Building A MENTAL MODEL of Covid-19 or how to invest AROUND the VIRUS

Philip ( buy what you understand)

Publish date: Sat, 11 Apr 2020, 03:16 PM

Hi All,

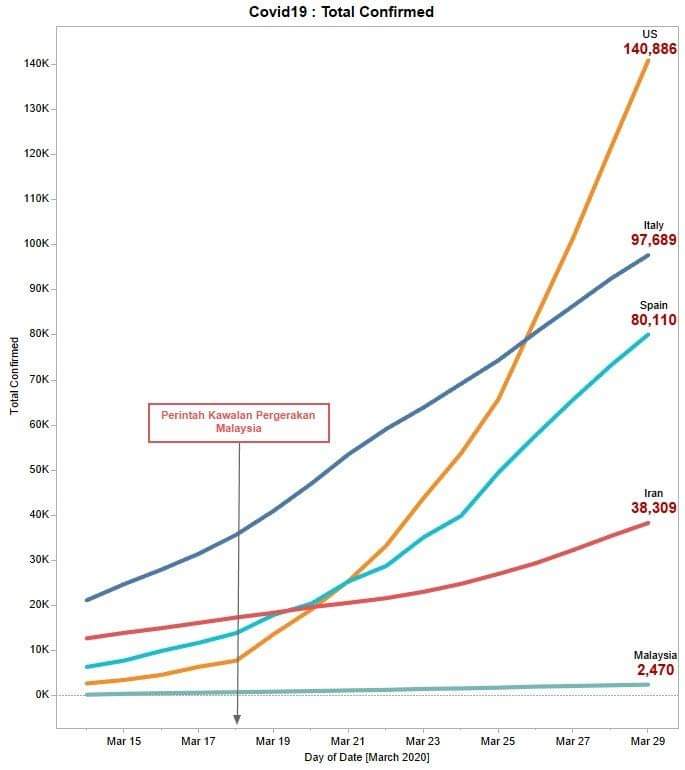

My name is Philip. Before I begin, please take a look at the following graphs:

This is a graph depicting the performance of each country in handling the crisis and I believe it is a good predictive factor in evaluating how those countries will come out of the economic crisis that follows.

Imagine a flesh eating disease that spreads in a room. A number of people are infected, and they run to the nearest hospital. Who lives and who dies? If you think about how fast that flesh eating disease works, the best option is to cut out whatever body part is infected, before it spreads to far out. Here's the thing, the more you hesitate, babble and waste time, the more body parts will get infected and the longer (or more impossible) it becomes to save the host. In this case, the correct answer would be to take a deep breath, and cut off the arm. It is the correct decision, and it saves lives that can be productive later on, rather than burying corpses in the snow.

Now, in the case of Covid-19 and country economics, it is not as serious (countries can grow back their economies): however the same mental model applies:

Do you EAT that cookie NOW? Or WAIT until later, to get 2 COOKIES? In other words, DELAYED GRATIFICATION.

Now this is not a new mental model, this concept has been around for decades.

https://en.wikipedia.org/wiki/Stanford_marshmallow_experiment

So, how do we invest with this mental model in place.

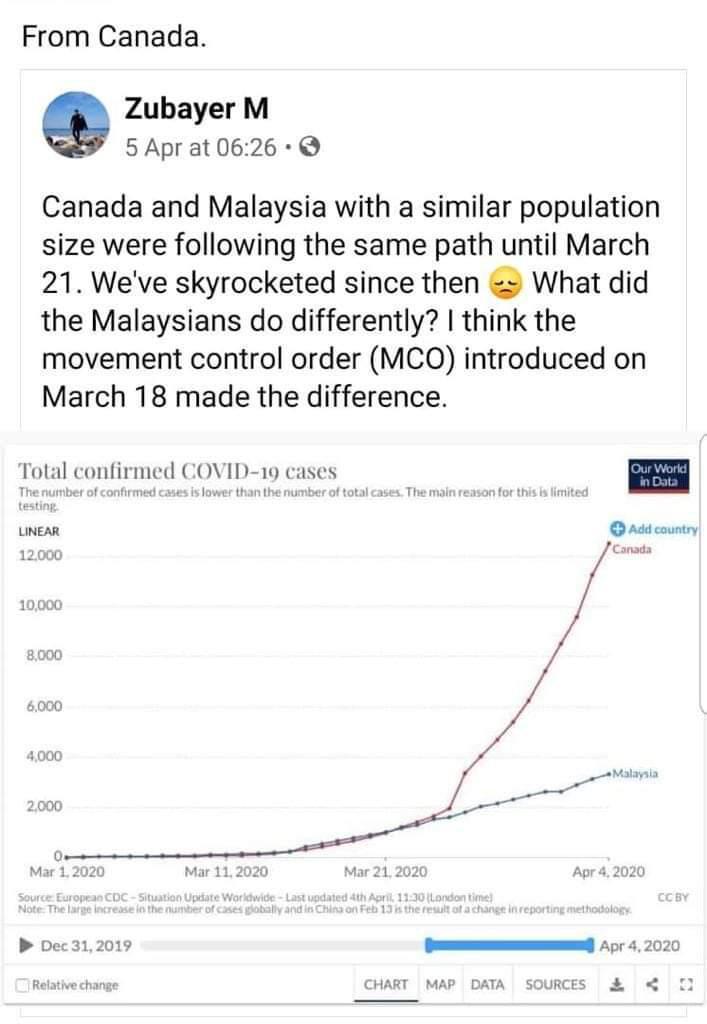

Obviously, the countries which sacrificed and put the economy at the backend (via Movement Control Orders or MCO), have seen a huge flattening of the curve.

These countries will have far less trouble picking up their economies out of the doldrums and moving out into filling the supply chain when the entire world recovers from the covid fever. By sacrificing early, they will be able to put their workers back to work far earlier. You will have problems with countries that try to come out of MCO to fast and get trapped in the 2nd imported wave of cases (USA and the UK springs to mind). Avoid investing in these countries or their stocks (no matter how cheap they get, it can always get worse).

Instead, look to countries that have followed a strict protocol. You will find their curve flattening, and you will realize that the share prices have already begun to climb from the lows in March, when the world began to panic.

Please be warned, just because the world is throwing massive amounts of cash into the market does not mean the companies will recover. If anything, for those countries, barring a cure being found (and even if), the effects of the economic loss of life, loss of income and productivity will be felt for the next year to come (or more).

If anything, Malaysia is a good example of governance by extending the MCO to April 28th, and in stages (slowly bringing back essential services to life).

As usual, investing in wonderful companies is the key activity here, even if you make losses in the short term (consider it buying on a discount month). In the next 2-5 years, you will have multiple gains from the prices that you paid for. And if you dipped into margin as I have (even being able to get margin during this discount month is a wonderful thing), you will find the rewards to be very attractive.

If you do not have the time to spend looking for wonderful companies to pick up, the usual advice I recommen is to pick up a basket of index funds. And since you cannot find index funds in Malaysia that has a very low rate comparable to vanguard, You will either need a big pool of money, or to pool money with a group of friends and family (like I have).

Using the FBMKLCI index as a guide,

https://aseanup.com/top-30-companies-from-malaysia-klci/

https://en.wikipedia.org/wiki/FTSE_Bursa_Malaysia_KLCI

I believe there are many deals available for the young investor that is looking to buy at multi year lows, and is willing to buy and hold for the next 5 years. You will be rewarded for your delayed gratification. From a index of 1700 to a low of 1300, on average a 25% discount. I think the dividends alone you will be getting is a fair and safe, especially if you do not wish to do this actively.

Others:

companies like Astro is giving out 75% of their earnings as dividends (which work out to around 9%, and is relatively unaffected by the virus, trade war or oil prices).

banks like public bank at 8 year lows (4.6% dividend)

utilities like TNB which have a solid dividend payout and low prices

But if you do look towards active investing, try to avoid companies with excessive debt (never mind assets, if your company is not backed by cash, keep a wary eye). I would avoid property developers, hotel companies, oil exploration companies (but not oil storage or O&M companies which are not controlled by oil prices), and generally any companies that rely on major exports to countries that have not practiced proper MCO procedures or are too late in doing so (USA, ITALY, SPAIN, EUROPE etc). Those will suffer along with the countries economies for a long while to come.

As usual, keep away from long bets, stay within proven revenues and earnings, and especially now of all times, monitor debt levels of the companies you are looking to invest in. If their quarterly cash flow and resources cannot survive to pay interest and operational needs for more than 1 year, you need to be very very careful in your valuation.

Remember, in stocks, you don't need to actually buy anything. You can wait and wait and wait until a wonderful deal comes around. Forget FOMO and stupid concepts like that. Remember the 1st rule in stock investing.

Never lose money.

Lets all learn new things every day.

Philip

More articles on Investing theory 7 - mental models

Created by Philip ( buy what you understand) | Jan 23, 2022

Created by Philip ( buy what you understand) | Aug 28, 2021

Created by Philip ( buy what you understand) | Jul 12, 2019

Discussions

Hi backdoor unit trust portfolio holder

Is it better to buy single stock to build a portfolio mcm u punya unit trust like portfolio or beli je unit trust tu terus je?

2020-04-11 15:52

Philip ( what you can learn from RJ MITTE )

It depends your skill level as an investor.

Maybe if you show me your portfolio first I can tell you what is wrong.

But if you are a gambler, then your jiwa angkuh dan liar is not going to help you.

How long have you been trading in the market?

2020-04-11 16:31

Hi Philip, what are your thoughts on Stone Co that is operating in Brazil whereby the administration's management of Covid-19 is a bit out-of-hand? Bolsonaro has been refuting the importance of social distancing and cases grew from 1 to close to 20,000 in about 45 days (although the share of population getting it is still low)?

2020-04-11 19:00

Philip ( what you can learn from RJ MITTE )

Hi Chong. I am still holding my shares in Stone Co. In the end, herd immunity or social distancing aside, we will get through this crisis.

If we don't and the virus mutates, then there is no point holding any asset.

So if we have to believe in something, believe that one day things will recover. So if it does, then holding on to stoneco will probably be a very profitable activity.

2020-04-11 19:20

Philip ( what you can learn from RJ MITTE )

And before the invariable comment on losing money comes around, let me clarify. When warren buffett says never lose money, he doesn't mean that literally. What he means is to always buy something for cheaper that it is intrinsically worth years from now. Buy companies with a proven competitive advantage, good revenues and growing earnings. Low debt, good cash levels and good share holder management (share buybacks, dividends, no ESOS). etc. etc.

Losing money is when you buy things with finite life, taking on margin, short term trades that become long term traps. unsold options, cutloss etc.

The fact is, if you buy a stock and you didn't sell it, in the short term the price will always be volatile. But in the long term it will either go up or down.

Or you might be losing money in opportunity costs.

Rule no. 1: Never lose money.

2020-04-11 15:22