HEXTAR (5151) – New Acquisition To Expand Its Chemical Arm

BuyCall

Publish date: Mon, 08 Mar 2021, 06:33 PM

For better reading experience, please visit the original article through the following link

HEXTAR (5151) – New Acquisition To Expand Its Chemical Arm

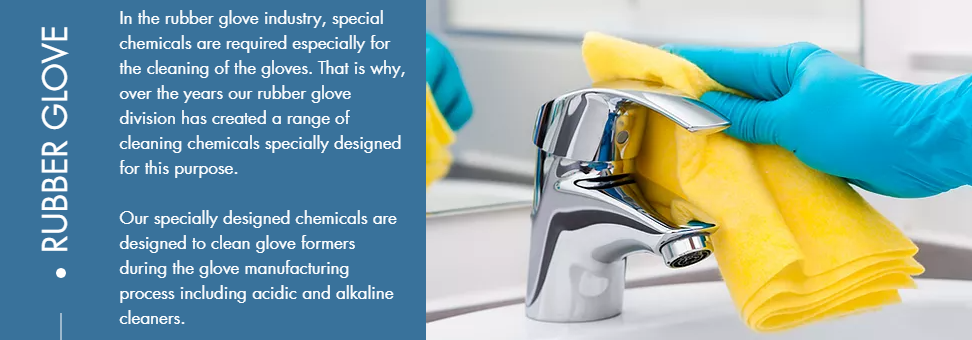

Hextar Global Berhad (Hextar) has just announced their latest 100% acquisition in Chempro Group of Companies (Chempro), a multinational hygiene specialty cleaning chemicals expert with the track record of ooperating in various locations around Asia. Full details of the acquisition can be referred through here.

Chempro

A multinational hygiene specialty cleaning chemicals expert providing niche specialty chemicals products for cleaning, hygiene and food industry as well as rubber glove industry in Southeast Asia.

Details of acquisition

The 100% acquisition of Chempro will be for a purchase consideration amount of RM138 million, coupled with a profit guarantee of RM39 million over three years which translates to a profit after tax of RM13 million a year until the end of 2023.

The purchase consideration will be funded via internally generated funds and/or bank borrowings, the proportions will be determined later.

Rationale – by Management

Opinion

A diversification by Hextar, which is also a chemical business but for different industry and applications.

Chempro products are mainly cater to these four industries:

Although Alpha Aim (M) Sdn Bhd is not under Chempro Technology (M) Sdn Bhd, but the company is also included in the Chempro’s acquisition deal.

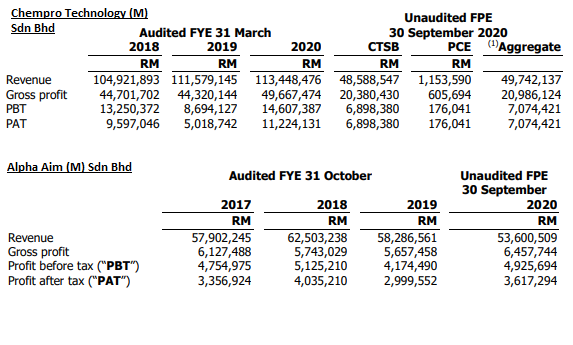

As we can see from the table below, Chempro are actually a profit making companies which have acceptable profit margins. The companies have been profitable for the past few years.

So how well will Chempro be doing pursuant to the acquisition?

As we know the current owner of Hextar – Dato Eddie Ong Choo Meng is also the largest shareholder of Ruberrex Corp (M) Berhad.

This could be one of the reasons behind the acquisition of Chempro, whereby Chempro can provide the specialty chemicals used during the rubber glove production to rubber gloves companies in Malaysia like Rubberex and those in Southeast Asia. Rubber gloves will continue to be in demand due to the on-going pandemic and global Covid19 immunisation efforts, this bodes welll for companies like Chempro.

Additionally, due to the Covid19 pandemic, the increased awareness and needs for hygienic living environment will also boost the demand for Chempro specialty products moving forward. Service sectors such as F&B and accommodation are expected to use a larger amount of specialty chemicals for cleaning and disinfecting purposes as required by stringent government SOPs even after vaccination takes place nationwide.

Therefore, market experts expect the outlook for the specialty chemicals industry Chempro is in to be positive and favorable moving forward.

Profit Guarantee

A profit guarantee of RM39 million (RM13 million a year) included in the deal shows the confidence in the business potrayed by Chempro owners. Based on the profit & loss table above and also the future prospect of this particular specialty chemicals industry, I believe the profit guarantee of RM13 million a year for 3 years is easily achievable.

Source of Funding

As mentioned, the deal will be funded via internally generated funds and/or bank borrowings. The borrowing level of Hextar has been coming down in recent year to a healthy gearing level. On top of that, its cash flow management has been improving healthily. Therefore, I believe the company will not be financially pressured by any internally generated fund or bank borrowing for the consideration of RM138 million.

Valuation

The latest annualized EPS of Hextar is 5.43 sen. Assuming the company will be earning additional of RM13 million per year pursuant to the acquisition of Chempro, which gives an additional EPS of 1.58 sen. The total annualized EPS value will then be 7.01 sen (5.43 + 1.58). At the last trading price of RM1.23, the company will then be trading at the forward PE multiple of 17.6 times, which is slightly on the high side. But given the potential future earning growth of the enlarged company, the high PE multiples will then be justified.

Conclusion

The share price of Hextar took a hit right after the company released the acquisition news today. This shows that some people are not happy with the acquisition deal. Personally, I think the acquisition of Chempro will be beneficial to the company going forward due to the reasons mentioned above.

With the solid financial position of Hextar, the company is able to fund the deal without having to raise fund through the assistance of their beloved shareholders. As such, we will not seeing any dilution going on for this deal.

I am excited to see how much Hextar will grow in the near future with all the expansion plans in place. To understand more about Hextar, please visit my complete analysis on Hextar.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

DISCLAIMER

This post is completely for education and discussion purpose only. The author of this post does not have the required licenses to provide any investment advice or induce any trade for the readers here. Therefore, it should not to be taken as investment advice or inducement to trade and the Author take no responsibility for any gains or losses as a result of reading the contents herein. Please invest at your own risk.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Buy Call - Stock Analysis & Insight

Created by BuyCall | Feb 01, 2021

Created by BuyCall | Jan 26, 2021