Bullbearbursa.com

What’s next for Techbond (5289) after its listing debut year (TP: RM0.90)

Bullbearbursa

Publish date: Mon, 28 Oct 2019, 08:45 PM

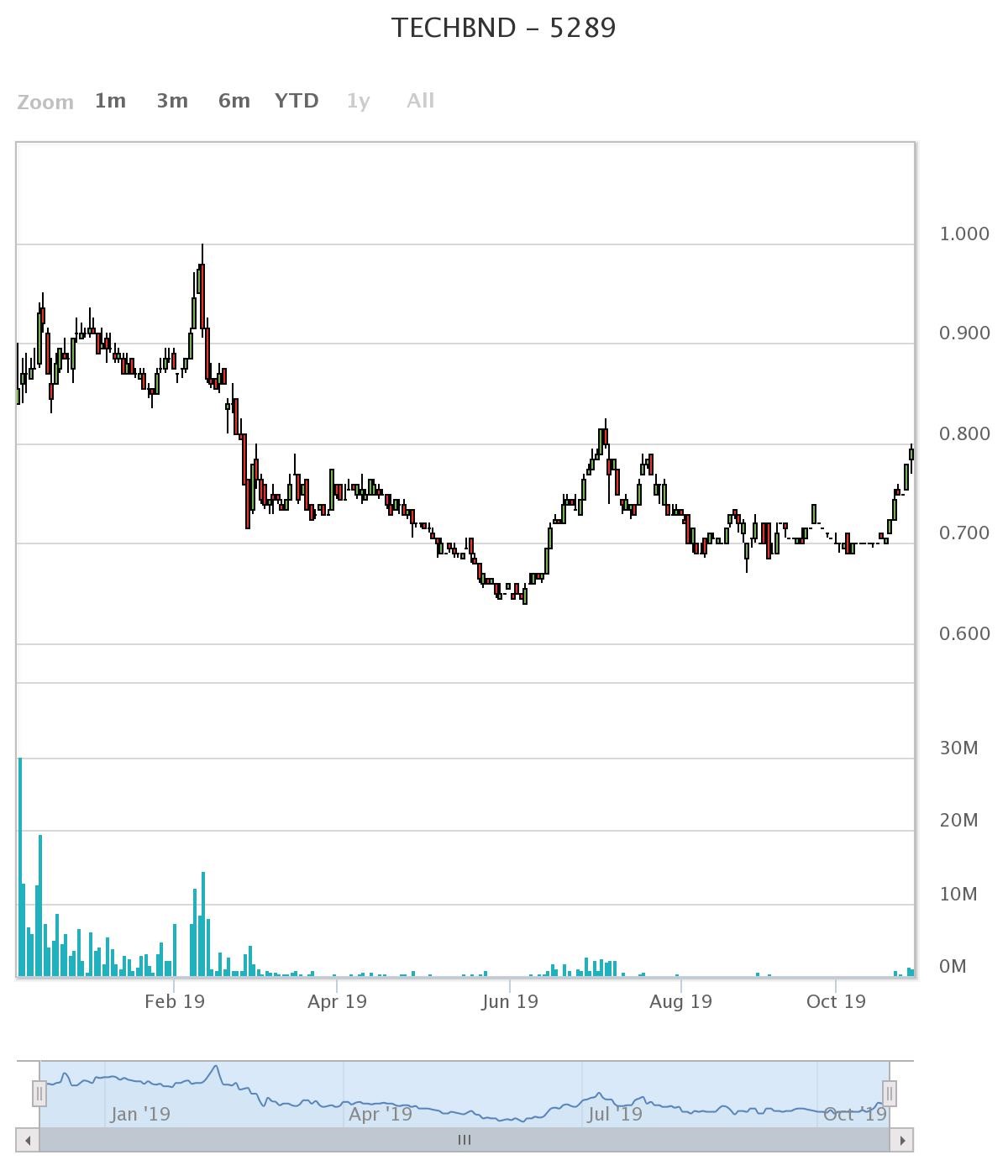

Techbond group berhad (TECHBND) raised RM 39.67 million following its listing on main market at the end of last year. Based on its initial offering price of RM0.66 per share, the share price of the company surged 20.45% to RM 0.795 as of 25 October 2019.

Comparing the performance of its stock price to KLSE index since its debut, the outstanding shares of the company outperformed the benchmark index (-7.1% YTD) amid global trade disputes.

Our next question, what’s next for TECHBND? In this article, we will share our views on the company’s financials.

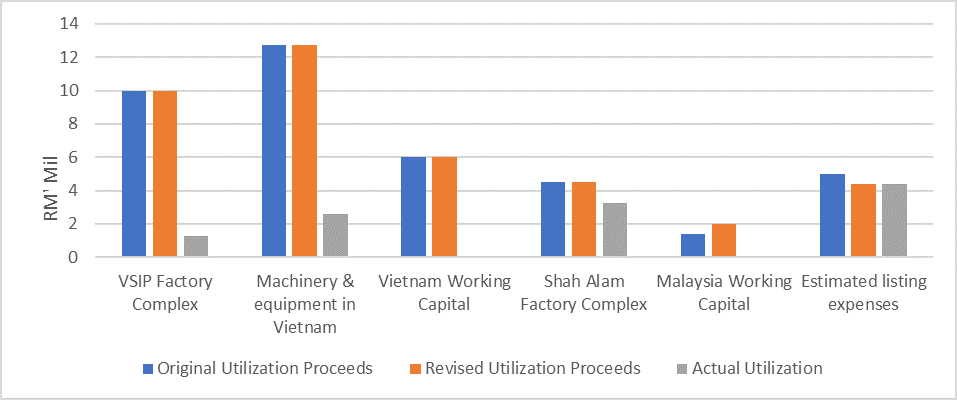

1) Utilisation of its IPO proceeds

Sources: Bloomberg, Company’s filings and Bullbearbursa compilation.

As stated in its prospectus, the company guided that they were planning to expand the company’s production line in Malaysia and Vietnam.

After compiling the information from various sources, we concluded that the company is expected to complete its expansion plans in the first half of 2020. We expect the soon-to-be enlarged production capacity is going to improve the company’s top-line growth.

Here are some updates to the progress:

I. Expansion of Vietnam operations

a) Construction of a factory complex in the Vietnam-Singapore Industrial Park (VSIP)

Construction commenced in May 2019. The management expects the completion by the first quarter of 2020.

b) Manufacturing of new products in Vietnam

TECHBND expects to commence production of PVAc polymer by the second quarter of 2020. The company also wants to start the manufacturing of the new types of water-based adhesives using its own manufactured PVAc polymer in the abovementioned quarter.

II. Malaysia operations

a) Expansion of production capacity in Malaysia.

According to the latest update from the management, Shah Alam Phase 1 Expansion was completed in December 2018 and commenced manufacturing operations in March 2019. Meanwhile, Shah Alam Phase 2 Expansion commenced installation in March 2019 and expect to commence manufacturing operations by September 2019.

b) Develop and manufacture new types of adhesives

With the completion of Shah Alam Phase 1 Expansion, group have commenced the manufacturing of high viscosity hot melt adhesives for a commercial trial run.

The company is expected to commence manufacturing the new range of low viscosity hot melt adhesives by September 2019 upon completion of the Shah Alam Phase 2 Expansion.

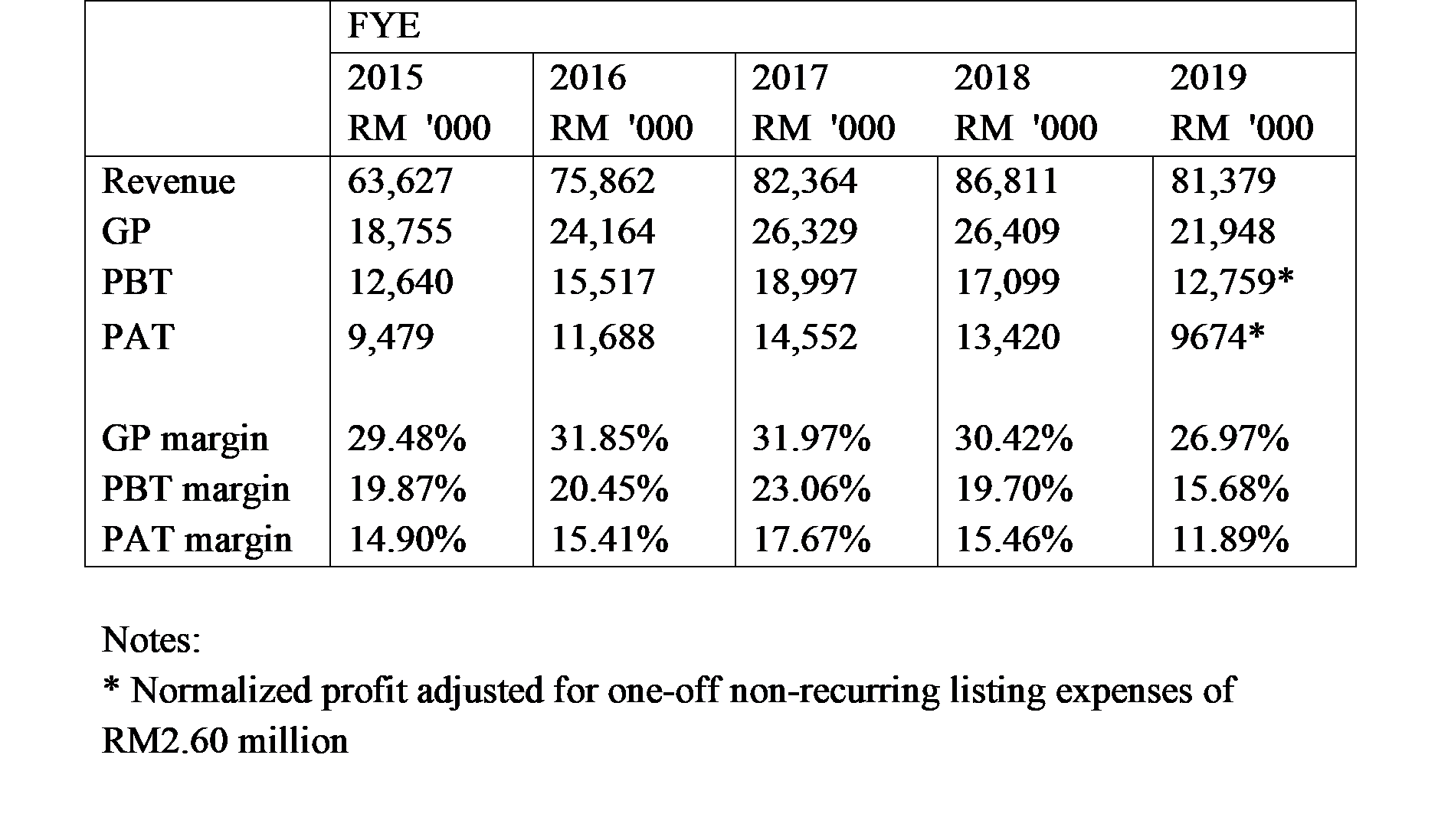

2) How Does Its Financials Look Like?

Financial Statement FY15-19

For the FY 2019, TECHBND recorded RM 81.37 mil of revenue and RM9.67 mil of normalized profit after tax with a profit margin of 11.89%. The manufacturing of water-based adhesives and hot melt adhesives contributed to the top-line sales 67.42% and 26.14% respectively.

On the other hand, effective tax rate for the FY 2019 was 30.37%. It was higher than statutory tax rate of 24% because of the one-off charge of the listing expenses amounting RM2.6m which was non-tax deductible.

TECHBOND maintains a strong balance sheet as it is a net cash company with no debt. As of 30 June 2019, the company reported a sizeable cash pile of RM 66.14 mil , enabling it to be on the lookout for M&A opportunities. This could offer another leg of growth on top of aggressive capacity expansion that it is currently embarking on.

The company’s operation is cash generative, which accounted for RM 6.4m of positive operating cash inflow for FYE 2019 and which its net profit 9.6m was backed by cash as its net operating cash flows made up 67% of its net profit.

3) Valuation

Looking at the compiled data from the table above, we saw the company’s operating performance deteriorated slightly from its pre-ipo performance. However, the strong balance sheet remains the key cushion for investors and most of its net profit was backed by its net operating cash flow.

Assuming a CAGR of 6.78% for its net profit in FY 2021 when the expansion plans are completed, we would derive a target price of RM0.90 with a conservative P/E ratio of 12x.

Techbond’s valuations look very compelling against its international peers, as its PER and P/B are well below its international peers. Therefore, we see decent upside for Techbond, given its strong track records, positive growth prospects and strong balance sheet.

More articles on Bullbearbursa.com

6 things you should know about MTAG – Potential 45% upside you wouldn’t want to miss!

Created by Bullbearbursa | Sep 23, 2019

Techbond TP RM 1.28 - 33% Upside You Never Want to Miss [RHB Research]

Created by Bullbearbursa | Feb 13, 2019

Bina Puri Holdings Berhad (BPURI) – Optimism in stance amidst challenging times

Created by Bullbearbursa | Dec 31, 2018

5 Things You Need To Know About TechBond IPO – 43.18% Upside You Never Want to Miss

Created by Bullbearbursa | Dec 03, 2018

Discussions

Be the first to like this. Showing 0 of 0 comments