Reality Bites & Myth Preserved?-Do you have what it takes to control your market expectation? (Pt1)

SimonShuet

Publish date: Tue, 08 Mar 2016, 10:52 AM

Following my two other blogs that I have written, I felt that it was an appropriate time to write a bit on myth and practices we do in stock market. I have written in length in the other topics to explain what and how RSI means in layman terms. In doing so, we understand now oversold and overbought doesnt mean just that. Many experts rely on this indicator to determine rebound and I have seen this fatal mistake especially if they feel very confident and do a "show hand" which turns out otherwise.

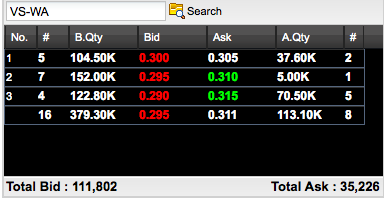

When we look at the market, it is essntially a place where punters of different expertise and experience look at their screen and decide what they want to do. This are the first tier punters that includes (syndicates, traders, investors, green horns) while the second tier are those who place orders base on tips or treasury buy back where not much strategy is used. The second tier does not pose any risk to us as they are premeditated and their action and response does not cause much fluctuation in a stock. The second tier are easy to spot! HOW? Their queue is consistent and they DO NOT change position. Take an example Fig 1 below. The buy queue is 104.50k @ 30cents per unit. If the buy queue is breached with SELLER RELENTING, 2 things have to be observed.

1) Did the quantity at seller position of 30.5c ie 37.60k reduced? if they did, they are likely the same seller at 30.5c queue who sold to the buyer at 30cents.

2) If 104.50k volume @ 30cents is taken up (ie bought) with none of the seller quantity 37.60k @ 30.5c position change, the buyers are from outside the queue

Once you have confirmed the (2) items, and assuming all of the buyer at 30c queue has been exhausted (queue now at 29.5cents) note the quantity of 152.00k. Did the quantity reduced without any transaction? if they did, the seller have change their position buying queue. They belong to Tier 1 players who are active. If they keep changing their position, especially if the volume is high, it is likely they are not interested in buying but to try to support the price (prevent from further declining) or create the enviroment of perceived collection or demand.

Fig 1

Fig 1

Why is it important to determine the active players ie Tier 1? It is because if there is high volume amongst the active players for that day, means it is likely not in collection mode and this are traders or syndicates playing. If it is at the expense of buyer (ie seemingly like panic selling where buy rate is at oversold position with high volume) traders will also identify this as syndicate at play and dump their stock. When this happens, you may likely have a slump in the price. In a slump, there will be a gap down. And if this gap down is at closing, it will mean weakness or wait for next day to determine. To traders, they will read this as weakness and not take a chance for rebound as some may perceive as the Oversold is a indicator of possible rebound due to panic selling.

How about "Morning Star" some of you may ask? Ref to chart in Fig 2. This is where I mention "next day to determine" if a rebound is possible or even imminent. Chances are most traders will avoid especially during such a tumultuous times where most markets are not in sync.

Fig 2

Fig 2

Your chances to win is always with the sentiment. The sentiment is what defines the market. Hence anotther good indicator though is easy and simple is the Gainers, Loser, Untraded indicator. While many are looking at complex indicators, in my opinion, unless you can understand how they derive the indicator (like what I hv explained "RSI vs Buyrate") the indicator is actually static. You have to make the indicator active by the correct application.

Ok I think I have gotten the hard part to share that point out of the way, another myth that many have shared with me is "When I sell my share, my share price almost always go up" This is a timing issue! Most people sell after a prolong stagnant period or a downtrend channel is spotted or volume of transaction decreasing or market uncertainty.....however the key word here is prolong. I have mentioned in many of my comments, prolong period of stagnant (or little movement) stock for previously active stock will momentarily have a movement if it is not panic selling due to some undesired news. One of the method I use is doji to decide. Few doji s (previous days) will signify indecisiveness and likely the price will go down.

In this part, we touched on expectation, indicators to look for and likely spotting declining stocks. In Part2, I will share how to spot a possible incline for a short change. This will allow you to make some money as day trader.

More articles on Facts of Life - Take the Bull by the Horns or Wait for the Bull?

Created by SimonShuet | Apr 09, 2016

Created by SimonShuet | Apr 04, 2016

Created by SimonShuet | Mar 14, 2016

Discussions

Thank you Simon. Beautiful. No more Buy buy buy for me. When is you Pt2 coming?

2016-03-08 15:39

Now that you are familiar with the methods, this should cut your exposure by further 30%.

2016-03-08 15:54

Jake, overall I believe VS is a good company with many potential. At this moment due to strengthening of ringgit, there are concern however to me it is a buying opportunity.. To know how it will fair today, have a look at gainer vs loser. Gainer to lead loser with ratio 62% and above would be good indicator with optimum participation, Untraded by lunch less that 650 should be healthy.

Maomum, I believe yesterday's slump for some exports stocks should have been factored in. Any further drop on those should be collection opportunity for those good FA stocks. As for KLCI, use the gainer loser to gauge.

2016-03-09 08:40

Bro Simon, can I ask you again for your opinion in E&O? Can you advice?

2016-03-09 10:08

This where the curve ball is coming! KLCI went above 1700 and a due consolidation is to happen. I personally would like it to consolidate lower rather than higher. Lower would mean closer to 1665 and higher would mean 169X. Lower allows more stability and to stay above the 1665 if any volatility next week.

2016-03-11 10:20

Oil is down and ahead of Doha meet, is Malaysia getting the best deal at the moment with ringgit strengthening and oil price dropping? Malaysia is nett importer of oil while ringgit strengthens maybe an opportunity to hedge. Hedge ringgit, hedge the oil!

If so what do you think will happen? My opinion is this window maybe very short for this to happen(i.e. Oil down and ringgit strengthening)

2016-04-04 10:37

lawrencechan

Really learn a lot and its free

2016-03-08 14:50