Future Potential of Petronm (Part 2)

davidtslim

Publish date: Sun, 09 Jul 2017, 01:15 PM

Refinery Profit Margin Sensitivity Analysis

Let go through some of the good news on recent world refinery improving margin on the following links:

1.http://in.reuters.com/article/asia-refinery-idINL4N1JY2A3

Key excerpt from this link “South Korean and Japanese refiners are running their plants at near-maximum capacity to cash in on profit margins that are at five-month highs”

Key excerpt from this link “Asia's refining margin for 180-cst fuel oil against Dubai crude rose to a 5-week high on Tuesday, after crude oil prices slipped on expectations of rising US shale oil output in May”

3.http://www.gulfoilandgas.com/webpro1/main/mainnews.asp?id=59199

Key excerpt from this link “product crack spreads to strengthen across the barrel and refinery margins in Singapore gained more than $1/b versus the previous month’s level, to average around $8.50/b in April, a relatively healthy level.”

Key excerpt from this link “I have seen times in my 36 years in Shell where upstream has delivered far more cash than the downstream (but) we are seeing a reverse at the moment," Abbott said.”

Refinery margin (crack spread) is improving a lot in Q2’2017 as compared to Q2’2016 as shown in table below:

|

|

2016 (margin in USD), month end closing figure |

2017 (margin in USD) month end closing figure |

% of increment |

|

Apr |

7.8 |

9.1 |

14.286 |

|

May |

6.8 |

8.7 |

21.839 |

|

June |

5.2 |

9.7 |

46.392 |

|

Average |

6.6 |

9.17 |

27.51 |

Data Source: From Newmaster where he sourced them from http://www.cmegroup.com/

Sensitivity of Petronm’s Profit to refinery margin change

Let see a how sensitive Petronm’s profit to refinery margin change based on their refinery throughput.

The past daily throughput data from 2016 AR is in the range 46kbpd to 51kbpd – source (a bar graph of Future Potential of Petronm’s article - http://klse.i3investor.com/blogs/david_petronm/127344.jsp).

Based on 91 days and 48kbpd in Q2’17, total throughput is:

=91X 48k = 4.368 mil barrels

Assuming Petronm manage to increase its throughput to 51kbpd (Motivation is current refinery margin is relatively high)

Based on 91 days in Q2’17, new total throughput is:

=91X 51k = 4.641 mil barrels

The new estimated refinery profit in Q2’17 will be:

= 4.641mil barrels X (USD5.3X4.3)

= RM105.7 mil (previous article is RM99.5 mil)

Note: Estimated refinery margin per barrel: I take a lower value of USD5.3 from predicted 9.17 due to I believe Petronm is a simple refiner and want to be conservative to allow higher safety of margin in the calculation (extra is bonus)

One can observe that 3kbpd increase lead to RM6.2 mil increase in profit (refer first article: from 99.5 to 105.7). Annual report shows that Petronm maximum daily throughput is 88kbpd (page 3 of AR).

The table below shows the sensitivity of profit when there is a change in refinery margin and throughput:

|

|

Profit increment (mil) |

Profit increment (%) |

EPS (sen) |

|

Every 1k increase in Throughput |

2.07 |

2.08 |

0.768 |

|

Every 1USD increase in Refinery margin |

18.78 |

18.87 |

6.956 |

One can notice that as long as refinery margin increases by 1 USD, the profit of petron will improve by RM18.78 mil or equal to 6.96 sen of EPS (on top of the 37 sen EPS).

I can see big room of possible future profit improvement from the increment of current refinery capacity of 48kbpd to 88kbpd (I left this for your own calculation if throughput increases by 10kbpd)

It is worth noting that RM18.78 mil and RM2.07 mil are just from 1 quarter contribution. Imagine what profit is if these positive contributions can last for 4 quarters (especially throughput is under Petronm control).

From this analysis, I can figure out why Petron Philippines is considering to invest big to expand the daily throughput to 150kbpd.

Revenue Segment and Forex Sensitivity

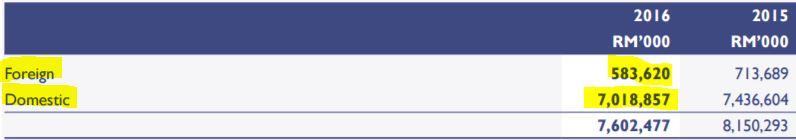

Revenues of Petronm mainly derived from the sale of petroleum products to domestic customers including its affiliates and competitors. A breakdown of the revenues by geographical location is as follows:

Source : 2016 Annual Report (AR)

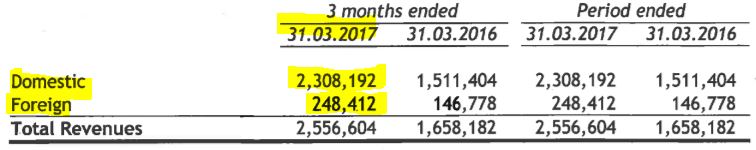

Source : Q1’17 QR

From these two tables, one can observe that its export contribution stay within 8-10% (8.3% in 2016 but 10.7 in Q1’17). Main revenues are still come from domestic sales. The recent appreciation of RM versus USD rate should help Petronm to reduce its import cost (Crude oil is purchased in USD) while export revenue is slightly affected (net effect is positive - read the following for forex analysis).

Let analyze the USDRM rate on 31 March 17 and 31 Dec 16 for estimation of the forex gain/loss on Petronm

|

|

31 Dec 16 |

31 Mar 17 |

|

USDRM |

4.499 |

4.426 |

|

Change |

-1.62% |

|

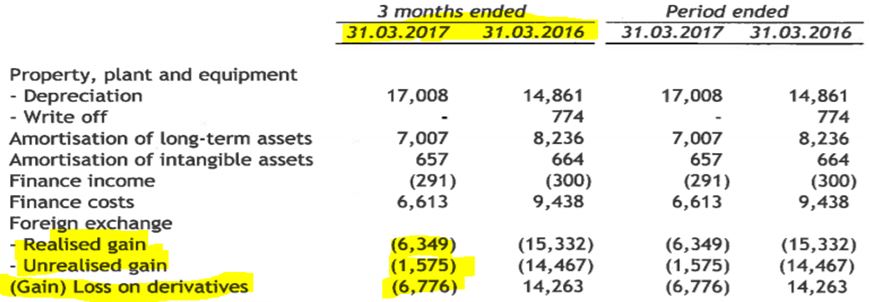

Based on Q1’17 report, this depreciation of USDRM rate will benefit Petronm. Let us see the figure of Forex gain/loss based on Q1’17 quarter report as shown in table below:

From this table, petronm enjoyed forex gain (realized) of RM1.5 mil and unrealized gain of RM6.3 mil in Q1’17 (net effect from these two is gain of RM7.8 mil). It also gained from derivatives contract (6.7mil) which I believe they hedged for a USD rate but the actual USD rate in this period is higher than their hedging rate.

Based on Q4’16 report, Petronm suffered relatively large amount of forex loss due to appreciation of USD to RM from Sept to Dec 2016. The closing rates of USDRM at end of Sept and Dec are as shown in table below:

|

|

30 Sept 2016 |

31 Dec 2016 |

|

USDRM |

4.047 |

4.499 |

|

Change |

10.04% |

|

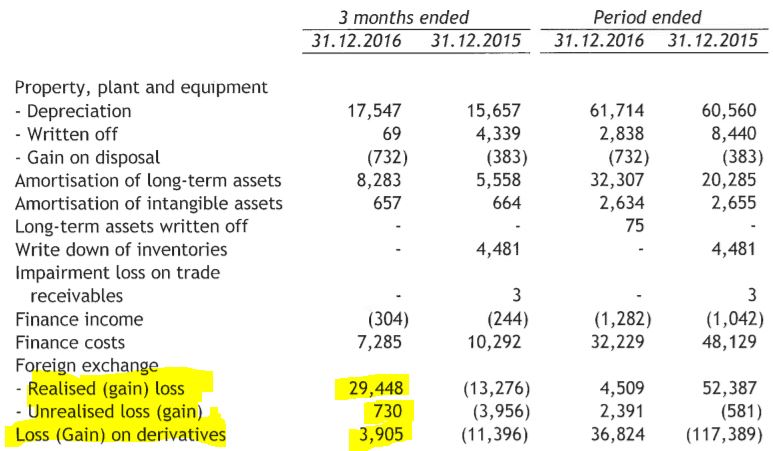

Petronm suffered RM29.4 mil realized loss and unrealized loss of RM0.7 mil in Q4’16 as shown in the table below (net effect from these two is loss of RM30.1 mil). In addition, it also suffered loss from derivatives contract (3.9mil) which I believe is due to they hedged for a USD rate but the actual USD rate in this period is lower than their hedging rate.

Source: Q4’16 report

Simple Conclusion from these two tables:

Higher USDRM rate may lead petronm to suffer forex loss. Lower USDRM rate should bring petronm to enjoy forex gain. However, exact gain on derivatives contract is hard to estimate as their Forex hedging rate details are not available.

In coming August result (Q2’17), I expect Petronm should has some forex gain due to lower USDRM rate (refer to table below) in this period as compared to Q1’17.

The USDRM rate from Q1’17 depreciated about 2.98% leads Petronm to gain from forex exchange (exact amount is hard to predict but I expect should be slightly larger than Q1's forex gain amount). This forex gain assumption is by assuming similar hedging rate on derivative contracts.

|

|

31 Mar |

30 June |

|

USDRM |

4.426 |

4.294 |

|

Change |

-2.98% |

|

This extra forex gain may be able to offset 50% of crude oil stock loss from first article calculation which will further improve gross profit of Petronm

Debt and Free Cash Flow

Petronm Net Debt improved dramatically from RM1 billion in 1Q14 to almost no debt now (if you consider its cash in hand). You can refer to quarter report of Q1’17 or AR or http://klse.i3investor.com/blogs/kianweiaritcles/126496.jsp for its cash flow and debt.

For parent company financial strength and background - Petron Corp. is the largest oil refining and marketing company in the Philippines, supplying more than a third of the country’s oil requirements. with a rated capacity of 180,000 barrels per day (market cap = Peso 91.59Billions). Petron Corp is trading at PE 11.3

Petron Corp is 51% owned by San Miguel Corporation is a Filipino multinational publicly listed conglomerate holding company. It is the largest publicly listed food, beverage and packaging company in Southeast Asia (market cap = Peso 246.37Billions)

Summary

1. Petronm has recorded growing number of petrol stations (596 from AGM data) and higher number of sales in crude oil (32.1 mil barrels in 2016 vs 30.4 mi barrels in 2015). In fact, Petdag and Hengyuan actually recorded lower no of sales in crude oil YoY (can refer to their quarter report or AR). Anyway, due to refinery profit margin is improving significantly from Q3’16 to Q1’17, Hengyuan recorded a super high profit in last two quarters due to it is a pure refiner that can enjoy the largest benefit of refinery business.

2. Petronm commercial (jet fuel) and lubricant sectors showed strong growth (more than 10% in Q1’17) and may drive higher retail profit in Q2’17 as higher number of air travelling is expected due to Ramadan month fall in Q2.

3. Possibility of increasing its refinery throughput will further drive its profit to higher level.

4. Higher future demand of gasoline, diesel, LPG, and aviation fuel from growing vehicle population in Malaysia will provide future growth opportunity in profit for Petronm.

5. By product of Petronm (fuel oil) margin improving to 5-year high which should benefit simple refiner like Petronm (http://www.reuters.com/article/refineries-fueloil-idUSL3N1JH360)

6. Buying a counter is buying its future where past FA data is served as reference but more focus should be put on its future earning visibility (supported by refinery analysis), healthy balance sheet and decent margin of safety.

7. Petronm nature of business (petroleum product retails) is highly recursive (repeatable as we need to go back to refuel every week) and super low labour-dependent (315 employees for RM8 Billions+ revenue) and its comfortable environment for refreshment (Petronm station’s restroom equipped with air-cond).

8. I would say one of the most realistic rewards for long term minority shareholders is dividend (capital gain also) and one important asset for Petronm is its strong capability of free cash flow generation from operation (现金为王,有钱好办事. Eg. Apple and Google huge cash pile).

You can get my latest update on share analysis at Telegram Channel ==> https://t.me/davidshare

Disclaimer:

This writing is my own imagination for all the assumptions and estimations. It is strictly for sharing purpose, not a buy or sell call of the company.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Future Potential of Petronm

Discussions

aiyah!!! how to fathom when my education is only Std 6 level!!!! ok.. bottom line can i buy now?

2017-07-09 14:58

Below is my thoughts on why PetronM capacity is limited to 48k bpd:

If you see the Dec - 2011 qtrly report, the reason for the modification done is to handle crude of higher sulfur content which is way cheaper than the sweeter crude (lower sulfur).

I suspect the capacity of the Hydrotreater installed in PetronM for further purification of Gasoline or Diesel to meet the Euro IV requirement is at say at 25k bpd level.

https://www.quora.com/Petroleum-Engineering-Can-some-one-explain-what-is-Euro-III-and-Euro-IV-specifications-on-petrol

It would be less economical for PetronM to source a low sulfur crude (more expensive) and run at a high throughput say 88k bpd instead of higher sulfur crude and run at a lower throughput. Here is the prove:

Say the crack spread of Fuel Oil = - 3 USD/ brl (respect to high sulfur crude)

and crack spread of others product at : 7 USD/brl (respect to high sulfur crude)

Lets also assume the Low sulfur crude is more expensive than high sulfur crude by 'X' USD/brl.

(A) Old scenario:

30% fuel oil: 26k bpd ,

Margin: -3 - x

and remaining 55% of Distillate Fuel + Gasoline + Jet Fuel : 48k bpd ( 7 - x)

Margin : 7 - x

Old scenario Profit : 26* (-3-x) + 48* (7-x)

(B) Current scenario:

30% fuel oil: 15k bpd

Margin : - 3

and remaining 55% of Distillate Fuel + Gasoline + Jet Fuel : 26k bpd

Margin : 7

Current scenario Profit : 15* (-3) + 26* (7)

If you use an excel and do some trial & error you will know that the moment the X value is more than 1.7 USD/ brl...its more economical to go for Option B which is exactly what they are doing now for the last 6 years....

2017-07-09 15:18

the is inline with the word 'optimization' they use to justify their modification decision on the plant

2017-07-09 18:17

Thanks probability for your sharing on 48kbpd capacity. The option A and B is your own estimation or any official statement from Petronm? Is it possible current higher profit margin for gasoline and diesel products make it possible to run at higher throughput using low sulfur crude oil (as what HY doing)?

2017-07-09 23:29

Just made a calculation because of your request...which you can work it out also from above equation. For simplicity assume that 'X' will be minimum 2 USD/brl.

Its probably higher than this, but in any case definitely low sulfur crude will be more expensive than high sulfur crude.

If x = 2, you can work out that the Fuel crack spread has to be at least on the positive territory (more than > 0 USD/brl crack spread) with gasoline crack spread at 7 USD/brl for Option A to generate same or higher earnings than Option B.

If they do that, the Next question is...can their hydrotreater (whatever component they installed to make Eur IV fuel) can handle the higher throughput of these distillate oil + gasoline + jet fuel?

2017-07-09 23:57

David these are just my deductions...nothing of these are mentioned by PetronM.

2017-07-09 23:58

Thanks for your calculation. Good question on whether their hydrotreater can handle or not. Petronm mentioned that they are compliant with Euro 4 spec but some asked me whether they already compliant with both RON97 and RON95 fuels? Some said they just compliant with RON97 only? Do you have info on this?

2017-07-10 00:10

If x = 2, you can work out that the Fuel crack spread has to be at least on the positive territory (more than > 0 USD/brl crack spread) with gasoline crack spread at 7 USD/brl for Option A to generate same or higher earnings than Option B.

This is possible if they facility can handle it.

They are selling 8.3 mil barrel in Q1'17, due to they refinery throughput is only 4.3 mil barrels, so ~4 millions barrels are bought from competitors for trading. I guess these 4 mil barrels are purchased in the form of finished refined products.

How much the profit can be get from this trading? It should be less than if they refine the crude oil and selling the finished products based on current refinery profit margin?

2017-07-10 00:20

Posted by davidtslim > Jul 10, 2017 12:20 AM | Report Abuse

If x = 2, you can work out that the Fuel crack spread has to be at least on the positive territory (more than > 0 USD/brl crack spread) with gasoline crack spread at 7 USD/brl for Option A to generate same or higher earnings than Option B.

This is possible if they facility can handle it.

They are selling 8.3 mil barrel in Q1'17, due to they refinery throughput is only 4.3 mil barrels, so ~4 millions barrels are bought from competitors for trading. I guess these 4 mil barrels are purchased in the form of finished refined products.

FEEDBACK: yup thats what i think may be from Petron Philippines...any info from AGM?

How much the profit can be get from this trading? It should be less than if they refine the crude oil and selling the finished products based on current refinery profit margin?

FEEDBACK: Its lesser because the value addition is only from the retail margin - no 'refinery margin value addition' on these streams as they bought as refined products. But the margins are steady - fixed for retail.

2017-07-10 00:25

yup thats what i think may be from Petron Philippines...any info from AGM?

Feedback: I remember noboday ask this question in AGM. No info so far.

Good news is they have flexibility to increase their refinery throughput for low sulfur crude oil. In addition, they said no maintenance shut down in 2017. Management replied to question that they are confident to repeat the Q1'17 performance in AGM.

2017-07-10 01:38

Consider to write part 3 if you think needed. Still hv some idea and point to share for Petronm

2017-07-10 16:30

go ahead David...it will stir some ideas from me too..

just make the title with the word petronm big "PETRONM" ;)

2017-07-10 16:33

to have an idea what is 'X' value like, you can take that as the difference between Brent (sweeter) and Dubai Crude (sour)..

This you can determine by seeing the Crack Spread of Singapore Fuel oil to Dubai Crude and comparing it to Singapore Fuel oil to Brent

2017-07-10 18:41

Actually, the commercial sector is another area to look into it, the management stated commercial sector took up about 30% of the total revenue. The best part is this sector has been experiencing a double digits growth for the last 2 financial years.

Keep up the good work

2017-07-10 20:04

probability

Next Icon in the making....

lots of information there...need to go through and crack my head! he he..

2017-07-09 13:23