FCPO Updates

Daily Futures Commentaries: [FCPO Malaysia Palm Oil] 28/9/2018 - Fell more than 1% on technical correction & concerns of rising CPO inventories

InvestorsDoctor

Publish date: Fri, 28 Sep 2018, 09:56 AM

28/9/2018

*FCPO Dec 18*

Previous Close: 2166 -24

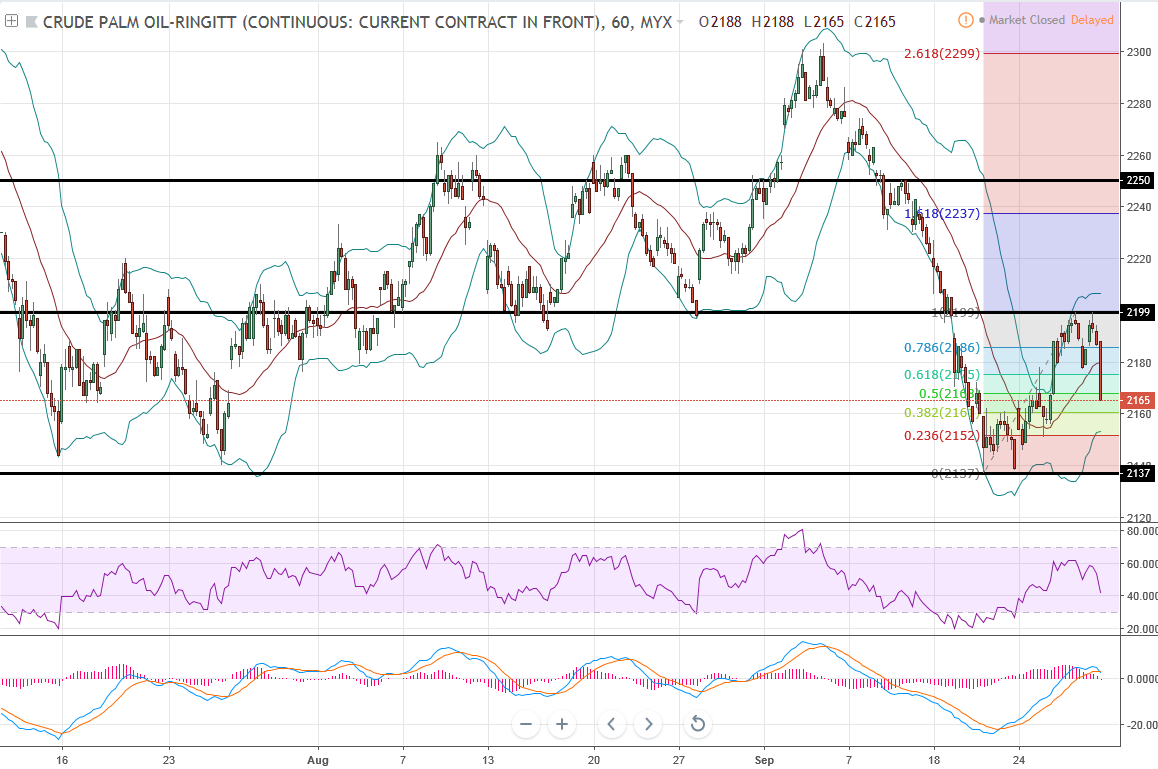

FCPO fell more than 1% yesterday on technical correction and concerns of rising inventories weighed down CPO & related edible oils. US soyoil break above 29 while Dalian palm olein rebound from losses, FCPO may test rebound 1st later.

Hourly chart showed a sharp fall after a double top at 2199, which is also 38.2% Fibo level of swing 2303-2137. Look at Fibo retracement of swing 2137-2199, FCPO may test 38.2-61.8, which is 2161-2175.

*Classic Support & Resistance*

Resistance: 2199 2250

Support: 2137 2088

*Recommend Trading Plan for the day:*

1. If expect FCPO to track gains in US soyoil, buy 2170, stop 2164, profit 2176/2182/2188/2194.

2. Sell 2164, stop 2170, profit 2158/2152/2146.

*FCPO Margin Requirement*

Overnight MYR 4500

Spread MYR 1200

Disclaimer: Idea sharing only, trade at your own risk.

Join our channels to find out more!

Telegram link:

https://t.me/investorsdoctoracademy

Facebook link: https://m.facebook.com/investorsdoctoracademy

More articles on FCPO Updates

Discussions

Be the first to like this. Showing 0 of 0 comments