Mplus Market Pulse - 30 Jul 2020

MalaccaSecurities

Publish date: Thu, 30 Jul 2020, 10:42 AM

No breakthrough, yet

Market Review

Malaysia: The FBM KLCI (+0.1%) endured a volatile trading session before finding some footing as the key index recovered all its intraday losses in the second half of the trading session on quick to bargain hunting activities among beaten down stocks. However, the lower liners ended mildly lower after recovering most of their intraday losses, while the broader market finished mixed.

Global markets: US stockmarkets rebounded overnight as the Dow rose 0.6% after the US Federal Reserve maintained benchmark interest rates at record low levels and pledged to increased holdings in treasuries and mortgage-backed securities in coming months to support the ailing economy. Elsewhere, European stockmarkets closed mostly higher, while Asia stockmarkets ended mixed.

The Day Ahead

The dovish tone set by the US Federal Reserve in regards to the low interest rate environment implies that liquidity will remain within the stockmarkets and assets that deliver higher yields. For now, the FBM KLCI is also largely on track to deliver its biggest monthly gain since October 2011, whilst the both the FBM Small Cap and FBM Fledgling are still on course for a V-shaped recovery.

Sector focus: The government’s move to extend the loan moratorium by additional 3 months to targeted groups could possibly reduce the non-performing loan (NPL) rate bodes slightly well for the financial sector. Elsewhere, healthcare-related stocks may continue to anchor the gainers list, while the energy sector may be spurred by the higher Brent oil prices that closed near 2-weeks high.

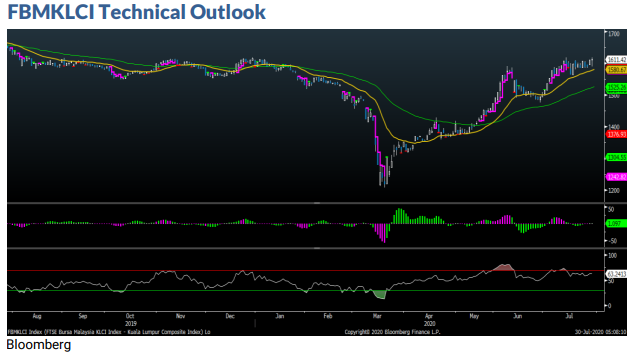

The FBM KLCI formed a hammer candle after recovering all its intraday losses as the key index rebounded off the daily EMA9 level. Still, we reckon that the 1,615 will serve as the immediate hurdle which the key index has re-tested yesterday, with next resistance located at 1,630. Support is pegged at 1,585, followed by 1,560. Indicators remained slightly positive with the MACD Histogram extended another green bar, but remains below the Signal Line, while the RSI remains above 50.

Company Brief

Luxchem Corporation Bhd’s 2QFY20 net profit fell 23.4% YoY to RM7.6m, due to weaker performance in its trading segment. Revenue for the quarter declined 25.5% YoY to RM140.3m. An interim dividend of one sen per share, payable on 30th September 2020 was declared. (The Star)

Telekom Malaysia Bhd (TM) has confirmed that its managing director cum group chief executive officer Datuk Noor Kamarul Anuar Nuruddin had resigned, and that Imri Mokhtar had returned to the group to take over the helm. Noor Kamarul's departure is effective immediately and that Imri's appointment will take effect on 1st August 2020. (The Edge)

KIP Real Estate Investment Trust's (REIT) 4QFY20 net property income (NPI) grew 17.0% YoY to RM13.2m, largely underpinned by 11 months' income contributions arising from the acquisition of AEON Mall Kinta City, but partially offset by the amortisation of rental rebates. Revenue for the quarter increased 4.3% YoY to RM16.9m. A final distribution per unit (DPU) of 1.53 sen, payable on 27th August 2020 was declared. (The Edge)

Tenaga Nasional Bhd (TNB) is taking over Menteri Besar Negeri Sembilan Inc's 5.0% stake in associate company Jimah Energy Ventures Holdings Sdn Bhd, which runs a power plant in Negeri Sembilan, for RM80.0m. At the same time, it will take up 5.0% of the Class B Notes issued to help fund the power plant. (The Edge)

Ta Win Holdings Bhd has teamed up with Perbadanan Memajukan Iktisad Negeri Terengganu to jointly develop an industrial park at a gross development cost of RM2.40bn in Kemaman, Terengganu. The industrial park aims to integrate the supply chain of non-ferrous metal industry that pools industrial players both from the upstream and downstream segments. (The Edge)

TCS Group Holdings Bhd has clinched a RM146.3m contract for main building works for serviced apartments in Sentul, Kuala Lumpur. TCS Construction Sdn Bhd has received a letter of acceptance from Southern Score Sdn Bhd which is principally involved in construction, contractors, subcontractors and property development for the construction of the Vista Sentul Residences. (The Edge)

KNM Group Bhd's unit has bagged a contract worth RM20.9m from an Australian oil and gas firm for the supply of air coolers bundles for gas compression stations in Australia. The tenure of the contract is for a period of 34 weeks. (The Edge)

Axiata Group Bhd is expecting to cut its RM6.60bn planned capex for 2020 by around 15.0% or about RM990.0m to RM5.61bn. Meanwhile, it aims to cut another RM1.00bn in costs this year as part of its long-term strategy, with the bulk of the reduction to be seen in its network and IT infrastructure, as well as digitalisation efforts. (The Edge)

Parkson Holdings Bhd is divesting its remaining 30.0% equity stake in its whollyowned hire purchase unit, Parkson Credit Sdn Bhd, to Hong Kong-listed subsidiary Parkson Retail Group Ltd for RM26.0m. Parkson Holdings wholly-owned unit Parkson Credit Holdings Sdn Bhd has entered into an agreement to dispose of the stake to Parkson Retail's wholly-owned subsidiary Oroleon (HK) Ltd. As a result, Parkson Holdings' effective interest in Parkson Credit will be diluted to 55.0% from 68.5%, resulting in a lower future earnings contribution from Parkson Credit to Parkson Holdings. (The Edge)

SYF Resources Bhd is injecting some RM30.0m into one of its residential development projects to expedite the construction progress. The project, Alstonia Residence in Kajang, is being undertaken by Darul Majumas Sdn Bhd, which is 75.0% owned by the group via its indirect unit SYF Development Sdn Bhd. (The Edge)

Fraser & Neave Holdings Bhd (F&N) has entered into a related-party transaction to dispose of its Teapot trademark for RM83.2m to better leverage on F&N Global Marketing's expertise in managing brands and related intellectual property. (The Edge)

Source: Mplus Research - 30 Jul 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-17

PARKSON2024-11-16

KNM2024-11-16

TENAGA2024-11-15

AXIATA2024-11-15

F&N2024-11-15

KIPREIT2024-11-15

KIPREIT2024-11-15

TENAGA2024-11-15

TENAGA2024-11-15

TENAGA2024-11-15

TENAGA2024-11-15

TM2024-11-15

TM2024-11-15

TM2024-11-15

TM2024-11-14

F&N2024-11-14

M&A2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TM2024-11-14

TM2024-11-14

TM2024-11-13

F&N2024-11-13

F&N2024-11-13

M&A2024-11-13

TENAGA2024-11-13

TENAGA2024-11-13

TENAGA2024-11-13

TENAGA2024-11-13

TENAGA2024-11-13

TM2024-11-13

TM2024-11-13

TM2024-11-12

AXIATA2024-11-12

AXIATA2024-11-12

F&N2024-11-12

F&N2024-11-12

F&N2024-11-12

M&A2024-11-12

M&A2024-11-12

TCS2024-11-12

TCS2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TM2024-11-12

TM2024-11-12

TM2024-11-12

TM2024-11-11

AXIATA2024-11-11

F&N2024-11-11

F&N2024-11-11

TCS2024-11-11

TENAGA2024-11-11

TENAGA2024-11-11

TENAGA2024-11-11

TM2024-11-11

TM2024-11-11

TM2024-11-11

TM2024-11-08

AXIATA2024-11-08

AXIATA2024-11-08

AXIATA2024-11-08

F&N2024-11-08

F&N2024-11-08

TENAGA2024-11-08

TENAGA2024-11-08

TM2024-11-08

TM2024-11-08

TM2024-11-08

TM2024-11-07

AXIATA2024-11-07

F&N2024-11-07

F&N2024-11-07

F&N2024-11-07

F&N2024-11-07

F&N2024-11-07

F&N2024-11-07

PARKSON2024-11-07

PARKSON2024-11-07

TENAGA2024-11-07

TENAGA2024-11-07

TM2024-11-07

TM2024-11-07

TM2024-11-07

TM2024-11-06

AXIATA2024-11-06

F&N2024-11-06

F&N2024-11-06

F&N2024-11-06

F&N2024-11-06

F&N2024-11-06

F&N2024-11-06

F&N2024-11-06

F&N2024-11-06

F&N2024-11-06

F&N2024-11-06

F&N2024-11-06

TCS2024-11-06

TCS2024-11-06

TCS2024-11-06

TCS2024-11-06

TCS2024-11-06

TENAGA2024-11-06

TENAGA2024-11-06

TENAGA2024-11-06

TM2024-11-06

TM2024-11-06

TM2024-11-06

TM2024-11-05

AXIATA2024-11-05

F&N2024-11-05

F&N2024-11-05

M&A2024-11-05

TENAGA2024-11-05

TENAGA2024-11-05

TENAGA2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TMMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024