FCPO Updates

Daily Futures Commentaries: [FCPO Malaysia Palm Oil] 3/7/2018 - Trade in flat as market awaiting MPOB result

InvestorsDoctor

Publish date: Tue, 03 Jul 2018, 09:53 AM

3/7/2018

FCPO Sep 18

Previous Close: 2329 +3

FCPO traded in flat yesterday after a mixed production & export data. Watch out for MPOB survery data. US soyoil & Dalian palm olein dropped slightly, FCPO may test support 1st.

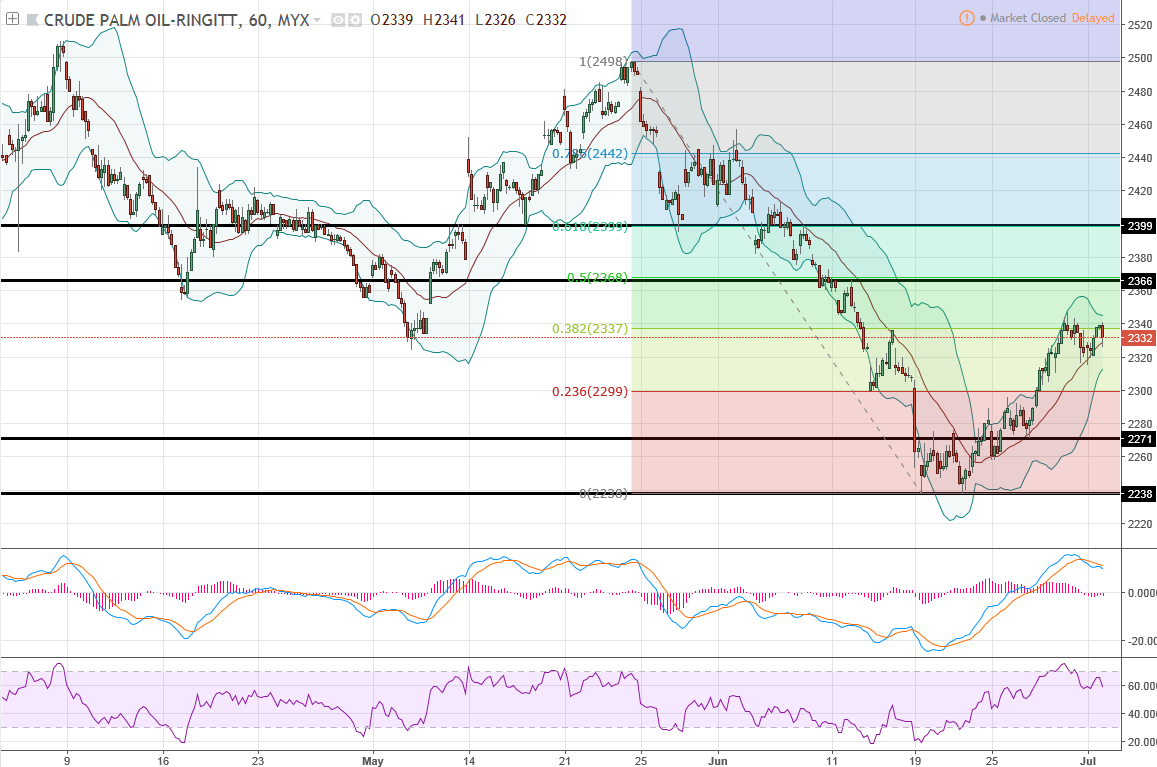

Daily chart showed FCPO testing rebound above middle line of BB, yet to be confirmed, while hourly chart testing Fibo retracement 38.2% of around 2340, from previous down swing (2498-2238)

Classic Support & Resistance

Resistance: 2366 2399

Support: 2271 2238

Recommend Trading Plan for the day:

1. Trade in range 2310-2350.

FCPO Margin Requirement

Intraday MYR 2250

Overnight MYR 4500

Spread MYR 1200

Disclaimer: Idea sharing only, trade at your own risk.

Join our channels to find out more!

Telegram link:

https://t.me/investorsdoctoracademy

Facebook link: https://m.facebook.com/investorsdoctoracademy

Since 14th May 2018 (stock market reopened after 509 GE-14), FKLI Futures dropped nearly 200.5 points from high 1876.5 to recent low 1676!

Simple Calculation:

200.5 x RM 50 per index point = RM 10,025 (Potential Profit!)

Well, NOW is the time for you to understand more about FKLI Trading!

Come & Join us on 14th July 2018 from 2PM to 4PM at SI Academy.

IDA will discover together with You - What is FKLI............

https://goo.gl/forms/SyxDaLNwkuYagkA02

Since 14th May 2018 (stock market reopened after 509 GE-14), FKLI Futures dropped nearly 200.5 points from high 1876.5 to recent low 1676!

Simple Calculation:

200.5 x RM 50 per index point = RM 10,025 (Potential Profit!)

Well, NOW is the time for you to understand more about FKLI Trading!

Come & Join us on 14th July 2018 from 2PM to 4PM at SI Academy.

IDA will discover together with You - What is FKLI............

https://goo.gl/forms/SyxDaLNwkuYagkA02

More articles on FCPO Updates

Discussions

Be the first to like this. Showing 0 of 0 comments