Inflation theme stocks, or what to do as the world crashes

Philip ( buy what you understand)

Publish date: Sun, 23 Jan 2022, 09:12 AM

Good morning, my name is Philip.

First, the bad news.

https://www.google.com/amp/s/www.marketwatch.com/amp/story/why-did-almost-no-one-see-inflation-coming-11642519667

For some reason, majority of the public did not see inflation coming, piling more and more money into services industry and tech stocks, while ignoring the huge iceberg in front.

https://www.reuters.com/world/us/biden-says-inflation-temporary-fed-should-do-what-it-deems-necessary-recovery-2021-07-19/

https://www.channelnewsasia.com/commentary/malaysia-food-price-rise-inflation-flood-government-2450546

While leaders are thinking far too short term and ignoring major breaking points as simply temporary. And now inflation is well and truly on us.

https://www.bbc.com/news/business-60044210

Oil prices are expected by traders to hit 100

https://www.firstpost.com/world/explained-all-you-need-to-know-about-erdogans-rate-cuts-turkeys-inflation-problem-and-his-new-unconventional-fixes-10301661.html

Government policies and ideas on interest rate management.

https://www.bloomberg.com/news/articles/2022-01-21/palm-oil-jumps-to-new-record-on-dwindling-production-in-malaysia

The mental models I practise for these:

1. Covid is causing issues for workforce and supply chain. Pain oil prices and soy bean prices are going through the roof because not enough workers are around to pick and process. Construction and manufacturing labor are also constrained, with plant closures causing havoc on profitability and deliveries.

2. Bad government policy by keeping interest rates low, and trying to "stimulate" the economy with cash influx into the public instead targeted response and capital controls will have a huge negative effect in the next 5-10 years.

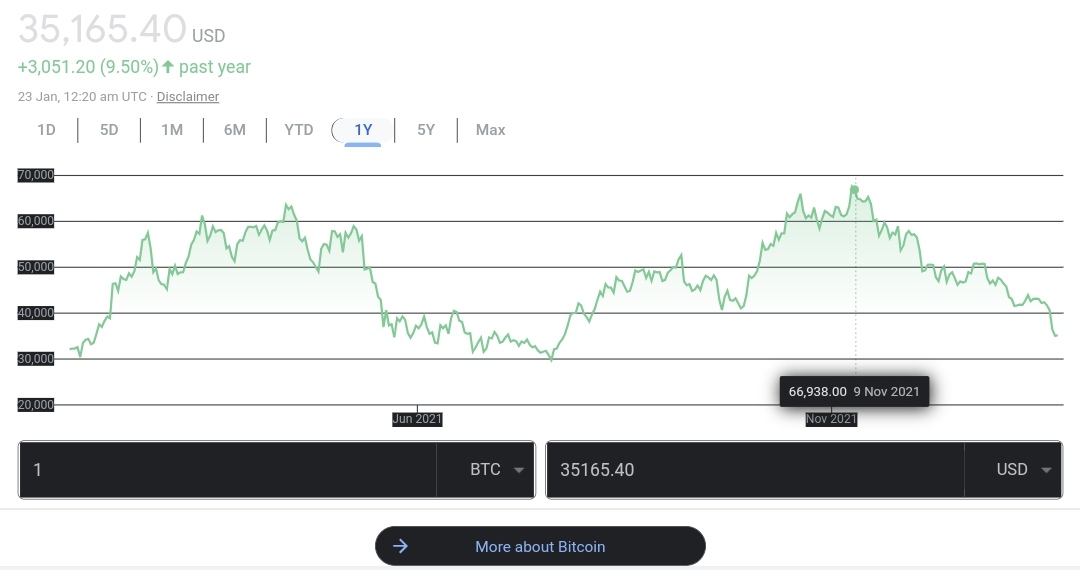

3. Cash is trash, buy assets: a few of the young investors in my telegram group have already moved their glove profits into buying assets like luxury watches, houses, shops, stocks and digital assets(gulp!).

Although a good transition from holding on to glove stock profits, buying ANY assets requires spending much more time on scuttlebutt, reading forums, telegram and Facebook groups, comparing the best prices to find the gaps, buying reliable and non fake watches etc

SPOT THE FAKE WATCH!

My current portfolio as to date kept on track on i3 investor publicly:

https://klse.i3investor.com/servlets/pfs/120720.jsp#tabs_group2

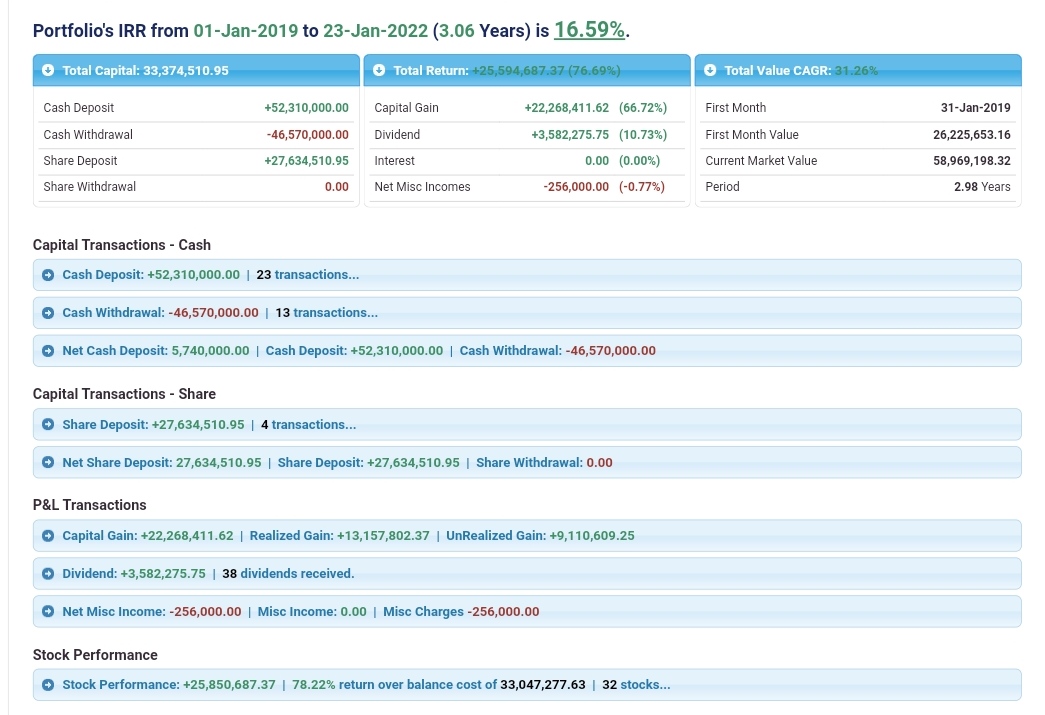

As usual, you can see every transaction that I have done, all the profits and losses, my big egg on the face with serba dinamik, my 3 year CAGR which has dropped to 16.59% , how I leverage down when I buy stocks I trust ( but never leverage up), and how I have crafted my long term strategy in buying stocks based on my mental models.

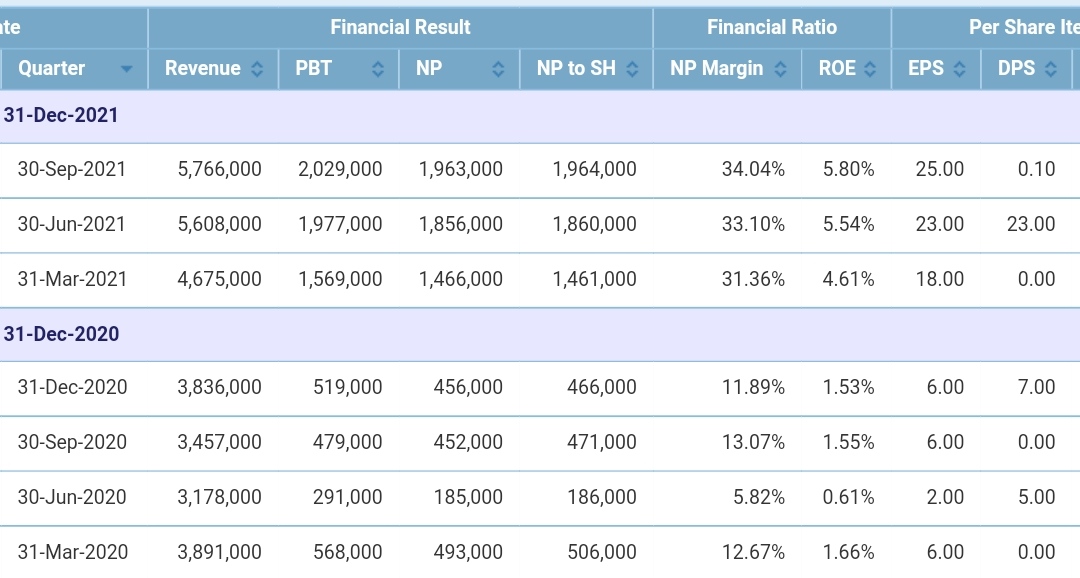

As those in my telegram group have found out, my overall portfolio guide is to find local bursa stocks that are able to compete internationally and be profitable, and buying in sectors that are overlooked by the majority of the market. In 2019 I bought pchem for the growth into pangerang, and their ability to sell commodities at higher prices if the oil prices go up. Yinson for its capability to bid international projects successfully, and their lack of greed compared to armada and sapura in only charging fixed charter prices for their FPSO which is not connected to production or the price of oil. QL for their ability to export seafood to Japan, surimi, and their acquisition of family mart products which they sell at a premium and the market loves.

I have also built an exposure to oil palm around 5% within companies that I know have a better ability to find workers and manage overheads like sop and innoprise who happen to be paying almost 20% in dividends. Unsustainable? Definitely which is why I only have 5% exposure. But buying what you know and understand? Definitely.

So looking at how I have structured my long term portfolio with small bets on Dyson, cows and cash positive developers (very rare), my big bets are still on expectations of inflation, long term.

Chicken and eggs, cows, additives, make up, pvc, chemicals, fertilizer, fish, cooking oil, palm oil.

If you look at my foreign investments, it also shows similar mental models since 2019( this was started recently).

After selling Tesla and Facebook, these are what is left of my foreign portfolio:

Baba

Uniqlo

Stoneco

Palantir

CATL

Roblox

Wilmar

Netflix

So, banks, TV, batteries, software and dairy Queen.

What am I getting at?

https://www.forbes.com/sites/ninabambysheva/2021/11/03/ethereum-co-founder-vitalik-buterins-net-worth-hits-146-billion-as-ether-is-trading-at-all-time-high/?sh=206734cc2250

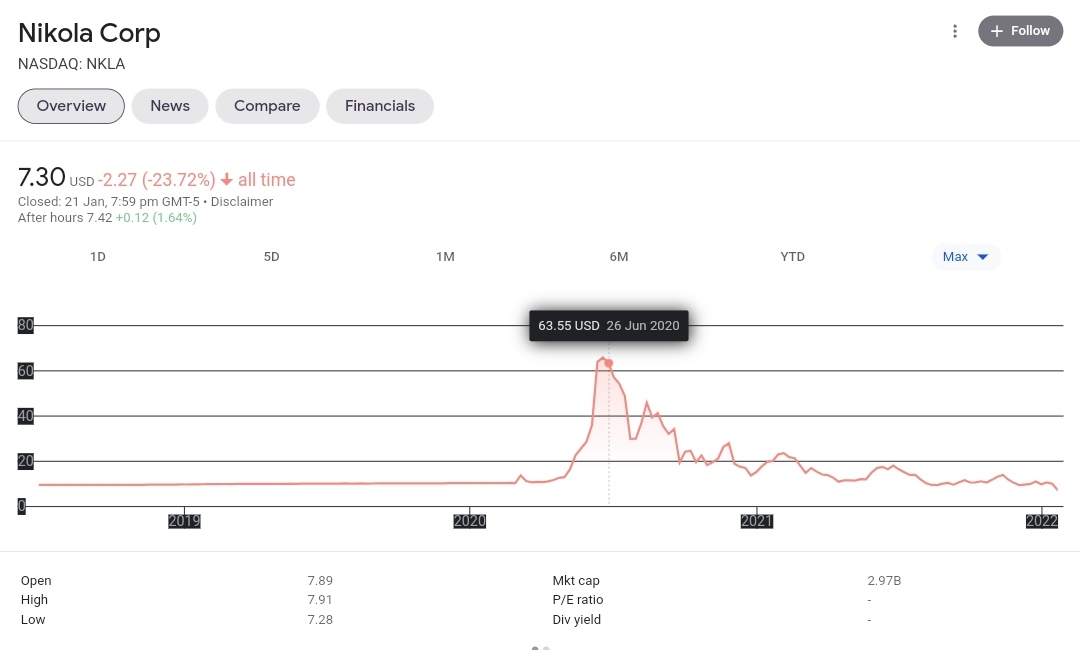

https://www.forbes.com/sites/jonathanponciano/2021/11/24/indicted-billionaire-trevor-milton-has-sold-nearly-300-million-worth-of-nikola-stock-since-criminal-fraud-charges/?sh=3ac7cfb97c10

CAUSE AND EFFECT.

Everything has a cause and effect. When you have money disappearing from the system to the 1% it has to come from somewhere. If you filter everything down, you will find that the ones that ultimately pay for everything the 1% earns is the 99%.

So what happens? After a certain period of zero sum games, all of the financial engineering will filter into increased costs, and the public will soon realize that the really profitable business with cash and dividends come from basic businesses like banks and manufacturing that are valued lower due to being boring.

But:

One company vitrox is selling at 7 billion while the other company pchem is selling at 71 billion. What form of justification and profitability long term are you projecting to give such valuation, except to compare it with tech companies in NASDAQ and say it is fair. Is vitrox growing at a far faster pace than pchem, generating far larger revenue growth and TAM to justify the market velocity? I don't know. Many do.

Silly valuation in my opinion, and yet it remains.

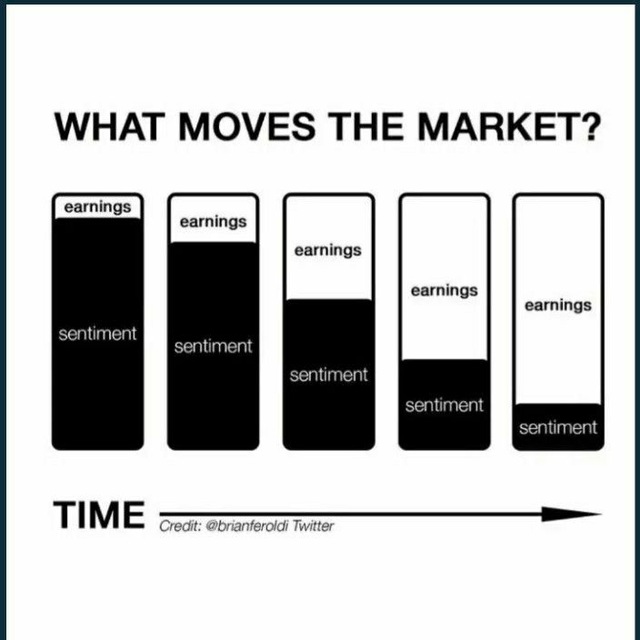

In the end, as the tech industry starts to show slowing growth (Netflix and others start to slow down) and the valuation goes back down to earth, we finally realize one fact.

Mental model:

So the final question remains:

What to buy if you expect inflation to rear it's ugly head?

Commodities.

Daily use brands.

Healthcare.

Chemical

Agriculture

Building materials

You know, things that really matter if you go outside the metaverse, and just look around your and scuttlebutt.

So how do we pick and buy? The answer is easy and difficult at the same time.

Simple answer: Buy stocks that have their own ecosystem and local input cost. Then the production and r&d is localised and exported out. We need to make sure that the companies can compete overseas and is taking market share internationally. These companies will continue to grow over time. The shares price will follow.

So what kind of inflationary measures are we looking at. High input costs which are imported from overseas ( raw materials like steel, electronics, chemicals, oil, feedstocks etc). High transportation costs like shipping and forwarding. All the basics.

What kind of business are we looking for? Companies which can control their raw material costs: big companies which buy in bulk at long term supply contracts. Own feedstocks for agriculture, fertilizer etc in production. End product manufacturers with their own supply chain.

How do I look at these inflationary controls? Let's take pchem for example. It's competitors are foreign companies with factories and plants in Taiwan, China, Japan, Europe, USA, far from the south East Asia population. Production of chemicals like isononanol and melamine which is important suddenly becomes expensive due to foreign cost of import, transportation and raw materials. What does pchem do?

https://www.theedgemarkets.com/article/petchem-be-sole-southeast-asia-melamine-producer-new-plant-kedah

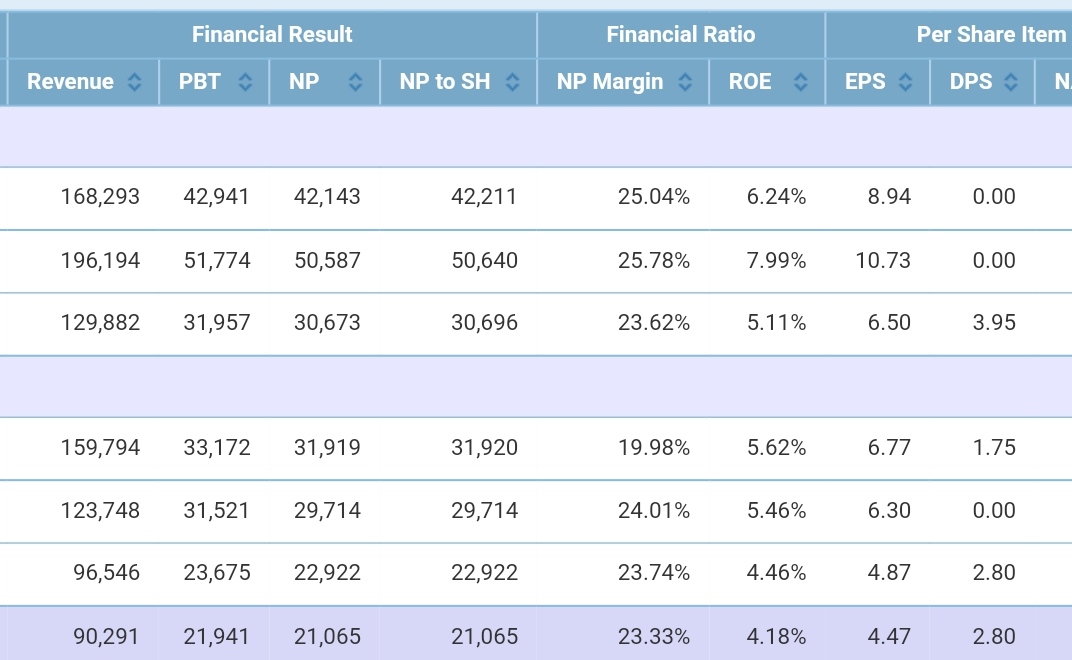

https://klse.i3investor.com/servlets/ptres/40090.jsp

With localised supply chain and production avenues in Malaysia directly and feedstocks from Aramco and Petronas, pchem is able to control supply and reduce their cost while maintaining market share. They are then able to sell at market price which is inflationary due to increasing production and delivery costs from competitors and keep the profit margins in hand. Simple logic. Patience required.

2014-2022.

https://www.theborneopost.com/2014/04/05/pic-rapid-green-light-to-boost-malaysias-og-sector/

How about producers like rhonema and farmfresh, inflationary costs from dairy milk mainly imported from Australia and overseas UHT and reconstituted locally, healthcare and veterinary assistance will play a huge part as the cost gap between overseas importers increase, and the local farmers find demand for cheaper alternative more abundant, allowing them to increase their selling price and get more cows.

https://www.mykayaplus.com/farm-fresh-berhad-8-things-you-need-to-know-before-investing/

https://www.theedgemarkets.com/article/rhone-ma-diversify-dairy-operations-through-jv-kulim

Supply chain management and local cost production will help these companies to break even faster as they sell for higher price in the inflationary market while keeping their costs lower than importers.

So on and so forth.

As usual the ones to suffer the most are contractors and developers. Imagine selling a new condo for 300 million, which will take the next 3 years to build only for the input costs like steel, cement and interiors to climb 100%. Not a very good time to be a developer or contractor when you have huge cost uncertainty and guaranteed contractors with LAD for late deliveries. I would avoid the "construction theme" in inflationary markets. I would however be in the market to buy homes and shoplots, as future development will no longer be selling at the prices you are paying for them now.

The other ones to avoid would be the raw material manufacturers as their costs pile up and almost guaranteed to drop later on when the speculation ends. Things like steel and aluminium spot prices are already dropping, and many suppliers and trading house who have bought containers which are in the way to malaysia are already being bombarded by new pricing from the factories selling products at cheaper prices. A few of my friends doing trading house business for steel imported from China are already complaining that they will be losing money on the current shipment as the selling prices are down 10-15% from previous pricing. And if you are in the trading house business where the profit margins are razor thin, you will quickly realize the profits from 2021 will be eaten up in 2022.

So what to buy? Always keep a mind of for the longer term 5 years ahead. I bought pchem in 2019, it to me 3 years to get 44% returns by averaging down and 70 cents in dividends. It will probably take another 2-3 years for the full fruit of labor to come in and get me 10% dividend every year on it. The goal is to buy businesses with minimum risk and highest upside.

I bought hartalega with an average cost 5.89, with dividends at 55 cents and averaging down from rm6 all the way down to rn4.9. same mental models, inflationary costs and transportation and workforce will cause many new entrants to be unable to compete with the scale needed to minimize production costs like topglove and Harta and bluesail etc, piling them into negative cash flow territory without the massive cash balances that the encumbants enjoyed during the demand spike. Many are already working on negative ASP, with production costs as high as $33 per box, while selling prices will drop to 40. Meanwhile hartalega can work around the $18-25 range per box, and with access to a growing market of 10% annual growth per year, in the long term they will do well. Many will close, others will be forced to increase prices to maintain profitability. The big guys will be profitable throughout.

This is probably the year where we will find that buying basic profitable companies selling at modest PE and giving out dividends and growing safe and steady to be a good buying choices for the coming few years.

I hope you have a fruitful Chinese New year.

Philip

PS. I have been in the stock market since the days of aokam in the 80s and 90s, survived dot com crash in the 00s, made my money right after financial crisis in 08, enjoyed my gains during the glove fever in 20s, and all I can say is this. DON'T WORRY. THIS TOO SHALL PASS.

More articles on Investing theory 7 - mental models

Created by Philip ( buy what you understand) | Aug 28, 2021

Created by Philip ( buy what you understand) | Apr 11, 2020

Created by Philip ( buy what you understand) | Jul 12, 2019

Discussions

Posted by uncensored > Jan 23, 2022 2:32 PM | Report Abuse

well not if you bought a property in Iskandar Johor...

Answer : Dude! Yeah! In Johor you need to be mindful! Do you homework before buying to sell back!

2022-01-23 14:34

For commercial property during the bull runs in 2011 to 2015 could give you a ROI of 1,000% (based on initial capital invested ) when you sold off.

2022-01-23 14:41

Yeah, if you bought back your property back in 2005, you are laughing all the way to the bank! 2011 to 2015 was the best time to sell!

2022-01-23 14:52

Anyway, i don't see much value if you buy nowadays! Auction yeah! New ones, no!

2022-01-23 14:53

Yeah, you are responsible for unpaid bills! So do you homework before buying auction one!

2022-01-23 15:07

That's why i only go for landed for auction! I mean, overdue council fee quite manageable! For apartments, not so! Need to settle management fee! Water and electricity too!

2022-01-23 15:09

especially if the ex owner refused to move out of the house.

One things lack in Malaysia is the law on Landlord & Tenant Act

2022-01-23 15:09

Yeah! That's why you need to personal look at the property if it's occupy or vacant! If occupy by ex owner, a bit of problem!

2022-01-23 15:10

By law you can charge the ex owner rental! Or seek a lawyer to get the police to ask them to move out! Another pain there!

2022-01-23 15:11

That's why better to check if it's vacant first! Vacant ones are so much easier!

2022-01-23 15:12

In Singapore or HK, vacating a tenant is much more easy & faster but in Malaysia not so easy.

2022-01-23 15:14

Yeah, i won't go into hassle of chasing anyone out! Best to check the property first! Check the outstanding as well if you really decided to buy it!

2022-01-23 15:54

Nowadays, you can set the outstanding electricity bill of ex owner! As for water, if you buy apartment or condo, you need to pay them!

2022-01-23 15:55

And also you need to prepare to do some refurbishment as well! You know some things like broken faucet, lights, cracks and so forth! If structural then better don't buy! I mean, structural can be a bit of a pain! Unless of course you know how to do it, that's different story! Paying contractor to do structural is quite expensive!

2022-01-23 15:58

Fortunately my experience with auction property has been pleasant! You know during down time of our economy like back in 2005, there was like piles and piles of property on lawyers desk! Boy, those where the days!

2022-01-23 16:00

I still remember my lawyer telling me to call him if i want to buy more property! He was telling me got few more piles for me to look through!

2022-01-23 16:01

Actually i am quite surprise how resilient property during this 2 year Covid! I was hoping to see many property on auction! Still got but not as much as i was hoping for!

2022-01-23 16:03

Ya.. a lot people hunting for properties to invest in with 6% ROI but sad or glad depends on which side said: it is difficult to get a property with 6% ROI.

2022-01-23 16:07

The way one writes elucidates ones thought process (or what you term as 'mental models') which for you is all over the place

Petrochemical feedstock costs are rising while higher selling prices are only temporary due to reopening/restocking after the long pandemic induced lockdowns, like what is happening in the automotive chips sector

You want to be at the upstream, the actual producers of the commodities, not the mid-down stream

However, we know that commodities are cyclical - palm oil, crude oil, steel etc. What goes up must come down

Milk (fresh milk especially) however is different. Although fresh milk is in effect a commodity (though rarely seen as so due to its shelf life etc), there are other external, structural factors in force, including the: 1)huge domestic demand vs domestic supply deficit, whose gap is growing

2)Logistics costs (cold chain*) associated with importation (large part of the countries' fresh milk demand is met by Australian/New Zealand imports) with current container costs going through the roof

*https://www.kyvalleydairy.com.au/export

(If you scroll down, you'll see an image that is very telling...)

3)foreign exchange rates, amongst other structural factors

Hope you learned something today

GM

2022-01-23 18:32

MYR actually depreciate against many currencies. That is why all import good price go up.

The good hedge is buying those plantation compnay that hold free hold plantation land. Land will sure to appreciate.

2022-01-23 19:18

Philip ( buy what you understand)

Recessions are when you open your chequebook and buy all those discounted products. If you look at my portfolio, recessions and panics are when I made the most money. 2009 I bought QL, 2010 I bought topglove, 2020 bought heavy into pchem and Tesla. If there is a recession you shoot fish in a barrel.

When the world is screwed up is when you get the best prices for good companies.

>>>>>>>>

qqq3333 Sslee..Jim Rogers ah? But the world is so screwed up what if there is a recession? If there is a recession even your land values also go down

23/01/2022 7:24 PM

2022-01-23 19:40

Philip ( buy what you understand)

Simple answer is YES. Long answer is if supply is < demand, prices will always go up.

>>>>>>

qqq3333 In a reverse QE, u think your Rolexes will still go up meh

23/01/2022 7:03 PM

2022-01-23 19:42

Don't look down on Rolexes. When Chinese citizens are buying Rolexes instead of apartments, you can anticipate prices to appreciate in near future. Some of these Rolexes cost more than my house =).

2022-01-23 19:46

Recession or not you must hold some cash to take advantage of every situation/opportunity.

DON'T WORRY. THIS TOO SHALL PASS.

2022-01-23 19:46

Philip ( buy what you understand)

Correct and well said.

>>>>>>>>

Posted by Sslee > Jan 23, 2022 7:46 PM | Report Abuse

Recession or not you must hold some cash to take advantage of every situation/opportunity.

DON'T WORRY. THIS TOO SHALL PASS.

2022-01-23 19:47

Fabien _the efficient capital allocator

Roblox is interesting! Looking to add into my portfolio since the valuations have become more palatable.

2022-01-23 19:59

"This is probably the year where we will find that buying basic profitable companies selling at modest PE and giving out dividends and growing safe and steady to be a good buying choices for the coming few years."

Thank you for your words of wisdom, Philip. Wishing you a roaring 2022!

2022-01-23 20:06

qqq3 you can plant vegetable without land but can you plant Palm tree without land?

2022-01-23 20:17

"

Sslee Maybe can consider invest in Real Estate Investment Trusts (REITs)

23/01/2022 6:00 PM"

==============================================

This sector or industry should be terminated.

It is the real reason for inflation.

Driving up real estate price and costly facilities management managed by vultures.

2022-01-23 20:28

Anyway big thanks to @Philip for your advice. I was a bit clueless on the other industries. Happy New Year of the Tiger!

2022-01-23 21:23

Inflation theme stocks = commodity stocks ? So, put our moni in commodity stocks ?

2022-01-24 17:59

Philip ( buy what you understand)

Inflation theme stocks is to buy stocks that benefit from inflation. Simply looking at commodity stocks to buy is dangerous as commodities have no pricing power. You should be looking at commodity stocks with own brand name which is locally sourced and immune to transport costs.

For example PETRONAS additives and pchem fertilizers. Or coca cola soft drinks, McDonalds burgers etc. You will soon see these kind of business post quarter after quarter of growth in revenue and margins.

I am trying to avoid pure commodity stocks like steel manufacturingfactories or palm oil farms as those are more cyclical

2022-01-25 20:17

Philip ( buy what you understand)

I am a CPO producer and I don't see why benefit because the increased price of CPO is tempered by the difficulty in sourcing workers and delivery costs. If my small 100 acre farm can feel it, imagine how the upset the larger farms would be

2022-01-26 21:17

Tobby

Basically all needed some refurbishment! But nothing major, just repair here and there! And no contractor involve, all done directly by those you know who! I mean, why give fat margin to contractors when the workers can get better pay directly!

2022-01-23 14:33