VSTECS (5162) – Latest Quarter Results [4QFY20] – Key Takeaways

BuyCall

Publish date: Thu, 25 Feb 2021, 10:51 AM

For better reading experience, please visit the original article at the following link:

VSTECS (5162) – Latest Quarter Results [4QFY20] – Key Takeaways

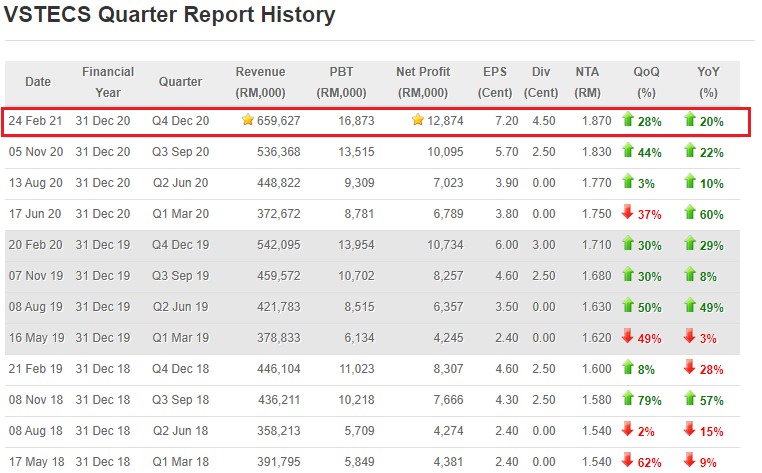

Vstecs Berhad (Vstecs) has just released their latest 4th quarter financial year 2020 result. Before we get into its latest quarter result, you probably want to understand the company better first through my complete analysis on Vstecs.

During this quarter Vstecs has managed to achieved an all-time-high record of revenue and net profit amounting to RM659.6 million and RM12.8 million respectively. Although during its financial year 2020 the whole world was faced with the pandemic issue, the company still able to break its own record by reaching a 12-months record high revenue and net profit after tax of RM2.02 billion and RM36.8 million respectively.

Below are the key takeaways from the latest quarter report:

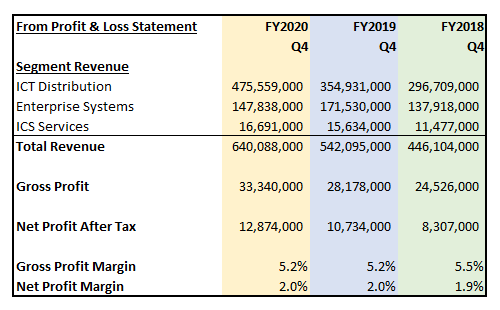

ICT Distribution Segment

Vstecs has increased its revenue by 21.7% this quarter to RM659.6 million from RM542.1 million a year ago. As we know since March 2020 our country had went into several lock downs and movement control orders that have restricted many from having their normal daily life. As such, many are forced to work and learn from which explains why Vstecs’s ICD distribution segment has done so well last year, which we can see its ICT Distribution segment to have increased from RM354.9 million in Q4 2019 to RM475.6 million in this quarter, which represents a percentile increase of 34%.

ICT items like notebook, tablet, smartphone and printers are the ones that are selling well as they are products required by many to work from home.

Enterprise Systems

Despite the increase needs for better ICT and IT structure, Vstecs’s Enterprise Systems segment has fell short as compared to the same quarter last year. Enterprise Systems’ revenue has decreased by 13.8% from RM171.5 million to RM147.8 million. The management explained that due to the movement control orders, many projects and deployments are delayed as corporate decisions were postponed. Vstecs also faced challenges in crossing state borders to deliver the technical implementation services.

A slow down in the SME market is expected as many smaller organizations are facing difficulties durin the pandemic, thus ICT Projects contract and award will be given at a slower pace.

ICT Services

The revenue from this segment has increased by 6.8% from RM15.6 million to RM16.7 million mainly due to maintenance services. No explanation was given by the management but I suppose more people are fixing their old ICT items during the pandemic as ICT items have become important in many’s life during the pandemic. Those who could not afford to purchase new ICT products will then have to fix their old ICT productss.

Profitability

In Tandem with the increase in revenue, both gross profit and net profit after tax also increase as well. Vstec’s gross profit margin and net profit after margin have been fairly consistent at around 5% and 2% respectively. As we know the ICT business is competitive as ICT products are getting cheaper day by day due to the constant introduction of new products to the market. Due to its status as one of the market leader in the market, Vstecs is still having a slightly better profit margins than its peers.

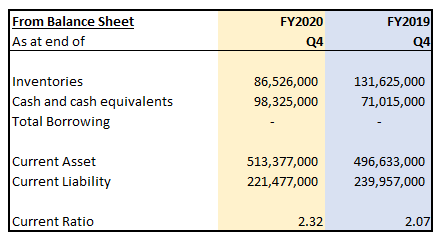

Balance Sheet

In case you did not know, Vstecs has been zero borrowing company for many years. A company with no debts will have massive advantages during economy downturn as they can utilize their cash reserve for many purposes to expand and improve the company.

As seen from the table above, Vstecs has managed to increase their cash and cash equivalents level to RM98.3 million from RM71 million a year ago. With such large amount of cash in hand, Vstecs can then consider acquisitions, expansion or even better, higher dividend payment to reward its shareholders. Due to its strong and healthy balance sheet, the company further improved its current ratio to 2.32 from 2.07 a year ago.

You must be wondering why inventories has dropped from a year ago, and also from last quarter since its business is doing well and products are selling well at this point of time. This is due to the vast increase in global demand for ICT products that has resulted in many vendors having challenges in delivering their orders on schedule as explained by the management.

Cash Flow

VStecs’s cashflow has been stable with nothing much to comment on. The company managed to generate a total of RM37.8 million from its operating activities, which is RM9.6 million less than a year ago. Despite the decrease, it is considered acceptable still. Since 2019, Vstecs has been obviously spending less on capital expenditure. Looking forward to see what the company is planning to do with its massive cash in bank, it will be disappointing if those cash are not utilized in a useful way.

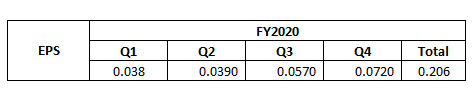

Earning Per Share

Due to the Covid-19 outbreak which happened swiftly in early 2020 which got our country to enter into lock down mode, the first two quarters of Vstecs were affected as the company at that point of time was not adapted to the pandemic situation yet.

In the latest quarter, Vstecs has achieved an EPS of 7.2 sen, which is a record high value, which gives us an annualized EPS of 20.6 sen. Using the last trading share price of RM2.80, we will then get an PE multiples of 13.6 times.

Lets assume for the next two quarters, Vstecs’s EPS remain the same as its latest EPS which is 7.2 sen for the next two quarters. We will then get the annualized EPS of 27.3 sen (5.7 +7.2 + 7.2 +7.2). Based on the last trading share price of RM2.80, its forward PE multiple will then be merely 10 times only. Remember, my assumptions are based on the fact that Vstecs’s peformance is to be remained the same as this quarter with no improvement. Its forward PE multiple will be even lower if its performance were to be improved in the coming quarters!

Conclusion

Vstecs’s latest quarter result has been satisfactorily except for its Enterprise Systems segment. Due to the new norm caused by the Covid19 pandemic, there will be more and more companies and people to adopt the working and learning from home systems. I believe even with the complete rolled out of vaccination happening world wide, this new norm is there to stay with us as least for another couple of years. As such, ICT products will be selling like hot cakes, since the new norm has developed everyone to be more accustomed to the usage of ICT products.

I was actually looking forward to its Enterprise Systems to grow at this stage due to its better profit margins than its ICT distribution segments. But due to the reasons explained above, the Enterprise Systems segment is facing some delays. But I believe eventually this segment will do well, and probably will do better than its ICT distribution segment moving forward. This is because be it organizations or people like us, we have all adapted to the new norm quick enough which caused worldwide digital transformation to happen sooner than it should be.

Valuation wise, Vstecs is currently trading at the PE multiple of between 12-15 times. Since Vstecs is not entirely a IT company, it does not enjoy the same high PE multiple as the other pure IT companies. But given its rapid growth in its business, I foresee the company’s share price to be trading at a higher PE multiple going forward. Therefore, at the current trading share price of RM2.80, I deem the share price is still attractive. Every correction is a buying opportunity.

To understand better, please visit my complete analysis on Vstecs.

Invest at your own risk.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

DISCLAIMER

This post is completely for education and discussion purpose only. The author of this post does not have the required licenses to provide any investment advice or induce any trade for the readers here. Therefore, it should not to be taken as investment advice or inducement to trade and the Author take no responsibility for any gains or losses as a result of reading the contents herein. Please invest at your own risk.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Buy Call - Stock Analysis & Insight

Created by BuyCall | Feb 01, 2021

Created by BuyCall | Jan 26, 2021