Mplus Market Pulse - 17 Mar 2022

MalaccaSecurities

Publish date: Thu, 17 Mar 2022, 08:43 AM

Due for a rebound

Market Review

Malaysia:. The FBM KLCI (+0.9%) reversed the three-day losing streak and rebounded along with the regional markets after China vowed to keep the stockmarkets stable. The lower liners trended higher with the technology (+5.1%) and the construction sectors (+5.0%) led gains on the positive broader market.

Global markets:. Wall Street ended with sharp gains overnight as the Dow (+1.6%) rallied despite the US Federal Reserve raised interest rate by 25 basis points and signalled more hawkish tone going forward. The European markets ended in a positive tone, while the Asia stockmarkets finished mostly in the green.

The Day Ahead

The FBM KLCI soared in tandem with the regional peers after China promised to roll out support measures to bolster its stockmarkets following the recent market turmoil. Given the positive overnight performance on Wall Street, we expect our local market to extend its rebound with the banking sector taking the lead after the interest rate hike in the US. As we are getting closer to the reopening of borders, investors may focus on recovery theme and consumer stocks. Commodity wise, the crude oil continued to trade below the USD100 per barrel mark, while the CPO price hovered below RM6,000 amid fading geopolitical tension.

Sector focus:. We believe the technology sector is on track for recovery following the extended gains in Nasdaq. Meanwhile, traders may focus on recovery theme sectors such as consumer and banking with the anticipation of borders reopening. Besides, we noticed significant buying interest within the construction sector yesterday, which may sustain ahead of the GE15.

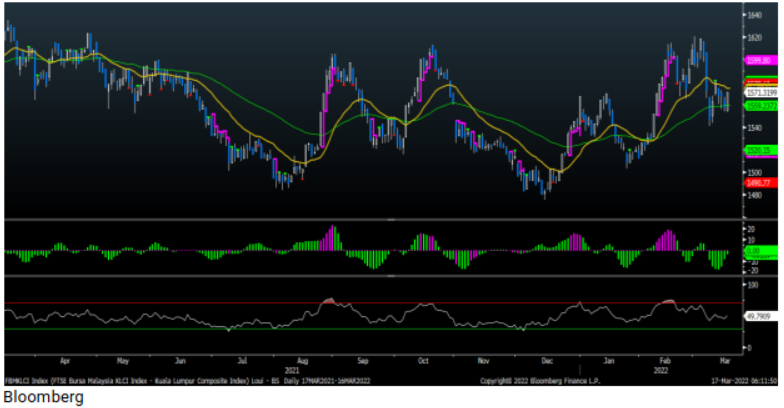

FBMKLCI Technical Outlook

The FBM KLCI staged a strong rebound, breaching above its immediate resistance at 1,570 and closing around the daily EMA9 level. Technical indicators are recovering as the MACD Histogram climbed closer towards zero, while RSI hovered is approaching 50. Next resistance is set around 1,580, followed by 1,590, while the support is located at 1,540-1,550.

Company Brief

AirAsia X Bhd (AAX) had completed its debt restructuring, and will write RM33.00bn back to profits in the next quarter. Under the airline's restructuring proposal, it would pay just 0.5% of debt owed and end its existing contracts. The restructuring was proposed to avoid liquidation after the long-haul low-cost airline posted a record quarterly loss last September. (The Star)

Scientex Bhd’s 2QFY22 net profit fell 16.5% YoY to RM93.7m as the packaging segment continued to face challenges from rising raw material costs and freight cost. Revenue for the quarter, however, rose 5.0% YoY to RM952.0m. (The Star)

EcoWorld International Bhd’s (EWI) 1QFY21 net loss stood at RM14.7m, vs. a net profit of RM56.0m recorded in the previous corresponding quarter, mainly due to lower revenue and profit recognition from Yarra One and West Village, as fewer sold units were handed over during the period. Revenue for the quarter plunged 83.8% YoY to RM49.2m. (The Edge)

Sunway Bhd has secured a surety bond facility of S$200.0m (approximately RM616.7m) in aggregate from Berkshire Hathaway Specialty Insurance Company in relation to a residential development housing project in Singapore. Berkshire, through its branch in Singapore, will issue a qualifying certificate bond of S$37.1m (approximately RM114.4m) that is 10.0% of the price of the land in Yew Siang Road, Singapore acquired by Hoi Hup Sunway Kent Ridge Pte Ltd (HHSKR), an associate company of Sunway, in favour of Singapore Land Authority (LDAU). (The Edge)

LYC Healthcare Bhd's Singapore unit LYC Medicare (Singapore) Pte Ltd (LYC SG) is buying the remaining 49.0% stakes it does not hold in two Singapore-based healthcare companies via cash and share deals, ahead of the unit's proposed listing on the Singapore Exchange (SGX). It is buying the stake in T&T Medical Group Pte Ltd from Dr Ting Choon Meng for S$8.1m (RM25.0m) and the stake in HC Orthopaedic Surgery Pte Ltd from Dr Chan Ying Ho (Dr Henry) for S$9.2m (RM28.2m). (The Edge)

Tan Chong Motor Holdings Bhd has completed the inaugural issuance of RM300.0m sukuk murabahah under its RM1.50bn sukuk murabahah programme. Proceeds from the issuance shall be utilised by the group's subsidiaries for working capital requirements. (The Edge)

JF Technology Bhd has set up its Test Contacting Centre of Excellence in Kota Damansara, Selangor with an investment of RM40.0m, in a bid to further expand its business and capture immense opportunities in the semiconductor industry. The Centre of Excellence will be established at JF Technology's expanded facility and will house state-of-the-art labs and equipment for the development of new intellectual properties (IPs) and products to serve its customers globally. (The Edge)

Elsoft Research Bhd, via its wholly-owned unit Siangtronics Technology Sdn Bhd has entered into an agreement with manufacturer of industrial equipment SRM Integration (Malaysia) Sdn Bhd to sell a two-storey factory-cum-office building in Barat Daya, Penang for RM38.0m. Proceeds of which will be used for business expansion, a production facility, general working capital, and a special dividend. (The Edge)

Alam Maritim Resources Bhd has received a notice from Messrs. Al Jafree Salihin Kuzaimi PLT (Salihin) to voluntarily resign as auditors of the company. Salihin gave notice in writing to the board of the group on 11th March 2022. Alam Maritim is in the midst of identifying new auditors. (The Edge)

Source: Mplus Research - 17 Mar 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-17

ALAM2024-11-17

EWINT2024-11-16

AAX2024-11-15

SUNWAY2024-11-15

SUNWAY2024-11-14

SCIENTX2024-11-14

SCIENTX2024-11-14

SCIENTX2024-11-14

SCIENTX2024-11-14

SUNWAY2024-11-14

SUNWAY2024-11-13

SCIENTX2024-11-13

SCIENTX2024-11-13

SCIENTX2024-11-13

SCIENTX2024-11-13

SCIENTX2024-11-13

SCIENTX2024-11-13

SCIENTX2024-11-13

SCIENTX2024-11-13

SCIENTX2024-11-13

SUNWAY2024-11-13

SUNWAY2024-11-12

SUNWAY2024-11-12

SUNWAY2024-11-12

SUNWAY2024-11-12

SUNWAY2024-11-12

SUNWAY2024-11-11

EWINT2024-11-11

JFTECH2024-11-11

JFTECH2024-11-11

JFTECH2024-11-11

JFTECH2024-11-11

SUNWAY2024-11-11

SUNWAY2024-11-11

SUNWAY2024-11-11

SUNWAY2024-11-08

SUNWAY2024-11-08

SUNWAY2024-11-08

SUNWAY2024-11-07

SUNWAY2024-11-07

SUNWAY2024-11-07

SUNWAY2024-11-06

SCIENTX2024-11-06

SUNWAY2024-11-06

SUNWAY2024-11-05

SCIENTX2024-11-05

SUNWAY2024-11-05

SUNWAY2024-11-05

SUNWAY2024-11-05

SUNWAY2024-11-05

SUNWAY2024-11-05

SUNWAYMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024