Mplus Market Pulse - 28 Mar 2022

MalaccaSecurities

Publish date: Mon, 28 Mar 2022, 08:56 AM

Surpassing 1,600

Market Review

Malaysia:. The FBM KLCI (+0.3%) re-captured the 1,600 level with more than two thirds of the key index components finished higher as the key index rose 0.8% YoY. The lower liners also marched higher, while the broader market closed mostly higher led by the construction and technology sector that rose 1.4% each.

Global markets:. Wall Street rebounded from a volatile session as the Dow (+0.4%) rose as dip buying activities emerged in the second half of the trading session offset the concern over the political developments in the Middle East. Elsewhere, both the European and Asia stock markets closed mixed.

The Day Ahead

The FBM KLCI finished higher for the second week as investors brushed off some concerns over the Russia-Ukraine conflict while looking forward to the reopening of border on 1st April 2022. We expect the recovery-themed sector to remain resilient prior to this event. Meanwhile, commodity prices are likely to remain volatile on the back of the unresolved conflict between Russia-Ukraine and the Covid-19 related restriction in China where Shanghai will be on a lockdown mode in few stages for 9 days. The crude oil price traded above USD120 per barrel mark, while the CPO price hovered above RM6,000.

Sector focus:. Investors may continue to put recovery-themed stocks on radar, including consumer, banking and tourism. Besides, the commodities related counters are likely to stay upbeat on the back of elevated commodity prices environment. Another catalyst in the current market sentiment may include the speculated GE15 that will be held in the 2H2022, which may boost the trading activities in construction and building material stocks.

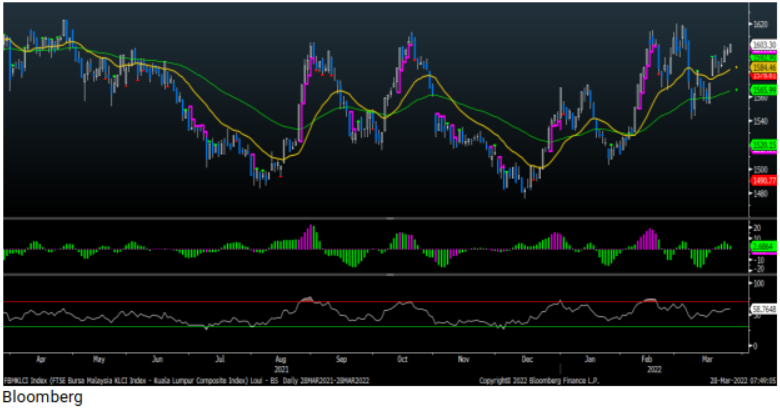

FBMKLCI Technical Outlook

The FBM KLCI rose for the third session as the key index surpassed the key 1,600 level. Technical indicators remained positive as the MACD Histogram extended a positive bar, while the RSI hovered above 50. Next resistance is located around 1,620, while the support is pegged around 1,580.

Company Brief

VS Industry Bhd’s 2QFY22 net profit fell 30.3% YoY to RM44.5m, dragged by increase in labour and raw materials costs, as well as higher depreciation incurred from new facilities while mass production for a new key customer has yet to achieve optimal level. Revenue for the quarter, however, increased marginally by 1.5% YoY to RM1.01bn. (The Star)

National oil company Petroliam Nasional Bhd (Petronas) has denied reports and speculation on talks with the government on a proposal to take a significant stake in financially troubled Sapura Energy Bhd. Petronas' statement came after former premier Datuk Seri Najib Razak wrote on Facebook on 20th March 2022, urging the government to protect Sapura Energy from bankruptcy by providing loans or getting Petronas or Khazanah Nasional Bhd to take over ownership of the group from Permodalan Nasional Bhd. (The Edge)

Malaysia’s largest mobile phone network operator and fourth largest bank are among key contenders to win one of five coveted digital banking licences in the country, which could unlock a slice of the booming e-commerce market. Among the front runners is a consortium comprising mobile phone network operator Axiata Group Bhd and RHB Bank Bhd. (The Edge)

Kein Hing International Bhd’s 3QFY22 net profit rose 56.1% YoY to RM6.3m, on the back of its highest-ever revenue achieved and a one-off gain arising from the waiver of a loan granted to a subsidiary by a non-controlling interest amounting to RM1.31m. Revenue for the quarter increased 21.8% YoY to RM80.7m. (The Edge)

Berjaya Corp Bhd’s subsidiary Berjaya Enviro Holdings Sdn Bhd (BEnviro) is teaming up with Qhazanah Sabah Bhd (QSB), the Sabah State government’s strategic investment arm, to develop and modernise waste management facilities in Sabah. BEnviro has signed a Memorandum of Understanding (MoU) with QSB to cooperate on the development and operation of integrated waste management projects utilising modern and advanced technologies. (The Edge)

Berjaya Land Bhd is collaborating with Sabapak Eco Sdn Bhd to jointly develop a Sustainable Tourism Destination in Sabah. The two parties inked an MoU for this purpose on 25th March 2022, under which they will jointly formulate a comprehensive sustainable plan to develop and transform part of Gaya, Sapi and Bohey Dulang Islands into a prime destination for eco-tourism. (The Edge)

Telekom Malaysia Bhd (TM) has denied all allegations and claims in a notice of arbitration made by MYTV Broadcasting Sdn Bhd last month over a dispute of non payment for the provision of digital terrestrial television, broadcasting infrastructure and network facilities. TM on also counterclaimed against MYTV for the following reliefs. These are the RM90.2m for the outstanding charges and RM5.5m for late-payment charges due and owed by MYTV to TM under the service agreement as of 25th March 2022. (The Edge)

Seacera Group Bhd is partnering with Ikhlas Al Dain Sdn Bhd, the indirect wholly owned unit of Mlabs Systems Bhd, to develop holiday villas in Kemaman, Terengganu that will have an estimated gross development value of RM156.5m. Seacera has entered into a joint venture (JV) agreement with Ikhlas via its wholly owned subsidiary, Seacera Builders Sdn Bhd. Ikhlas was in August 2021 granted sole, exclusive rights by Ribuan Bakat Sdn Bhd to develop several plots of freehold Malay Reserve Land totalling 30.2-ac that Ribuan Bakat owns. (The Edge)

Bintai Kinden Corp Bhd has formed a 51:49 JV with Petro Flanges & Fittings Sdn Bhd (PFF) to supply materials and equipment to the local and international oil and gas industry, including the Middle East, via the distributorship channel of PFF. The two companies are setting up the JV, Bintai Energy Sdn Bhd, to capitalise on the expected O&G industry recovery as capital investments pick up at home and abroad in response to the global energy and commodities crunch. (The Edge)

Loss-making Practice Note 17 (PN17) company Jerasia Capital Bhd has reported that its executive deputy chairman Datuk Yap Fung Kong and his daughter, executive director Debbie Yap May See, have resigned due to personal reasons. The resignations took effect on 24th March 2022. (The Edge)

The voluntary resignation of Messrs Al Jafree Salihin Kuzaimi PLT (Salihin) as the auditor of Alam Maritim Resources Bhd was due to the former's limited number of partners registered with the Audit Oversight Board. The group noted that it remains in the midst of appointing a new auditor. (The Edge)

AME Elite Consortium Bhd has obtained the approval from the Securities Commission Malaysia for the proposed establishment and listing of an industrial real estate investment trust (AME REIT) on the Bursa Malaysia Main Market. AME REIT will have an initial fund size of 520.0m. (The Edge)

Genting Bhd, via Genting RMTN Bhd, has issued medium term notes (MTNs) via two tranches of RM500.0m as part of its RM10.00bn MTN programme. The two tranches comprise a 5-year note amounting to RM400.0m with a coupon rate of 5.2%, as well as an RM100.0m note with a 10-year tenure and 5.6% coupon rate. Proceeds raised from these MTNs will be utilised by the group for the operating expenses, capital expenditure and working capital requirements. (The Edge)

Source: Mplus Research - 28 Mar 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-17

ALAM2024-11-17

GENTING2024-11-17

SAPNRG2024-11-16

BINTAI2024-11-15

AME2024-11-15

AXIATA2024-11-15

BJCORP2024-11-15

RHBBANK2024-11-15

TM2024-11-15

TM2024-11-15

TM2024-11-15

TM2024-11-14

RHBBANK2024-11-14

RHBBANK2024-11-14

TM2024-11-14

TM2024-11-14

TM2024-11-13

RHBBANK2024-11-13

SAPNRG2024-11-13

SAPNRG2024-11-13

SAPNRG2024-11-13

SAPNRG2024-11-13

TM2024-11-13

TM2024-11-13

TM2024-11-13

VS2024-11-13

VS2024-11-12

AXIATA2024-11-12

AXIATA2024-11-12

RHBBANK2024-11-12

TM2024-11-12

TM2024-11-12

TM2024-11-12

TM2024-11-12

VS2024-11-12

VS2024-11-11

AXIATA2024-11-11

GENTING2024-11-11

RHBBANK2024-11-11

RHBBANK2024-11-11

TM2024-11-11

TM2024-11-11

TM2024-11-11

TM2024-11-11

VS2024-11-11

VS2024-11-09

GENTING2024-11-08

AXIATA2024-11-08

AXIATA2024-11-08

AXIATA2024-11-08

RHBBANK2024-11-08

RHBBANK2024-11-08

RHBBANK2024-11-08

TM2024-11-08

TM2024-11-08

TM2024-11-08

TM2024-11-08

VS2024-11-08

VS2024-11-08

VS2024-11-08

VS2024-11-08

VS2024-11-07

AXIATA2024-11-07

TM2024-11-07

TM2024-11-07

TM2024-11-07

TM2024-11-07

VS2024-11-07

VS2024-11-06

AME2024-11-06

AME2024-11-06

AXIATA2024-11-06

BJCORP2024-11-06

GENTING2024-11-06

GENTING2024-11-06

RHBBANK2024-11-06

TM2024-11-06

TM2024-11-06

TM2024-11-06

TM2024-11-05

AME2024-11-05

AME2024-11-05

AME2024-11-05

AME2024-11-05

AXIATA2024-11-05

BINTAI2024-11-05

BINTAI2024-11-05

BINTAI2024-11-05

BINTAI2024-11-05

RHBBANK2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TMMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024

Good123

macam tiada impak :)

Seacera Group Bhd is partnering with Ikhlas Al Dain Sdn Bhd, the indirect wholly owned unit of Mlabs Systems Bhd, to develop holiday villas in Kemaman, Terengganu that will have an estimated gross development value of RM156.5m. Seacera has entered into a joint venture (JV) agreement with Ikhlas via its wholly owned subsidiary, Seacera Builders Sdn Bhd. Ikhlas was in August 2021 granted sole, exclusive rights by Ribuan Bakat Sdn Bhd to develop several plots of freehold Malay Reserve Land totalling 30.2-ac that Ribuan Bakat owns. (The Edge)

2022-04-01 09:50