Fund Raising Activity, Is it Good, or Bad?

SilentCapital

Publish date: Wed, 16 Mar 2022, 07:00 PM

Fund Raising Activity, Is it Good, or Bad?

Since the infamous Serba Dinamik incident, investors are now shunning equity fund raising activities. Which, is quite ridiculous given how the stock market is all about equity funding.

But in contrast to the current raising interest rate environment, the zero-interest bearing equity funding is relatively cheaper now.

Let us take this company Fast Energy as example.

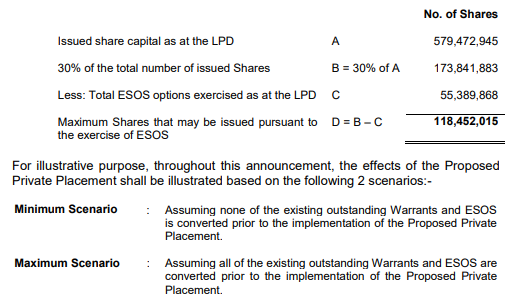

A few days back then, Fast Energy had announced to raise issue a maximum of 10% new shares in order to finance their existing booming oil bunkering business. While Fast Energy had a number of convertible derivatives, you may refer for the following chart for the tabulation of minimum and maximum scenario:

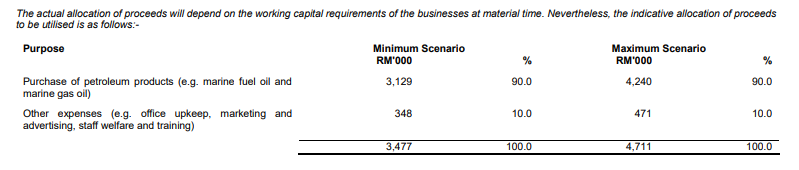

The purpose of the fund-raising activity is also really simple, which are mainly for working capital purposes which includes the purchase of petroleum products such as marine fuel oil and marine gas oil.

Due to the port congestion and busy offshore activities as the oil price increases, we can tell that Fast Energy is having more orders on hand, hence why they would need more capital to expand their business.

I would like to emphasis that there is always good capital raising and bad capital raising, just like we have good liabilities and bad liabilities. A bad liability example would be spurring cash to purchase luxury items with no ROI. A good liability example would be investment in property, which would appreciate in value over time.

In Fast Energy case, is this a good fund-raising activity or a bad one?

I believe it is leaning towards a good one. Buying more inventory simple means that business is too good that their existing capital is insufficient to cater for the additional demand. This is a strong sign of confidence to the investors.

Over the past 1-month period, it is obvious that the local energy sector and Fast Energy is having a discrepancy between them and the oil price. By all means I have no connection to help you to get to the private placement, but the current share price has sufficient discount to value.

Learn to differentiate between good fund raising and bad fund raising, and investment opportunities will emerge.

More articles on Trend 2022

Created by SilentCapital | Dec 21, 2022

Created by SilentCapital | Mar 25, 2022

Created by SilentCapital | Mar 15, 2022