PPHB (8273) - Latest Quarter Result [4QFY20] - Key Takeaways

BuyCall

Publish date: Wed, 24 Feb 2021, 10:16 AM

For better reading experience, please visit the original article at the following link:

PPHB (8273) – Latest Quarter Result [4QFY20] – Key Takeaways

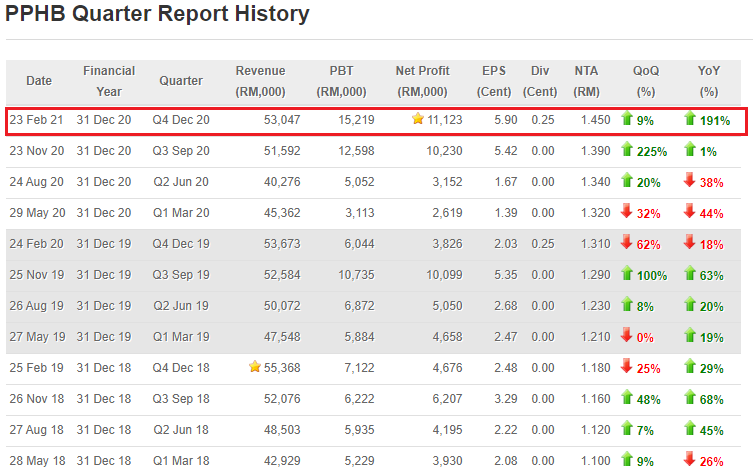

Public Packages Holdings Bhd (PPHB) latest quarterly result – 4th quarter ended 31/12/2020 Financial Year 2020

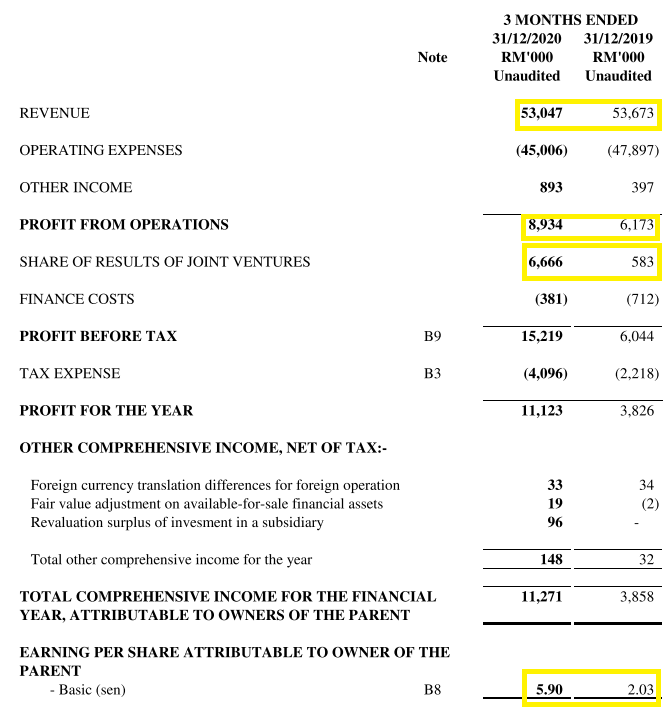

PPHB has just released one of its greatest quarterly result yet again. The company managed to achieved a total revenue of RM53 million with a record high net profit after tax of RM11.1 million that has soared 191% from the same quarter last year.

Revenue

Comparing the latest quarter with the same quarter last year, we could see that the revenue amount is almost the same. The revenue in this quarter is actually RM626,000 less than the same quarter last year. There are a couple of reasons why the revenue did not increase in this quarter:

- Corrugated paper material price has dropped significantly last year partly due to the covid-19 pandemic, therefore the selling price of PPHB’s product could be reduced in tandem with the decrease in its raw material price.

- The paper packaging industry is saturated and competitive. Players are keeping their paper products prices low and competitive to gain market share.

- PPHB’s hotel business segment is not doing as well as before due to the pandemic, therefore the amount of revenue contributed by its hotel segment is much lesser than a year ago

Profit from operations

Although the revenue did not increase this quarter, its profit from operations has managed to soared by 44.7% to RM8.93 million. This means that their profit margin has greatly improved from a year ago and this could be due to the following reasons:

- Low cost of material

- cost efficiency measure implemented by the company due to the pandemic

Share of results of joint venture

There is a sudden jump in the share of profit from its joint venture to RM6.66 million this quarter. The share of result of joint venture has always been below RM1 million every quarter in the past. Little explanation was given in regards to its share of profit from its joint venture but we do know that its joint venture company New Merits is doing developments and property management. A sudden one-time gain in profit like this could be due to the sale of assets during the pandemic.

Earning Per Share (EPS)

In tandem with the increase in profit from operations, PPHB managed to improve its EPS to 5.90 sen from 2.03 sen a year ago.

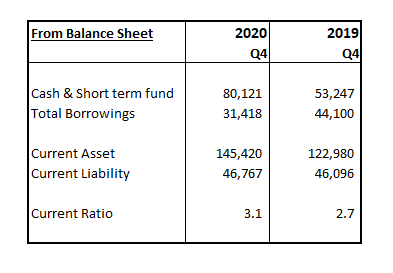

Cash Status

Part of the reasons of doing business is to have more money aka cash in our bank account. As we can see from the table above, PPHB’s cash and short term fund have increased quite a bit from RM53.2 million a year ago to RM80.1 million as at the end of this quarter.

Borrowing

We know that the increase in its cash and fund was not done through the application of more debts by the company. On the other hand, the company actually managed to decrease their total borrowings to RM31.4 million from RM44.1 million a year ago.

Current Ratio

The bottom line for current ratio should be 1.5, and anything above 2 is great. PPHB’s latest current ratio is 3.1, which is fantastic. Due to its increase in asset and decrease in liability over time, its current ratio has improved from 2.7 to 3.1.

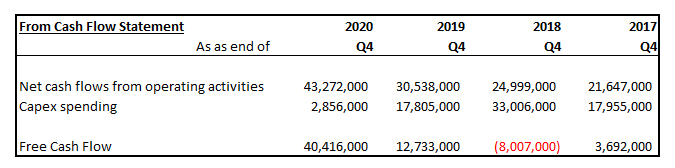

Cash Flow

Over the years PPHB has become more efficient in collecting money and handling cash flow. This is witnessed through the improvement in their net cash flows from operating activities over the years as seen in table above.

We can see an obvious reduction in their spending on capex in 2020 as compared to previous years. The management could be cautious on their spending due to the cost measure and the pandemic, hence, chose to save on spending on capex in 2020.

As a result, their free cash flow level has improved a lot. With such amount of free cash flow, the company will then have many options to utilize the available free cash flow for the advantage of the company in future, or to rewards their shareholders through dividend payment.

Quarter on Quarter

Comparing quarter on quarter, although its revenue has slightly improved, its profit from operations has actually dropped from RM12.3 million to RM8.9 million. The management did not explain why the profit from operations has dropped, but I assume that the decrease in profit from operations could be by the following reasons:

- Increase in cost of raw material as compared to last immediate preceding quarter

- Lower selling price of paper products due to market competition

Although their profit from operations has dropped, but the company managed to register a higher net profit after tax of RM11.1 million, a 8.7% improvement from last immediate preceding quarter. This is due to the gain in share of result of joint venture amounting to RM6.66 million.

Conclusion

Even before the pandemic happens, PPHB’s business has been gradually improving. This is due to the increase in popularity of paper packaging in recent years as more people favor paper packaging now than before partly because of safety environmental reasons.

Due to the low cost of raw material, the paper packaging players are enjoying higher profit margins than before. Is this phenomenon going to last? I believe not.

But fundamentally, PPHB is an amazing company that is still growing. The company is growing sales and more cash without the expense of incurring more borrowings, which shows the excellence of the management of the company. Its cash flow management is amazing, the company has been generating healthy operating cash flow for more than 10 years.

A year ago, PPHB was trading at the share price of around RM1.28 when its annualized EPS was 12.5 sen. Today, its latest annualized EPS is 14.38 sen and yet it is still trading around RM1.05. Do you think PPHB’s share price should be trading above RM1.28 since its EPS is higher now and the company is performing much better than before? I will leave it to you to answer.

Invest at your own risk.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

DISCLAIMER

This post is completely for education and discussion purpose only. The author of this post does not have the required licenses to provide any investment advice or induce any trade for the readers here. Therefore, it should not to be taken as investment advice or inducement to trade and the Author take no responsibility for any gains or losses as a result of reading the contents herein. Please invest at your own risk.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Buy Call - Stock Analysis & Insight

Created by BuyCall | Feb 01, 2021

Created by BuyCall | Jan 26, 2021