Trend Trading for stock do work, Trend trading for daily chart for futures may not work.

StallionInvestment

Publish date: Sat, 01 Feb 2020, 05:25 PM

Why is it a person can do well in stock market using trend trading with a capital of 50k, but he is unlikely to do well in futures market with the same amount of capital. Let me illustrate the scenario when you are doing investment .

Scenario 1 :

A person bought a stock at 1.00. Assume this stock go against him 40%. Assume this is fundamental sound with good financial result but due to some unforeseen circumstances, shares price retrace from the position when he invest. The strategy he adopt is every drop of 0.10, he will buy in 10k worth of stock.

At the price 1.00 , he bought 10,000 shares at 1.00

At the price 0.90, he bought 11,111 shares at 0.90

At the price 0.80, he bought 12,500 shares at 0.80

At the price 0.70, he bought 14,285 shares at 0.70

At the price 0.60, he bought 16,666 shares at 0.60.

Total number of shares in hand is 64562 shares with average cost 0.7745.

So, when the shares price rebound from 0.60 to above 0.78. Technically speaking, investor should be break even and start to make profit.

Scenario 2 :

A person who have capital of 50k, Assume you enter FCPO (FUTURES CRUDE PALM OIL) with a margin of 6K.

Again this particular investor, believe palm oil in long run will do doing good but unfortunately, he enter at the peak 3,000 and refuse to cut losses. Adopt dollar averaging method since long run should be trending upward looking at weekly or monthly chart. Not hourly, daily chart.

So, this person adopt strategy every 100 points drop of FCPO, add additional 1 contract

First Contract A , long 1 contract FCPO at 3,000 ( equal to buy 1 contract ), innitial margin 6k

* To add fresh position, margin call need to cover before new position is allow*

Second Contract B, long 1 contract FCPO at 2,900, to do so,margin call for contract A, 100 point x RM25 = RM 2,500

To add position, client need to put in RM6,000 (initial Margin) + RM2,500 (margin call for Contract A)

Total Amount : RM8,500

Third Contract C, long 1 contract FCPO at 2,800. To do so, margin call for contract A, 100 points x RM25 = RM2,500

margin call for contract B, 100 points X RM25 = RM2,500

Total Amount : RM11,000

Fourth contract D, long 1 contract FCPO at 2,700. To do so,

margin call for contract A, 100 points x RM25 = RM2,500

margin call for contract B, 100 points x RM25 = RM2,500

margin call for contract C, 100 points x RM25 = RM2,500

Total amount : RM13,500

Fifth contract E, long 1 contract FCPO at 2,600. To do so,

margin call for contract A, 100 points X RM25 = RM2,500

margin call for contract B, 100 points X RM25 = RM2,500

Margin call for contract C , 100 points X RM25 = RM2,500

Margin Call for contract D , 100 points X RM25 = RM2,500

Total amount : RM16,000

To do above averaging, capital require is RM6,000 + RM8,500 + RM11,000 + RM13,500 + RM16,000 = RM55,000

Which mean a person can't average down till 2,600 FCPO price, the trader will be cut off the position due to margin call.

Technically speaking, a person who look at daily, weekly chart, in order to survive in futures position trading in long run, capital less than 100k not easy to survive. So, trend trading does not make sense at all for small time trader/investor unless from the start you keep on making profit.

To trade crude oil CME, you need a capital 100k USD to do position trading.

The moral of the story is a same strategy adopt in stock, there is no margin call, but in futures trading, there is. So, a person need to understand the risk but not just pure technical. Having say that, you need to closely monitor futures market. So, a good stock investor may not neccessary success in futures investment. 90% end up lossing money. So, understand the nature of products is crucial.

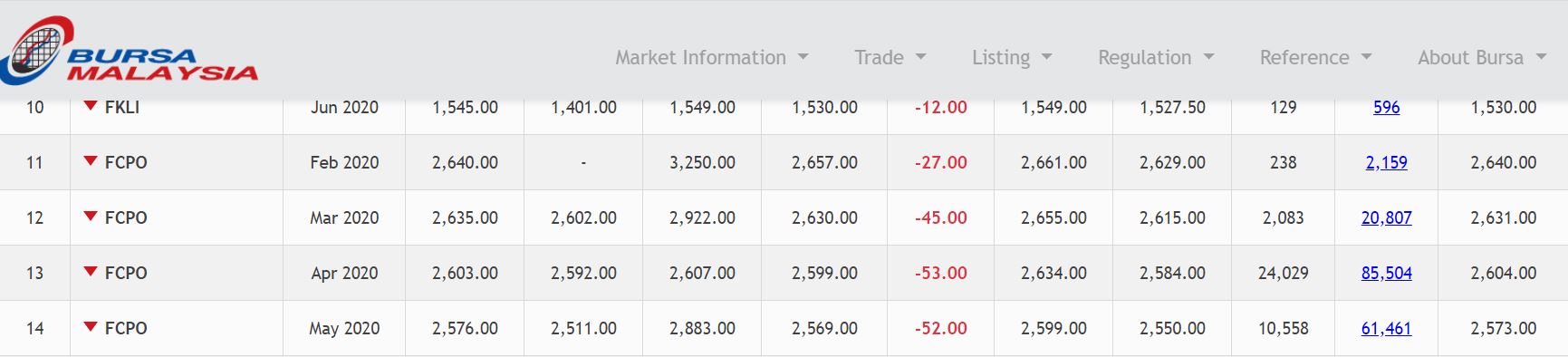

Not to forget there is expiry date of the contract but stock dont have expiry date. Therefore, you either realise losses and roll over to the following month contract provide the current month and following month spread hopefully in your favor, what if go against you further, meaning your losses is more. Below cases, which favor the investor and able to long it at lower price.

TRADE WITH WISDOM

FB LINK : https://www.facebook.com/Steventheeinvestment/

TELEGRAM LINK : https://t.me/steventhee628

Subcribe Stevent Hee Youtube Channel :

https://www.youtube.com/channel/UCYm446mSdNPaxlSVDCVj7bA

免责声明:买卖自负。以上视频纯碎做为学术性分享。任何投资都有风险,在您做出任何投资决定,可以向你的股票经纪询问投资意见。

.png)

.png)

Taehyung

Futures is directional trades, don't mix up with stocks investment..

2020-02-01 21:16