Stock Infographics

Efficiency, Valuation and Gearing of Malaysia listed Real Estate Companies

DonkeyStock

Publish date: Tue, 22 Oct 2019, 01:36 PM

KL Property Index has fallen by half since the year 2014 and is now back to the price level of the year 2009.

The 2020 Budget includes a few measures to boost the property sector, such as:

· Lowering of the threshold of high-rise property prices in urban areas from RM1 million to RM600,000 for foreign buyers

· Shifting the real property gain tax base year from 2000 to 2013

· A new Rent-to-own scheme for first-time homebuyers

· Extension of BSN's Youth Housing Scheme

Encouraged by the government effort to boost the real estate sector and the low valuation of properties companies, I started to check out those smaller properties companies not covered by any news or any research house.

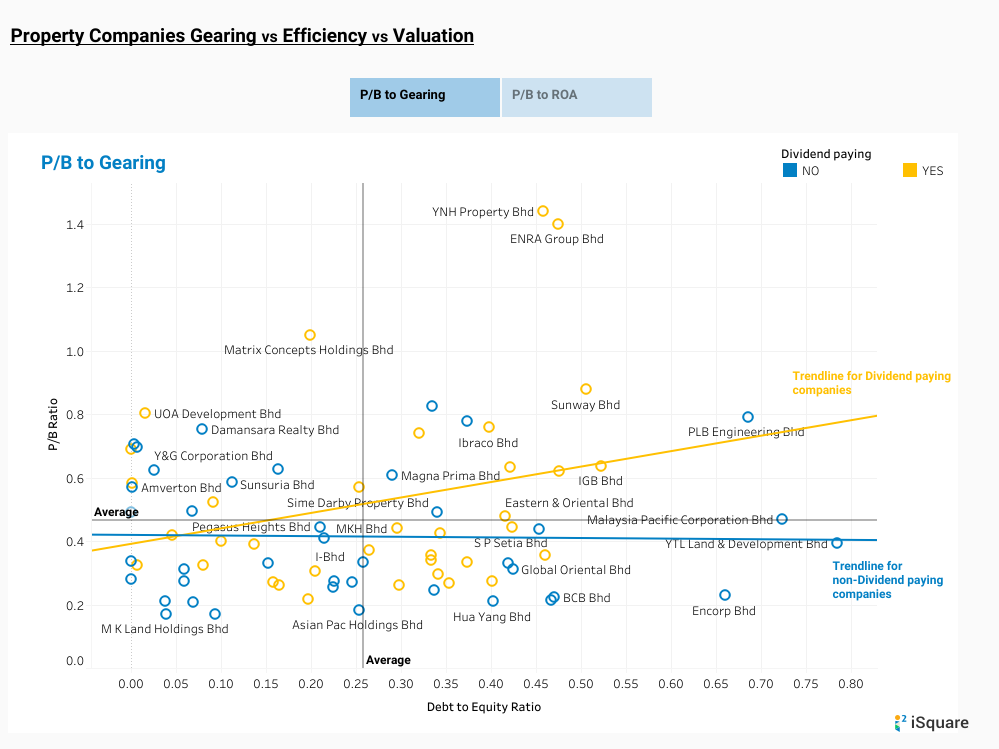

Turns out that not all companies that have a lower gearing ratio command a lower valuation. Companies that are consistent in paying out dividends actually command a higher valuation when they increase their gearing ratio.

Also, I did a chart that shows the relationship between the company valuation and the efficiency of the company. I used Return on Asset (ROA) to gauge its efficiency as the number of sales generated from the underlying asset is very important for a real estate company since it is a high capital intensive industry. The result was pretty satisfactory. Companies that generate a higher ROA command a much higher valuation. This can also explain why some of the companies like UOA Development has been pretty resilient in this industry downtrend while the share price of companies like Ecoworld and SP Setia has been plunging like a waterfall.

Here are some of the outstanding companies from my view.

1)Matrix Concept is a company that is able to generate a good return from its assets and delivers a consistent dividend. But it is still trading above 1x PB Ratio.

2) UOA Development is another company that has the same characteristics but trading below its NTA.

3) Mah Sing Bhd, MKH Bhd and Malton Bhd are companies that have above-average ROA but below-average valuation, which make them a good counter to buy if once their price revert to the industry mean.

UOA Development and MKH are now On my watch list. Which property company is in your watchlist currently and why? Share it with us.

You can access the interactive chart here if your desired company is not being labelled in the chart above.

More articles on Stock Infographics

Missed the Opportunity to Purchase More Shares During the Company’s Price Dip

Created by DonkeyStock | Jun 05, 2024

MPHB Capital Privatization: A Questionable Valuation

Created by DonkeyStock | May 28, 2024

Higher offer price for MPHB Capital Bhd ?

DC Healthcare’s Financial Roller Coaster

Created by DonkeyStock | May 27, 2024

DC Healthcare Bhd has delivered a worsening financial result

These investors are mastering the real estate game.

Created by DonkeyStock | Jan 04, 2024

Property investing by these visionary Singapore-based companies

Why Guan Chong Bhd share price reach Covid 19 low ?

Created by DonkeyStock | Jan 03, 2024

Discover the factors behind this surge, the challenges faced by top cocoa producers, and the ripple effect on chocolate manufacturers

The USD to RUB exchange rate might hint at an impending truce.

Created by DonkeyStock | Aug 15, 2023

Companies that delivered significant profit growth in the latest quarter

Created by DonkeyStock | May 03, 2023

Companies listed on Bursa Malaysia with an outstanding quarter results for the month of Apr 2023.

Discussions

Be the first to like this. Showing 1 of 1 comments

valuelurker

Nice work

2019-10-22 14:18