What could be the rationale behind YTL Power disposal of ElectraNet?

DonkeyStock

Publish date: Wed, 09 Feb 2022, 04:10 PM

YTL Power International Bhd is disposing of its entire 33.5% equity interest in Australia’s ElectraNet Pty Ltd for A$1.03 billion (RM3.06 billion). Upon completion of the disposal, the group will recognize a gain of RM2.21 billion.

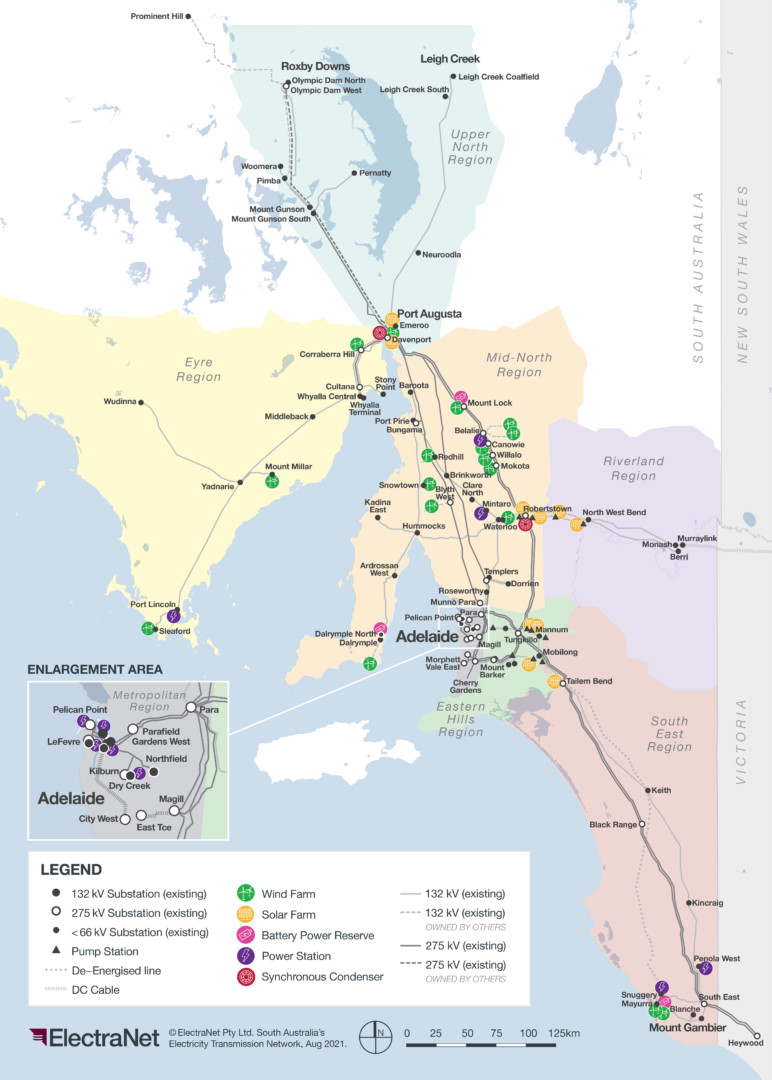

YTL Power acquired the 33.5% stake in December 2000 for A$58.5 million. ElectraNet operates the high voltage electricity transmission system throughout South Australia state under a 200-year exclusive lease granted by the state government.

Why is YTL disposing of this cash cow now?

* The 30 years interest rate down trend is now turning up

1) Rising Interest rate

Rising interest rates can impact utilities more than other sectors because they can make bonds more attractive to conservative investors seeking that yield. The high capital cost/debt levels of operating a utility also increase borrowing costs with rising interest rates eating deeper into earnings. A rising interest rate thus decreases the valuation of utility companies.

2) The energy world is changing rapidly.

A system designed around big, centralized power plants and one-way power flows is grinding against the rise of smarter, cleaner technologies that offer new ways to generate and manage energy at the local level (think solar panels and batteries).

Firstly, wind and solar complicate the management of the grid because they are variable — they come and go with the weather. You can’t ramp them up and down at will like you can fossil fuel plants. The sun comes up, you get a flood of power from all those solar panels; the sun goes down, you get none.

This vastly increases the complexity of matching supply to demand in real-time and creates an urgent need for flexibility. A grid with lots of renewables badly needs resources that can ramp up and down or otherwise compensate for their natural variations.

The second is the rise of distributed energy resources (DERs): small-scale energy resources often on the customer side. Some DERs generate energy, like solar panels, small wind turbines while Some DERs store energy, like batteries, fuel cells, or thermal storage like water heaters. The inclusion of DERs to the grid requires a new way of managing the energy.

Hence, more capital expenditure is needed to make sure the grid is coping with the changing energy landscape.

In short, rising interest rates and the need to pump in more money for this company may be the reason behind this disposal.

Source: iSquare Intelligence

More articles on Stock Infographics

Created by DonkeyStock | Jun 05, 2024

Created by DonkeyStock | May 28, 2024

Higher offer price for MPHB Capital Bhd ?

Created by DonkeyStock | May 27, 2024

DC Healthcare Bhd has delivered a worsening financial result

Created by DonkeyStock | Jan 04, 2024

Property investing by these visionary Singapore-based companies

Created by DonkeyStock | Jan 03, 2024

Discover the factors behind this surge, the challenges faced by top cocoa producers, and the ripple effect on chocolate manufacturers

Created by DonkeyStock | Aug 15, 2023

Created by DonkeyStock | May 03, 2023

Companies listed on Bursa Malaysia with an outstanding quarter results for the month of Apr 2023.