FCPO Updates

Daily Futures Commentaries: [FCPO Malaysia Palm Oil] 5/7/2018 - Will coming US China trade war benefits Malaysia CPO?

InvestorsDoctor

Publish date: Thu, 05 Jul 2018, 10:01 AM

5/7/2018

*FCPO Sep 18*

Previous Close: 2298 -15

FCPO settled below 2300 as tracking weakness in related edible oils. However MPOB survey data for June 2018 showed production decrease more than export, caused inventory declines, which is more to bullish, may supported FCPO price. Later we compare survey data with actual MPOB result.

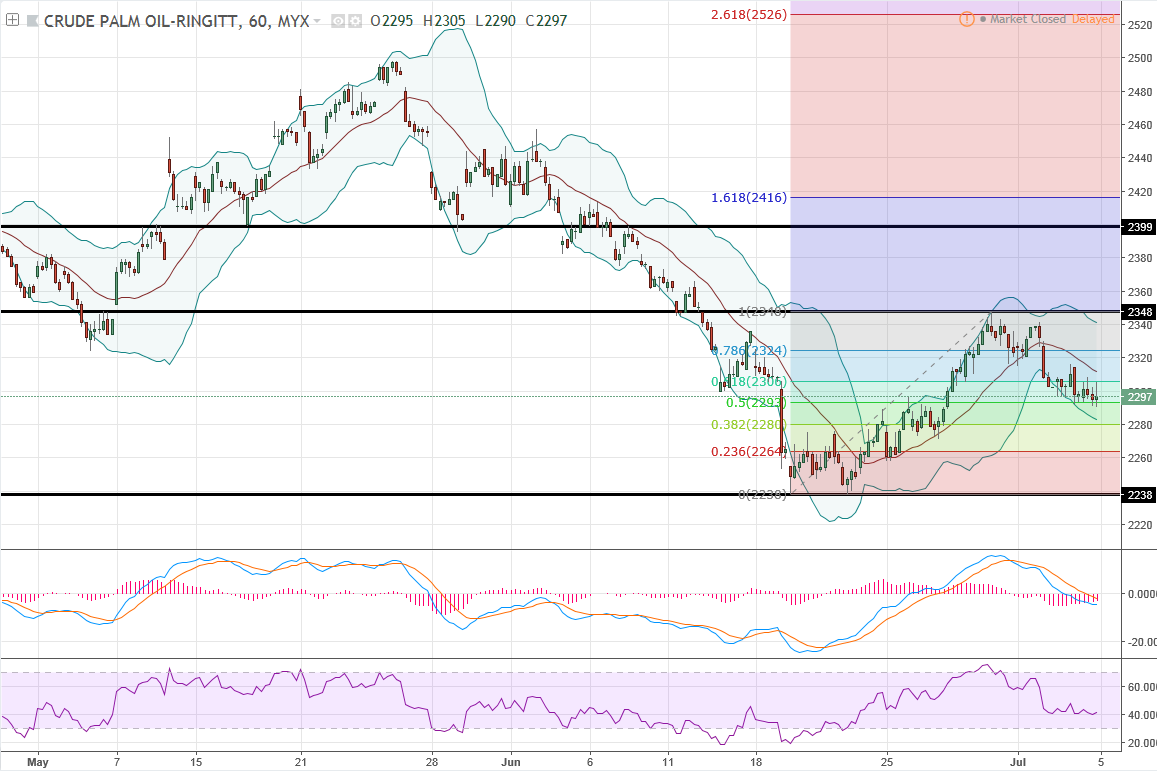

Daily chart showed FCPO testing rebound above middle line of BB, yet to be confirmed, but trend weakening with lower highs & lows. Hourly chart showed FCPO testing area 38.2-61.8 of Fibo retracement of previous swing (2238-2348).

*Classic Support & Resistance*

Resistance: 2348 2399

Support: 2238 2200

*Recommend Trading Plan for the day:*

1. Look for buy signal above 2316.

2. Look for sell signal below 2290.

*FCPO Margin Requirement*

Intraday MYR 2250

Overnight MYR 4500

Spread MYR 1200

Disclaimer: Idea sharing only, trade at your own risk.

Join our channels to find out more!

Telegram link:

https://t.me/investorsdoctoracademy

Facebook link: https://m.facebook.com/investorsdoctoracademy

Since 14th May 2018 (stock market reopened after 509 GE-14), FKLI Futures dropped nearly 200.5 points from high 1876.5 to recent low 1676!

Simple Calculation:

200.5 x RM 50 per index point = RM 10,025 (Potential Profit!)

Well, NOW is the time for you to understand more about FKLI Trading!

Come & Join us on 14th July 2018 from 2PM to 4PM at SI Academy.

IDA will discover together with You - What is FKLI............

https://goo.gl/forms/SyxDaLNwkuYagkA02

Since 14th May 2018 (stock market reopened after 509 GE-14), FKLI Futures dropped nearly 200.5 points from high 1876.5 to recent low 1676!

Simple Calculation:

200.5 x RM 50 per index point = RM 10,025 (Potential Profit!)

Well, NOW is the time for you to understand more about FKLI Trading!

Come & Join us on 14th July 2018 from 2PM to 4PM at SI Academy.

IDA will discover together with You - What is FKLI............

https://goo.gl/forms/SyxDaLNwkuYagkA02

More articles on FCPO Updates

Discussions

Be the first to like this. Showing 0 of 0 comments