Mplus Market Pulse - 28 Oct 2020

MalaccaSecurities

Publish date: Wed, 28 Oct 2020, 10:27 AM

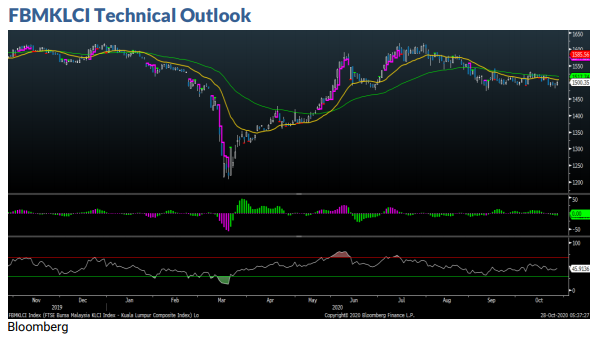

Re-testing 1,500

Market Review

Malaysia: The FBM KLCI (+0.4%) rose to finish above the 1,500 psychological level, driven by gains in healthcare stocks following Hartalega’s record high quarterly results. The lower liners and the broader market both ended in a mixed tone with the healthcare sector (+2.9%) outperformed in the latter.

Global markets: With the rising Covid-19 cases in the US, Wall Street ended mixed as the Dow (-0.8%) and S&P500 dipped for a third and second straight trading session respectively, but Nasdaq (+0.6%) climbed as the gains in technology sector offset the extended selloffs in other sectors. European stockmarkets extended its losses, while Asia stockmarkets ended mixed.

The Day Ahead

With the FBM KLCI re-capturing above the 1,500 level, coupled with the toned down political uncertainty, we reckon that further upsides are in the cards as investors bargain hunt on beaten down stocks. Strong upsides, however, remain elusive at current juncture as the extension of Conditional Movement Control Order (CMCO) in certain states may derail the prospect of V-shaped economic recovery. The lower liners are enjoying a better run which may lead to further rotational play as traders capitalise on the positive market sentiment.

Sector focus: Following the recent batch of strong corporate earnings from glovemakers, we expect trading interest to remain upbeat within the healthcare sector. The technology sector is also expected garner further trading interest backed by the improved prospects.

The FBM KLCI has rebounded to form a bullish candle as the key index re-tested the daily EMA9 level. The extended recovery is expected to take shape, but gains are likely to be cap near term immediate resistances located at 1,520-1,530. The immediate support is at 1,470-1,480. Indicators have turned mixed as the MACD Histogram has turned green, but the RSI remains below 50.

Company Brief

Bursa Malaysia Bhd's 3QFY20 net profit increased by 158.9% YoY to RM121.9m, propelled by strong investor participation across segments led by domestic institutions and retail. Revenue for the quarter improved 93.8% YoY to RM237.7m. (The Star)

Luxchem Corporation Bhd's 3QFY20 net profit rose 65.5% YoY to RM14.2m, boosted by its stronger trading segment. Revenue for the quarter increased 2.0% YoY to RM191.3m. (The Star)

Minetech Resources Bhd’s unit, Techmile Resources Sdn Bhd (TRSB), has bagged a RM37.5m contract from ARNN Technologies Sdn Bhd (ATSB) for works on an integrated data centre on a call-out basis. Works would begin on acceptance of the service order and was expected to be completed within 24 months from the starting date with any extension period obtained from the project owner to be added to the completion date. (The Star)

The Armed Forces Fund Board (LTAT) has still yet to decide on the privatisation of its debt-laden flagship group Boustead Holdings Bhd, five months after the army fund first expressed consideration for the corporate exercise. The Securities Commission Malaysia (SC) granted a further extension of four months until 2nd February 2021 to LTAT to announce its firm intention in relation to the proposed privatisation. (The Edge)

Supermax Corp Bhd’s 1QFY21 net profit surged 30.9x YoY to RM789.5m, thanks to the continued booming demand for rubber gloves amid the Covid-19 pandemic. Revenue for the quarter jumped 265.6% YoY to RM1.35bn. Separately, Supermax announced that it is planning for a dual listing on the Singapore Exchange to expand and diversify its shareholder base. The proposed listing is still at an initial stage and the structure of the listing has not been finalised. (The Edge)

Atrium Real Estate Investment Trust’s (Atrium REIT) 3QFY20 net rental income jumped 74.0% YoY to RM7.7m on improved topline growth. Revenue for the quarter added 68.1% YoY to RM8.3m. An interim distribution of 2.0 sen per unit, payable on 30th November 2020 was declared. (The Edge)

RGT Bhd's 1QFY21 net profit soared 124.2% YoY to RM4.3m, on the back of a surge in demand for hygiene care products such as soaps and sanitiser dispensers. Revenue for the quarter swelled 257.6% YoY to RM41.8m. (The Edge)

Malaysia Marine and Heavy Engineering Holdings Bhd’s (MHB) 3QFY20 net profit stood at RM2.6m against a net loss of RM4.7m recorded in the previous corresponding quarter, mainly due to higher revenue from its heavy engineering segment. Revenue for the quarter rose 45.3% YoY to RM369.5m. (The Edge)

Source: Mplus Research - 28 Oct 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-16

SUPERMX2024-11-14

AIZO2024-11-14

AIZO2024-11-14

BURSA2024-11-14

BURSA2024-11-14

MHB2024-11-14

MHB2024-11-14

MHB2024-11-14

MHB2024-11-14

MHB2024-11-14

MHB2024-11-14

MHB2024-11-11

BURSA2024-11-08

BURSA2024-11-07

BSTEAD2024-11-07

BURSA2024-11-07

BURSA2024-11-07

SUPERMX2024-11-07

SUPERMX2024-11-06

BURSA2024-11-05

BURSAMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024