Public Bank Needs to Grow Its Revenue and Profits Faster than Assets

Thirai Thiraviam

Publish date: Thu, 20 Jun 2024, 02:07 PM

Public Bank (PBBank) reached its highest point in 2018, with a P/E Ratio exceeding 17. Now that ratio has reduced to 11.8. The question is why?

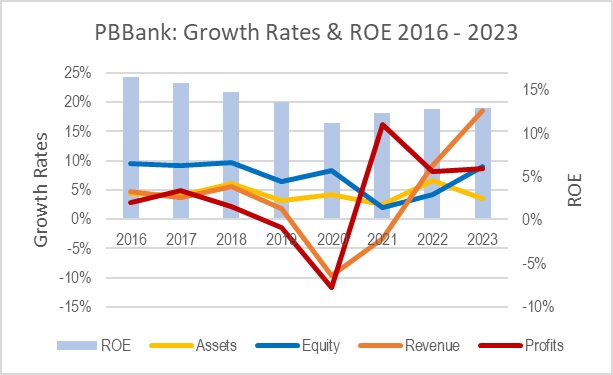

Between 2018 and 2023, the bank's assets grew from RM420 billion to RM511 billion (CAGR: 4.0%). During the same period, revenue grew from RM22.0 billion to RM25.4 billion (CAGR: 2.9%), and profits, from RM5.6 billion to RM6.7 billion (CAGR: 3.5%). It is apparent from the above that the assets at the bank grew faster than the profits generated from those assets in the last five years, indicating maturity and a slowdown.

Comparing the above figures with those from five years prior — between 2013 and 2018 — we get a CAGR of 4.0% for asset growth, and 5.5% and 4.4% for revenue and profit growth, respectively. From this, we can clearly see that revenue and profits were growing faster than assets in the five years leading up to the bank's peak in 2018.

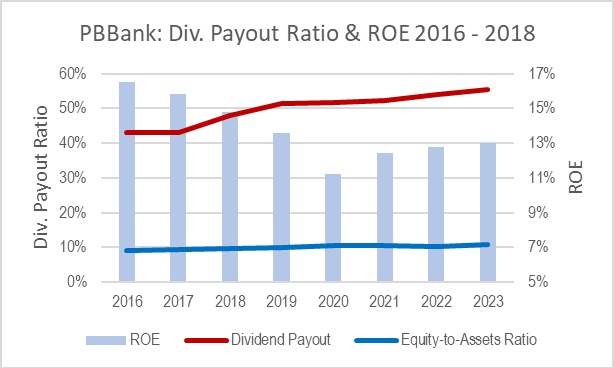

The bank prides itself on having the highest Return on Equity (ROE) of 13.0%. Although this number has slipped from 14.8% in 2018, it remains respectable. The thing about ROE is that it can be improved either by increasing profits (the numerator) or reducing equity (the denominator). Sadly for PBBank, it is doing the latter. Between 2016 and 2023, the bank has consistently increased its dividend payout ratio. As a result, the payout percentage grew from 43.0% to 55.5% during these years. This is yet another sign of maturity and slowdown.

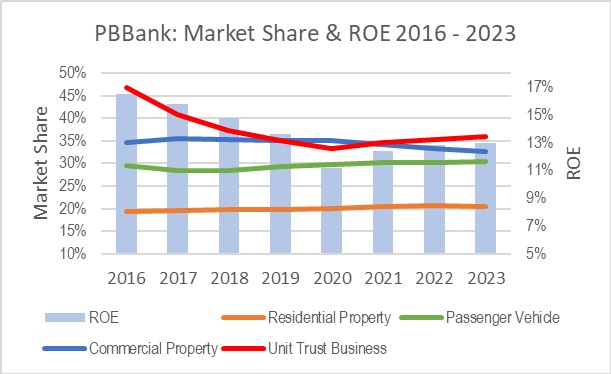

In short, Public Bank needs to get aggressive about increasing its topline and bottom-line. It isn't sufficient to say the bank holds the leading position in the Malaysian market for residential and commercial property financing, passenger vehicle financing, and the private retail unit trust business (which, thankfully, has started growing again after hitting a low point in 2020).

Maybe the bank is already addressing this, as the gross impaired loan ratio (GIR) increased a few basis points in 2023, and the bank has publicly revealed its target for GIR to be less than 1.0. (Between 2015 and 2022, the bank's GIR averaged below 0.5. Higher values were seen in 2014 and 2013, when the numbers were 0.6 and 0.7, respectively.)

Besides the above, I'd also like to see the bank get aggressive about incorporating digital technology within its operations and reducing manpower. At present, the bank has over 19,000 employees. The financial sector is one of the biggest beneficiaries of new technology. When PBBank gets serious about this, it will likely result in job cuts. However, I suspect the bank is reluctant to take this step.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Discussions

@1288Go - you are absolutely right. My bad. I've corrected it now. Thanks.

1 week ago

Thirai..thanks for evaluating banking stocks which i am completely not competent to do so...

do you have any comments on ABMB? Is it cheap and a good buy?

could you tell which is the best banking stock to buy among those listed in Bursa... really appreciate, thanks

1 week ago

@probability --

I bought a bunch of banking stocks -- CIMB, Maybank, ABMB, RHB and AMMB -- when they were a lot cheaper a few years back. Almost all of them, safe RHB, have increased in price considerably since. At present, I am analysing all banking stocks again to see how best to rebalance my holdings.

1) You asked about ABMB. At the current price, it is very attractive (Price to Tangible Book is 0.89); however, its earnings growth is weak. Since mid-2022, the earnings are almost flat. (P/E to Growth Ratio or PEG Ratio is 2.16.)

2) PBBank, despite my comments above, is somewhat attractive. It has a high quality book, and therefore sells at a premium. (Price to Tangible Book: 1.5.) It is growing, albeit slowly (its PEG Ratio is also 2.16 despite higher P/E). I took a position in it recently, and may add more if the price drops well below RM4.

3) I find HLFG the most attractive among the banks at present. Its Earnings Per Share (EPS) has grown by 9.67% annually over the last five years. But the share price, for whatever reason (needs further investigation), hasn't kept pace. Its Price to Tangible Book is barely 0.74, and its PEG Ratio is 0.76. However, there are a couple of things that I don't like about the bank, and they are: 1) low dividend yield (of around 3%) owing to low dividend payout ratio; and 2) very low trading volume.

1 week ago

@Thirai....thanks for the inputs, looks like nothing wrong with ABMB from your feedback...i dont look forward too much on growth, as long as they can sustain the earnings and slowly increase dividend payout i would be happy

yes HLFG is the other finance stocks that i am interested other than ABMB

i see both these bank have very high free cash flow...not sure how much it matters for banks...

look forward for your analysis (bank comparison) to be presented in i3 :)

1 week ago

1288Go

Thirai, Pbb bank assets is in the billions!!

Not millions?

1 week ago