FCPO Updates

Daily Futures Commentaries: [FCPO Malaysia Palm Oil] 17/8/2018 - Sustain above 2200 on technical buying, but fundamental remain bearish for now

InvestorsDoctor

Publish date: Fri, 17 Aug 2018, 09:37 AM

17/8/2018

*FCPO Nov 18*

Previous Close: 2222 +6

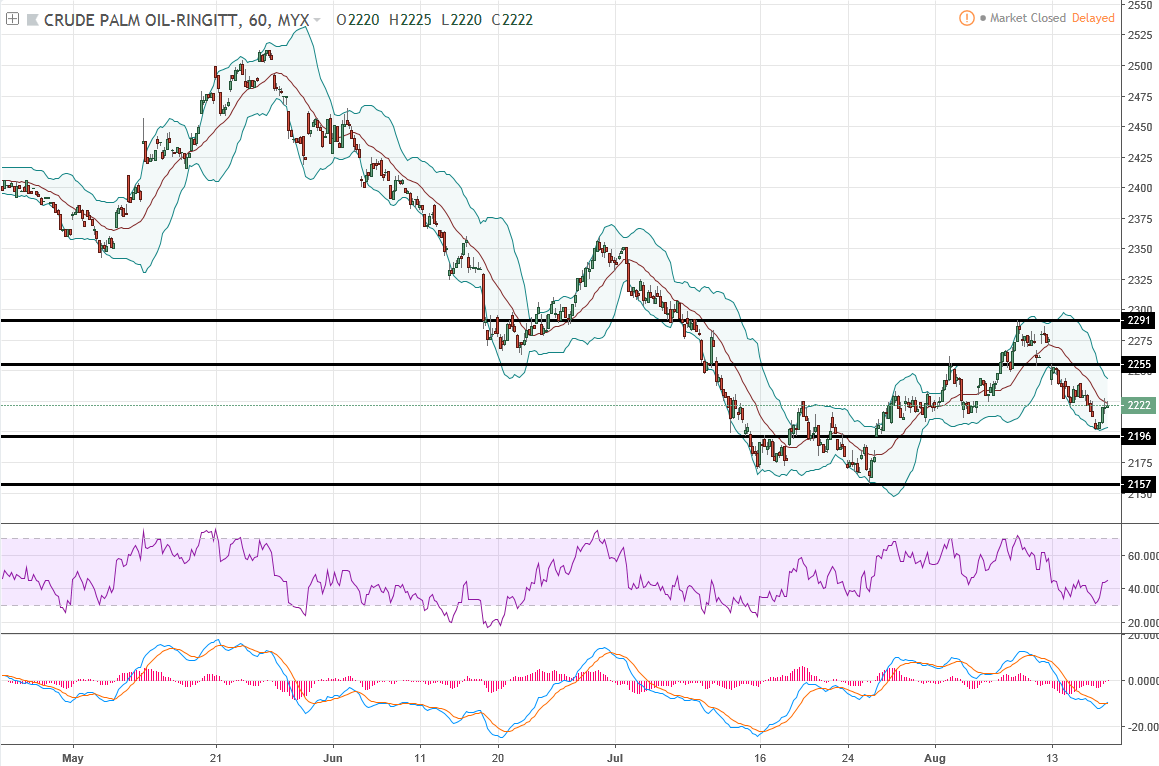

FCPO sustained above 2200 level and settled slightly higher on technical buying. However, market sentiment is still more to bearish as slowing CPO export & recovering production. Watch out for weather factor whether it will affect production in coming months. Related edible oils showed some rebound, FCPO may gap up and test resistance 1st.

Daily chart showed FCPO testing middle line of BB, which is also around 50% Fibo retracement of previous upswing 2156-2291, watch out for any rebound signal from Fibo level. As in overall trend is still more to bearish as technical indicators showed no strong sign of rebound yet.

*Classic Support & Resistance*

Resistance: 2255 2291

Support: 2196 2157

*Recommend Trading Plan for the day:*

1. Buy 2228, stop 2219, profit 2237/2246.

*FCPO Margin Requirement*

Overnight MYR 4500

Spread MYR 1200

Disclaimer: Idea sharing only, trade at your own risk.

Join our channels to find out more!

Telegram link:

https://t.me/investorsdoctoracademy

Facebook link: https://m.facebook.com/investorsdoctoracademy

More articles on FCPO Updates

Discussions

Be the first to like this. Showing 0 of 0 comments