AJINOMOTO - GEM OF THE EAST

GreatWarrants

Publish date: Sun, 10 Jun 2018, 12:04 AM

Dear Valued Investors,

Take a look at this stock AJINOMOTO (AJI).

This is definitely one of the best stocks In Bursa Malaysia. Below Are the Reasons :

1) LOOK EAST POLICY :

Tun M is going to visit Japan on the 11th - 12th June and it will be exciting for Japanese firms in Malaysia. Investors and business owners should take note of this policy which is being introduced by the new government.

GUESS WHERE AJINOMOTO COMES FROM?

JAPAN !!!!!!! These are definitely exciting times for AJINOMOTO Malaysia and Greatwarrants is definitely BULLISH on This stock.

Source : Thestar.com.my

2) BEAUTIFUL BALANCE SHEET ! AMAZING CASH PILE !!

Source : Q4 FY 2018.

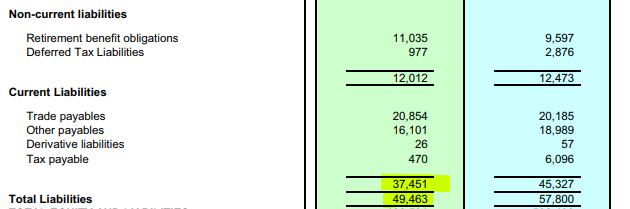

Total Assets RM 486 MILLION !

Total Liabilities : RM 49 Million ONLY !

The nature of this business DOES NOT NEED TO incur much liability !. This is a better business than REITS / PROPERTY !!! The cash flow is truly AMAZING !!!

With this great cash flow, expect dividends to flow into shareholders pockets annually !

The PE Ratio is only 23.94x compared to the Consumer Industry PE Ratio of 40.29x.

Market cap is only RM 1.3 billion which is rather small.

This stock is extremely Undervalued

2) BULLISH CONSUMER SEGMENT

0% GST ! Businesses, The Rakyat, The Food Manufacturing Industry will definitely produce more complementary products. Imagine all the Food Stalls Across Malaysia doubling up their revenue, requiring more Ajinomoto !!

3) WORLD CUP

All eyes will be glued to the world cup coming soon this year.

Of course, What better way to watch a football match with a ton of Junk Food, Mamak/ Hawker Stalls, Etc Etc which uses some Ajinomoto !!

5) The Chart

Investors should also take a look at the chart which is about ripe for a Breakout.

Based on the chart, Aji is about to breakout in the long term in line with its impressive fundamentals. Therefore, first target would be RM 30, followed by RM 50 and RM 100 in the next 5 years.

Long term investors should take a look at this stock. This is definitely one of the better stocks in the sector.

Disclaimer:

| Investing in stocks is a great tool for capital gains. However, all investments come with risk. Therefore, all investment decisions should be borne at your own cost and I will not be held liable for any investment decisions made. Do not buy Equities if you do not know the risk !! Thank you. |

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on GREATWARRANTS

Created by GreatWarrants | Feb 03, 2020

Discussions

total assets is 486 mil,but market cap is 1.34 bil,doesn't it sounds overvalued? it is only low cap that support the stock price otherwise it won't be worth this much

2018-06-10 12:08

If you compare with other stocks in the industry such as Nestle, Dlady and Heim... This is dirt cheap !!

Thanks and i will be looking to load up..

2018-06-10 12:57

Dont buy or ignore this article if you have conflicting views. The market does not need your money to buy into this gem. Smart money and time will only reveal the true value for this stoxk. Thanks

2018-06-10 13:04

cos nestle,dlady,heim,F&N all being cornered,otherwise not worth this much.all these stocks PE too high

2018-06-10 15:16

In terms of its revenue, the company repeated almost the same pattern in FY2016, FY2017 and FY2018. That is, its revenues were around 95,000K - 98,000K in Q1, and around 110,000K - 115,000 in Q4. I'm not saying the revenue in the next QR announcement will be around 95,000K - 98,000K. Just observation.

2018-06-10 15:21

Nestle PE 52x , industry PE 40x, Aji PE 24X...

Looks like fabien and newbie has no brains...

Dont touch this share pls.. or sell me cheap cheap i sure buy

Good sharing.. next time just PM me i go buy !

Dont need to share to people who dont see true value.. haha thanks.

2018-06-10 17:49

You guys can comment, but dont need fight.. Dont buy if you dont like, really. Im just writing for sharing purposes only..

Ultimately, big money, time and the market will decide the value of this stock.. You can say this article is bad or whatever.. but really, at the end of the day its your money and your choice. Good luck.

2018-06-10 18:21

all these stocks are overvalued,just being cornered,if many retails go and buy,they will dump for u and u will cry holding such overvalued stocks.....so better avoid these kinda counters

2018-06-10 18:48

no need to insult people. u can share ur comments OBJECTIVELY.

you can share ur thought as to why PE of 24x is undervalued. Assuming earnings are constant, PE of 24x means you will need 24 years to recoup your initial investments.

PE of 24x also means the company earnings are growing by 24%. so if the company can grow their earnings by more than 24% then PE 24 may not seems expensive or even a bargain.

SUMATECRM1 Nestle PE 52x , industry PE 40x, Aji PE 24X...

Looks like fabien and newbie has no brains...

Dont touch this share pls.. or sell me cheap cheap i sure buy

Good sharing.. next time just PM me i go buy !

Dont need to share to people who dont see true value.. haha thanks.

10/06/2018 17:49

2018-06-10 20:27

Okay fine, sorry. Hope for the best for you my fellow investor, I agree to spread positivity amongst KLCI rather than hatred... Goodluck to Aji too, long term should be alright..

2018-06-10 23:50

market cap is 3 times over the net assets,doesn't this consider over valued? PE also 24 times and dividend yield also low

2018-06-11 00:08

if when Aji price RM3-4, you published this article then hebat la. Now only publish only blow blow water and shiok sendiri

2018-06-11 09:22

apolloang market cap is 3 times over the net assets,doesn't this consider over valued? PE also 24 times and dividend yield also low

brother. branding branding branding

2018-06-11 09:30

too expensive for the brand name,just low capital easy to cornered and manipulate

2018-06-11 09:34

I think the author next will blow about PANAMY with titled "THE JEWEL OF THE EAST". Hahahaha..

2018-06-11 09:40

I think PANAMY current price is not expensive @ PE 17x. It's reasonably priced.

Sebastian Sted Power I think the author next will blow about PANAMY with titled "THE JEWEL OF THE EAST". Hahahaha..

2018-06-11 19:41

Hahaha, most probably could be truly if CTR Panamy is going to distribute dividen for RM 2.22 @

2018-06-11 20:36

Foresight123

Wow.. Good article. Thanks

2018-06-10 00:41