Hard Drive Capacity by Data Center market Roadmap

kkwong13

Publish date: Thu, 15 Aug 2024, 03:39 PM

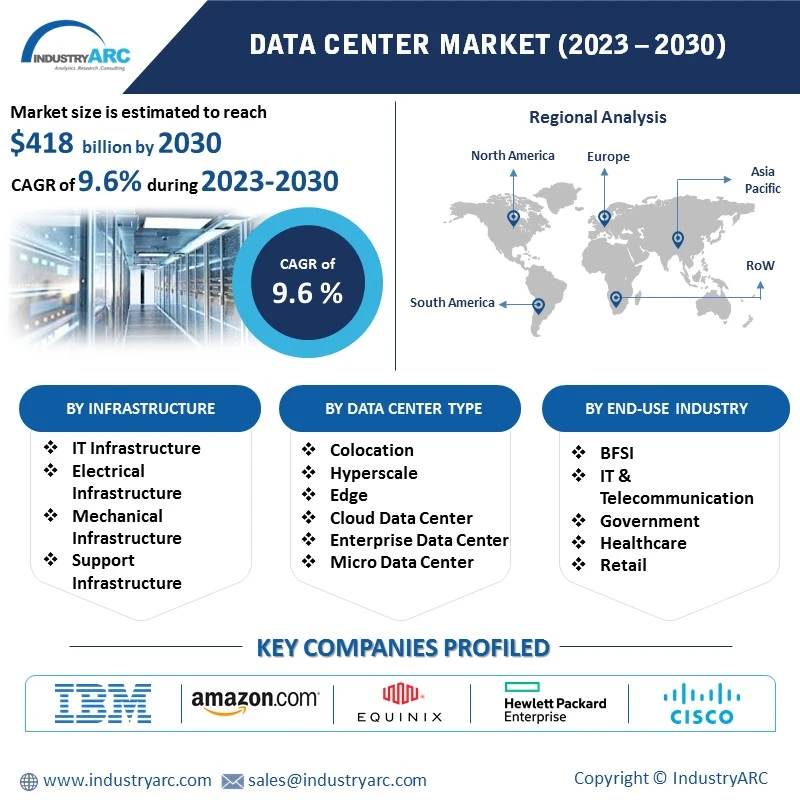

More data = more data centers = more data storage

Seagate's Multicloud Maturity report revealed that companies with a high level of maturity in storing and managing data in a multicloud bring new solutions to market six times faster than competitors with a lower level of maturity. Tech companies and cloud service providers are rapidly investing in new data centers around the world to keep pace with the surge in data demand, driven by AI, to serve their cloud customers and help them gain that competitive advantage.

Hard drive manufacturers need to keep up with this proliferation of data centers and ensure they can produce drives as fast as AI consumes the data they store. After a rocky few years for the hard drive industry, the AI craze is renewing demand for mass data storage. To meet these needs, manufacturers have ambitious plans to increase hard drive capacity.

The past few years have proven challenging for hard drive manufacturers, with Western Digital, Seagate, and Toshiba all posting large declines in shipped units. Now, with demand for nearline storage picking back up, each of the Big Three have hit the 30TB milestone, and have ambitious plans to further ramp up hard drive capacity.

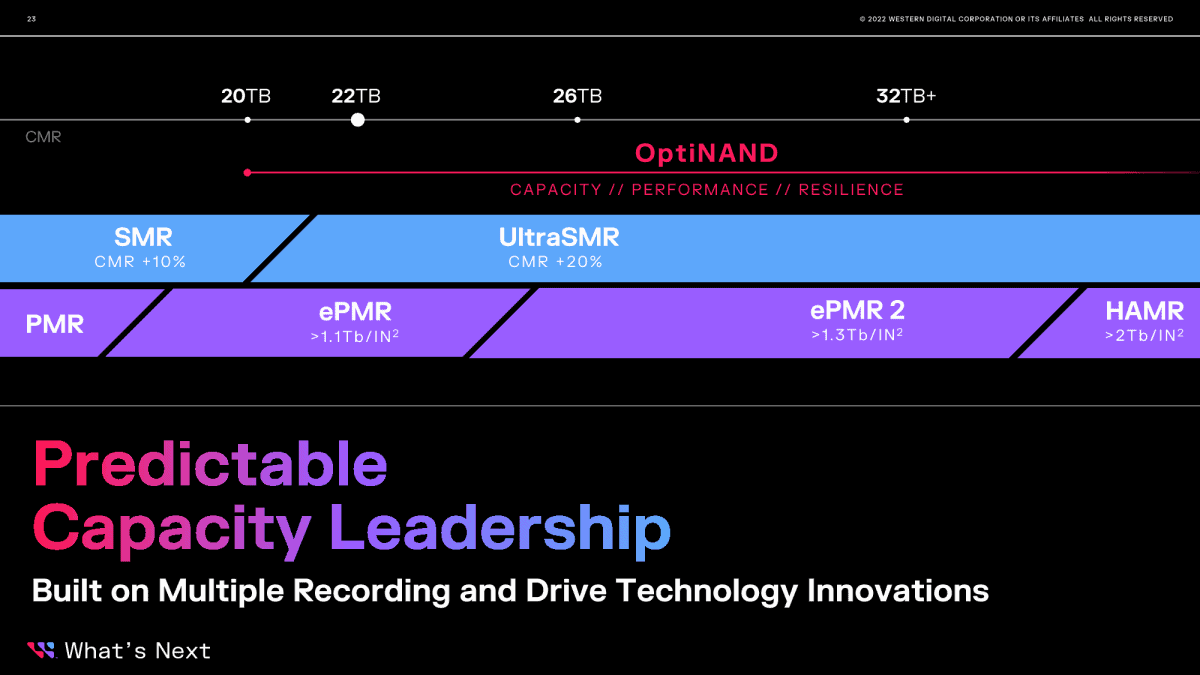

Western Digital, Seagate, and Toshiba have all laid out capacity roadmaps for the years ahead, with hyperscalers in mind. The long-awaited mass production of HAMR drives is finally a reality, and the need to store datasets for AI training is likely to increase demand for high-cap drives moving forward. Here’s a look at the current state of high capacity hard drives, and the factors which will shape their future

Unit Shipments: A Turning Point

2022 and 2023 were hard years for hard drives. HDD unit shipments almost halved in 2022, and this was followed by declines in revenue for the three largest HDD manufacturers. In 3FQ2023, Seagate saw a 33.6% y-o-y decline in revenue, and a staggering loss of $433 million in profits. Western Digital saw a 35% y-o-y decline in revenue, and a $572 million loss in profits. In addition, Toshiba saw its full-year net profit fall by 35%, including a 30.4% decline in operating profit.

The declines in overall HDD shipments were partly due to the collapse of the market for consumer hard drives, but the decline in nearline sales was likely due to a supply chain glut. In any case, it was soon clear that the problem wasn’t HDD per se. Flash manufacturers suffered as well, and processor sales saw their biggest decline since 1984.

Predictions for High-Cap Growth

While Tom Coughlin thinks the continued decline in legacy HDD applications will keep numbers of units shipped from soaring anytime soon, he’s more optimistic about high-cap drives. Coughlin predicts that “high capacity nearline HDD growth should continue in 2024 and in the future”. The reason? Secondary storage is needed to support a massive influx of data, itself necessary to support AI training. He predicts that by 2027, this should boost the number of annual HDDs shipped.

Wells Fargo analyst Aaron Rakers also sees a sunny future for high-cap nearline drives. He predicts that shipped HDD capacity will grow at a 19% CAGR through 2027, compared to a 21% CAGR for SSD. By 2027, he predicts that nearline will constitute 93% of HDD revenue.

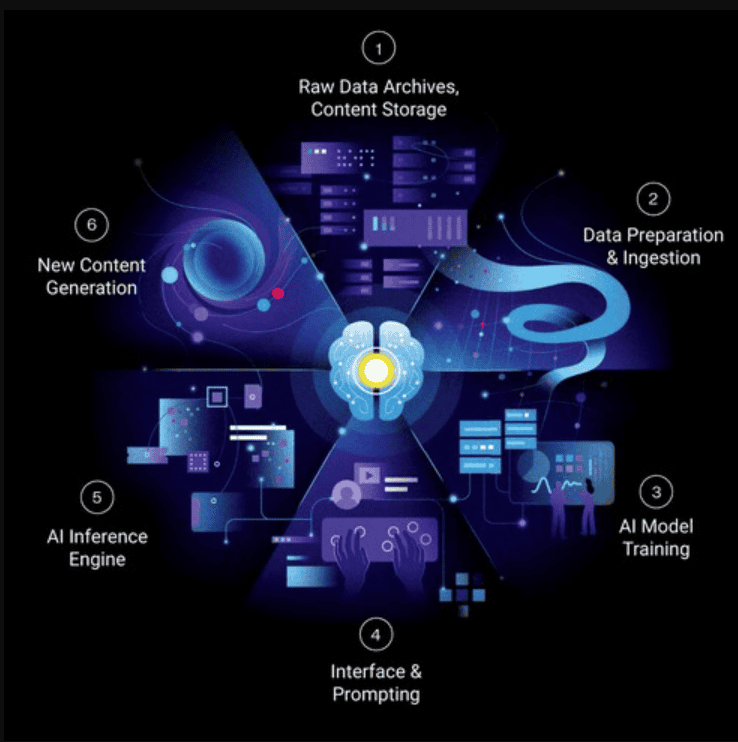

WD recently announced that it will create a 32TB drive, the Ultrastar DC690. This will augment its 28TB HC680 with UltraSMR to gain an extra capacity boost. Interestingly Western Digital is pushing their new 32TB drive as one of two new devices which are made with its new AI data cycle framework in mind. In this framework, the cycle begins and ends with data stored in high-cap HDDs. All of the data prep, ingestion, and model training happens in the intermediate stages, for which WD offers its new DC SN 655, a 64TB TLC NAND drive.

.png)

.png)