SUPERMAX (7106) – Latest Quarter Result [2QFY21] – Do you still care about result?

BuyCall

Publish date: Mon, 01 Feb 2021, 06:52 PM

For better reading experience, please visit the original article by clicking the title below:

SUPERMAX (7106) – Latest Quarter Result [2QFY21] – Do you still care?

Do anyone still bother looking at the quarterly results of glove companies? I certainly do, but it seems to me that majority of investors just do not care about quarterly results anymore, this is well witnessed through the recent share performance of all glove companies and also the discussion going on between investors in the usual forums.

Supermax Corporation Berhad (Supermax) has just released their latest 2nd quarter financial year 2021 result (2QFY21), few days after Hartalega has released theirs. Both companies have posted superb quarterly earnings which are on record high and yet their share price performance have been frustrating. Before I go further into this issue, let’s just go through Supermax’s latest quarterly results to have a clearer picture of how overall glove industry is doing.

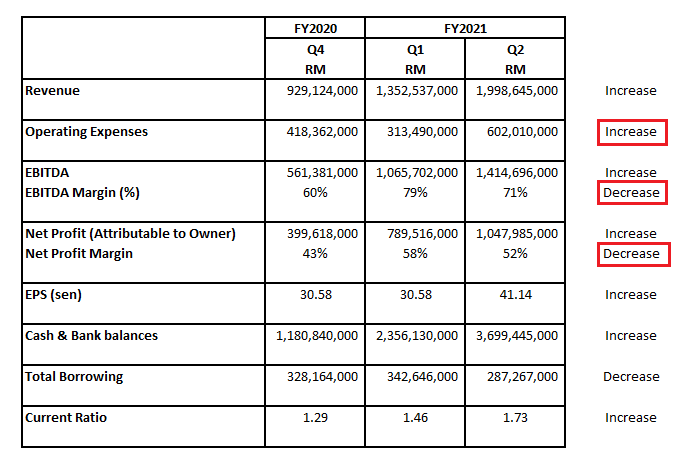

As I have mentioned before in Hartalega’s latest quarterly result analysis, we do not need to compare its result year-on-year because all glove companies are performing at a whole new level as compared to a year ago. In order to monitor and follow the progress of the glove industry, it will be wiser to compare their results on quarter-on-quarter basis.

It is within most people’s expectation that the Supermax’s latest quarterly results will no doubt will performing really well, which is why I will not touch on too much but only a few aspects that are a bit of a surprise to most:

In this quarter, Supermax has managed to achieve another record breaking Revenue and Net Profit again which are within everybody’s expectation. As explained by the Group, this is mainly due to:

- On going Exponential increase in demand GLOBALLY for gloves

- Increase in sales from additional production capacity due to completion of new lines at its Plant 12

- Consistent increase in average selling price (ASP) for its gloves each month

- Proven business model through Own Brand Manufacturing (OBM) – which means they do not have to go through any middle men to sell their gloves which gives them a better profit margins

From the table above, despite the increase in its profitability, we could see its Profitability margins such as EBITDA and Net Profit have dropped from 79% to 71% and 58% to 52% respectively. From the report, it is mentioned that Natural rubber glove prices are beginning to gap up in tandem with rising demand as nitrile glove supply becomes more constricted by raw material supply constraints. I guess due to the raw material supply constraint, raw material cost have been increased which affected its profitability margins.

Its operating expenses have increased by nearly 100% this quarter as compared to last quarter. No explanation was given in regard to this but I believe the reasons behind the increase are as follows:

- The donation of RM75 million (fall under other expense) made by Supermax to our Government during November 2020 as part of their effort in assisting the country to curb the Covid-19 pandemic

- Could be due to the nitrile raw material supply constraint, Supermax could not deliver part of its orders in time during last quarter (Q1FY21). This will then transfer the orders to this quarter (2QFY21) which resulted in increase in Revenue and expenses.

Supermax’s cash & bank balance has been further improved to RM3.7 billion, which is an excellent amount of cash. Currently a net cash company, the Group could easily settle all its borrowing.

Valuation

At the last closing price of RM6.80, Supermax is trading at a PE of only 8 times. This is insanely low for a company of such caliber (same goes to other glove leaders). If the next quarter EPS remains as 41.14 sen (assuming no improvement in its results – which is highly unlikely), at the current price of RM6.80, Supermax will be trading at a PE multiple of only 4.7 times.

Last Friday was a historical day for Malaysia stock market investors as we witnessed a group of retail investors gathered via Telegram to start a movement against the short sellers (Institutional Fund House) of glove companies, specifically Top Glove. At the time of writing this article, the Telegram group has successfully gathered 45,000 members in just few days.

Well, these bunch of people are obviously very frustrated because the Fundamental, Prospect, Business, of glove businesses are obviously improving tremendously every quarter, yet the share price was pressed down and heavily shorted by institutional funds for their very own unfair benefits.

Opinion

Given the current share price of Supermax, I personally find the stock to be really undervalue. I have not seen the PE multiple of these glove leaders to be less than 10 times in the past 10 years. Well, I believe the main reasons the share price is not moving up north for the time being is because majority investors are uncertain of how the glove companies will do when vaccination is completely rolled out around the globe. Once the picture is clearer through the painting of another release of next two quarterly results, I believe investors will gain confidence and run back in these glove stocks.

At the current price level, the dividend yield is pretty attractive as well. So regardless of capital gain or dividend yield, the current price level is just nice and safe. At this point of time, there is really nothing much to discuss about glove stocks anymore, I believe most investors are well equipped with the knowledge and information of glove stocks these days.

I strongly believe all glove companies will continue to do well until 2022, as many of the glove companies have continuously letting us know that the ASP for their gloves are still increasing (which is the main reasons behind their amazing profitability) and the highest ASP are yet to be reflected in their latest quarter.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

DISCLAIMER

This post is completely for education and discussion purpose only. The author of this post does not have the required licenses to provide any investment advice or induce any trade for the readers here. Therefore, it should not to be taken as investment advice or inducement to trade and the Author take no responsibility for any gains or losses as a result of reading the contents herein. Please invest at your own risk.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Buy Call - Stock Analysis & Insight

Created by BuyCall | Jan 26, 2021

Discussions

Supermax has a dividend payout policy of 30% in a financial year, so far they have paid a total of 5.3sen in current financial year which translates to 7.4% payout ratio. So it is safe to assume and expect the next dividend to be higher to achieve a dividend payout ratio of 30% in this financial year.

2021-02-02 08:45

Miserable dividends that put Supermax the same standard as Hiap Tek's recent dividends????!!!

2021-02-02 08:47

The profit margin will sure eventually drop back to a reasonable level.

Therefore,

We should not use the current EPS and say the PE ratio is cheap,

we should not also use the future EPS and say the PE ratio is too high because we should consider the extra profit earned during the very good timenow.

So in my opinion, we should use discounted model which capture both.

2021-02-02 16:41

Why so many are hard up for dividends when growth of the company's share or capital gain is more crucial for investors.

2021-02-02 22:56

My comment apart of the two points you mentioned in the increased of operating expenses are:-

1)Sharp increase in raw material costs

2)Higher staff costs such as Covid-19 related expenses, OT and year end bonuses

3)Increasing in exporting cost mainly due to 3-5 fold of freight charges particular for owned oversea distribution centers.

2021-02-02 23:11

gemfinder

Y all use donations as an excuse? Is it a new norm in malaysia?

2021-02-01 19:01