Shell Trilogy: The Great Sale

Lau333

Publish date: Wed, 20 Sep 2017, 09:55 PM

April 2015 marks a new chapter in the long, illustrious history of Shell when it announced it was acquiring British Gas for £47bn. Simultaneously, Shell declared the combined business would sell off £17bn in assets, which would be returned to shareholder through share buyback. It certainly seemed a smart strategy considering oil price had plunged from $100+ per bbl to around $60 per bbl by the time the announcement was made. What could not be foreseen however was that oil price would further plunge to below $30 per bbl in Jan 2016, barely 8 months later. In response, Shell vowed to cut investment in order to protect its dividend.

All projects were scrutinized for their cash flow viabilities. Decisions were made where non-critical investments were postponed while those not able to self-sustained were earmarked to be disposed. Guided by the management decision, accelerated by the plunging oil price, the great sale especially those assets on the fringe (to Shell at least) began. When the big boys dine, we feed on their crumbs and frankly, the taste is not too bad!! And hence, the trilogy of deals relevant within the universe of Bursa Malaysia.

1) Anasuria Cluster (Deal announced Aug 2015, closed March 2016)

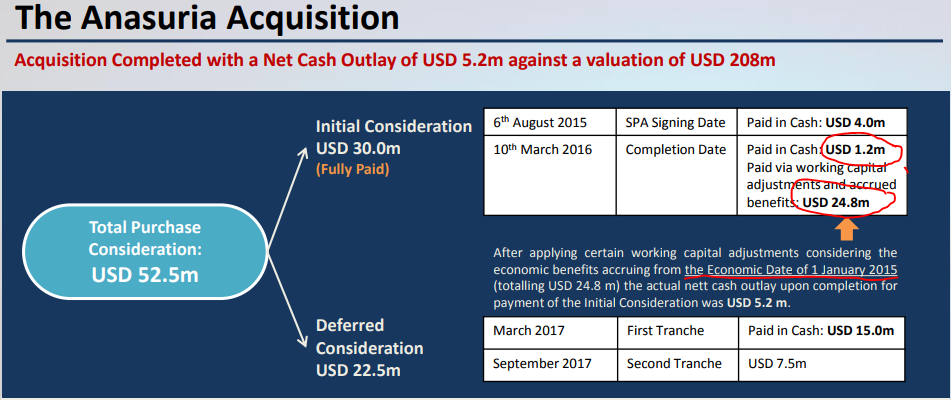

Hibiscus's quarterly reports revealed Opex cost around US$15 per barrels. But just two years earlier in 2014, the average cost per barrel in North Sea was around US$30. With oil price dropping to around US$30, this made Anasuria a no-brainer sale. How cheap then is the selling price? Hibiscus paid US$52.5 million for 50% stake in Anasuria. RCP Energy (a third party analyst) valued the asset (Hibiscus's portion) at US$113m in Sept 2015 report and US$208m in subsequent June 2016 report. Even then, the economic benefits were backdated to 1st Jan 2015. As shown below after adjusting for the "working capital adjustments and accrued benefits" of US$24.8m, the net purchase price was US$52m -US$24.8m = US$27.2m ONLY for an asset valued at US$208m!! Similarly, Hibiscus reported FY2016 negative goodwill gain on acquisition of RM364.1m.

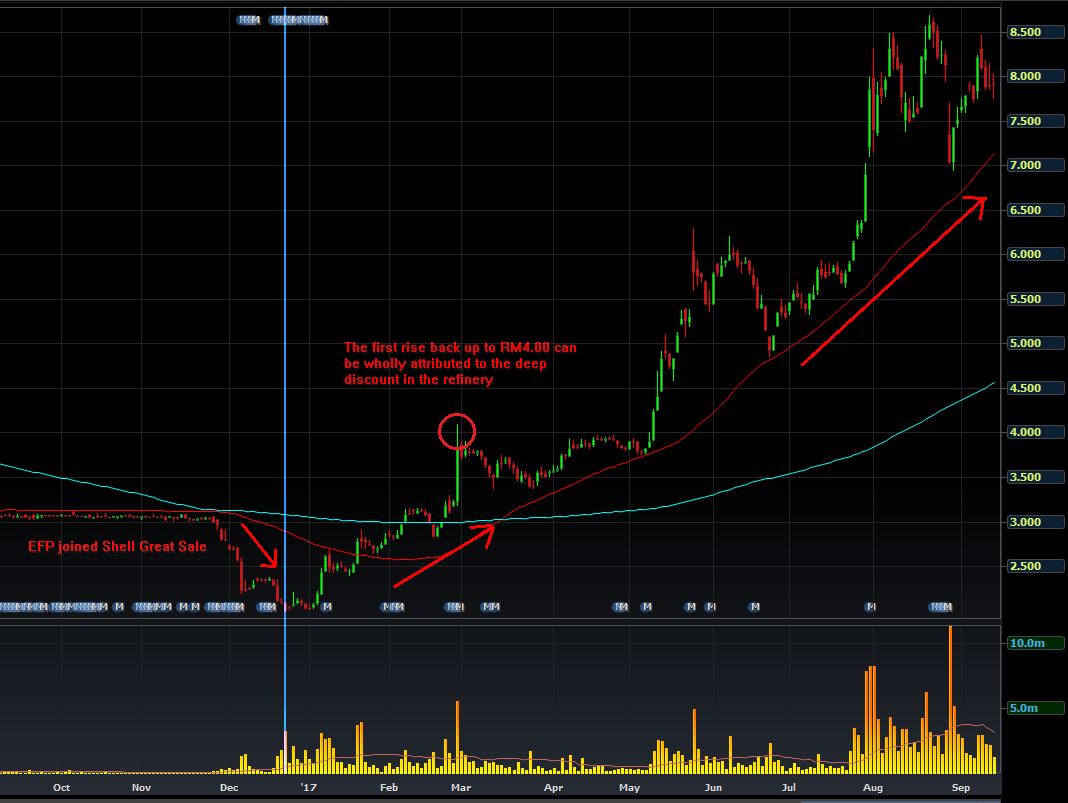

Hibiscus's one year chart post completion told an interesting story of both a cautionary note and an opportunity. A cautionary note in the sense that a deal shall never be evaluated in isolation but must be within the context of operating environment. At the time of the deal completion, Hibiscus was trapped in a vicious vortex due to plunging oil prices, so vicious that eventually resulted in zeroing out all its investment in its 2 major operating subsidiaries Lime Plc and Hirex, a loss totaling some RM280.4m which would have outstripped its market capitalization at the time. The windfall of RM364.1m from Anasuria acquisition had more than cushioned all the impairment losses. More crucially, Anasuria gives Hibiscus a business unit that is generating positive cash flow quarter after quarter. Without a hint of exaggeration, Anasuria was the deal that saved Hibiscus from a near certain bankruptcy. The Aug 2016 announcement of 4QFY2016 results gave the clearest indication that the worst was over and hence lay the opportunity. Famed investor, Benjamin Graham once remarked that "In the short run, the market is a beauty contest but in the longer run is a weighing machine". The market will wake up, as it eventually did, to the potential of new Hibiscus, no doubt given the jolt by the announcement of the North Sabah deal.

2) Hengyuan (previously known as Shell Refinery Company (SRC)) (Deal announced Feb 2016, closed Dec 2016)

Not too dissimilar to Anasuria, the sale of 51% stake in SRC for a meagre sum of RM 1.80 per share (or US$66m) was driven by the desire to avoid capital investment more than anything else. So firm was its decision not to invest further in SRC than it chose to impair the refinery asset by RM461m in 4QFY2015, officially declaring to the world it would not upgrade the refinery. At worst, Shell was prepared to go as far as converting the refinery to an oil terminal, essentially writing off the whole asset. To Shell, US$66m sale is a welcome upside from a complete write off!! This is akin to your neighbor selling his house way below the market value because he is migrating oversea and not coming back. Would you similarly sell your house at that price? Well, unless one of your neighbor is a certain EPF…

A perfectly fine refinery with a name plate capacity of 156kbpd and is upgradable to meet Euro 4M and 5 standard at a relatively modest sum of US$160m which we found out later. How big is the discount then? A brand new 260kbpd, recently commissioned in Yunnan, China was built at the cost of US$4.4b, or roughly US$1.6b per 100kbpd capacity. At RM1.80 per share, total Enterprise Value (EV = Market cap + Debt - Cash) based on 4QFY2015 data was around RM1.85b or just US$282m per 100kbpd name plate capacity (USD:MYR 4.2:1), a mere 18% of the sticker price of a brand new refinery. Adding up 150% of the reported US$160m upgrade cost will increase EV per 100kbpd to US$436m, just some 27% of a brand new refinery. The math get more interesting if you consider than for every RM1 increment in Hengyuan's price is equal to 2.9% of a brand new refinery. What does that mean? Well, if you value the refinery at 33% of a brand new refinery that is more than 100% gain from Shell selling price of RM1.80. At 40%, that's more than triple the Shell selling price.

3) North Sabah EOR (Announced Oct 2016, closed ??)

To be continued...

Disclaimer:

1) The author has no access to management of Shell, Hengyuan and Hibiscus. The report was written purely based on the news reports, company statements and media releases together with industrial trade reports. Verificacy of the report is based on best efforts and was subject to the author's knowledge inadequacies, assumptions used and the probabilistic nature of the future events.

2) The author has positions in both Hibiscus and Hengyuan and while trying to stay as objectively as possible but may still be influenced by subconscious confirmation and memory bias.

More articles on Hibiscus Petroleum Berhad

Created by Lau333 | Nov 22, 2017

Created by Lau333 | Sep 16, 2017

Created by Lau333 | Sep 14, 2017

Discussions

"The math get more interesting if you consider than for every RM1 increment in Hengyuan's price is equal to 2.9% of a brand new refinery. What does that mean? Well, if you value the refinery at 33% of a brand new refinery that is more than 100% gain from Shell selling price of RM1.80. At 40%, that's more than triple the Shell selling price."

LOL!

2017-09-21 14:43

I feel like an idiot. I have no idea how i failed to study hibiscus properly. Especially with research as good as yours around.

This is definitely one of my bigger failures. And i saw it in sept 2016 and just didnt study it properly. I must be stupid really.

2018-11-27 23:48

JayC

wow, your analysis is very very detailed. very good analyst

2017-09-21 14:40