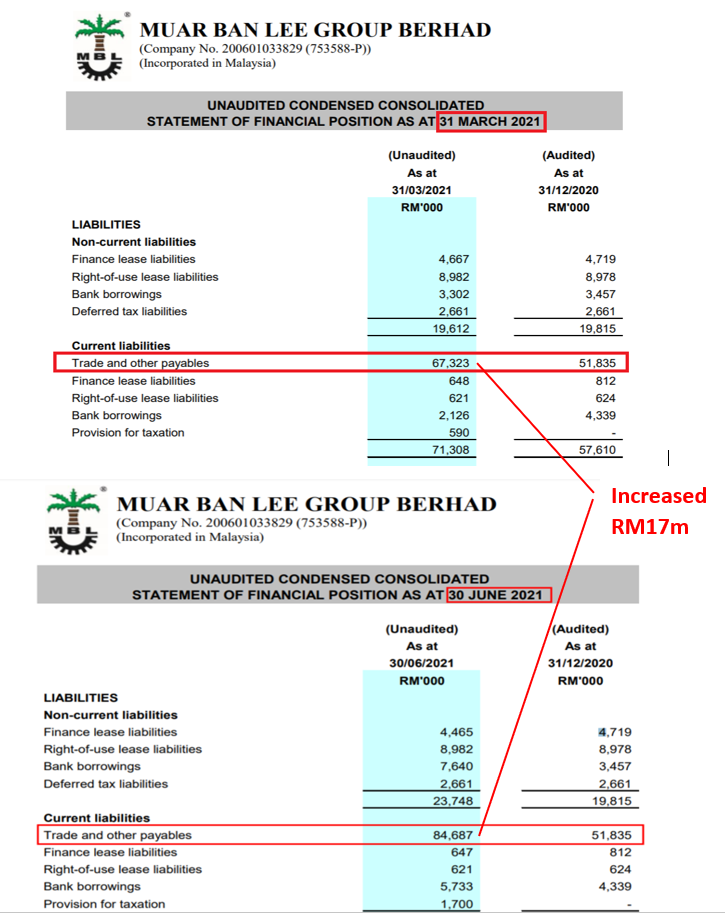

More amazing is RM17.0m out of the RM22.4m actually landed in MBL's account in the period of April to June 2021 (Q2) period, as shown in the below snapshot :

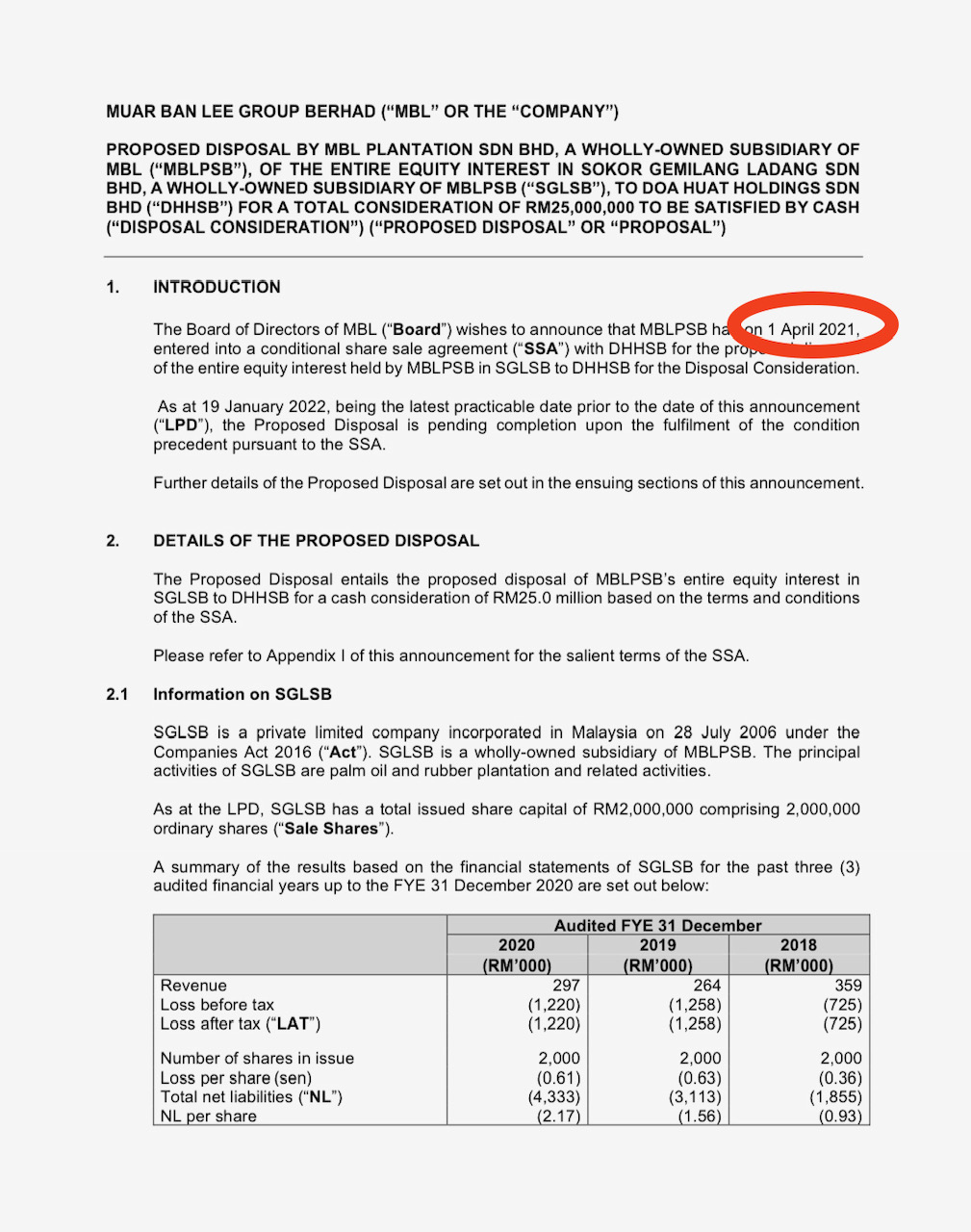

The answer may be hidden in the announcement of 21 January 2022 by MBL in relation to the proposed disposal by its 100% wholly-owned subsidiary, MBL Plantation Sdn. Bhd. of its entire shareholdings in Sokor Gemilang Ladang Sdn. Bhd. to Doa Huat Holdings Sdn. Bhd. for a total cash consideration of RM25.0m.

As shown in the above announcement, MBL Plantation Sdn. Bhd. has entered into the said Share Sale Agreement with Doa Huat Holdings Sdn. Bhd. on 1 April 2021, almost 10 months ago!!

QUESTION 1 :

Why is MBL hiding this transaction from the

shareholders and investing public for

almost 10 months??

QUESTION 2 :

Where did MBL hide and use the RM20m+ for?

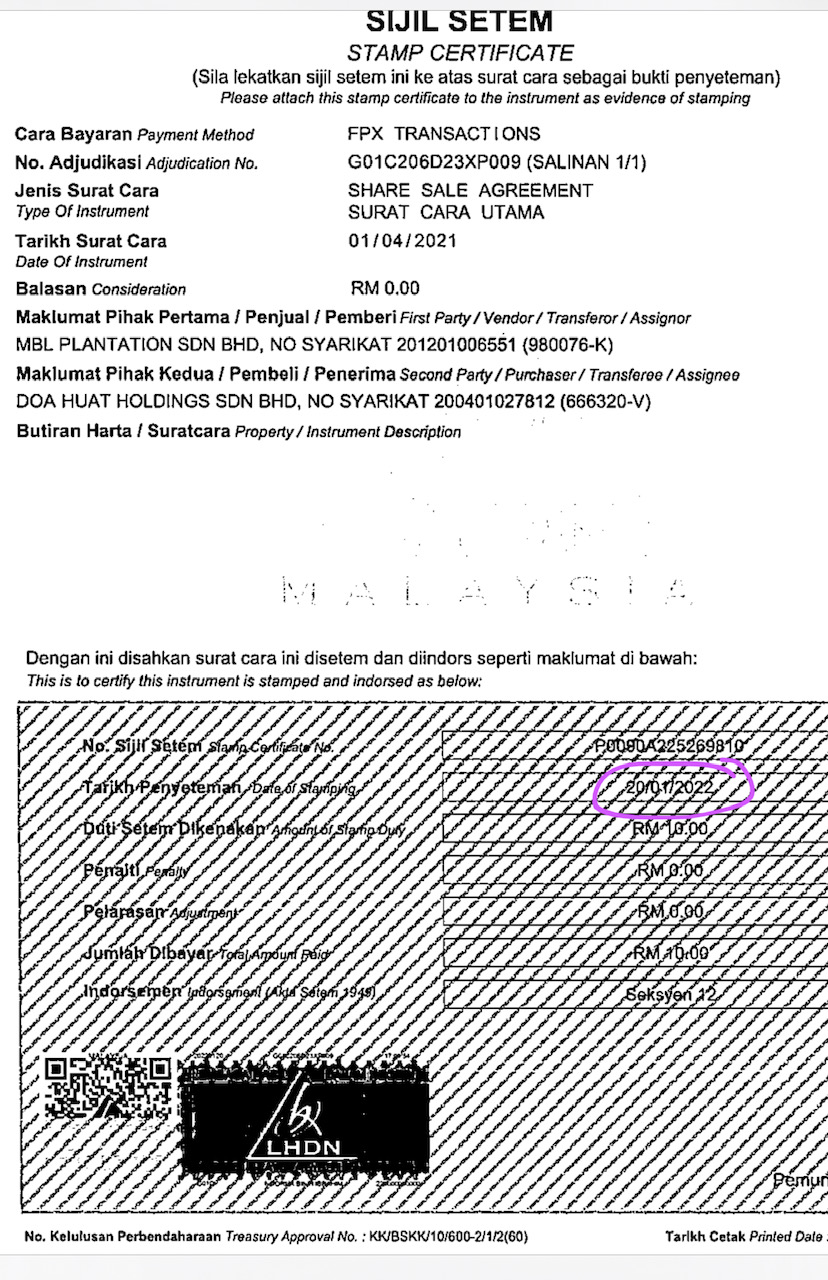

To make it a double whammy, MBL only stamped the said Share Sale Agreement of

1 April 2021 on 20 January 2022, just a day before making the announcement through Bursa on 21 January 2022!!

QUESTION 3 :

After hiding the Share Sale Agreement for almost

10 months, what prompted MBL directors to hurrily

stamped the agreement on 20 January 2022 and

announced the sale the next day??

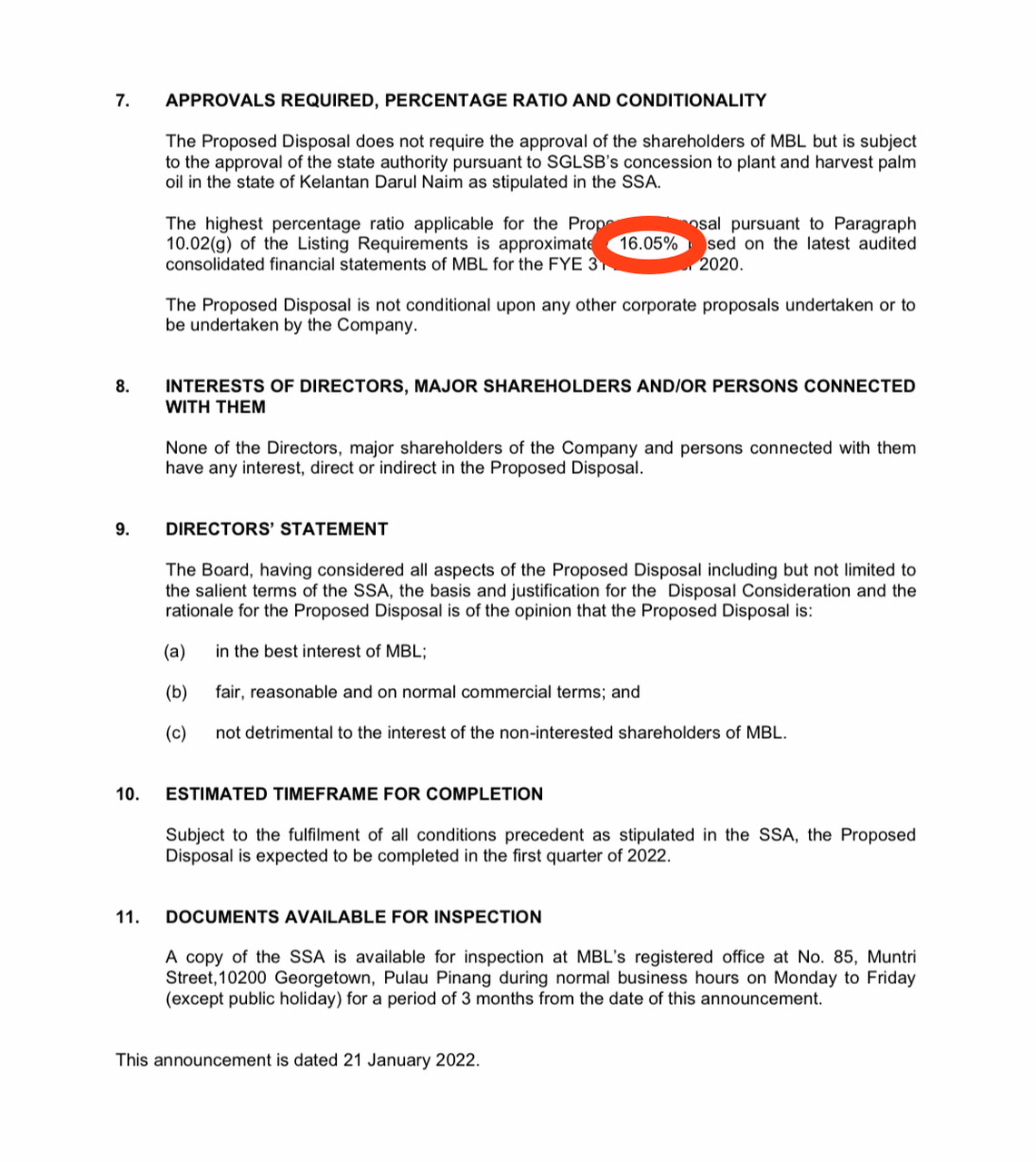

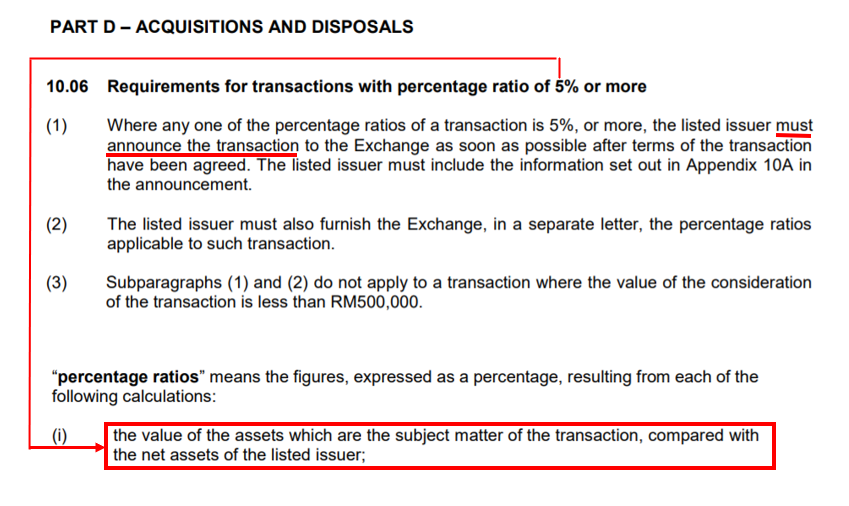

As indicated in their announcement, this disposal of RM25.0m amounts to a percentage ratio of 16.05% which warrants for an immediate announcement based on Chapter 10.06 of Bursa Listing Requirements.

QUESTION 4 :

Knowing fully well that under Bursa Listing

Requirement, the Proposed Disposal will trigger the

immediate responsibility of the directors to announce

and disclose the transaction, so why did MBL and all

its directors chose to remain mum for 10 months??

All I can say is MBL has dug its own graves. More revelations next.

Mana Boleh Lari

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on MBL - What the hell are you doing?

Created by ismailkarin | May 29, 2022

Created by ismailkarin | Jan 19, 2022

Created by ismailkarin | Jan 16, 2022

Created by ismailkarin | Jan 13, 2022

Created by ismailkarin | Jan 12, 2022

Created by ismailkarin | Jan 09, 2022

Discussions

Will this be a spectacular CNY firecracker explosion? Well done sir and I guess the director will not have a peaceful CNY this year.

2022-01-24 15:50

wahidpenang

This is going to explode in the face of all mbl directors

2022-01-23 16:45