Athena Advisors - Fed's Action and Market's Reaction

AthenaAdvisors

Publish date: Tue, 16 Jun 2020, 03:28 PM

Fed’s liquidity flows are quietly fading. From an initial US$75 billion injection per day when the Fed announced

the launch of Unlimited QE in mid-March, the US central bank has reduced its daily buying to US$60 billion

per day, then announced a series of consecutive ‘tapers.’ It also shrinking average daily POMO to US$5 billion

last week, in its latest just published schedule and would in the coming week, to purchase ‘only’ US$4.5 billion

per day. Such is the case as the market rally to date has been defined by the five largest stocks in the index.

Compounding to this concern, corporations are issuing debt at a record pace to supplant liquidity needs to

offset the economic crisis. Risk of a market failure has risen.

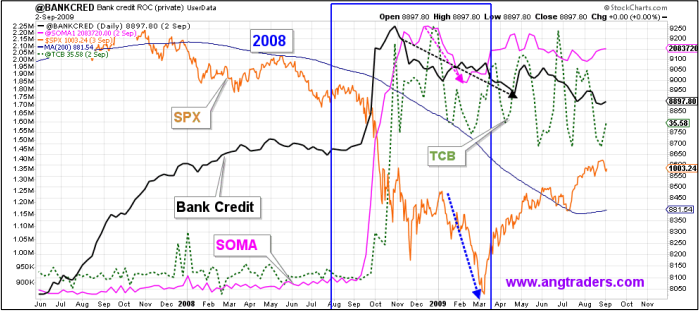

In a lay-man term, a total of US$5.2 trillion of new money has been created and injected by the Fed. In recent

weeks, I started to observe some "kinks" that have been developing in the US banking data which could have

medium-term implications for the stock market. I noted that a reduction in the rate of change of US’s system

open market account (SOMA) and in the aggregate banking statistics as operated by US Fed Reserve New

York. Much of the relief money flowing to both consumers and corporations is being cancelled by paying

down debt. It represents a destruction of money creation.

If history is a good guide, when a similar situation happened in 2008, the SPX suffered a serious pull back. The

fact that credit money is now being cancelled instead of being created, and Fed has drastically reduced its QE,

it means we are increasingly vulnerable to short-term weakness in the market.

The underlying fundamentals for market are unequivocally poor. This is where things get murky. It would be

worth noting if whether Fed will be successful or not in providing sufficient monetary support to keep the

artificially inflated on-going crisis stock market going for few more rounds into this new unknown in the

coming weeks and months. It is said that Fed is stopping at nothing to save the economy and financial markets

or Fed is divined to keep making things ultimately worse with each successive “rescue” efforts given extreme

valuations, unsustainably tight credit spreads, high leverage and excessive risk taking.

Chee Seng, Wong

CIO, Athena Advisors

wong-chee-seng@outlook.com

More articles on Athena Advisors

Created by AthenaAdvisors | Jun 30, 2020

.png)

.png)