FCPO Updates

Daily Futures Commentaries: [FCPO Malaysia Palm Oil] 18/7/2018 - Enter into flat range yet daily chart still bearish

InvestorsDoctor

Publish date: Wed, 18 Jul 2018, 09:46 AM

18/7/2018

*FCPO Oct 18*

Previous Close: 2171 -2

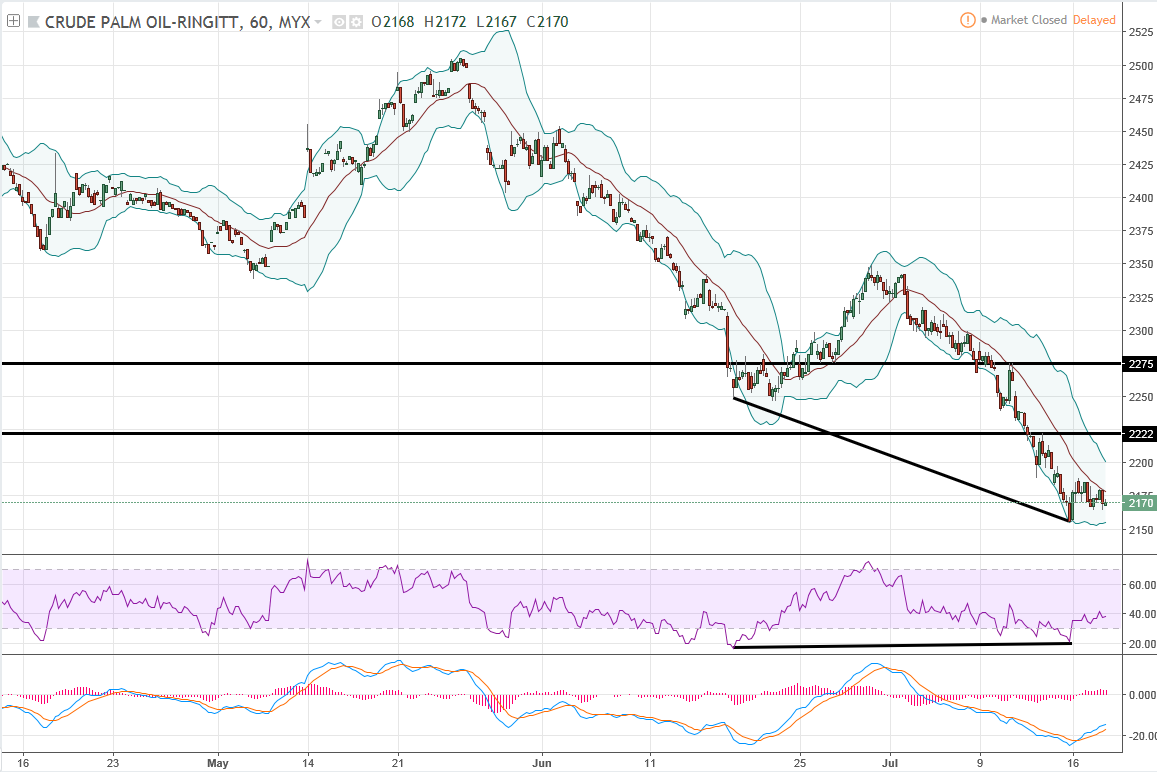

FCPO traded in flat range yesterday as market wait for more catalyst. US soyoil not much changes, remain weak around 28, while Dalian palm olein +0.47% this morning, FCPO may test rebound 1st.

Daily chart showed FCPO still more to bearish as technical indicators pointed more to downside, but watch out for potential technical rebound i nshort term as there is a RSI bullish divergence in hourly chart.

*Classic Support & Resistance*

Resistance: 2222 2275

Support: 2156 2088

*Recommend Trading Plan for the day:*

1. Trade in range 2150-2190.

*FCPO Margin Requirement*

Overnight MYR 4500

Spread MYR 1200

Disclaimer: Idea sharing only, trade at your own risk.

Join our channels to find out more!

Telegram link:

https://t.me/investorsdoctoracademy

Facebook link: https://m.facebook.com/investorsdoctoracademy

[Free English Seminar]

期货&原产品投资交易- 赌博?高风险投资?需要大笔资金?

Futures & Commodities Trading - Gambling? High Risk? Require Big Capital?

不对!如果您一直以来有这样的想法,是时候让IDA 破解您对期货交易的迷思和误解!

NO! Time to Crack All The Myths of Trading Commodities Futures!

Myth 1: Trading is all about making Fash-Cash!

Myth 2: You must have perfect timing to pick highs & lows.

Myth 3: You need a lot of money to start strading.

Myth 4: You must know what will happen next.

Myth 5: You can only make money in trending markets or 'easy' market conditions etc............

[Free English Seminar]

期货&原产品投资交易- 赌博?高风险投资?需要大笔资金?

Futures & Commodities Trading - Gambling? High Risk? Require Big Capital?

不对!如果您一直以来有这样的想法,是时候让IDA 破解您对期货交易的迷思和误解!

NO! Time to Crack All The Myths of Trading Commodities Futures!

Myth 1: Trading is all about making Fash-Cash!

Myth 2: You must have perfect timing to pick highs & lows.

Myth 3: You need a lot of money to start strading.

Myth 4: You must know what will happen next.

Myth 5: You can only make money in trending markets or 'easy' market conditions etc............

More articles on FCPO Updates

Discussions

Be the first to like this. Showing 0 of 0 comments