What's The New Game in Global Market? Important read for market direction !!

SimonShuet

Publish date: Sat, 09 Apr 2016, 11:11 AM

In Battle Royale Blog, I wrote of domestic influence in our stock market and about Malaysian Goverment's best bet by hedging at the point when the oil was sliding and ringgit was strengthening. This was an opportunity as many expected the crude oil to rebound within the following day however it lasted the week and sliding above 7% while the ringgit strengthened. Back-to-back on the grid would have given Malaysia at least close to 15% margin by hedging. That means a possible 15% cheaper fuel at retail if they hedge for that week for the rest of the 3weeks of the month and we could get RM1.45-1.50 /litre fuel.

Let me start by saying "The Global market does not really go on merits anymore" not at least until end of this year. Today the game is a game of avoidance and to flow with the tide. To avoid means to move away from the sectors in calamity. Today we hear IOI has been removed from the RSPO roundtable.

- - Malaysia's IOI was suspended from the RSPO over violations of the roundtable's sustainability standards in Borneo.

- - Since then, IOI's customers have moved to cancel contracts with the conglomerate, to date one of the major suppliers of RSPO-brand "Certified Sustainable Palm Oil."

- - IOI has submitted an action plan for RSPO reinstatement.

It went on to say

"In the wake of IOI Group’s suspension from the the world’s largest association for ethical palm oil production, its customers Unilever, Kellogg and Mars have announced they will stop doing business with the Malaysian conglomerate." and this was because "its downstream affiliate IOI Loders Croklaan, were suspended from the Roundtable on Sustainable Palm Oil (RSPO) last month over the group’s plantations in the Ketapang area of Kalimantan, the Indonesian part of Borneo. Three of IOI’s subsidiaries are allegedto have violated a raft of RSPO standards meant to prevent rainforest destruction and social conflicts, and to have broken the law."

So this is one example of avoidance above the merits they have achieved. IOI is also one of the co-founder of the RSPO association. In addition to this, as a whole the plantation sector is also hit by El Nino phenomenon albeit businesses like timber still carries on as usual, those fruit bearing will be hit hard.

Similarly depressing/devaluing ones currency like that done by the US and China recently to prop their exports is also a strategy already in the books of traders, being a strategy that is over played. This means when a currency is devalued, traders will counter by buying their local stock as one example pulling their foreign funds into US. When that happens and intensifies, the USD again will strengthen naturally. By then, the traders will start to hedge once their value is reached. Now the same thing happens when crude oil price is depressed due to oversupply, the USD strengthens and so on and forth. At the moment the balancing point of crude oil is USD35/barrel psychologically. That means if it stays above USD35 the possibility of rebound is there while falling below USD35 will convince many of further decline. Hence at this point, MYR will strengthen ahead of oil.

In my earlier blog, I have mention what makes a currency strong is with respect to how tradable it is. Let's face it, MYR is not very tradable which also means not desired especially when the currency was fluctuating at a high difference. Even as late as Feb this year, I was still hearing Thailand and Indonesia not accepting MYR exchange at their money changer. So in short, it is NOT the RM currency (MYR) strengthening or weakening but the reference i.e. USD. Many are reporting here everyday the exchange rate between USD and MYR where a lot of pundits are using to decide whether to buy export stock for a flip. If you are one of them playing this, it is truly punting as no skill is involve.

"Through the week ended April 1, foreign investors bought a net RM5.5 billion of Kuala Lumpur stocks this year, data from the research arm of Malaysian Industrial Development Finance showed. Last year had total outflows of RM19.5 billion, it said.

Offshore investors have raised their local bond holdings by RM11.8 billion in January-March, central bank data shows, with increased interest in longer-tenor debt. For all of last year, foreigners slashed holdings by 11.1 billion ringgit.

The cautious stance of Federal Reserve Chair Janet Yellen on US rate hikes has caused investors to seek higher yields in Asia, aiding flows into Malaysia."

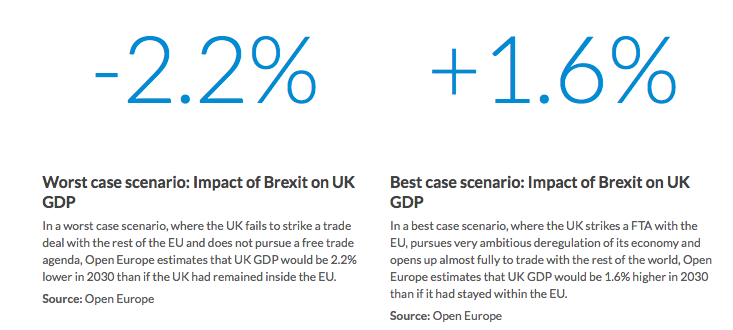

What are some of the concerns of Brexit?

- If Britain leaves the EU, it will no longer have to contribute towards the European Union's budget.

- In March Brexit campaigners slammed a report that claimed that leaving the EU would cause a £100billion “shock” to the UK economy.

- Research commissioned by the Confederation of British Industry (CBI) predicted that Brexit would "significantly" reduce UK living standards, economic output and employment.

- But those campaigning for Britain to quit the EU said the report was flawed and pointed out that the CBI receives money from Brussels.

(Source - http://www.express.co.uk/news/politics/645667/Brexit-EU-European-Union-Referendum-David-Cameron-Economic-Impact-UK-EU-exit-leave)

Another source:

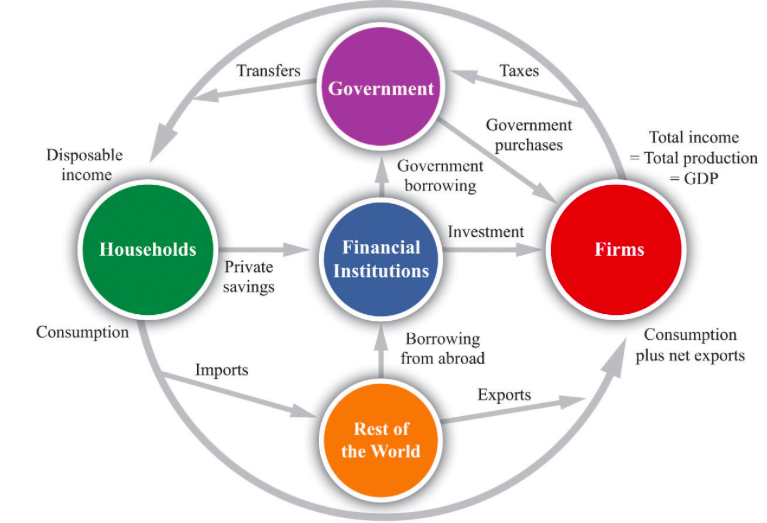

The above is just an anticipation from an economic standpoint. In layman, we should be thinking in terms of UK being a standalone outside EU in terms of trading support whilst UK being outside of Eurozone from the very beginning have saved them from the catastrophe of Greece and or even Spain and etc. What does it mean by being out of EU and Eurozone?? In the latter, I would believe it was a long standing and challenge trying unite a currency amongst countries of different economic status leaving alone trading support. I say that with conviction because only 19 countries in Eurozone are in EU's 28 nation. So while the latter is just a subset of the EU which means not being in Eurozone is a blessing (and does not forgo their trading commitment) as they are in the greater conglomerate of inclusive countries of EU, now leaving EU may not be.

More articles on Facts of Life - Take the Bull by the Horns or Wait for the Bull?

Created by SimonShuet | Apr 04, 2016

Created by SimonShuet | Mar 14, 2016

Discussions

Thank you Boss Simon. Looks like as long as Feds cannot confirm and Brexit comes into play, money will be here longer

2016-04-09 11:28

Makes sense but judging from the high equity is that the reason KLCI is going up?

2016-04-09 11:31

Thx Simon. Base on your earlier call on oil and RM, i believe you could be right on the coming months again. Good Luck

2016-04-09 11:34

Mr Simon, I agree w your points but can you comment more on the counter to buy?

2016-04-09 21:19

Thx for The Global Direction view sharing here, I'm still cautious on The Nxt BN successor.

2016-04-10 13:22

Some of the Brexit money is already in Asia and Malaysia. The decline of the GBP last year started since Sept 2015 to date at 5.53 against MYR stems from the out flow due to the concern. To be exact 17% decline.

2016-04-10 20:58

A quick check at BPAM and MGS on bonds as follow. Having heard this morning on BFM that China has taken up 8% of our bond as they did in a few other country. It is either they have a hand in the restructuring of our debt being buyers of some of the asset (which is a fact) or they trust the Goverment or both. This will be handy if both our debt is reduce and GDP improved would be ideal case

"Malaysia Government Bond 10Y increased to 3.82 percent on Thursday April 7 from 3.81 percent in the previous trading day. Historically, the Malaysia Government Bond 10Y reached an all time high of 5.35 in April of 2004 and a record low of 2.87 in January of 2009."

2016-04-11 09:41

What else do we need?

1. Last year we had outflow of foreign investment totalling RM19.5Billion. if divided by 4Q each Q is RM5Bil. The 1st Q this year reported RM5.5Bil already.

2. Bond market registered RM11.8 in 1st Q (Jan -Mar this year) while the lost of whole of 2015 in bond pull out was RM11.1Bil. We are on a move for bond. this has not factored in the China 8%. Question here is are we selling more asset that China is in a know?

3 The rest as mentioned in the writeup

If someone buys up your debt knowing that the debt restructure will work, knowing that they can buy assets that you dispose to settle debt at a price (lower or higher than market price) but is cheap to the foreign buyer due to the exchange rate. What this means in addition to point 1-3 is the spill over will again be into equity and secondly upon optimise of bond, the money will go to equity.

Risk? Opposition political party spoiling the deal

2016-04-11 10:43

NICE (7139)...can collect now!!. .it is moving upwards for the next wave. Resistance at 0.155 n 0.195!!!!! Collect before too late!!!!

2016-04-11 11:36

Oil is not only stable but gaining ground. This means ringgit will strengthen further. Once it strengthen and if it strengthens to 3.70 many foreign investors will sell then. But between now till 3.70 watch the oil potential to go up. If oil gap to 45 with momentum, expect the heavy buy in between then.

2016-04-12 08:59

For those who ask me about export counter when ringgit strengthens -

Answer: You hv to remember export theme is local consumption only. Sector play is also local theme. They are prevalent when the foreign investors are not present. For foreign investors they do not understand our theme play simply because the system they use to filter is base on factual value, potential and past 2 Quarter growth.

For those looking at export stock, my advice is look at the volume and buy rate. If buy rate is very low for the export counter you are looking at but the volume is very high say 2 to 3 times higher than AVERAGE HIGH. The translation is low buy rate from previous day of high buy rate could mean correction however low buy rate from say 50% buy rate from previous day is likely panic selling.

I am more convince of correction if the buy rate is high for few days followed very low buy rate to support the correction theory. 1 day high buy rate followed by correction is very unlikely to be correction. A lot of export stock had 1 day high buy rate on Monday but immediate yesterday the buy rate dropped.

Do you think is correction or panic selling? If you believe like me on the theory above that panic selling ensued due to strengthening of MYR (then also read my comment yesterday at 8.59am)

If what its said is true that yesterday was panic selling then one must look at the volume because if the volume is high, there is a buyer. If you have high panic sellers but not buyer the price will drop significantly because of low volume at each level of buy queue.

So what does it mean if buy rate is low with significant volume transacted (double or triple the AVG HIGH volume)? It means someone is buying. As I have mentioned the export theme is only local to us, for those with panic selling (low buy rate), at higher than AVG HIGH volume, maybe a sign of buy up by foreign investors. So far as shared the foreign investors are taking up in quarter similar amt of investment seen by quarter against the pull out last year.

Hope this explains

2016-04-13 08:55

Wah Boss so confident even export stock. can share after first half this morning what you think?

2016-04-13 14:15

Yesterday participation in first half and second half was good. This morning the ungraded is at 854. If it moves towards 700 or below like yesterday before 1st trading session, it will be considered good. When you have more participation, the consensus of the KLCI will be accurate and you can trade with more confidence.

As what I hv written as oil approaches USD45 per barrel, the consensus in Malaysia will be expecting 3.70 exchange against USD to be met. Whether met or not, the expectation is likely it will and KLCI market will move in that direction. Foreign investor may look upon the strengthening of MYR to buy now and throw at 3.70 exchange.

From our perspective, it may work to their advantage when we sell now due to weakness in export stock. So look out of this buying by the foreign investor. How? as mentioned earlier high volume of take up at low buy rate. Note: They may not present themselves in the buy queue but the volume will be high.

2016-04-14 11:09

If you hv read my earlier write up in Battle Royale, one of the tool to prop confidence is by using the market. Whether it is planned or not by the PM it seemed to hv coincided with the Sarawak election and the whole deal of bond selling and take up by the Chinese was also too convenient to ignore.

My personal take is , the Chinese has been buying key assets in Malaysia and they know the debt can contra or settled with more deals.

2016-04-14 11:16

Wow Boss Simon, your USD45per barrel upwards and toward RM3.70 buy call really happening. So sell at near 3.70 exchange??

2016-04-22 09:07

the British pound is under pressure from all fronts. Until after the British voted " stay or quit " the anxiety is there. People do not like fiscal or economic uncertainites.

The British economics is not what it used to be. the British to be honest has lost their edge in most manufacturing and technology. They are still good at the education level. without overseas fundings Great Britain is just Britain nothing Great. Scotland is planning to secede from the union. things are not too rosy at his point of time

2016-04-22 09:15

ADC888, as you can see many of the fundamentally good stocks are moving already even export stock as I mention earlier when the USD45 /barrel psychological barrier and expectation of forex 3.70 against USD becomes more real and I will sell when my rules are fulfilled

2016-04-22 09:44

Boss Simon as usual thanks. All my 3 stocks started to move already. Appreciate your comments

2016-04-22 09:49

How is the global money going to flow between this point till June

If break it down

1. Not many want to trade GBR at this point causing the exchange for the currency to weaken until they are clear of the stance of Brexit. No simple answer as there are up to half a million EU trustees moving in and out of UK causing more damage yearly utilizing taxpayers monies and benefit. Weighing on this monies will continue to flow out. Only 2destination, Asia or US as the Brits are too familiar with the Euro challenges at this point. Not only influx of refugees in Europe causing much concern that supporting human rights and humanitarian will soon kill Europe's economy. If they are still not convince on Paris and Brussels attack a few more terrorist act will definitely convince them. My personal opinion is UK should leave the EU for the reason stated above and the fact that EU has also lost 50% of their trade strength in the few many years earlier.

2. Import to US generally has slowed down as we have read As I wriote before that most if not all forex are referenced to USD. This means when we say example MYR has weaken against the USD what we really mean is USD has been traded more and hence they strengthen and when that's happens MYR will be referenced as weaken. At this point, US has played almost every card they have, include devaluing their currency to strengthen their export to reducing imports to consolidate their standing (basically a correction mode) to deliberating their interest rates hike ...... The latter is perceived as a delay tactic and the idea is to balance the stock market because there are many variable from ECB and Japan's negative interest rate which when coincide together must put US in a controlled environment. Example if US devalues the USD and have a rate hike and similarly ECB and Japan does the same, the export numbers will not happen for US and it will deficit the purpose of doing so

3. The Bill to reveal 9/11 if passed in US may have the Bond market spiraling downwards. The Saudis have large bonds term assets which total USD750B which may be pulled out if US declassify the secrecy. So now we know who is behind 9/11??? :) those money entrusted in bonds or other asset IF pulled out from US again very unlikely will end up in Europe right?

4. Oil's fallen prices last year and to date has taken a large toll on Middle East , Russia and US. How do we know? because the Saudis are now taking loans while Russia is taking on Syria directly and more engage in aggressive stance to compensate for their losses in oil while US is trying to improve their relations with the Saudis to avoid No3. Real?? Yes!!

ISIS is also at its weakest now because of prolonged oil losses.

So now for the question:

1. Once you have read the above, Brexit may seem more straight forward. It is a choice of long term rewards and short term pain if they exit or take the easy way by remaining in a degrading EU economy. My guess is further fueled by Obama's recent advice for UK to remain in EU. This is because it is easier to manage EU as a whole than having to deal with splinter groups. UK made a calculated choice when they avoided joining Eurozone however Eurozone is a subset of EU since 18 member states in Eurozone are part of the 29 member states of EU. UK being out of EU means they are neither part of EU or Europe already. Before if ECB is to Europe and Feds is to US where does that leave UK??

2. US is a failing state in my opinion. Why? Firstly the business model of the world is changing. If it use to be service is to India and manufacturing is to China in the last decade, today the model is all so complex for US. Every body is buying into everyone else's business to spread their egg from being in a single basket. Part of globalization? If it is many like Saudis and China are holding plenty of American eggs. In the business world when you are a customer and also a supplier to the same company, you are automatically a Business Partner. Yesteryears we talk about allies among countries but today (akin to business partner) they are stakeholders and partners. Can US really afford for China or Saudi to fail? Can they afford for UK to exit EU and lose another stakeholder ?

If the above still does not convince you that more money will flow into Asia between now till June, the only other way is status quo which we know will not happen because if money does not move USD will weaken in the way US is not in control

2016-04-24 22:16

I actually made a lot money from your advice hahahahahaha. I follow TA FA sifu but I follow your timing!!!!! Hong Bao! Hong Bao lai liao.... Sold a few following Boss Simon rules....no regrets

2016-04-25 10:00

Some of the things i have shared prior

1. Phenom - Oil weakening (for 1 week) on to > 7% decline with MYR strengthening, and DJIA up trending which happen 2-3 weeks ago. BUY call

2. DJIA Correction - (1.5-2 weeks ago) - SELL

3. Anticipation of USD45/barrel crude oil and MYR3.70 (last week) - BUY

4. Sell following the rules of 3 days, 10-15% on leap, etc - WAIT for more sign

The above situation is why I am doing trading than investment. Moving forward is tricky now that oil is looking at half a leg already passing USD45/per barrel. In our market anticipation moves the transaction. The USD mark is a psychological barrier for MYR strengthening further as mention to 3.7. Because the oil movement will be followed by USD and as a defence to USD the MYR will weaken or strengthen. So in this case, the oil move must be convincing. In my opinion it looks convincing at least for the next 1 week.

Realistically once it passes USD 45 convincingly then all anticipation will move to MYR to strengthen to 3.70 as USD likely to weaken due to above plus the Feds deliberation in the coming days.

Rightfully, MYR should strengthen!

I would not make any move as yet with the reason of the current happenings in Malaysia. Wait for the 1Mdb debacle on default, wait for Sarawak situation to be clearer and wait for Bank Negara Governor to be announced.

WHY?

Because the 1Mdb may determine how the money flows again fr both Malaysia and foreign investor, while Sarawak situation will give indication of Najib's position and the Bank Negara Governor selection may determine the confidence in moving forward for our currency and bigger part whether the OPR rates will stay.

What to look out for?

Look out for news if the candidate is Bank Negara/Zeti's choice or outside her influence. If outside her influence expect reaction from market.

2016-04-27 09:01

Just named Muhammad Ibrahim as New Bank Negara Governor should be good news as he is the Deputy to Zeti and should be a good lineage and in keeping the on going endeavour. So one down and 2 to go.

2016-04-27 15:00

SimonShuet, Your articles and comments are very well written. Very detail analysis and useful info. Keep up the good work. Looking forward to seeing more articles from you.

2016-04-27 15:15

I guess with Muhammad Ibrahim continuing Zeti's legacy and rightfully succeeding her fr Deputy to Bank Governor will give ease as you mention to the concern of interest rate hike.

2016-04-27 15:25

Well written article with bundles of analytical facts and information. Thanks

2016-04-27 15:40

Market will not jump the gun as yet but I am sure the market is relieve that the New Governor provides a continuity and is not someone from MOF to ensure the check and balance is maintained

2016-04-27 15:52

Feds will keep rate unchanged. 2/3 already. Left 1Mdb. If oil continues it momentum pass USD 45 at this point on left 1Mdb to affect the forex. If 1Mdb pays off (i don't know it its that straight forward after defaulting since Dec 2015) the course towards anticipation of 3.70 will follow.

2016-04-27 15:59

Today 2 out of 3 of the questions I am looking for has been answered but left the most ruthless one - 1Mdb. On its own it doesn't create much problem but defaulting further without a solution will bring in the rating agencies because they don't want to be blame for giving a more positive outlook earlier.

2016-04-27 16:23

ACD888

sounds promising

2016-04-09 11:22