Long Short positions of hedge funds for markets related to Russia Ukraine Conflict

DonkeyStock

Publish date: Thu, 24 Feb 2022, 05:27 PM

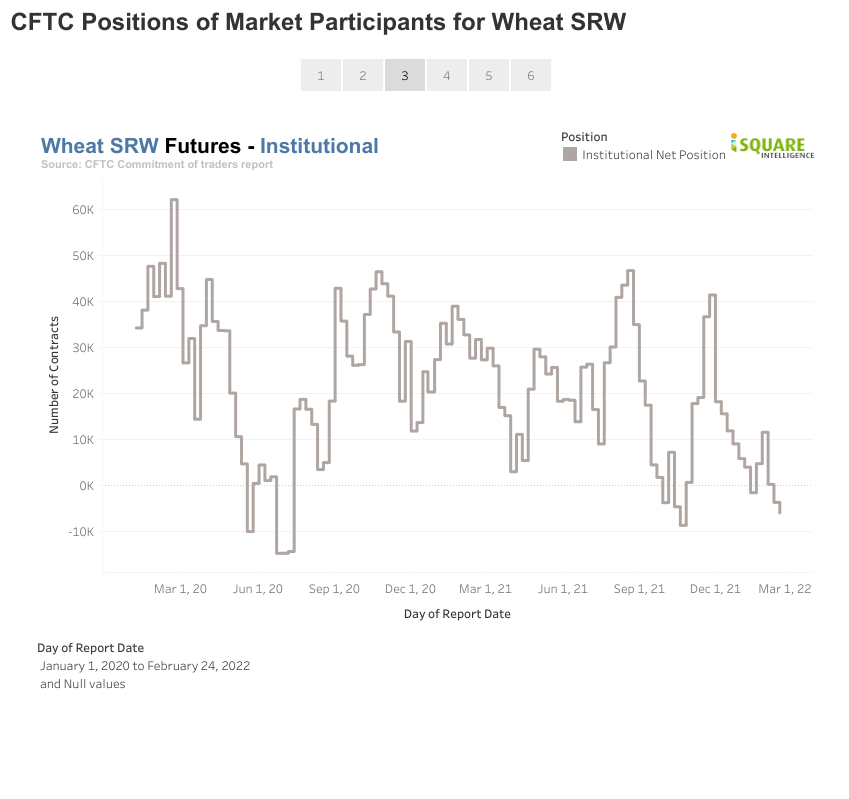

The views on institutional players on wheat have turned slightly bearish after wheat prices surged to a level not seen over the last 10 years due to an extremely low inventory level in 2020-2021.

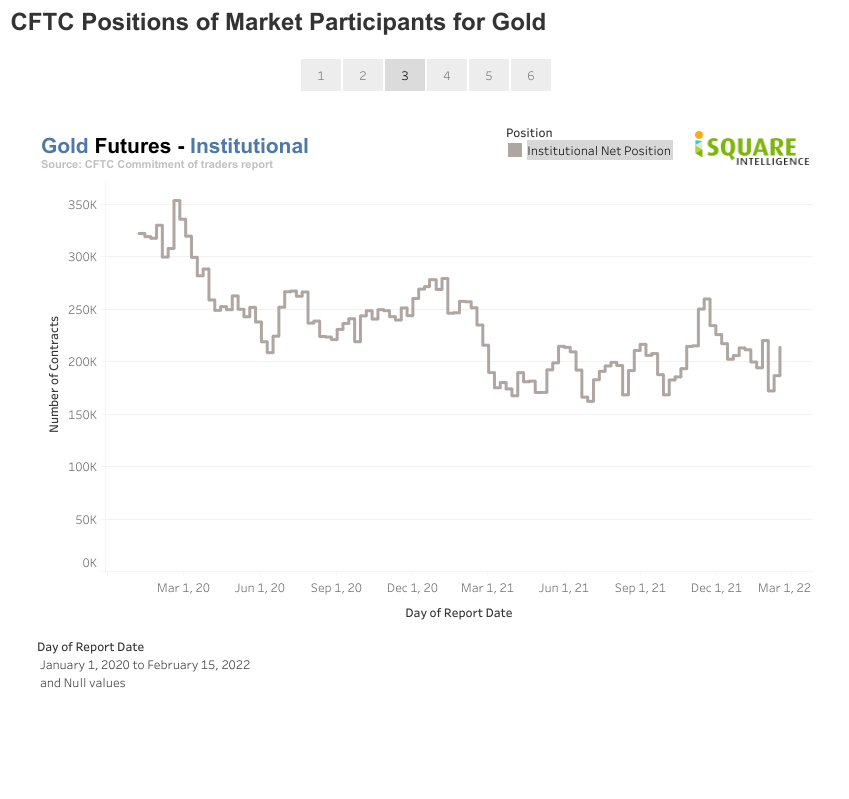

Institutional traders have maintained their view on gold price although the conflict is escalating. In the long run, the real interest rate is the determining force for the gold price while regional conflict's impact on gold prices was only temporary and quickly vanished.

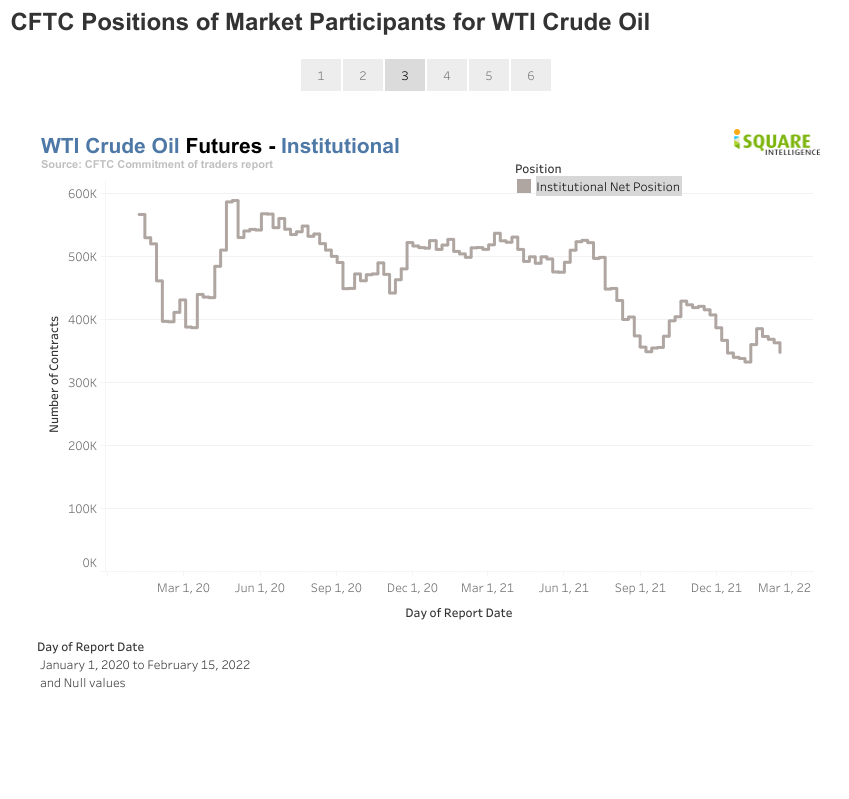

Institutional traders have been closing down their long position on oil after a strong bull run from the 2020 negative oil price. Russia highly relies on oil export and Europe is highly relying on Russia's energy export. Don't think there could be any major long-term disruption to the oil market.

Hedge Funds traders are placing their long bets on the Russian Ruble after the currency has fallen to a historical low accompanied by the high oil price environment.

We will follow closely on their position level again after the latest data is released this weekend.

More articles on Stock Infographics

Created by DonkeyStock | Jun 05, 2024

Created by DonkeyStock | May 28, 2024

Higher offer price for MPHB Capital Bhd ?

Created by DonkeyStock | May 27, 2024

DC Healthcare Bhd has delivered a worsening financial result

Created by DonkeyStock | Jan 04, 2024

Property investing by these visionary Singapore-based companies

Created by DonkeyStock | Jan 03, 2024

Discover the factors behind this surge, the challenges faced by top cocoa producers, and the ripple effect on chocolate manufacturers

Created by DonkeyStock | Aug 15, 2023

Created by DonkeyStock | May 03, 2023

Companies listed on Bursa Malaysia with an outstanding quarter results for the month of Apr 2023.