Mplus Market Pulse - 19 May 2022

MalaccaSecurities

Publish date: Thu, 19 May 2022, 08:40 AM

Mild rebound but upside limited

Market Review

Malaysia:. The FBM KLCI (+0.4%) registered its third winning streak in tandem with gains across the regional markets following expectations that China may relax some of its strict Covid-19 restrictions. The broader market ended mostly higher as the energy sector (+1.2%) outperformed, but the lower liners retreated.

Global markets:. Wall Street turned volatile as the Dow (-3.6%) erased all its previous session gains over the concern over corporate earnings growth amid the steep inflationary pressure. The European stock markets also turned choppy, but the Asia stock markets closed mostly upbeat.

The Day Ahead

The FBM KLCI rebounded as investors continued to scoop up beaten-down shares, especially the banking heavyweights. Nevertheless, we expect market sentiment to remain fragile as volatility and selling pressure resumed on Wall Street on the back of inflation fears and weak results from retailers. Also, the hard-hit technology stocks may face further selloff under this interest rate hike environment. Nevertheless, we are slightly positive on the recovery-themed sectors. Commodities wise, both the crude oil declined further, hovering around USD109 and RM6,050 respectively.

Sector focus:. Given the heavy selldown on Wall Street, traders may avoid technology sector. Meanwhile, we expect the transportation & logistics sector to benefit from the rising Baltic Exchange Dry Index amid declining Covid-19 cases in China. On the recovery themed sectors, we favour consumer, tourism and REITs.

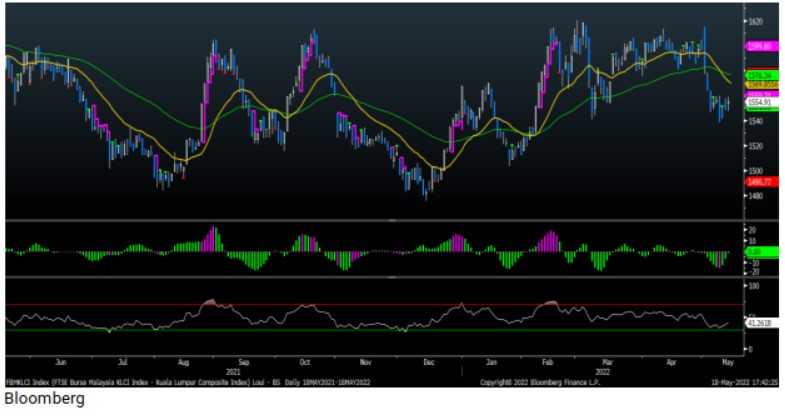

FBMKLCI Technical Outlook

The FBM KLCI rose for the third session and breached above the SMA200, attempting to retest its daily EMA9 level. Technical indicators are mixed, the MACD Histogram moved higher towards the zero line, but the RSI is hovering below 50. Resistance is located at 1,570-1,580, while the support is pegged around 1,530, followed by 1,500.

Company Brief

Signature International Bhd is acquiring a 23.7% stake, or 120.0m shares, in Fiamma Holdings Bhd for RM180.0m. The proposed acquisition is for the group to tap into Fiamma's extensive distribution and servicing network for home and kitchen electrical appliances. The deal is expected to be completed within 4 months from the date of conditional share sale agreement. (The Star)

Sunway Real Estate Investment Trust’s (SunREIT) 1QFY22 net property income rose 77.4% YoY to RM118.9m, on strong retail sales which approached 100.0% normalcy as compared to the same pre-pandemic period in 2019. Revenue for the quarter rose 47.7% YoY to RM154.0m. (The Star)

Malaysia Smelting Corporation Bhd’s (MSC) 1QFY22 net profit jumped 190.9% YoY to RM64.3m, on the back of positive movement in average tin prices. Revenue for the quarter rose 30.3% YoY to RM359.5m. (The Star)

Country Heights Holdings Bhd was slapped with an Unusual Market Activity (UMA) query by Bursa Malaysia that is requesting the company to disclose any corporate development, rumours or reports concerning the business and affairs of the group, and any other possible reasons that may account for the UMA. This came after trading volume in its shares rose sharply and its share price hit limit down yesterday. (The Edge)

Four subsidiaries of Serba Dinamik Holdings Bhd are seeking a restraining order and leave to convene a creditors’ meeting, which is a move seen to revive the troubled oil and gas group that is facing a winding-up petition from its creditors. The subsidiaries which have filed the application for the aforesaid purposes are Serba Dinamik Group Bhd (SDGB), Serba Dinamik Sdn Bhd (SDSB), Serba Dinamik Development Sdn Bhd and SD Controls Sdn Bhd. (The Edge)

E.A. Technique (M) Bhd’s external auditor Messrs Ernst & Young PLT (EY) has expressed a disclaimer of opinion in its audited financial statements for the financial year ended 31st December 2021 (FY21). The group’s and the company’s reported net loss of RM150.6m and RM161.2m respectively for FY21 and that the group’s and the company’s current liabilities exceeded their current assets by RM405.3m and RM416.9m respectively, but the group and company only had cash and bank balances of RM6.4m and RM5.5m respectively. (The Edge)

Zelan Bhd’s external auditor Messrs Afrizan Tarmili Khairul Azhar PLT has expressed an unqualified opinion with material uncertainty related to going concern in its audited financial statements for the financial year ended 31st December 2021 (FY21). The auditor drew attention to the engineering and construction group’s net loss of RM3.0m in FY21, noting that the group’s and the company’s current liabilities exceeded its current assets by RM186.9m and RM21.7m respectively. (The Edge)

LBS Bina Group Bhd’s 1QFY22 net profit rose 19.9% YoY to RM30.2m, on the back of a pick-up in sales and construction activities following the easing of Covid-19 lockdown restrictions. Revenue for the quarter rose marginally by 1.6% YoY to RM409.0m. (The Edge)

Apex Healthcare Bhd’s 1QFY22 net profit gained 32.8% YoY to RM15.8m, underpinned by higher sales revenue achieved by its operating subsidiaries. Revenue for the quarter rose 20.3% YoY to RM215.9m. (The Edge)

Cahya Mata Sarawak Bhd’s 1QFY22 net profit dropped 7.4% YoY to RM72.0m, higher tax expenses recognised in relation to higher taxable incomes. Revenue for the quarter, however, rose 5.9% YoY to RM214.0m. (The Edge)

VSTECS Bhd’s 1QFY22 net profit fell 6.7% YoY to RM11.9m, due to an increase in operating expenses and a decrease in finance income from lower cash and bank balances. Revenue for the quarter dropped 3.8% YoY to RM643.8m. (The Edge)

Three shareholders of Caely Holdings Bhd — Leong Seng Wui, Kok Kwang Lim and Valhalla Capital Sdn Bhd, collectively hold at least 10.0% of the company, have requested for an extraordinary general meeting (EGM) to discuss various issues, including the removal of its newly-appointed executive chairman Wong Siaw Puie and 6 other existing directors. (The Edge)

Kanger International Bhd’s Memorandum of Understanding (MoUs) with Zuellig Pharma Sdn Bhd and Sinaran Advance Group Bhd (formerly K-Star Sports Ltd) have been terminated after it failed to get the Drug Control Authority of Malaysia’s approval to be the registered holder for China’s Sinopharm Covid-19 vaccines in Malaysia. (The Edge)

Encorp Bhd has teamed up with Jentayu Sustainables Bhd to jointly develop a 1.6- ac piece of land in Bukit Kepayan in Kota Kinabalu, Sabah into 1 block of 10-storey condominiums featuring 166 units, which will have a gross development value of RM67.7m. The venture will be the group’s first property development in Sabah as part of its expansion plans. (The Edge)

Lion Posim Bhd is forming an unincorporated joint venture to undertake a mixed residential and commercial development in Shah Alam, with a gross development value of RM867.0m. The group, via its unit Lion Posim Waterfront Sdn Bhd, has entered into a conditional development agreement with a unit of Selangor Menteri Besar Inc, Landasan Lumayan Sdn Bhd, for the development on a parcel of land to be alienated by the Selangor State government to Landasan Lumayan, measuring approximately 26.7-ac. (The Edge)

MPHB Capital Bhd’s unit Multi-Purpose Capital Holdings Bhd (MPCHB) has agreed to sell its 51.0% equity interest in MPI Generali Insurans Bhd for RM485.0m to Generali Asia. Generali Asia and MPCHB have agreed that the purchase price will be adjusted if completion of the deal occurs during the extended period till 31st August 2022. (The Edge)

Petroleum Sarawak Bhd non-executive chairman Tan Sri Dr Hamid Bugo has emerged as the second-largest shareholder of Zecon Bhd, following his purchase of 19.1m shares in the Sarawak-based construction and property firm. The move raised his total stake to 13.4% or 19.8m shares. (The Edge)

Dynaciate Group Bhd proposed name change to Ingenieur Gudang Bhd has been approved by the Companies Commission of Malaysia and is subjected to its shareholders’ approval at an extraordinary meeting to be convened at a date to be announced soon. (The Edge)

Source: Mplus Research - 19 May 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-17

MSC2024-11-15

CMSB2024-11-15

INGENIEU2024-11-15

JSB2024-11-15

LBS2024-11-15

LBS2024-11-15

LBS2024-11-15

MSC2024-11-15

SUNREIT2024-11-15

SUNREIT2024-11-15

SUNREIT2024-11-15

SUNREIT2024-11-15

SUNREIT2024-11-15

SUNREIT2024-11-15

VSTECS2024-11-15

VSTECS2024-11-15

ZECON2024-11-15

ZELAN2024-11-14

SUNREIT2024-11-14

SUNREIT2024-11-14

VSTECS2024-11-14

VSTECS2024-11-14

VSTECS2024-11-14

VSTECS2024-11-14

VSTECS2024-11-14

ZELAN2024-11-13

SUNREIT2024-11-13

VSTECS2024-11-12

SUNREIT2024-11-06

SUNREITMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024