Mplus Market Pulse - 4 Feb 2021

MalaccaSecurities

Publish date: Thu, 04 Feb 2021, 12:50 PM

Market Review

Malaysia: Despite coming off from its intraday peak, the FBM KLCI (+0.2%) managed to retain some of its intraday gains to close mildly higher, driven by gains in selected oil & gas and banking heavyweights. The lower liners delivered a swift recovery, while the broader market finished mostly on a positive tone, led by the technology sector (+3.2%).

Global markets: US stockmarkets registered their third day winning streak as the Dow added 0.1% after recovering all its intraday losses, driven by the strong ISM Non-Manufacturing PMI at 58.7 in January 2021; the strongest expansion since February 2019. Elsewhere, both the European and Asia stockmarkets were mostly upbeat.

The Day Ahead

After experiencing a downward trend since mid-January, the FBM KLCI delivered a second session of gain as most of the counters ended positive except for healthcare stocks. As investors likely to have priced in news of further lockdown measures, buying interest in selected counters with high earning certainty during the February reporting period should be seen, while the broader market should be lifted by the mildly positive performance on Wall Street overnight.

Sector focus: Technology stocks may remain under the limelight as follow through buying interest might be observed for the second session. Besides, we expect O&G stocks to trend higher as Brent oil price is hovering near the 1Y high. Also, market players might be trading on vaccine-related sectors as vaccine rollout plan is expected to commence in the near term.

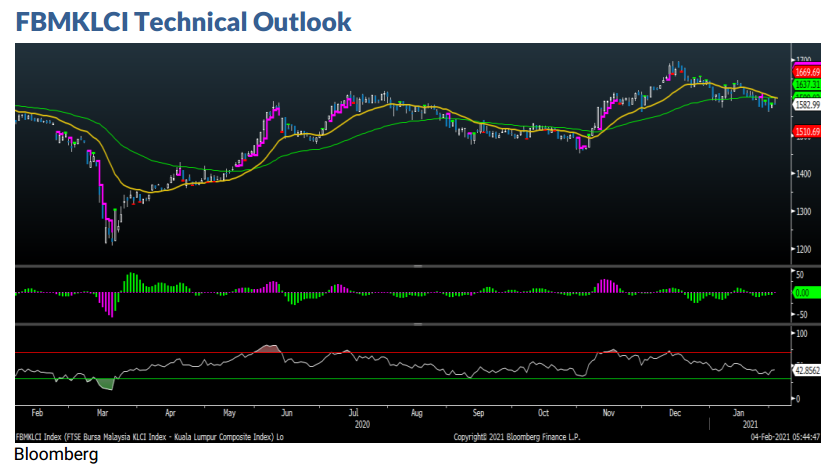

The FBM KLCI has rebounded for the past two trading days, but the selling pressure was noted along 1,600 psychological level. The technical indicators are still negative bias at this juncture; the MACD Line is below zero, while the RSI is below 50. FBM KLCI’s support will be set around 1,550-1,560, while resistance is located around 1,600-1,610.

Company Brief

LPI Capital Bhd’s 4QFY20 net profit climbed 10.0% YoY to RM86.6m, boosted by its general insurance business. Revenue for the quarter grew 5.8% YoY to RM422.4m. (The Star)

Hong Seng Consolidated Bhd’s 51.0% owned subsidiary, Pantasniaga Sdn Bhd, has secured a RM34.3m contract to supply Covid-19 test kits the Institute of Medical Research. The contract, which started on 3rd February 2021, is to be completed by 1st March 2021. (The Star)

Leong Hup International Bhd aims to expand its Baker's Cottage brand within its established Southeast Asian market. The group has ramped up Baker's Cottage's outlet expansion with an additional 67 outlets by end-2020 from 28 in January 2020. (The Edge)

Chin Hin Group Property Bhd has signed an offer letter with Frazel Luxe Sdn Bhd to acquire the 3.3-ha. freehold land situated on Jalan Kuchai for RM85.0m. The purchase of the land will be conditional upon the obtaining of relevant approvals, including from the State authority, its board of directors and shareholders and the Economic Planning Unit. (The Edge)

Icon Offshore Bhd has secured a US$13.3 m (RM53.9m) order to supply a jack-up drilling rig to Petrofac (Malaysia-PM304) Ltd, raising the group’s order book to RM768.8m. The award for the provision of the Perisai Pacific 101 rig was received by its newly acquired subsidiary Perisai Offshore Sdn Bhd. (The Edge)

Widad Group Bhd is partnering Motion Ventures Sdn Bhd, via a memorandum of collaboration, to provide facilities management to community solar projects and large-scale photovoltaic plants with a total capacity of 1,000MW in Peninsular Malaysia. (The Edge)

Asdion Bhd’s external auditor has issued an unmodified audit opinion with a material uncertainty related to the group’s ability to operate as a going concern. CAS Malaysia PLT drew attention to the group’s net loss of RM4.0m for the FY20 and its net current liabilities position of RM5.6m as at the end of the financial year. (The Edge)

Source: Mplus Research - 4 Feb 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024