Daily Futures Commentaries: [WTI Crude Oil] 11/6/2018 - Slowing China demand & JP Morgan bearish forecast weighed down oil price

InvestorsDoctor

Publish date: Mon, 11 Jun 2018, 12:02 PM

11/6/2018

WTI Crude Oil Jul 18

Previous Close: 65.74 -0.21

Crude oil erased its gains and ended slightly lower below 66 as JP Morgan cut oil price forecast and slowing demand from China.

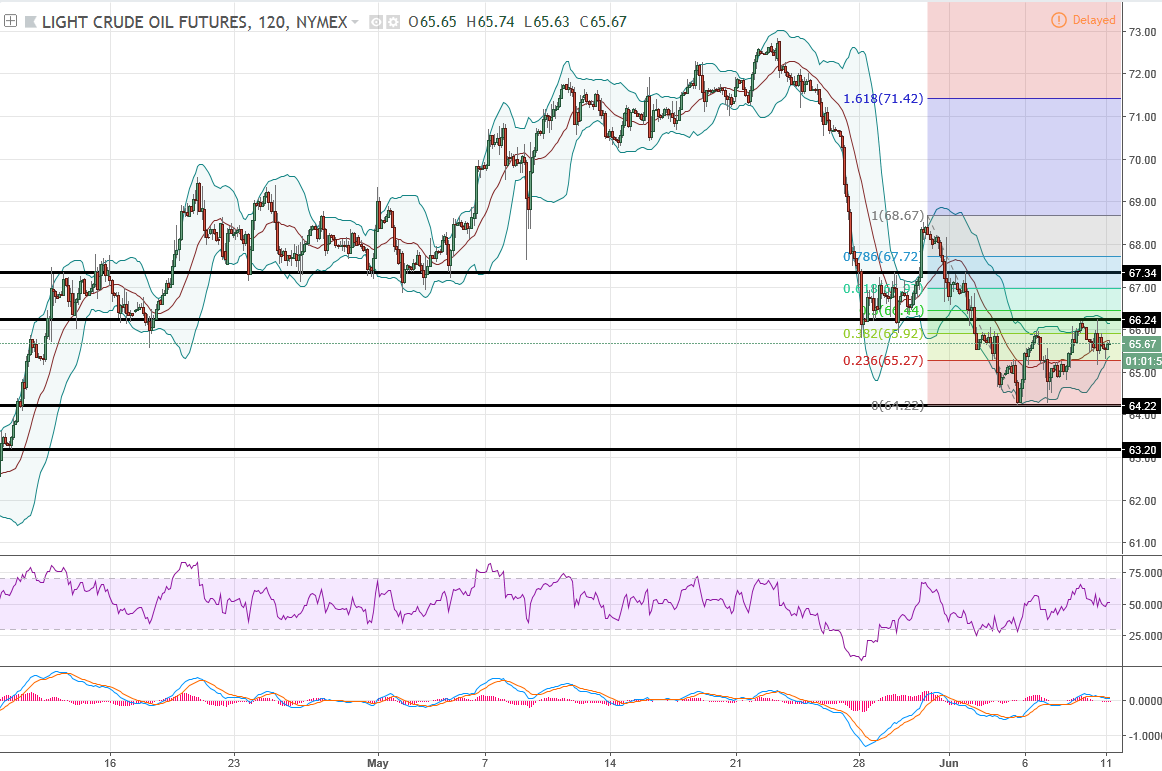

Daily chart show crude oil continue to hover around 50% retracement of previous swing, wait for breakout, but trend still in correction. Hourly chart show a technical rebound from RSI bullish divergence, required to close above 66.24 higher high to trigger further rebound signal.

Classic Support & Resistance

Resistance: 66.24 67.34

Support: 64.22 63.20

Recommend Trading Plan for the day:

1. Trade in 65-66, wait for breakout.

WTI Oil Margin Requirement (per lot)

WTI Crude : USD 2805

Mini Crude : USD 1402.5

Join our channels to find out more!

Telegram link:

https://t.me/investorsdoctoracademy

Facebook link: https://m.facebook.com/investorsdoctoracademy

More articles on WTI Crude Oil Updates

Created by InvestorsDoctor | Dec 31, 2019

Created by InvestorsDoctor | Dec 18, 2019

Created by InvestorsDoctor | Dec 17, 2019