HARTA (5168) – Latest Quarter Result [3QFY21] – Another Record Earnings

BuyCall

Publish date: Tue, 26 Jan 2021, 12:31 AM

For better reading experience, please visit the original article at:

HARTA (5168) – Latest Quarter Result [3QFY21] – Another Record Earnings

Hartalega Holdings Berhad (Harta) has just released their 3rd quarter ended financial year 2021 result today, which is another quarter of amazing result.

In this article I will be comparing Harta’s latest quarter (3rd quarter ended financial year 2021) with its immediate preceding quarter, which is the last quarter result (2nd quarter ended financial year 2021). This is because there is no point comparing with the same quarter preceding year, as we know its current business is enjoying huge profitability due to the pandemic as compared to a year ago.

Income Statement

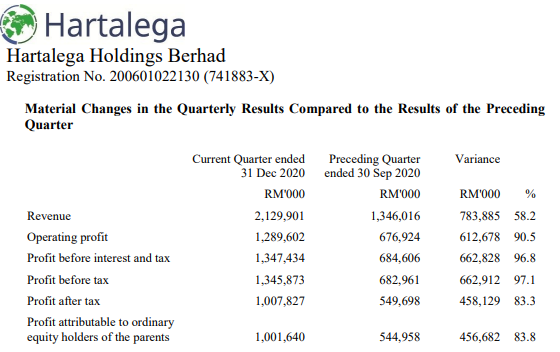

Revenue

From the Income Statement, Harta’s revenue has increased by 58% from RM1.346 bil last quarter to RM2.130 bil this quarter. We know that Harta’s production capacity utilization rate is near maximum since last quarter, this means that the total number of glove sold last quarter will not differ much as compared to this quarter. Hence, the increase in its Revenue is attributable to the increase of Average Selling Price (ASP) of its gloves.

Operating Profit

Harta’s Operating Profit has increased by 90.5% from RM676 mil last quarter to RM1.289 bil this quarter. The magnitude of increase in Operating Profit is far greater than its Revenue. From this we can deduce that the main reason for its operating profit margin to improve by this much is because the ASP in this quarter is higher than last quarter. If this keeps up every quarter, we can expect the upcoming quarters results to be sensational.

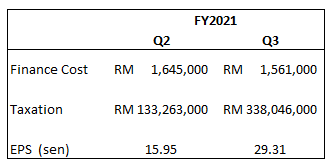

Finance Cost

Harta’s Finance Cost for this quarter has decreased slightly to RM1.56 mil from RM1.64 mil last quarter. Well, due to the healthy cash flow that the business is enjoying now, Harta managed to pay off part of its loan & borrowing which resulted in less Finance Cost.

Taxation

Taxation expense has increased by a great amount. It only makes sense to pay more tax when the business is making more profit. In this case, we can clearly see that Harta is profiting way more than last quarter. Therefore, we do not have to worry about the increased amount in Taxation expense.

Earning Per Share (EPS)

Harta’s EPS has increased from 15.95 sen last quarter to 29.31 sen this quarter, which represents an increase of 84% ! Please keep in mind that the increase in EPS has always been the greatest catalyst to move up the share price. But we are witnessing a different phenomenon here with the glove companies. The business is clearly getting better and better, whereas the share price has been miserable for the past few months. Many people are saying that the glove sector has turned bearish and downtrend, personally I think the current price level poses a great opportunity to collect the shares while they are undervalue!

Balance Sheet

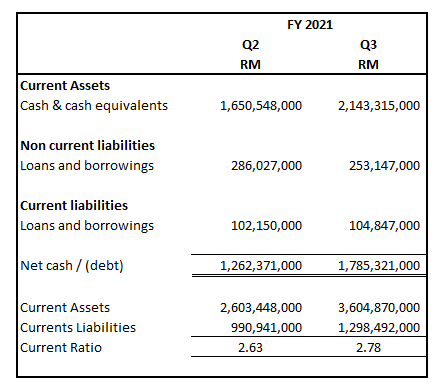

Cash & cash equivalent

Harta’s cash balance has been really healthy. As we can see, its cash & cash equivalent has increased to RM2.143 bil. There are so many expansion plans and investment opportunities that Harta can consider with such huge amount of cash in its bank.

Loans and borrowings

We can see that Harta’s total loans and borrowings has slightly dropped. The company has settled part of its loans and borrowings. I guess the company is not in a hurry to clear its loans and borrowings in order to preserve its cash for better purposes.

Net Cash Status

Harta has been in net cash status since last quarter. This means that with the amount of cash they have, they could easily settle all their loans and borrowings. Hence, we do not need to worry about its debt level.

Current Ratio

The commonly acceptable current ratio is ranged between 1.5 to 3, depending on the type of business the company is in. As we can see from the table, Harta’s current ratio is at 2.78 this quarter, which have improved from 2.63 last quarter. It indicates that the company’s financial position has improved.

Until here, we know that Harta is making more profit this quarter which led to improvement in its balance sheet. Does Harta have healthy cash flow management as well? Let’s check out:

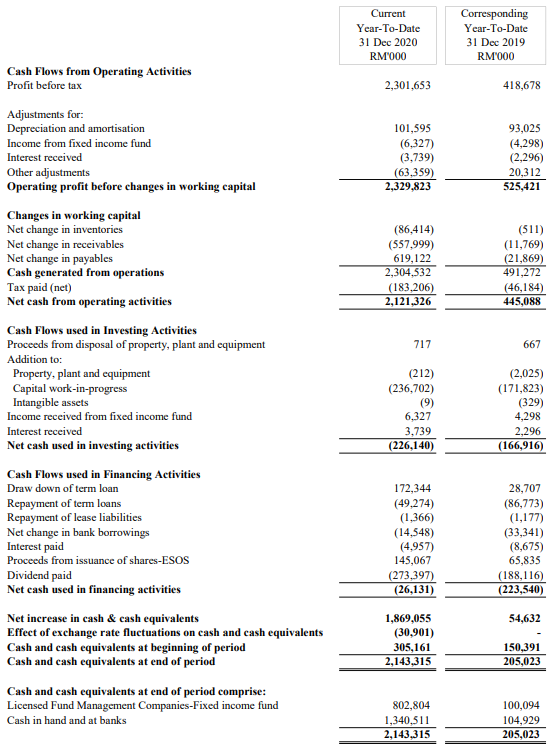

Statement of Cash Flows

The Cash Flow Statement here is pretty straightforward. What really matters will be its cash flow from Operating Activities.

Under cash flow from Operating Activities, there is a net change in trade receivables which amounts to (RM578mil). If you compare it with last year figure, it looks as if Harta is not doing a good job in collecting payment from its clients. But this is not the case as Harta’s sales revenue has been increasing in a tremendous amount which resulted in increase in trade receivables. This is acceptable only when the trade receivables is growing in tandem with the sales revenue.

Harta managed to achieve a net cash flow of RM2.121 bil from its operating activities. After including the cash flows used in investing and financing activities, Harta managed to increase its cash & cash equivalent status by RM1.896 bil for the cumulative 9 months period of financial year 2021.

Prospects by Management

It was mentioned again and again by the Owner that the demand for gloves is expected to outstrip the supply of gloves for the next few years. This indicates that the ASP for gloves is not dropping anytime soon. This gives us an extra safety margin to play with in our investment in the glove sector.

Conclusion

From Harta’s latest quarter report we can conclude that the glove sector is nowhere near its peak. Due to the Covid-19 pandemic, the demand for gloves worldwide has spiked and outstrip the supply for glove by a lot. This has caused the ASP for gloves to rise in a significant rate which resulted in all glove companies to profit handsomely.

Due to the shortage of supply for gloves, the ASP for gloves has been consistently increasing every month. It is estimated that it takes at least 3 years for the supply of gloves to meet the world demand for gloves. As such, it is estimated that the ASP for gloves will not fall from this level in near future, on the other hand, it might continue to increase due to the shortage of supply.

Harta has a dividend policy with a payout ratio of 45% in place. This means that if the company continue making more profit, the company will continue giving out more dividend payment as well. In this quarter itself, the company has declared a second interim single tier dividend of 9.65 sen per share.

With the closing price of RM13, the share is currently trading at a trailing PE multiple of 24. Historically, Harta has always been trading at a PE multiple of between 30-40, a market leader in terms of PE multiple among its peers. If we were to calculate its forward PE multiple, you will then realise that the stock is actually consider undervalue still at the current price.

To stay on the conservative side, let’s assume the next 3 quarters earning results are the same as this quarter (which means there is no improvement in its result at all in upcoming quarters), we will get a forward PE multiple of 11 !

Personally, I think Harta is still a good choice for investment at the current price of RM13. This is because I believe its business will continue to improve in coming quarters due to:

- Increasing production capacity by Harta

- Increasing ASP for its gloves

- Low Forward PE

- Good dividend yield

- No signs of slowing down of the pandemic in near future (I hope I’m wrong)

- Worldwide supply of glove remains shortage to meet the demand

I foresee another growth for Harta in coming quarter. Invest at your own risk.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

DISCLAIMER

This post is completely for education and discussion purpose only. The author of this post does not have the required licenses to provide any investment advice or induce any trade for the readers here. Therefore, it should not to be taken as investment advice or inducement to trade and the Author take no responsibility for any gains or losses as a result of reading the contents herein. Please invest at your own risk.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Buy Call - Stock Analysis & Insight

Created by BuyCall | Feb 01, 2021