How to sell Gloves Stocks - or buy what comes out in newspapers 2 years from now

Philip ( buy what you understand)

Publish date: Sun, 24 May 2020, 02:29 PM

Dear All,

Selamat Hari Raya Aidil Fitri.

This is probably my most thought of post of all, and its very important.

Firstly, Lets set the stage:

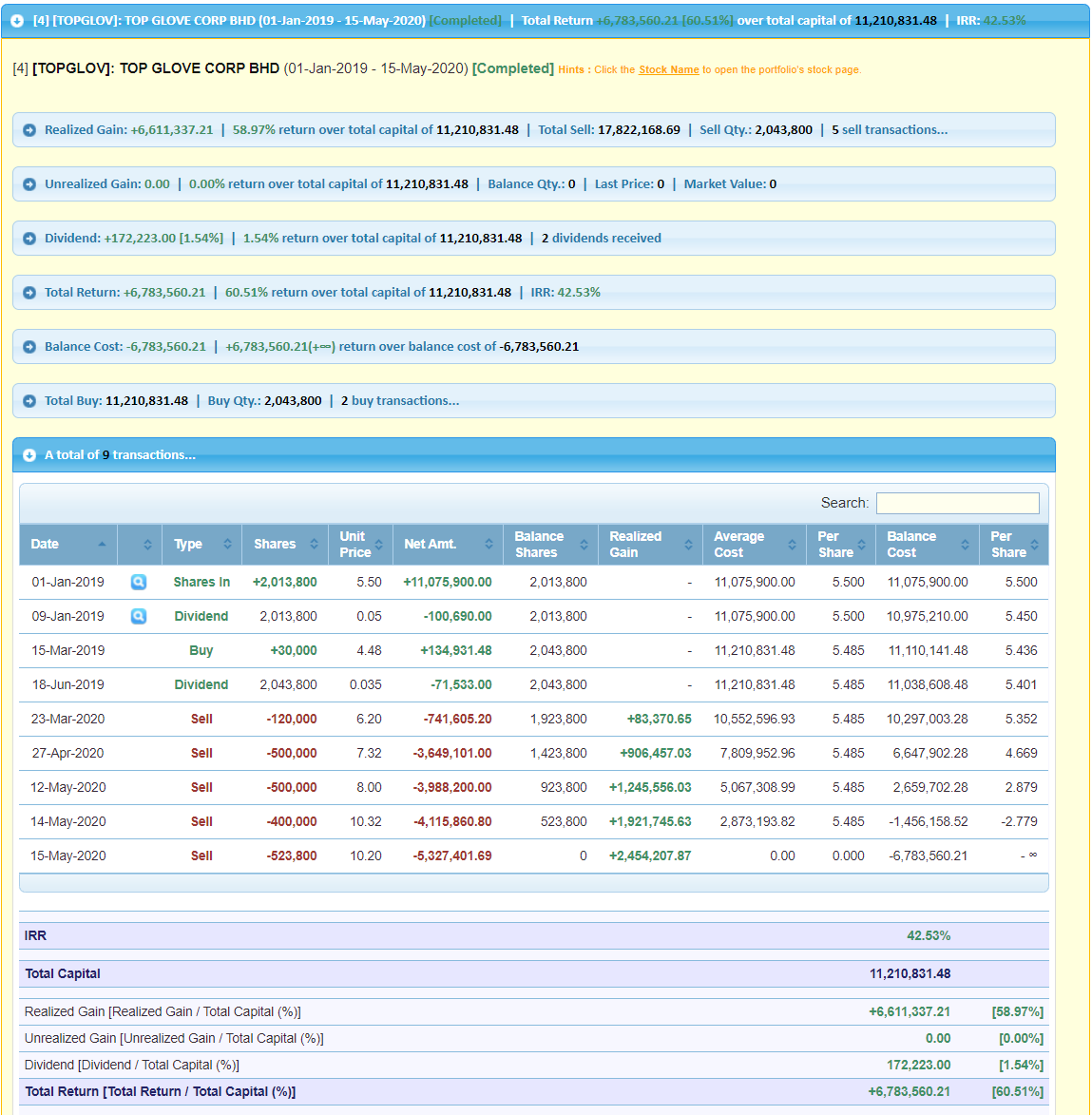

Some of you may know me, many will not. In any case, I have been investing in Topglove for the last 10 years, but as I cannot prove that, all I can do is maintain a trackable online portfolio starting in 2019 to monitor my investments, margin loans and returns. This portfolio is maintained publicly, it cannot be edited, deleted or removed. So the simple results will be reflected in profit and loss.

The main reason for me posting this publicly is not to show off or be arrogant (although I am confident) but I believe that all articles and stock promotions have to be compared with the real results of investing that can be attached as a supporting document to prove that the ideas and investing theories work. Warren does it, Bill ackman does it, Peter lynch does, Ray Dalio does it. That is why we listen to those investors, because their results are a body of work that proves their results.

In any case, lets begin.

Currently the theme for today is Glove stocks. Everyone is always saying buy buy buy, and as the prices go up it becomesa siren call to buy up more and more. And yet, after holding the glove stocks for over ten years, I have chosen to sell.

Why?

This question is very interesting, because everyone is always telling you what to buy. However you will quickly notice no one is ever telling you when and how to sell. So, in the spirit of sharing during this gracious holiday, I will try to share my experience in buying and selling topglove, in the hopes that you can also practise rational investing.

Rule No. 1 - How to Buy

When I first bought Topglove in 2010, I didn't find out through a stock screener or guru investment stock pick. It was actually through my Rotary Club. They had arranged a learn and visit session with the other rotary club members to visit the topglove factory and find out more about how it is run and what the business is like. When I went, the factory manager (who I later pulled into the Rotary Club), was a godsend. He spent a lot of time explaining what the business is like that I was so impressed. Wow, this seems like such a simple and scalable business, I wanted to know more. So I got to know the manager better and presented my checklist:

1. How scalable is the business (Apparently very scalable indeed. Specialized hand formers, machinery, workers and voila!)

2. How much does it cost to produce a glove? ( very cheap)

3. How much do you sell per glove? (in those days, depending on the customer and region, 20-30% margins)

4. Who is the target market (apparently they sell the world over)

5. How is the expansion like (at that time, the world market was growing at 5% a year, and topglove had a dominating position, so the minimum growth was to add 10% production capacity per year)

6.What is topglove competitive advantage? (apparently Malaysia. As the rubber latex only grew along the equator line, Malaysia with its political stability, the cash for building economies of scale, the english speaking supply chain, and most of all raw materials supply to topglove made it more gave it a huge competitive advantage compared to brazil, india and other cheaper areas.)

So after doing this scuttlebutt, I proceeded to look at the financials of the company. Remember this was around 2009+, right after the huge financial crisis and every stock was selling at dirt cheap prices. Here was a company selling at very fair valuations, 3 million in debt, 300 million in cash, 100 million in free cash flow, making 22 cents on the every dollar of equity. It was amazing! It is really hard for a company with no debt to get bankrupt. So with QL backing my collateral as margin, i bought a huge portion of Topglove, around 500K worth. I proceeded to top up every quarter since with my salary and bonuses and dividend income.

Rule No. 2 - How to Hold

This is a lot easier, but still not simple. I held the stock and added my position every year from 2010 to 2019. While you may say that in 2019-20 I did not add to my position, I must say I was very upset with the Aspion purchase. The company did not do due diligence and proper accounting, which caused dilution to the shareholders: me. So I left it on the back while investing in my other stocks. However, I did not sell a single share of topglove for the entire period 2010-2010. Why?

For me the basic rule is simple:

1. Sell and buy what? The thing to remember here is, if you have a growing busines that pays growing dividends, expands well , you have to weigh the cost of investing in something you know versus something you dont know that well. There is always an element of risk involved in buying stocks. But, one should always stay invested in stocks. So when you sell one, the goal is to reinvest in another company. If you can't find one better than the one you have, then you shouldn't be selling for the sake of selling. Only sell if you find that the valuation of another company is better than the one that you own. Only keep cash if cash is better than all the companies that you are thinking of investing in.

2. Never sell for the sake of selling. Most gurus who have never made real money in stocks, they are always very telling you to sell half, keep your profits etc. Never do this. IF you own disneyland, why would you sell half of disneyland just because the value of disneyland MIGHT drop? Understand your business. If you know it well, you will realize that selling a goldmine just to buy a new prospect elsewhere silly. I used the mental model of physics here, an object in motion tends to be in motion, an object at rest tends to be at rest. If you have a company with killer management, good cash levels, a strong business that is growing and maximizing its assets, it will tend to grow. If you have a company that has good cash and strong business, but is not scalable and the management not interested in growing the business, then it will tend to stagnate. If you have a busines that is changing CEOS and firing workers and losing market share, it will tend to drop over time. Please note I am talking about the business, not the share price. Over the short term the volatility will give you very different signs, over the long term share prices usually correlate with the busines prospects.

3. Never diworsify. Some people view diversification as risk management. For me I have never thought of selling a little bit of topglove and spreading it between kossan,supermax,harta, comfort. This kind of diversification to me doesn't make sense. There will usually only be one market leader in the industry. If you manage to find one at fair valuation, then stick with him all the way, instead of spreading your risks. As is shown over this covid19 period, holding onto 1000 stocks will just lead you to lose money in ALL of them. Buy and hold what you understand.

On the other hand, forcing diversification into new business or industries that you do not know well is even worse, that is like throwing money into the sea hoping it will come back to you somehow.

In my experience, in that entire period 2010-2019 I did buy 2 other stocks, Yinson in 2013 (which was my smallest position and a long term trading bet that became a long term investing hold ) and public bank in 2012 (which was bought because it was the lowest risk for acceptable prospects at that time that my wife and father in law could stomach, it was a joint private equity of 50/50)

Rule No.3 - When to sell

Now, this is the magic trick. No one can teach you how to anticipate this, not even Warren Buffett. You see, even value investing can only help you minimize risk, but buying with a margin of safety means nothing if the business prospects 2 years in the future is dim. Take for example Parkson, at 107 million in valuation with 2 billion in assets, it seems a compelling investment until you realize that if earnings do not come, no amount of value investing is going to help you.

To be honest , there is probably no way to predict what the newspapers will show 2 years from now, however what you can control is your discipline and rationality. I don't know about others, but as I recently sold my investment in Topglove after holding for 10 years, perhaps I can share my experience and my thoughts on it .

1. Sell when you find something else BETTER to buy. In my case there were 2 crisis going on at the same time in 2020, the oil crisis and the covid healthscare. In most cases, even at PE80, Topglove I would not be selling. I believe in its ability to generate 2x or even 3x earnings in the long run, as the market leader. However as one crowd runs into the shop to buy everything, somehow everyone is leaving the other shop in droves. For me oil & gas is at decade lows, business with huges assets and retained earnings are selling at IPO prices. The gap between holding and finding another wonderful company to buy had suddenly closed and rationally when that happened, when everyone is offering me multiple years of earnings baked into one black swan event for gloves, I just had to sell. I wouldn't say I was happy to do it, but finding another wonderful business with huge prospects and profits selling at bargain prices, it is hard to say no. The pure speculation of bursa in gloves leaves me shaking my head.

2. Sell when the business fundamentals change. Here I quote warren, he was a huge buyer of airlines. His reasoning for selling airlines was simple. An entire year of revenue gone, with fixed costs piling up daily, most companies would have gone bankrupt. For airlines to survive without government intervention, they would have to get huge loans at cutthroat rates that can only begin to pay back when the business returns to normalcy. The repayment of the loan will be a stone on their back that would kill the future of returns that one would expect from the business over the long term. Having to borrow 10 billion and paying 1 billion in interest payments would indeed be insane for any business.

The goal here is to understand risk. Business risk, margin of safety risk and share price volatility risk. A good business that has gone up in price can start to get risky (but not always), while a good business that goes down in price can become less risky (but not always). But a bad business at any price is always risky.

Summary

So in any case, I hope you learned something new today. Investment in essence does not require a phd in mathematics or constant investigation of details. It does however require some common sense. You do not buy a stock for what came out in the papers yesterday. You should be buying a stock for what will come out 2 years from now. Doing that requires you to be careful in investing, not chasing the current story, knowing when to be a contrarian and when to follow the herd, and being in earlier than others. Thats the real joy in investing

Philip

rylakk2016@gmail.com

P.S. I have also started a telegram discussion group started by my daughter, the telegram is on my portfolio profile tme/philipcapitalmanagement. Apologies about the title, it is a bit arrogant. But I think results speak louder than words.

More articles on Investing theory 7 - mental models

Created by Philip ( buy what you understand) | Jan 23, 2022

Created by Philip ( buy what you understand) | Aug 28, 2021

Created by Philip ( buy what you understand) | Apr 11, 2020

Created by Philip ( buy what you understand) | Jul 12, 2019

Discussions

some of the prices have increased triple, or even quadruple and yet, we have not even see the profit yet. I dont think their factory lines could produce 3 times more than the usual production. If you dont call this speculation, i dont know what it is. This is certainly not investing.

2020-05-25 19:41

Philip ( buy what you understand)

Another skill of yours, simply plucking up random figures and making it yours. Why do you seek to tell new investors such lies. Directors selling is a good thing?

Do you really not fear God? Are you not worried that what you say and do will come back to haunt you on judgement day?

>>>>>

calvintaneng Directors selling?

During Cement bull run year of 9mp

I saw one director sold YTL Cement at Rm2.40 & my friend Mr Lee of Public Auto Sitiawan was worried

As it turned out YTL cement was later Taken Private at Rm5.00 up another 100% from Director selling

NOW DIRECTORS HAVE SOLD ALL YET

SUPERMAX DIRECTORS HOLDING ALL FIRMLY

25/05/2020 7:25 PM

2020-05-25 20:06

https://www.theedgemarkets.com/article/malaysian-banks-cheaper-glovemakers-mania-continues

RHB Research analyst Alan Lim expects Top Glove to deliver a strong set of third-quarter results (3QFY2020), with its profit to jump 85% quarter on quarter to RM215 million.

His optimism is based on four factors: higher average selling prices (ASPs) driven by the tight demand-supply dynamic, strong volume growth, favourable foreign exchange, and lower raw material prices, particularly butadiene.

Lim also highlights that the impact of higher ASPs is a powerful boost to the bottom line, given little increase in production costs.

.........

RM 215m.....OMG!

2020-05-25 21:02

in 2017, got a sifu ask me how much i need to win, i say a myvi...but that time i can only win 4 tayar....now, i got myvi money d, but kiamsiap duwan buy car...wait x50

haha

2020-05-25 22:36

Hi Philip. I have keyed in 5,000,000 holding of supermax under my portfolio. Current profit about 21 million.

2020-05-25 23:26

Philip ( buy what you understand)

I think you need to share it with public for us to view.

2020-05-25 23:48

Philip ( buy what you understand)

But I think I understand what you are trying to do. Ok try to edit the numbers, can you do it? Can you delete the transaction?

Ok now that you know you can't change it, let's monitor your portfolio over a few years and see your results.

FYI a real portfolio, like yours in real life, should have commissions, dividends, buy and sell all key in.

I also have other transactions that I post and put in the comments section so everyone know when I buy and sell.

Let's see your continuous buy and sell results after 2 years.

2020-05-26 00:05

Philip ( buy what you understand)

Posted by Philip ( buy what you understand) > Apr 5, 2019 8:19 AM | Report Abuse X

Topglove seems to have a discount month of 15%, especially since it's business has not eroded, and is as string as ever with record growth.

Philip ( buy what you understand)

3543 posts

Posted by Philip ( buy what you understand) > Apr 5, 2019 8:20 AM | Report Abuse X

Time to average down on topglov

MrPotato88

90 posts

Posted by MrPotato88 > Apr 23, 2019 12:20 PM | Report Abuse

Philip, why Top Glove but not Harta ?

Philip ( buy what you understand)

3543 posts

Posted by Philip ( buy what you understand) > Apr 23, 2019 12:23 PM | Report Abuse X

Erm... Because it's a legacy stock that I bought since 2010 and I know it will enough to know how many lines it has, where all the factories are, I am comfortable with the management and most of all it is still very very profitable and growing over a long time.

2020-05-26 00:07

Philip ( buy what you understand)

I posted up in the comments details of every transaction. I have been holding and averaging down on topglove since April 2019.

The comment dates also cannot be faked. There are 779 comments on my portfolio since I started, so if you think I can edit my portfolio, be sure that everyone always looks closely at my investments.

But you can try and see if you can keep changing your results.

2020-05-26 00:10

Game over for Philip as he cut the flowers (topglove ) and keeping all the weeds serba, yinson , gkent and petchem

Don't be itchy to buy these lapsap and get stuck later like Philip having to beg and borrow to average down

Calvin stocks like Supermax comfort luxchem adventa esceramic mtag nylex just going up and up

Don"t need go begging money to average down

2020-05-26 00:42

If someone bought TG for the past 10 years,how many times TG reached over $12.00 ??..and yet never selling it?.. during that time viral infection not as severe as today COVID-19 where the whole world facing pandemic and still keep on going, south america, africa, india, indonesia, etc..still at the beginning.. during that time why TG price still acceptable, even at $14.00 !! ? ..if I am really investing in TG for the past 10 years, by now, my investment already multiple how many time? don't have to worry, in fact will shall stick to TG coz I would expect bonus issue, dividend, etc..as usual from TG.

but one thing for sure, at the current price better don't buy la, already too high, not mcuh room for profits..huhu

2020-05-26 04:11

Philip ( buy what you understand)

I thought I have explain very clearly, maybe you only see share price chart, but don't see the business:

In that entire time, there was never:

1. Oil crisis where share prices dropped to record low and everyone leaving o&g stocks in droves.

2. Never seen calvintaneng,kyy,OTB all promoted glove stocks.

3. Never was tg being speculated until PE 80.

4. Never had entire world close down, airline close down and all other business dead on the water.

5. Back then if sold tg, other stocks are still expensive on comparison. Today if sell tg, can buy gkent net cash, Pchem pre-ipo price, public Bank pe 10, Maybank with 8.6% past dividends yield, and many other industries left for dead but still earning money.

6. Has topglove+hartalega ever been valued worth more than public Bank? After covid19 ends, 3 years, 5 years from now, who do you think will have 5 billion in earnings?

7. Heavy stockpiling going on, everyone is buying gloves. But daily consumption? That box of gloves at home, how often do you use it? Or will you just use sanitizer and face mask when you go out instead?

8. Topglove is selling PE80... If you wanted to start your own tourist agency, which prices do you pay for those equipment like buses, boat and hotel? Do you pay the price when tourists come when no supply and everyone looking for a bus? Or do you buy during covid19, when buses are everywhere being parked, boats lying dead, when everyone cannot tahan loan interest payments and want to cheap sell?

But yes. If for not for those double swan event? I would gladly just sit and wait it out. Topglove definitely can have good earnings and make money, and I can receive 130k in dividends a year, on my long term invested capital of 1m.

But Covid19 is like nothing you have seen before, and investors are overly optimistic on the performance.

Just like it's products, if you want to buy gloves, do you really want to pay covid19 prices for them? Or do you prefer to buy when no one wants them?

Or do you think covid19 is just starting, and demand will never end?

Those who think that way, they will definitely start looking for reasons to say my portfolio is fake, my results are fake, and I am cutting flowers to water weeds....

But this is fact:

IF YOU FOLLOW THE HERD, YOU WILL GET THE HERD RESULT. KNOW WHEN TO FOLLOW AND WHEN TO STOP BEFORE THE CLIFF.

Everyone who buys from this point in is looking for the next idiot to buy. A few quarters of good results, yes the price may still go up.

But will the price keep going up forever? Or stay at this level forever?

That is when you need to start doing some rational investing.

>>>>>>>>>>

Posted by Ron90 > May 26, 2020 4:11 AM | Report Abuse

If someone bought TG for the past 10 years,how many times TG reached over $12.00 ??..and yet never selling it?.. during that time viral infection not as severe as today COVID-19 where the whole world facing pandemic and still keep on going, south america, africa, india, indonesia, etc..still at the beginning.. during that time why TG price still acceptable, even at $14.00 !! ? ..if I am really investing in TG for the past 10 years, by now, my investment already multiple how many time? don't have to worry, in fact will shall stick to TG coz I would expect bonus issue, dividend, etc..as usual from TG.

2020-05-26 06:55

This is precisely having knowledge but no true wisdom

Having a calculator does not mean business success

Everybody knows all gloves P/E have gone up if we benchmark P/E to Feb or May 2020 earnings

But market has a life of its own

As supermax doubles in profits its P/E in Aug and Nov 2020 when earnings play catch up.

So market buys ahead of future earnings

Conversely, the same mistake is made in gkent by looking at its past earnings and net assets.

To buy based on that alone is wrong as the future earning of gkent is shrinking

Philip has shown us an example of a head with imperfect understanding of how the market works

This same dislocated behaviour caused him to look at last year buy calls instead of this year winning calls

1. Supermax at Rm1.73

2. Comfort at 88.5 sen

3. Luxchem at 47 sen

4. Adventa at 57 sen (too high now)

5. Es ceramic

6. Mtag

7. Nylex

8. Ancom

These are Year 2020 chun chun buy calls. We are now near mid 2020 Glove bull run yet Philip point fingers at Year 2019 stocks to condemn

Come out now. Don't dwell in the past will you? Or you will be left behind

2020-05-26 08:25

Balik your Singapore la tanam jagung,stock manipulator calvintanend, remember ask kyy to join your sohai club too, so he can become your best friend, lol

2020-05-26 10:32

previously when glove stock went up, banking sector still in good condition. now they value itself drop due to enocomic downturn not just here but effect from abroad. covid very much different compare to mers, sars, etc..its more like Spanish flu and scientist even suggested there would be 2nd or 3rd waves. that vaccine only to calm the masses. we dont even successfuly in developing any vaccine from coronaviruses before, how come out of sudden..we can hv one, in a very unpresedented short time? it just misleading infos by politician, as usual la. I would expect investors thinking about Glove not for household use, but for medical and enforcement staff. bty, my background also n biology and i am quite knowledgeable about viral infection..and the diffuculties to contain the one that already widespread all over the globe. covid aslo very contagious. you just need 1 person to restart the next pandemic just within few months. Covid might mutate into more pathogenic strain, lets just hope it will not. Spanish flu, gone becoze mutated to less virulence, lets just pray covid also become one. but possibility is still there, no human techonology is capable to control virus mutation..look at seasonal flu..close relative of coronavirus

thanks for that explaination, everybody has they own reason. its your money anyway. good luck to everyone, wheather still in TG or venturing to other sectors.

2020-05-26 11:25

Glove companies earnings are correlated with demand of gloves. Demand of gloves are tied with Covid 19 which is highly infectious. As long as vaccine is not available(likely to be available only 2021, maybe 50% change only per Oxford Univeristy research team). I feel is a bit too early to sell. I will peak, but no body know when. I hope there is vaccine for cancers such that there will be less people suffer...

Just some thoughts

2020-05-26 11:52

Do not carry away wth a hit on jackpot... Instead thank God n wth humility.. so tht u will Always be blessed

2020-05-26 11:56

Philip ( buy what you understand)

Yes this is definitely true, however you can just do a little scuttlebutt and ask the local hospitals what their sop is for glove use in medical line. You will see that it has not changed by much, however the stockpiling done has increased by a lot.

The real question is: did you buy a box of gloves to put at home during onset of covid? If the answer is yes, then you are stockpiling. But do you do daily use and bring it around everyday and throw?

If you don't, but use price as a measure of demand, that few quarters of increased revenue marked by huge selling of glove stock director should tell you how long the glove demand will last.

>>>>>>>>

BlessedInvestor Glove companies earnings are correlated with demand of gloves. Demand of gloves are tied with Covid 19 which is highly infectious. As long as vaccine is not available(likely to be available only 2021, maybe 50% change only per Oxford Univeristy research team). I feel is a bit too early to sell. I will peak, but no body know when. I hope there is vaccine for cancers such that there will be less people suffer...

Just some thoughts

26/05/2020 11:52 AM

2020-05-26 13:19

Haha...Top Glove Singapore up 14.14% today.

Philip sifu might lose another RM 2.04 million tomorrow.

-6 million to -8 million!

2020-05-26 14:15

sell d and move on la, u slept a girl in a pub 1nite-stand and u told the whole world the u fucuk a girl? What a shame to mankind disgrace to the world.

2020-05-26 14:19

why keep on mentioning glove box at home?.. i don't get it. We should focus on medical gloves to used in hospitals, where 1 medical staff would use 20-30 pairs just for one day work. 1 box of 100 pairs, only for 1-2 person/day. That's how much glove usage in hospital during pandemic situation.. . This is not a fact, just based on my observation and knowledge in medical stuff.

you need to change gloves so often when ever you touch different material/things, when you move from 1 room to other sectors as well. Gloves is considered the most important first layer of personal protection. For COVID cases, at one go, medical staff would wear 3 layers.. can watch it on you tube.

2020-05-26 14:27

There is nothing wrong when someone sell all his shares when making good fortune. Moreover, he had kept fr such a long time.

It's definitely wrong to speculate in frenzy mania.

i sold all comfort shares at av price 2.3.

let others make profit if comfort can goes to 3, or 5.

2020-05-26 15:51

Philip ( buy what you understand)

Can you explain here how someone who sold all his gloves stocks can lose money on glove stocks?

>>>>

Goldgent Haha...Top Glove Singapore up 14.14% today.

Philip sifu might lose another RM 2.04 million tomorrow.

-6 million to -8 million!

26/05/2020 2:15 PM

2020-05-26 16:20

Reap what u sowed @ the right time!!!

Knows how to harvest is very important.

2020-05-26 17:00

Thank you Philip for your view. You are certainly a great investor.

2020-05-26 18:52

"To put into perspective, Hartalega's market cap has more than doubled by RM19.02 billion to RM34.93 billion from its initial market cap of RM18.48 billion at the beginning of the year. It is currently ranked at 7th place among the largest market cap Malaysia companies.

The meteoric rise on Top Glove, its market cap ballooned by RM22.9 billion in value – the increment is equivalent to Dialog Group Bhd’s market cap of RM21.36 billion".

https://www.theedgemarkets.com/article/it-mad-mad-glove-makers-market

2020-05-29 16:58

Philip sold all his TG at average 2.90+ before May/June 2020 n switched to Serbak....

Dont ask me if he could sleep well ever since then

But he certainly can sleep much better now for sure lah

2021-12-11 10:31

Thats how Uncle Philip nearly went bankrupt in Aokam loh!

Lesson not Learn loh!

Posted by Philip ( buy what you understand) > Jun 10, 2020 4:00 PM | Report Abuse

Here's how you do it.

Put up 50k of your own money. Then borrow about 50k from friends and family.

Then put it in trading account and get maybank approval to margin of 100k.

Now buy 200k of supermax.

Then, you will notice you have 200k of contra t+2 in your account.

Go ahead and buy more on contra.

You will now open 400k of supermax.

After it goes up by 20%, you would have 480k. Now you can close your position and turn 100k into 180k in a few days. Now repeat again:

180k into 360k into 720k contra, make 20% on that in T+2.

Rinse and repeat until you become a millionaire.

2021-12-11 10:33

Wrong.

If he did so in June 2020 by buying Supermax with margin he will make the biggest profits in his life if he sell all by End 2020

If he did so in June 2021 then will be a different sad ending

Timing is everything. Not really applicable to all those self proclaimed long term value investors lah

2021-12-11 10:39

We are now discussing bankruptcy of Top Glove

times have changed..........

2021-12-11 10:44

Topgloves will never go bankrupt loh!

What the management need to do now, is to curtail its capacity expansion now loh!

As its existing capacity of 110 billion pieces are more than enough to support its requirement and furthermore there are labor issue in msia mah!

If topgloves do that, it will be sitting on rm 2.8 billion cash equivalent of liquid funds mah!

2021-12-11 11:27

I believe Top Glove will proceed with expansion plan...

...........and the rest will be history

Rationale for the Belief

Thats what TG did in the past when faced with problems

no reason to think that TG will adapt

=> no adapt, sure die

2021-12-11 11:35

Are we going to beat China Glove Players like how our Lee CW beat Lin Dan in Badminton?

Place yr bets pls.

2021-12-11 11:37

China just opportunistic here for gloves loh!

Its interest will wanned loh!

Their main focus has been more on strategic Technology sector mah!

2021-12-11 11:40

yes you can bet

so far history had not been on your side

malaysia dvd factories shut down when China ex-factory was 20% of Malaysia ex-factory.

now China Glove ex-factory "could be" 50% of Malaysia ex-factory

another 30% more to go before history repeats itself.

2021-12-11 11:42

why is cost high?

.....a lot of Malaysians dun even have 4 inch mattresses to sleep on...

2021-12-11 11:55

Most likely China using AI automation to run the production lines and packing lines so no need 4 inch mattresses to sleep on...

2021-12-11 12:08

calvintaneng

Directors selling?

During Cement bull run year of 9mp

I saw one director sold YTL Cement at Rm2.40 & my friend Mr Lee of Public Auto Sitiawan was worried

As it turned out YTL cement was later Taken Private at Rm5.00 up another 100% from Director selling

NOW DIRECTORS HAVE SOLD ALL YET

SUPERMAX DIRECTORS HOLDING ALL FIRMLY

2020-05-25 19:25