Japan's Anime Market–A Growing Investment Opportunity with Major Backing from Industrial Giants

hashinvests

Publish date: Mon, 16 Sep 2024, 05:54 PM

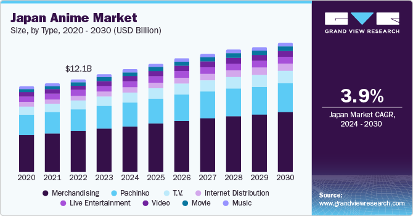

The Japanese anime industry is increasingly catching the attention of investors worldwide. In 2023, the Japan anime market was valued at USD 12.72 billion and is projected to grow at a compound annual growth rate (CAGR) of 3.9% from 2024 to 2030. This steady rise is driven by global demand, digital distribution advances, and the flourishing otaku culture, which remains the backbone of anime’s sustained popularity.

Major Conglomerates Eyeing the Anime Industry

Adding momentum to this booming sector, two of Japan's largest industrial and financial players have quietly started investing in anime. Marubeni Corporation, traditionally rooted in cereals and chemicals, has diversified and is now targeting the manga and anime markets through a new partnership with Shogakukan, one of Japan's leading publishers. This venture highlights how even non-entertainment giants are recognizing the financial potential within anime.

At the same time, Mizuho Securities, a key member of Japan's Mizuho keiretsu (business alliance), launched an anime film fund in 2024. The brokerage is raising funds from institutions and high-net-worth individuals in lots starting at JPY 300 million (approximately $200,000), with a target of raising $15 million by the year’s end. This direct investment into anime production from a major financial institution underlines the sector’s robust growth prospects.

Global Influence and Strategic Acquisitions

The global appeal of anime is another major contributor to its growth. International entertainment companies have been aggressively acquiring Japanese anime streaming firms to expand their content portfolios. A prime example is Sony Pictures Entertainment’s acquisition of Crunchyroll LLC from AT&T in August 2021 through Funimation Global Group, a joint venture with Aniplex Inc.. This deal brought Crunchyroll's content to more than 120 million registered users across 200 territories, solidifying Japan’s role as the hub of global anime content.

BloomZ Inc. Enters the Anime Scene?

Amidst this backdrop, BloomZ Inc. (Nasdaq: BLMZ), a well-known name in the voiceover industry for animation, recently made its mark by going public through an IPO in July 2024. While BloomZ has built a strong reputation in providing voiceover services for some of the top anime titles, rumours are circulating that the company may be planning to expand into the anime production business itself. If true, this could be a significant development for BloomZ, adding another layer of growth potential to their portfolio as they branch into full-scale animation production.

Manga and Video Game Adaptations: Cross-Media Synergy

Japanese manga, often serving as the foundation for anime adaptations, is another critical component of the market. Major titles such as Demon Slayer, One Piece, and Attack on Titan have successfully transitioned from manga to anime and video game formats, creating a cross-media ecosystem that amplifies fan engagement. The success of these adaptations not only fuels viewership but also boosts related industries such as video gaming and merchandise, further solidifying anime’s role in Japan’s economy.

Why Investors Should Consider Anime

The Japan anime market offers diverse revenue streams, ranging from streaming services and live-action adaptations to manga and video game adaptations. With the entry of major conglomerates like Marubeni and Mizuho Securities, and companies like BloomZ Inc. potentially venturing into anime production, the sector is poised for significant growth.

As Japan’s anime industry continues to expand its global footprint and attract heavyweight investors, it offers a compelling investment opportunity for those looking to tap into a high-growth entertainment sector. For investors, now may be the ideal time to explore opportunities in this dynamic market.

Disclaimer:

This article is intended for informational purposes only and should not be construed as financial advice. Investors are encouraged to conduct their own research and consult with a financial advisor before making any investment decisions. The author and publisher are not responsible for any financial losses or damages resulting from the use of this information.

More articles on Nasdaq Analysis | HASH Invests

Created by hashinvests | Sep 16, 2024

A Look into the Bigger Picture of Agape ATP Corporation (NASDAQ: ATPC)

Created by hashinvests | Sep 16, 2024

NASDAQ: AZ | Entering into New Collection Phase | Technical Review

Created by hashinvests | Sep 16, 2024

What does this explosive volume meant for NASDAQ: ATPC! Checkout this episode of our analysis to find out more!

Created by hashinvests | Sep 16, 2024

Benzinga: Why Is Agape ATP Stock Jumping Today?

Created by hashinvests | Sep 13, 2024

NASDAQ: AZ | Revolutionizing the $26.7 Billion Self-Service Market by 2028

Created by hashinvests | Sep 11, 2024

NASDAQ: AZ | Tap Dancing into the $26.7 billion Self-Service Market by 2028!!

Created by hashinvests | Sep 11, 2024

Rumours Swirl About Agape ATP’s Big Move – Is ATP2 Making a Comeback Soon??

Created by hashinvests | Sep 09, 2024

My latest technical analysis for ATPC!