Mplus Market Pulse - 15 Feb 2021

MalaccaSecurities

Publish date: Mon, 15 Feb 2021, 09:09 AM

Market Review

Malaysia: The FBM KLCI (+0.2%) recorded its third day winning streak ahead of the holiday-shortened trading week, boosted by gains in selected banking and gloves heavyweights. The lower liners also delivered a solid performance, while the technology sector (+2.9%) anchored the mostly positive broader market.

Global markets: US stockmarkets chalked in mild gains on last Friday as the Dow climbed 0.1% after enduring a choppy trading session on the progressive rollout of Covid-19 vaccine. European stocksmarkets rebounded, while Asia stockmarkets were fairly mixed with majority of the markets closed for the Lunar New Year break.

The Day Ahead

Despite the sharper-than-expected economic contraction of -3.4% in 4Q20, the FBM KLCI inched up ahead of the Lunar New Year holiday as investors may have priced in the impact of the ongoing MCO. We expect the positive sentiment on Wall Street overnight may spillover to stocks on the local front as market players should refocus after the long break ahead of the full blown reporting season. Meanwhile, we noticed crude oil price has surged above USD62 firmly last week.

Sector focus: With technology stocks in the US continued their uptrend move, it may benefit the technology firms on the local front at least for the near term. Meanwhile, traders may continue to like recovery-themed stocks ahead of the vaccine distribution in Malaysia and energy stocks amid the firmer crude oil price.

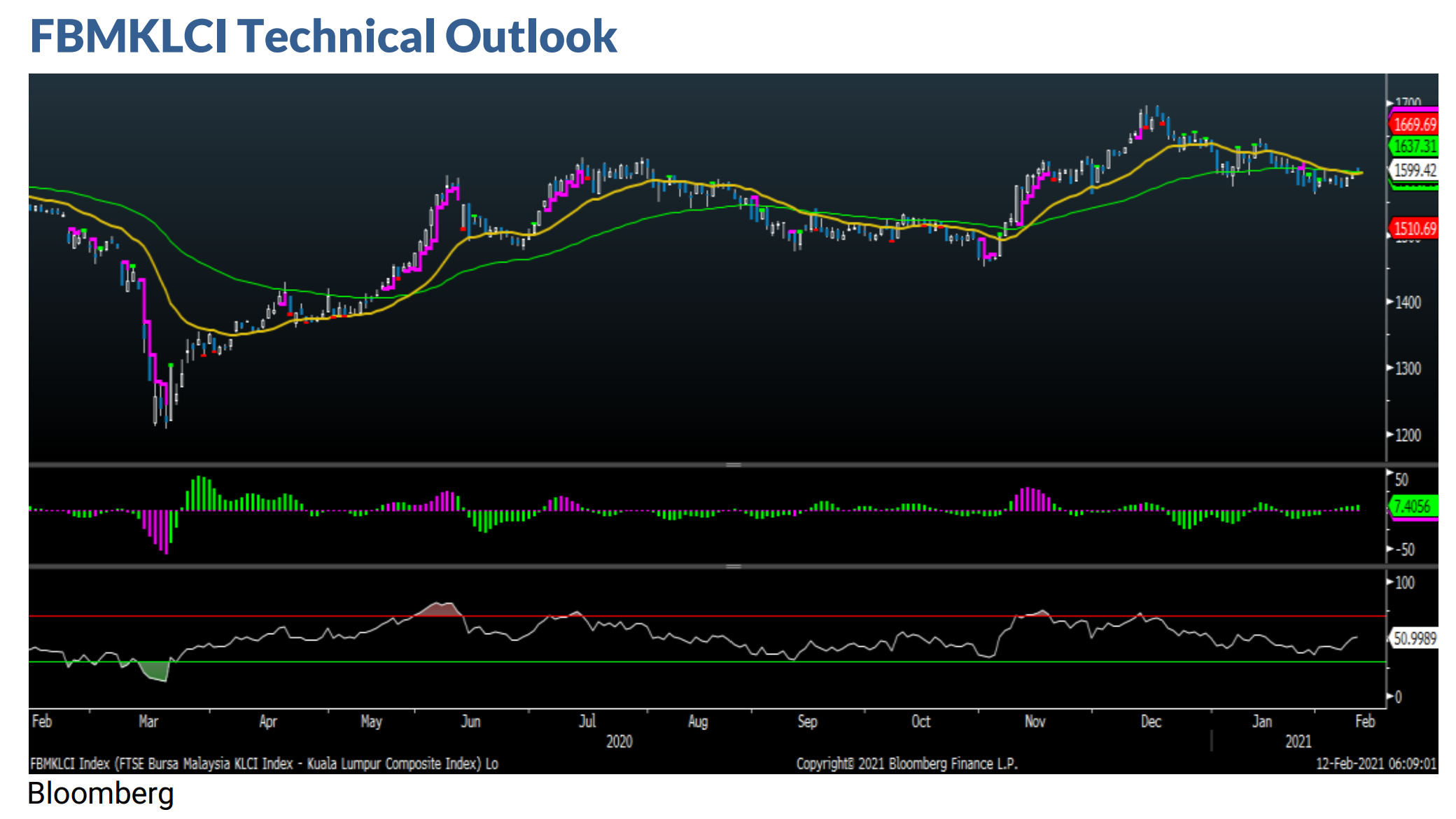

The FBM KLCI closed near the 1,600 psychological level on Thursday’s half-day trading with milder trading volume. As the key index was pushed further from the support level of 1,550-1,560, we expect it will trade range bound within 1,580-1,610. Resistance is pegged around 1,600. Meanwhile, technical indicators are turning slightly positive as MACD Histogram extended another green bar and RSI has rose above 50.

Company Brief

India imported more than 500,000 tonnes of palm oil from Malaysia in January 2021 out of its overall edible oil imports of about 1.1m tonnes. The imports from Malaysia comprised 497,337 tonnes of crude palm oil (CPO), 9,204 tonnes of crude palm kernel oil and 2,701 tonnes of RBD palm olein. India’s CPO imports from Malaysia in January were 23% QoQ higher than the December 2020 purchase. (The Edge)

Datuk Seri Mukhriz Mahathir is no longer a substantial shareholder in Opcom Holdings Bhd after he sold 24.6m shares in the company. Separately, Mukhriz’s wife Datin Norzieta Zakaria has also ceased to be a substantial shareholder in Opcom. This was after M Ocean Capita Sdn Bhd, a company owned by Norzieta, disposed 18.0m shares through the open market on 10th February 2021. (The Star)

Resintech Bhd's 3QFY21 net profit surged 275.9% YoY to RM2.6m, backed by higher revenue. Revenue for the quarter grew 25.2% YoY to RM21.6m. (The Edge)

TDM Bhd’s chief financial officer Amir Mohd Hafiz Amir Khalid has tendered his resignation, effective from 28th February 2021 to pursue other career opportunities. He is the second senior official to leave the group in three months after former CEO Zainal Abidin Shariff Amir Mohd, who resigned on 27th November 2020. (The Edge)

M3 Technologies (Asia) Bhd has announced the retirement of Lim Seng Boon, 63, as its group managing director. Lim was appointed to the board in 1999, and was a major shareholder of the company. (The Edge)

The Court of Appeal has allowed Puncak Niaga Holdings Bhd's appeal to reinstate its RM14.0bn case against former Selangor menteri besar Tan Sri Abdul Khalid Ibrahim and the Selangor government. The appellate court, however, dismissed the inclusion of another former Selangor menteri besar, Datuk Seri Mohamed Azmin Ali, as a defendant. (The Edge)

The closing date for the acceptance of the takeover offer by the Federal Land Development Authority (Felda) to acquire the remaining stake in FGV Holdings Bhd has been further extended to 2nd March 2021, from 16th February 2021. As at 10th February 2021, the total shares held by Felda and parties acting in concert in FGV amounted to 2.62bn, equivalent to a 72.0% stake in the company. (The Edge)

Source: Mplus Research - 15 Feb 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on M+ Online Research Articles

Created by MalaccaSecurities | Oct 02, 2024

Created by MalaccaSecurities | Sep 24, 2024

.png)