Globetronics May Edge Higher on Rumours of New Controlling Shareholder

zaclim

Publish date: Wed, 13 Dec 2023, 11:19 AM

Sentiments on semiconductor-related stocks are generally not positive as order book replenishment by the companies is not going to be robust. In fact, there is a cloud of uncertainty as the slow recovery in the industry is expected.

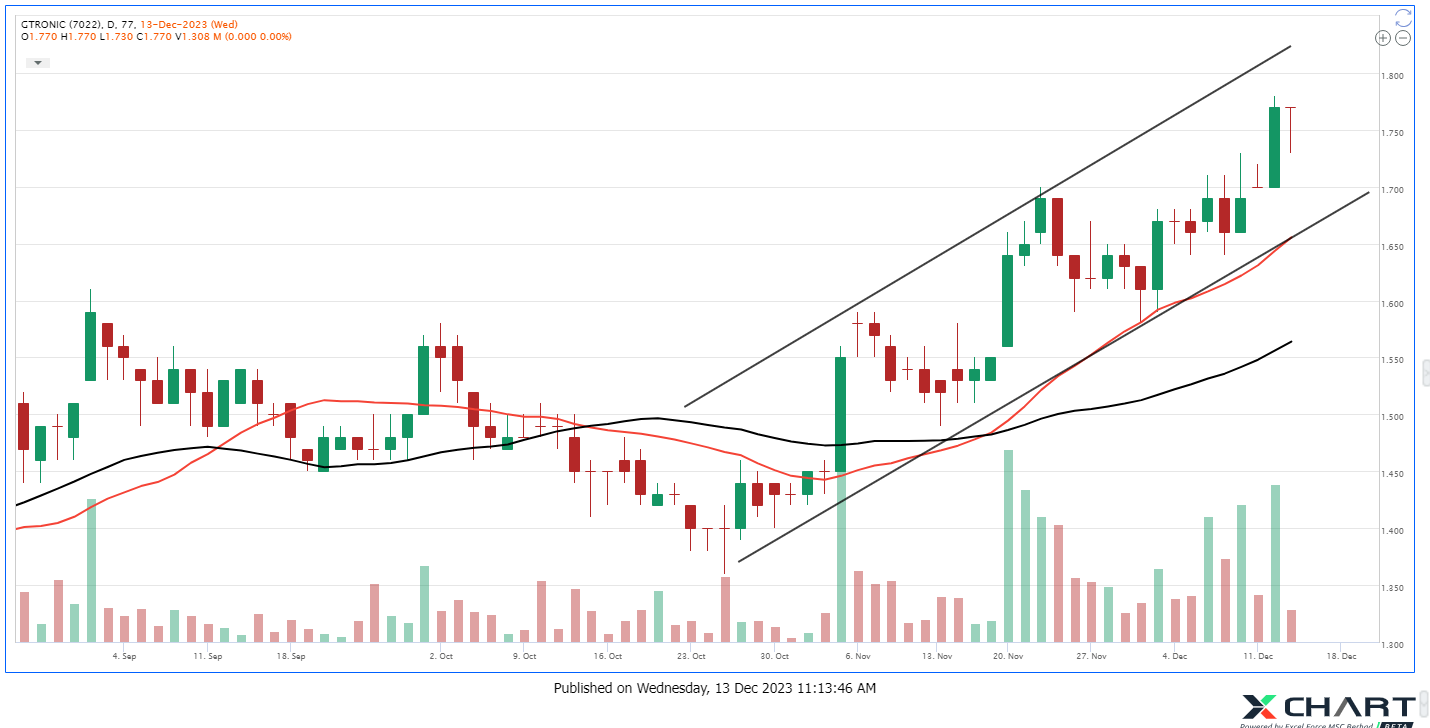

Globetronics Technology Bhd is among semicon related counters that would see near-term earnings prospects being capped by a slowdown in the global economy. But share price of Globetronics has been on the rise especially in the past month, up 11.2% to close at RM1.69 on Dec 8, giving it a market cap o RM1.1 billion. This is close to its 52-week high of RM1.73 and a good run up from its year low of 99 sen. On a year-to-date basis, the counter has appreciate by some 47%.

Technical analysts are expecting further upside for Globetronics after it gapped up and pushed above the RM1.60 resistance. Fueling the share price could be talks of the emergence of a new shareholder, but these are just talks.

Globetronics builds its sensors, which are its main revenue contributor, as well as encoders for a variety of automation and industrial applications. Its sales volume is also significantly dependent on revenue generated from quartz crystal and timing devices. These devices are used in a multitude of electronic products, such as mobile devices, GPS, and PCs.

Sales are primarily in Asian markets, with the United States accounting for a significant share.

Globetronics share price may be faring better but not its financial performance. For the third quarter ended Sept 30, 2023, the company posted lower net profit of RM9.5 million compared with RM12.8 million a year ago. This was due to lower revenue of RM34.6 million versus RM46.3 million a year earlier.

Globetronics saw lower volume loadings from certain customers in 3Q23 as well as lower forex gain of RM0.4 million versus RM3.9 million a year ago.

On a 9-month basis, net profit was down to RM19.9 million from RM33.4 million a year ago while revenue fell to RM99.3 million from RM137 million. It recorded higher tax expense of RM5.5 million compared to RM3.6 million a year earlier while there was a lower forex gain of RM4.3 million versus RM5.7 million.

But things could turn for the better for Globetronics as it is in the midst of diversifying its portfolio into non-consumer products in the industrial and automotive sectors. However, it would take a long time before these non-consumer products start generating meaningful income for the company.

Investors are probably wary of the counter’s growth prospects but rumours of new shareholder coming in may be a catalyst to drive up the share price.

GTRONIC has broken out of the consolidation phase and is now in a strong uptrend. The high volume on the upbars indicates that the buyer is dominant. The chart also shows a healthy Pullback that signals the continuation of the trend.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on The Daily Pulse of Bursa Malaysia

Created by zaclim | Jul 22, 2024

Optimax Holdings Bhd has set its sights on an upturn in its result after a less than desirable year end This augurs well for the company and investors may want a piece of the boom

Created by zaclim | Jul 22, 2024

Total logistics solutions provider has been hit by freight rates that fell to pre-pandemic levels. Hopes are high that the company will recover and trend higher.

Created by zaclim | Jul 19, 2024

Integrated layer farming company Teo Seng Capital Bhd is garnering much attention as it has almost doubled in terms of share price in the past year. Shold investors continue to hold on to it?

Created by zaclim | Jul 18, 2024

Price rose to a 52-week high of RM1.45 as it posted more than 3-fold increase in its net profit 4QFY24. Now that the counter has trended lower, indicate a good time to consider investing in Superlon

Created by zaclim | Jul 16, 2024

Unisem (M) Bhd is slowly but surely regaining its lustre. All things are moving towards better days for the manufacturer of semiconductor devices.

Created by zaclim | Jul 15, 2024

Texcycle has been on the upcycle in terms of share price, touching a record high of RM1.49. It has lost some ground since its high but the counter is trending out recently.

Created by zaclim | Jul 15, 2024

Electronic manufacturing services provider ATA IMS Bhd has been trading higher in the last couple of weeks and looks to be able to sustain its upward momentum. Is it still time for investors to enter?

Created by zaclim | Jul 11, 2024

Kobay Technology Bhd is seeing upward traction again after trending lower since touching a year high of RM2.58. Can it surpass its recent high?

Created by zaclim | Jul 09, 2024

The company recently ventured into the manufacturing of power cables and wires following a takeover exercise of Central Cables Bhd.

Created by zaclim | Jul 09, 2024

OCK Group Bhd continued its upward momentum on anticipation of a record breaking year in terms of earnings. Can the good run be sustained?